I’ve written posts on dividend paying companies. I love a great American business that has been around for decades, and rewards shareholders with a check every quarter.

Whirlpool caught my attention in 2020. It has brands like Whirlpool, KitchenAid, Maytag, Amana, and JennAir. It’s located in the US and has been around since 1955. Whirlpool has a solid balance sheet which should help it sustain its (at that time) 5% annual dividend.

Quick Note on Performance

You may remember from prior posts that I measure my dividend company performance differently than my growth companies. I expect growth companies (as a group) to beat the S&P 500. Why would I spend the time and take the additional risk, unless I could beat a nice low-cost S&P 500 fund?

Dividend-payers are different for me. I’m looking for old reliable US companies with a long history of solid performance in good times and bad. I’m looking for a solid balance sheet with low debt and lots of cash coming in. And I’m expecting an annual dividend yield of more than 3% to pay me a regular income stream. I expect little to no price appreciation. As a group, I expect some companies will have capital gains, while others losses, but the group will have a small gain.

Whirlpool

Whirlpool seemed to fit the bill. Ticker: WHR

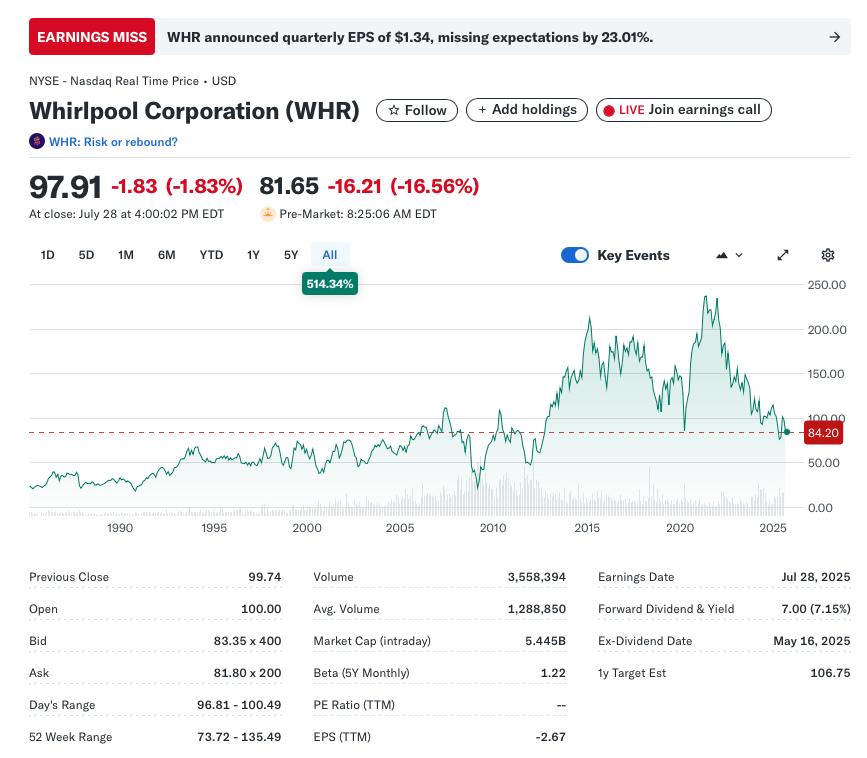

You’ll notice the big red EARNINGS MISS at the top of the yahoo quote. That’s what got me thinking about Whirlpool today.

I liked what I saw in 2020 and bought shares. I sold some covered call options, and bought some more shares. I was excited every time the quarterly dividend showed up in my account.

Inflation

Inflation is not new. It’s a common economic cycle, and like all cycles, we never know when they’ll start and end, we just know that they happen sometimes.

I know. Not helpful.

I remember when I started my first real job after college. Some older co-workers were buying homes and paying 18% mortgages. Can you imagine?? A bit of inflation in the mid 80’s as well.

But 2021, was my first experience with skyrocketing inflation during my active investing career.

Here’s what I learned

- Interest rates go up a lot.

- Great for opening a new CD or buying a treasury. I’ll get a much higher rate today

- Bad for owning a CD or treasury. I’m locked into a lower rate. And good luck selling my (low rate) treasury or CD

- Dividend-paying companies fall out of favor – quickly

#4

In retrospect, 1-3 seem kinda obvious. The problem is that I’d not invested during a period of skyrocketing inflation so these weren’t on my radar.

But why do dividend paying companies fall out of favor? Who doesn’t love a quarterly check?

Risk

The US equity markets are very good at pricing in risk. And as investors, we’re paid for taking risks. Equities fluctuate. Even a nice low-cost S&P 500 fund will have down periods. Investors are compensated for holding for long periods of time. The more risk, the more likely we’ll receive higher compensation.

In 2020, inflation was low. 1 year CDs and treasuries were paying somewhere around 0.5%.

At this time, Whirlpool and its dividend-paying peers are looking good. I buy $10,000 worth of Whirlpool and I’ll get $500 per year in dividends. Sweet!

I buy $10,000 worth of 1 year treasuries and I’ll get $5.

Which would you take?

Investors are lining up to buy shares of Whirlpool. There is some business risk, but there is also the chance of capital appreciation.

During this excitement, Whirlpool shares soared to almost $250.

And Then…

Inflation rears its ugly head.

All of a sudden, I can get a nice secure 1 year US Government treasury that pays a 5% annual yield.

I can get that same $500 per year from the treasury which is backed by the full faith and credit of the US government. Now granted that means a little less today with a $37 trillion national debt, but it is still the lowest-risk investment around.

