We all need to save some of our income. It’s not as hard as you may think. We’ll talk about experiences my wife and I have had and some easy ways we’ve found to save money and use those savings to fund our investments. Read on for some ideas that may help.

Why Save

For me, there are 3 key reasons I need to save. And I do need to save. My wife and I are comfortable. I am retired, she’ll be retiring in the next few weeks, and we keep our expenses low. But, the averages say we will live into our 80s or even 90s, so we need to continue to save and invest.

My 3 reasons:

- Have an emergency fund. We all need money set aside, in cash and readily available, in case of an emergency. If you read the post on budgets, you know the monthly budget allocates all the money to savings and expenses. That means if the car breaks down or you lose an income due to layoff, your budget is broken. An emergency fund protects you.

- Save for goals. This could be retirement, a child’s education, a vacation, or a new car. We’ll talk more about this, but if you want to build wealth, you need to resist the credit and buy-now-pay-later mindset and save for something before you buy.

- Investing – this is the biggee. Wealth comes from investing your hard-earned money and letting it grow over long periods of time. Read the secret to building wealth and compounding. You’ll be amazed. You don’t need to be an expert to be a great investor. Read the Sylvia story in the secret to building wealth. You can do the same by choosing a low cost S&P 500 mutual fund and being patient.

Why Listen to Me?

If you haven’t asked yourself this question yet, you should. This world is full of people willing to offer advice. With the advent of the internet, email and social media, anyone can pose as an expert and can reach thousands or millions of eager followers.

Does the chef eat his own cooking? Does the advisor put his own money in the products he’s selling you? If the answer is no, run away. In this post, I’ll talk about things that my wife and I do to save. We live a comfortable life. We have no debt (aside from our share of the US Debt) but we make saving a part of our daily lives.

Mindset

Before I talk about the methods, let’s talk for a minute about mindset. It drives me crazy when I pay more than I have to for something. Am I getting the best rate on our cellphone plan? Am I paying too much for home internet? Can I get a better insurance rate? Apple charges how much? ?? for a charging cable? Let’s check Amazon.

Luckily my wife and I have a similar philosophy on money and saving. We both worked hard for our money, we’re not giving it up without a fight. My wife and I took a trip to Vegas years ago. We didn’t gamble at all until the last day. My wife threw down a dollar at a video poker machine. She won, and ended up with $20 and we raced to the airport and headed home. I cannot remember either of us gambling since.

Groceries

Eating is expensive. With the big bump in inflation, as well as continuing supply chain problems, food prices are a big part of our budget. Thursday is an exciting day at our house. That’s when the sale flyers arrive. My wife goes through these to see what the deals are. That’s what we’ll be eating. She starts watching youtube videos to find new and exciting ways to prepare whatever is in the flyer. We have a freezer in the basement so if it’s a rib roast or another of our favorites on special, we’ll stock up.

I came home tired from golf last week and was greeted at the door by Rosco (who you can see on the home page) and my wife’s shouts that I needed to run to Shaw’s (our local grocery store). Halibut was on sale for $10.99 per pound. It is usually $25 per pound. AND it was the manager’s special, so an additional 50% off. My wife had bought some and then came home and made room in the freezer so I could go buy more.

We’ve made choices not to buy butter, bacon, steak, eggs and other products at various times because they were too expensive.

Pick Your Store Wisely

My wife is Asian and she likes to make her favorite dishes at home. Running to Shaws or Stop and Shop for her favorite spices or vegetables is pricey. These are in the exotic food sections and are sold with equally exotic prices. In the Asian market in Providence, they are every day staples and sold at a fraction of the price.

Restaurants

I’m the one who likes restaurants. I’m pretty good with smoked meat and grilling burgers and steaks, but my skills are pretty limited. My wife would prefer to make it herself and she’s got the skills so we dine out together only on special occaisions.

Tony & I get together for a long lunch every other week or so. We go to a local BYOB restaurant. He brings a bottle of wine and I choose a six pack of beer and we share. The food is good and there is plenty. We can usually split a meal and a salad and still take some home. Once we went to a local BBQ place for lunch, but when you add in the cost of the nicer atmosphere and buying drinks there, the price was nearly triple.

Rich and I meet for coffee every Saturday. This started during COVID and we’d set up beach chairs in the Starbucks parking lot and have coffee. As things opened up, we started going to local restaurants and diners, but now we’ve ended up back at Starbucks. The $3.65 coffee is pricey for me, but I spend an hour and consider it a social investment. We both hate the food at Starbucks so we eat at home before.

Cars

Cars are a big expense. I like cars and am constantly looking for my next ride. We’ve saved and paid cash for each car we own.

