Choosing our own investments can be daunting. We read that financial expert Suze Orman says we need $7 million in order to retire.

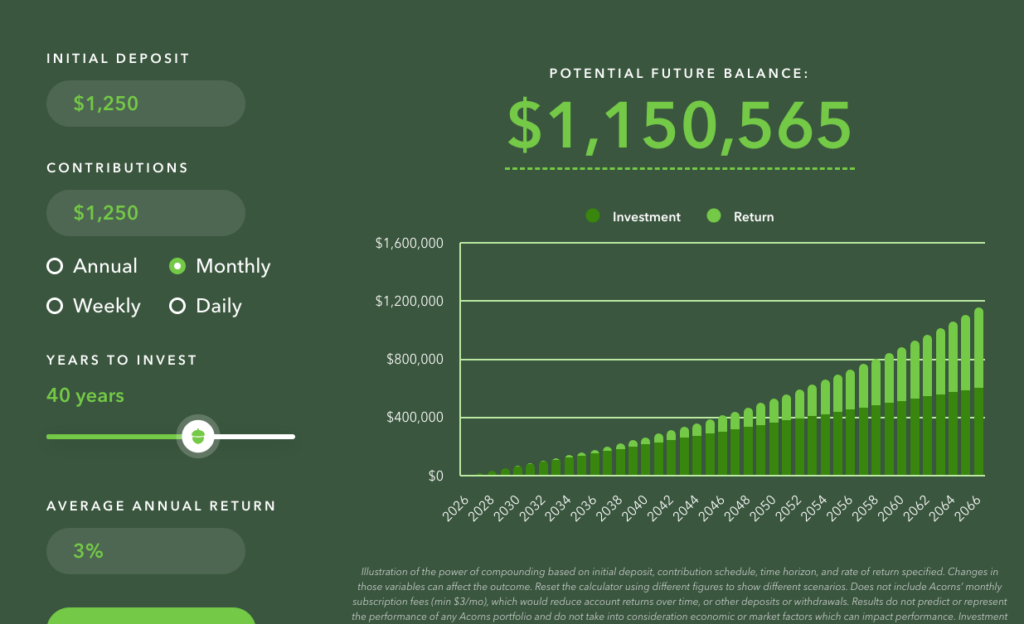

Let’s assume we make $100,000 per year and put aside the recommended 15% for retirement savings. We want to protect this money so we put it in a savings account that yields 3% per year.

From our friends at acorns.com, we’d have over $1million when we retire.

I don’t know about Suze, but I think I could do pretty well with this.

But, don’t forget inflation. That $1.15 million is in today’s dollars.

What does that mean? Let’s talk about this for a sec.

Inflation

Let’s take a gallon of milk as an example.

In 1995, I could buy a gallon of milk for $2.48. In 2022, that same gallon of milk costs $4.09. Read all the details at usinflationcalculator.com.

This isn’t new and improved milk. It doesn’t come from super-cows or from almonds or soybeans, it’s plain old cow’s-milk.

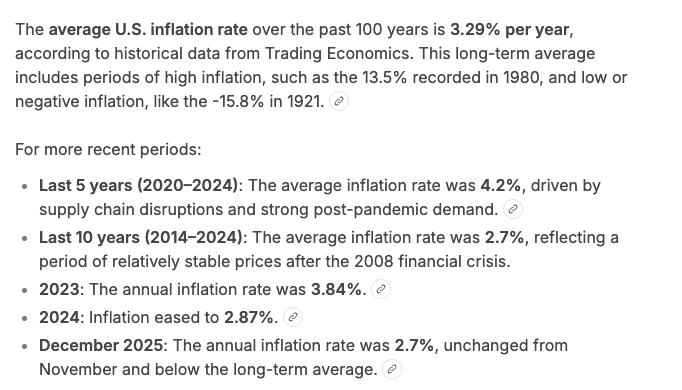

For those who were paying attention over the last few year’s, we’ve had a huge spike in inflation. However, the average inflation rate tends to be around 3%. Here are some details from investopedia.

Here’s a simpler version.

Simply put, this means every year, everything we buy gets a little bit more expensive – about 3% more. We may not notice, but then when we look back 30 years, we say “holy cow! $4.09 for a gallon of milk!!! I remember when it was about 2 bucks!”

This is why old people say stuff like this.

Inflation-Adjusted Returns

So when we project out into the future, we need to consider inflation. 40 years from now when today’s 25 year old retires, everything from milk to hamburgers to rent payments will be quite a bit more expensive.