There is absolutely no good reason to take on the additional risk of owning Whirlpool. Demand for Whirlpool stock dries up over night and the price plummets.

As a shareholder, I still get my dividend. But the stock price decline is a bummer. It will hurt if I need to sell, and even if I hold and am satisfied with the dividend, has this changed the value proposition for the company? If nothing else, paying a huge dividend further hurts a company that has already taken it on the chin.

Sell, Sell Sell

I invested in many dividend paying companies as I transitioned into retirement and was looking for a steady paycheck from my investments. Here’s a brief list:

- Whirlpool – WHR

- VF Corp – VFC

- Crown Castle – CCI

- Easterly Government Properties – DEA

- NextEra Energy – NEE

- Mosaic – MOS

- CF Industries – CF

- Intel – INTC

- Genuine Parts – GPC

- American Electric Power – AEP

- Altria – MO

- Truist Financial – TF

- Bank OZK – OZK

- Devon Energy – DVN

Yes, there are more. Some I kept, some I sold.

For those that I sold, I learned 3 things.

Pre-Inflation Love

Analysts and investors love these stocks when inflation is low. Most of them pay around a 5% annual dividend. What’s not to like.

And analysts tend to have a more favorable position on these companies in good times. Harvard MBAs aside, they’re just like us. They look more positively on these companies when they have an attractive yield.

So the news we read and the analyst reports tend to be positive which reinforces our excitement.

That’s the first lesson. Be skeptical of high dividend yield. How will that company look in a high inflation environment?

Some Recover, Some Don’t

I noticed that as inflation cooled, some of these company’s stock prices surged, some recovered slowly, and others continued to drop. Whirlpool and VF Corp took it on the chin while Altria was a rock-star.

While I’ve learned to be more skeptical, I’ve also learned that there aren’t glaring signs – for me, or apparently for the Harvard MBA analysts – that tell us a company is risky.

That’s not entirely true. Intel had lots of signs – you can read more here and here. But on the whole, it’s hard to tell.

It Just Doesn’t Matter

Go watch Meatballs.

Streaming for free on Plex.

So, as you may remember, I keep score on everything.

I have a nice big spreadsheet where I track every share purchase and sale. It includes 2 important tidbits for this topic.

- I can see the total gain/loss in dollars for the purchase/sale.

- I can also see the total gain/loss since sale. Since I have the sell price, and I can get the price today, I can calculate the per share gan/loss since sale and multiply by the number of shares sold to see what I would have gained or loss if I hadn’t sold.

Whirlpool was a huge loser. I lost $37,302 on my share sale. This is offset by $3,123 in dividends and $12,334 that I made in covered call options. Still about a $22k loss which hurts.

That matters.

But despite Whirlpool and VF Corp continuing to plummet after I sold, American Electric Power, Easterly Government Properties, and Genuine Parts rallied.

Taken as a group of 20 or so companies, I’m roughly even on capital gain/loss. I would have had a small paper loss if I had not sold any shares. But I would have had 5% annual income on the group.

Wrap Up

It Just Doesn’t Matter.

OK, let’s put this into context.

A group of 20 or so well chosen strong US companies with decades of solid performance and a history of rewarding shareholders, as a group, outperformed other income investments like treasuries and CDs.

For a strong group of companies, one company’s performance is not always significant. And who knows, that lagging company (Whirlpool, I’m talking to you) could be a big winner in 10 years.

My expectations for capital returns from this group was low. That’s what I have Amazon, Apple, Netflix and others for.

I want this group to not lose money and pay me in the neighborhood of 5% each year in dividends.

And despite the dumpster fire that Whirlpool and VF Corp have been over the past few years (VF Corp even cut its dividend), as a group, others have outperformed to keep me even.

The Big Lesson

Patience.

That’s it.

Sorry it wasn’t more dramatic.

Read more in the secret to building wealth – one of my first ever posts, and one of my favorites – Go Sylvia!

I stand by my Whirlpool sale. I held for 3 years. I hadn’t anticipated the inflation risk in my thesis. Post inflation, I updated my thesis to expect Whirlpool to turnaround quickly as housing recovered and we started buying more appliances and as inflation dipped and Whirlpool’s now 7% yield became attractive. When that didn’t happen, I sold.

But here’s the surprise.

- Do your research and create a thesis (in 15 minutes)

- Choose great American companies with a track record of success across decades

- Look for companies with a solid balance sheet – lots of cash on hand and low debt makes a difference when times are tight

- Wait

Be ready for volatility, enjoy the quarterly payments, and evaluate the performance of the group, not just the individual companies.

Bonus Material: Dividend Cuts

Further reading today on Whirlpool, I see that they’ve cut their dividend from $7 per share today to $3.60. My $500 annual dividend (from that $10,000 position) is now roughly $250. That’s a problem.

Companies rarely announce “Great news, we’re doing so well that we’re cutting the dividend!” Companies are striving to be dividend aristocrats or dividend kings that raise their dividend every year for 25 or even 50 years. Cut the dividend and the count starts at 1.

But sometimes it is in the best interest of the company to cut spending and get back on its feet. However, as a shareholder, we need to revisit our thesis. Does this company still have a place in our portfolio? The future is less rosy, and we’re only being paid half of what we were to sit and wait.

I saw this play out with Intel, VF Corp, and now Whirlpool. I bailed on all 3, though I bailed on Whirlpool before the cut.

Read more about evaluating dividend stocks, and the TV hit Ozark, here.

And while I look at dividend.com to evaluate companies, here’s how they rated the safety of Whirlpool’s dividend.

Be skeptical and do your own research.