Rich (Saturday morning coffee Rich) drove a 2001 bright red Toyota Matrix. It had over 200,000 miles on it and it looked it. His kids called it “the skittle” and were ashamed to be seen in it. Sadly the skittle died last fall. Rich was driving home and the body of the car dropped to the ground. Sadly he was driving home from having an oil change. Rich donated the car and has been car-free since.

Rich and his wife share 1 car. He works from home. He drops her at work on days he has an appointment. Sometime we shift our coffee plans to Sunday because his wife needs the car. He tried this and it worked for him.

Imagine what you would save if you could eliminate 1 car payment, the insurance that comes with it, gas, oil changes, maintenance, tires, excise tax… the list goes on and on. With Uber and Lyft, Zipcar, and rentals, there are alternatives.

Coffee

I will not tell you to stop buying coffee at the drive through on your way to work. If this is a choice you want to make, go for it, but every other financial writer tells you this, so you’re on your own with this one.

My wife and I are both at home and we start our day with a pot of coffee. We like Starbucks dark roast. We splurged and bought a Breville grind control coffee maker. It’s been going strong for over 15 years.

Good coffee is expensive. A 12 oz bag at Starbucks is over $15. I can get an 18 oz bag from Amazon for about $13. My wife has discovered that our local TJ Maxx frequently has the 28 oz bag for $14.99. She came home last week with about a dozen bags. The bags are vacuum sealed and we use whole beans that we grind when brewing so we’ve not noticed a difference between a fresh bag from Starbucks and one we’ve pulled off the shelf at home.

Crazy Deal

For those who lived through the 80s in the northeast, this is NOT Crazy Eddy. More on Crazy Eddy here.

In the pile of flyers that arrives on Thursday is one from Ocean State Job Lot. My wife has become a master of the crazy deal, a special sale offered by Ocean State Job Lot. Certain items are offered with a store gift card for the purchase price of the item. We bought a gazebo for the yard for $1,999. It came with a $1,999 gift card.

The patio set you see under the gazebo was also a crazy deal. The storage unit with the planters on top was built with the metal frames that held the gazebo’s shipping box in place, and some left over wood from 2 pallets.

Re-Use

We just talked about re-using some old pallets and a metal frame to build our storage unit. We extended our deck and tore down a privacy wall. I stripped the boards down and made frames, and my wife bought some cheap plastic inserts on amazon. We now have some nice privacy panels.

I installed a new dishwasher for my mom. It was packed with lots of styrofoam, and 4 nice hardwood boards. I took the boards home. I’m sure my wife will come up with a creative use for these.

Consignment

For me, a trip to the consignment store is a trip to hell. I like to spend 5 minutes in a store, if I don’t see exactly what I want (which is usually an exact replacement for something that is worn out) I’m outta there. My wife spends hours looking at items and imagining what they could be. In a prior post, I mentioned she furnished a whole room for under $100. She buys, mends holes in cashmere sweaters, strips and refinishes furniture, and has discovered bar keeper’s friend to make old pots and pans new.

Home Upgrades

The list is endless. We’ve done crown molding and hardwood flooring in every room. We’ve redone bathrooms, including sinks and shower stalls. My wife has built custom cabinets throughout the house. In most cases the cabinets are built with scrap lumber and doors she picked up at the curb. We’ve rarely hired contractors to help with any of this. With Youtube and a little creativity, there is almost nothing you can’t do on your own.

Cell Phone & Home Internet

For some reason, I am resigned to paying a monthly bill for electric and home heating. But paying for cable TV (it used to be free over the air!), home internet, and cell phone service drives me nuts. Maybe it’s because I’ve lived without them for much of my life.

Cell Service

My wife and I had a 3 phone plan with Verizon. Good service, but the monthly payment irked me. I started shopping. T-Mobile would pay off our 2 phones (we owed over $1,200). Their service with unlimited data (v. 2GB shared with Verizon) was $30 per month less even without the phone payments. And they threw in free Netflix which saved me an additional $10 per month. This little windfall gave me $1,200 off the bat to add to a low-cost S&P 500 fund, and an extra $40ish a month to add to that fund.

Cable TV

My wife and I cut the cord somewhere around 2009. No cable TV. We use a TV antenna for sports and subscribe to Netflix, our only paid service and get Amazon prime TV through our amazon prime subscription. My TV package had gone from $50 per month (introductory rate) to over $125 per month. I called the cable company and told them it was too much. After putting me on hold twice, they came back with a more expensive package with double the channels – special deal. I opted for an even more special deal. Cancel TV and I’ll put the $125 per month in a low-cost S&P 500 fund.