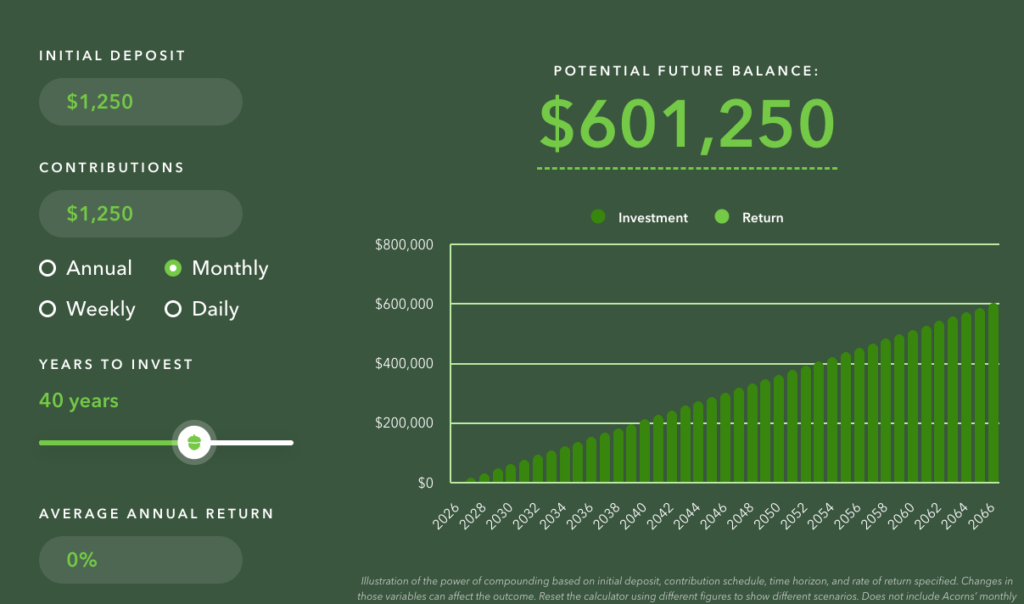

So in our earlier example, where we got 3% return on our savings account, if we also subtract 3% per year for an inflation adjustment, our inflation adjusted return (also known as buying power) is

$601,250, or about half as much.

A nice chunk of change, but will it last me from age 65 to 95?

We Need to Invest

Most of us got this memo. We need to invest in fixed income and equity to ensure that our returns out-pace inflation.

Over the last 100 years or so, a nice S&P 500 fund would have returned about 10% per year with dividends reinvested. A nice US corporate bond mutual fund would return about 4-6% per year.

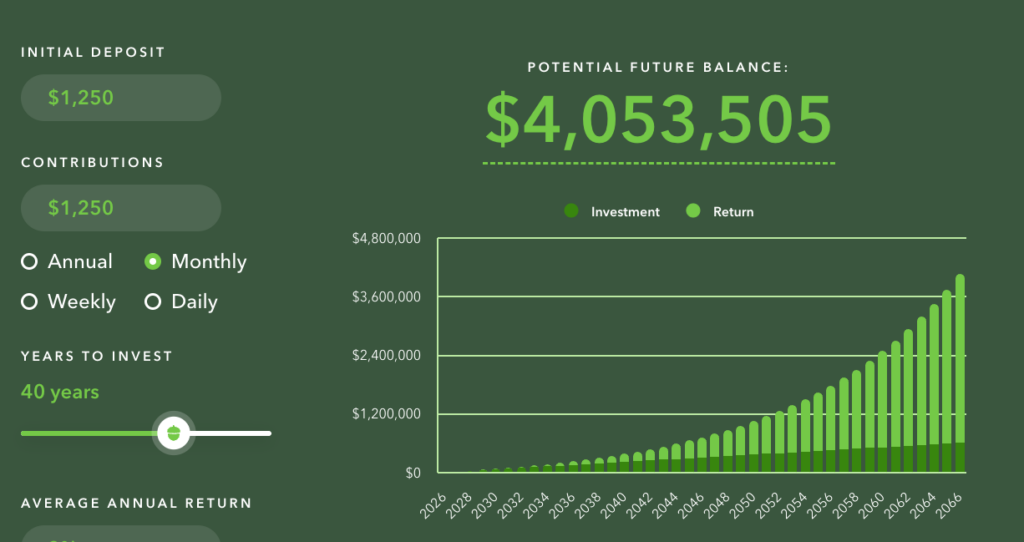

A portfolio with a mix of an S&P 500 fund for growth and some corporate bond funds for stability and income would historically return somewhere around 8%.