Home Internet

I cut the TV, but the cable company still had me. I needed them for home internet. I looked at lots of alternatives, satellite was slow and equally costly, FIOS and other packages weren’t available in my neighborhood. Then one day I got an email from my friends at T-Mobile. They offered wireless home internet. I jumped on board. $50 per month v. $75. My cable company gave me 300mbps speeds where T-Mobile could be anywhere from 50-300. I tested it out and found I could stream 3 movies at once. Seemed like enough for me. An extra $25 in my low-cost S&P 500 mutual fund.

Insurance

Christmas, Thanksgiving, Easter and Insurance shopping. These are my major holidays. Insurance shopping day usually falls in December, but sometimes January, if things are busy. Most companies will give you a quote online. Insurance companies make a bundle assuming (and mostly correctly) that we’re lazy.

Our rates increase year over year, while those same insurance companies will offer lower rates to entice new customers. Shop around and change as often as you like. I’ve changed several times and have typically saved $400 – $1,200 per year each time.

My latest trick was calling an insurance agent. I always assumed they would be more expensive, but the woman I worked with priced policies with all the companies she worked with and saved me over $1,000. Guess where I put this?

Pre-Existing Conditions

Home, car and umbrella insurance shopping has been a gold mine for me. The jury is still out on pet insurance shopping. My pet policy, and all I’ve shopped for, have a pre-existing condition exclusion. Rosco developed skin allergies, which were covered under his first policy. I switched when he was 4 and saved $600 per year. I didn’t realize then, but his allergy treatments are now a pre-existing condition. So far the savings have outweighed the cost, but this is something to be aware of before switching policies.

Pay Attention

This is a biggee. Many of us save countless hours by signing up for auto-pay. Many companies give a discount if you auto-pay, and we don’t have to get a bill in the mail and write a check each month. Yay! I auto-pay everything.

I also do a monthly recon. I use an account aggregator which pulls together the transactions and balances from all my credit card and checking accounts. More on aggregators here. The aggregator gives me one spot to go to see all my transactions. I want to see that all my bills got paid, the amounts are correct, and I didn’t pay for anything unexpected.

Keep an Eye on Auto-Pay

Auto pay is great until there is a glitch somewhere and it stops paying. This happened with my mom’s medicare payment. One day, it just stopped and before I knew it we were 2 months behind. No one at Medicare could tell me why. We got it fixed and it’s been working since. I’ve updated my process for my mom’s accounts to make sure I catch missed payments.

Missed payments can lead to cancellations. My wife is helping her mother with this now. It has been a nightmare. It can also lead to costly fees and added interest payments for outstanding balances. This can eat up your savings pretty quickly. Watch closely.

Verify Amounts

Are the amounts correct? This is easy with my T-Mobile payment. It’s the same every month. What about credit card payments? Other bills that are different amounts? Errors can happen. Watch closely.

Unexpected & Fraudulent Payments

When I started helping my mom with her finances, I found lots of odd payments in her credit card history. The credit card companies tend to be really helpful. We got refunds and new card numbers. We’ve also found a couple in her checking accounts. The bank was less helpful.

Protection

The first thing I do is set up alerts on all my credit cards for “card not present”. The chip and pin technology that the cards use is pretty secure when you insert or tap, but “card not present” means someone used the card, likely over the phone, and read off the card#, expiration and 3 digit code.

Card not present is trouble. If you’re not using insert or tap, someone is likely writing down your card info and keying it into a vendor system. You don’t want your card info written down.

My mom’s friend gave me a great tip. Scratch off the 3 digit code on the back of the card. The card is still usable for insert and tap, but no one can copy your card info. How easy is it for waitstaff to take your card to the register and snap a quick picture of the front and back. Most people are honest, some aren’t.

You can also set up alerts for dollar thresholds. I get a text for any card spending over $300.

Barbie

I got a text alert from my mom’s cable provider (I have alerts here too) that my mom had rented the Barbie movie. There’s no way my mom was navigating that system to rent, and this would not have been her choice (no offense to Barbie fans). I was able to get a refund online. When the bill came, I was on alert because the bill amount was higher than normal. She also had the daily burn (yeah, right, she’s 86) and she’d added the Spanish channel (no bueno).

I called and got these removed, but it reinforces that while auto-pay is a gift, we need to keep watch.

Save to Buy

I’ve included more on this in the post on budgets. The concept is simple. Advertisers are incredibly effective at getting us to want things. We feel like we need them now. Credit cards and by-now-pay-later plans make it easy for us to take on debt to get what we feel we want. Try saving before buying. In some cases you will find the urge goes away completely. That ab-lounger that you had to have at 3 in the morning doesn’t seem like a necessity the next day. Or, if it’s something you truly want, walking in with cash in hand and taking it home with no future payments will be rewarding.

Does it Matter?

Sometimes it feels like an uphill battle. We struggle to save a bit here and there, and then we invest, and if we are unlucky, we begin our investment right before inflation kicks in, or some other event triggers a huge market sell-off. All of a sudden, what we saved is reduced to almost nothing.