Our return looks a bit different at 8%.

and if we reduce by 3% to adjust for inflation, our buying power is

And to be clear, in the first scenario, we end with $4million at age 65. It’s just that each dollar in 2066 will buy less stuff than a dollar in 2026 will buy. That’s because inflation – increase in prices – eats away at our buying power.

Summary

Pensions are long gone so we know we need to save for our retirement. And because we know this is important, we want to protect that money we save. The best way to do this is to choose a guaranteed, FDIC insured savings account.

But safety of principal risks the safety of our retirement. That inflation adjusted $601k that we spend 40 years saving is unlikely to last us until we’re in our late 80s or our 90s.

Historical returns for the S&P 500 and corporate bonds provide a higher return and a better likelihood of meeting our retirement needs.

Investment Choices

To muddy the waters, we have an almost unlimited selection of investment choices. If I’m shopping for a mutual fund, I go to my broker’s website and see this.

And when I click on a category, I see a whole listing of funds to choose from.

I’m tempted to buy today’s hot sectors. Gold and silver prices are on fire. Industrials are up recently on all the AI data center building.

As humans, we’re pretty good at assessing what’s going on today, but not so good at projecting into the future.

For this reason, I mostly choose a nice low-cost S&P 500 fund. It is diversified across 500 companies and across every sector of the US economy. You can read more about why here.

What Do The Experts Say?

We just need to take a quick look at CNBC to get dozens of investment ideas.

Rare earth metals – that’s gotten a lot of attention. Coreweave is up. Nvidia continues to grow. And we can get Monday’s biggest analyst calls.

I’m already excited. I can’t wait for market open to buy buy buy.

The Greatest Piece of Investing Advice

I read this over the weekend on clark.com. In the article

Towards the end of the article is the key.

Both groups employ very smart people looking at the same data.

Caterpillar

Caterpillar has been featured in a number of recent posts. It was up big in 2025, and it continues to rise.

I’s up 54% in a year. That’s unheard of for a large cap industrial company.

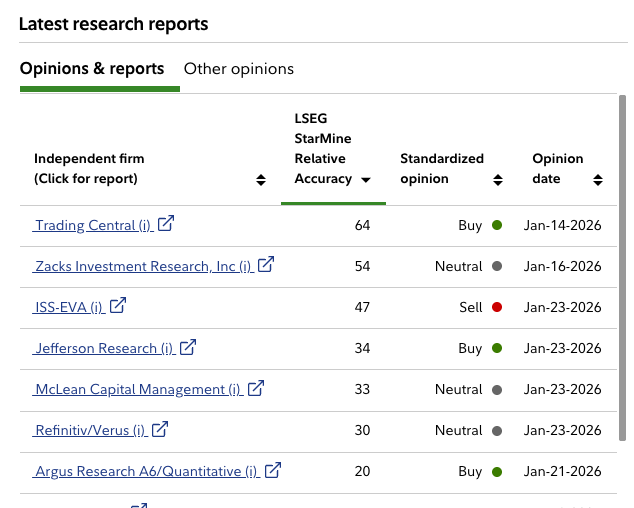

Should I buy? What do the experts say?

Some are neutral, some say buy, some say sell.

All groups employ very smart people looking at the same data.

Wrap Up

- We’re responsible for funding our retirement years

- We need to ensure our savings grow at a rate higher than inflation

- Equities and fixed income investments can provide higher rates of return

- There are lots of investment choices

And because there are so many choices, many of us get overwhelmed and we either make a poor choice, we change or investments constantly to try and catch the latest trend, or even worse, we defer saving because we’re unsure.

I’m a huge fan of the iShares Core S&P 500 ETF (Ticker: IVV). It’s got a very low expense ratio of 0.03%. This means the fund takes $3 of every $10,000 we invest to pay fund expenses (like record-keeping, custody, trading…)

And with IVV, we are owners of the 500 largest publicly traded US companies. We own a small piece of Amazon, Apple, Nvidia, Google parent Alphabet, as well as Caterpillar, Walmart, McDonalds and Lockheed Martin.

Think defense stocks are a great place to be? The S&P 500 has Lockheed, Boeing, RTX, and lots of other defense companies?

Think Caterpillar’s run will continue? It’s in the S&P 500.

And the key is that we don’t know. Even the experts don’t agree.

So we buy IVV and we own a basket of 500 companies. Will it build wealth? We never know for sure, but it has a track record of 10% annual returns with dividends reinvested over the last 100 years.

That’s pretty good.