In the posts on stocks, building a thesis, compounding, investor mentality, as well as others, 2 consistent themes are that:

- Wealth grows over time.

- The S&P 500 (the 500 largest US companies) has been a great place to invest over the past 100+ years. The growth rate with dividends reinvested is around 10% per year, even though we’ve seen drops of 40% or more and periods of several years in a row where the market declines.

Given this, what will likely happen with the money my wife and I saved? Here are the biggees:

- $1,200 from T-Mobile paying off our phones. We’ll invest this immediately.

- $40 per month we’ll add – this is savings on our monthly bill from switching to T-Mobile

- $125 per month from canceling Cable TV

- $25 per month switching from cable company internet to T-Mobile wireless

- $50 per month – savings from switching insurance carrier

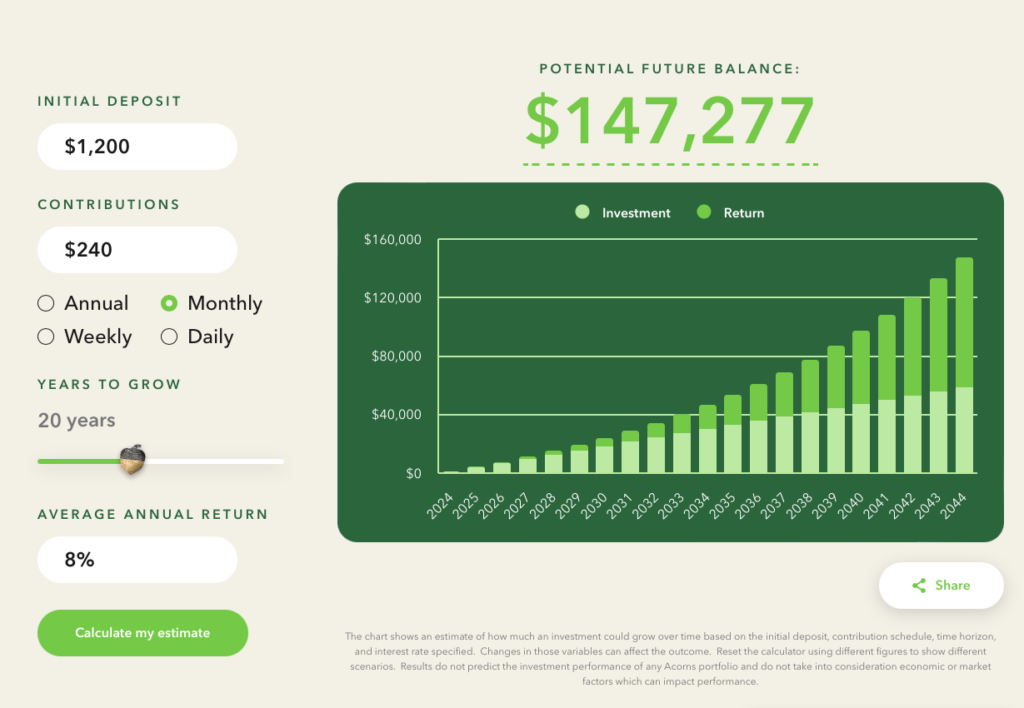

Project These Savings Out 20 Years

For simplicity, we’ll assume these savings started today. In reality, the Cable TV savings and returns started more than 10 years ago, so the projected gains will be much higher than we show here…but just for kicks, say we got the $1,200 today and started the total $240 per month savings next month. Here’s what the growth looks like with an 8% expected average annual growth rate.

This does not account for the savings on groceries, do it yourself, and some of the other ideas we’ve talked about. This is just hard dollar savings from finding a better rate and cutting the cord. We’re starting this saving when I’m 60 years old, when I’m 80, we’ll have almost $150,000. Try it yourself, here at acorns.com.

Some may find that eliminating cable TV is painful, but the other savings come from shopping for a cheaper option for the same services. Pretty neat way to put $150,000 in your pocket. Funnel some grocery savings and DIY savings into this projection and you will be in great shape to meet your goals.

Wrap-Up

Saving is not that hard. It sounds bad. It is usually linked to depriving ourselves in some way, but that’s not always the case. Most of the examples here, have saved us significant dollars that we have put towards investments in low-cost S&P 500 mutual funds. We don’t feel like any of these have caused us to feel that we’ve short-changed ourselves. Quite the opposite. We’re proud of the things we have built. I enjoy my lunches with Tony knowing that I can afford it without going into debt. The crazy deals, the groceries, the phone bills and insurance savings are all things we’re proud of.

These savings can all be used to fund investment, and investment is what will grow your wealth exponentially over time. It’s really not that hard.

Thanks for reading and us know if you have saving ideas.