It’s Friday May 9. It’s been a wild year to date in the market and I had a long drive today so I have a few thoughts.

The S&P 500 Performance

The S&P 500 has largely recovered from the belly-flop that started on Liberation Day. As you may recall, this is when the initial tariff announcement was made – the big one, including all countries, not just Canada and Mexico.

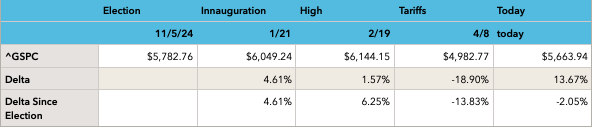

I like to keep a spreadsheet that shows me how the S&P 500 has faired on some of the more exciting days over the past year.

The S&P 500 was strong coming into the election in 2024. It stayed strong through the inauguration and hit a high on 2/19. Then the whole tariff excitement began.

But despite lots of ups and downs, the S&P 500 has recovered over 13% since Liberation day (in just 1 month) and is only down 2% since the election.

We’re Not Out of the Water Yet

There’s a lot of excitement about the “recovery” but let’s keep this in perspective.

Postponing tariffs is viewed as a positive by both businesses and individuals. This keeps prices down, for now. We’ve also announced a trade deal with the UK. That’s good too.

But tariffs have not gone away. No one’s sure exactly what will happen, but it seems possible that they’ll be back. When they come back, costs for businesses that import stuff will go up and costs for consumers will increase.

This will be a problem, at least in the short term.

Hold Steady

I don’t know what will happen with tariffs.

I don’t know when it might happen.

Presumably, it is a tactic we may implement after the 90 day pause, but given that it has been used as a negotiation tactic, it could reappear at almost any point.

The good news is that businesses tend to be resilient. Tariffs could cause some to fail, but some will likely thrive. This is why it is great to own businesses with a strong balance sheet.

I don’t think we know enough to call this a buying opportunity, and I don’t think it is time to panic-sell.

I’m going to hold tight.

Holding Tight

I have largely stopped buying new shares of funds or companies (except for dividend reinvest) and I have stopped trading covered call options during the volatility.

It’s just too unclear right now what tariffs might be and how they will impact any individual company or the market/economy in general.

Small Wins

However, I’ve realized that I need to be more excited about small wins in my portfolio.

When my account balance drops by tens of thousands of dollars on some days, it seems silly to celebrate a several hundred dollar dividend payment or a CD or bond interest payment.

But, these small wins are important.

Long Term v. Short Term

My long term money is in stocks and equity mutual funds. I expect it to be volatile, but if history is any indication, over long periods, it will likely grow.

Now is a period of extreme volatility. Because of this, I’m hanging tight and not making any buy or sell decisions.

But short term, my investments need to generate income to pay for my spending. While this isn’t totally separate from my long term investments, I rely on some of my dividend and interest payments to cover my expenses, while some I reinvest for future growth.

So even when my account value drops by tens of thousands in a day, I really haven’t lost tens of thousands unless I sell. I need to separate that unrealized loss from my short term real cash need and the dividend and interest payments that provide the funding.

So while a $60 dividend payment pales in comparison to a day’s unrealized loss, that $60 dividend payment is a round of golf. Or half a dinner out, or it pays half of my cell and internet bill.

$60, or $100 or $500 is real money. It shows up in my account and I can use it to pay bills or to spend.

For those of us in retirement, it is really important to separate the perceived unrealized loss of our long term investment portfolio from our short term funding of our lifestyle.

Example

That’s a lot of words, but let’s look at an example.

I continue to like T. Rowe Price (ticker: TROW) as an investment. I won’t go through my thesis now, but it’s a solid company and it pays a 5.56% dividend. I found TROW after I retired and started migrating from an all-growth portfolio to a more dividend-focused portfolio of investments.

TROW is one of several companies that helped teach me about the effects of inflation. TROW is attractive when it pays a 5% dividend in a low-inflation (low-bond-yield) environment. Apparently when super-safe treasuries are paying 5%, investors don’t want the risk of an equity that pays a similar yield. The price plummets. Take a look at the price chart for TROW from when I bought.

I’m down 50%, but remain optimistic. But notice all the D‘s in the chart. 4 times a year, TROW pays a quarter of that 5.56% dividend.

For me, each D means roughly $582.00 deposited in my account to spend as I see fit. That’s real income. Nothing unrealized about it.

Not Just Stocks

I realize that not everyone wants to invest in stocks, but we can do the same with other less-risky investments.

In my IRA, I hold a MORGAN STANLEY PRIVATE BK NATL CD 5.35000% 10/27/2025. This was a 1-year term CD that I bought in October of last year. I’m getting a solid 5.35% annual return. I put $50,000 in and I received a payment of $2,675 in April, and I’ll receive another payment of $2,675 in October of this year, and then I’ll get my $50,000 back.

I’ve also invested in over a dozen different stock and bond mutual funds that pay dividends. Why so many? Some are very safe short term bond funds that pay a small interest rate, while others are high yield (junk) bond funds that pay as much as 13%.

I have a mix of holdings that provide me with diversity as well as a steady income stream.

Wrap Up

So, 2 key realizations from today’s car ride.

First, while it feels good to see the S&P 500 returning to its earlier highs, the economic forces that caused the recent pullback have been postponed but are still looming. For those who are feeling that it’s time to get back in, you probably shouldn’t have gotten out in the first place. Market timing almost never works.

For those who are thinking it may be time to start investing again, be cautious. While I am a huge advocate for continuous auto-pilot investing like automatic deferrals into a 401k or automatic reinvestment of dividends, there are still storm clouds on the horizon. I’d hold off on new investment until the tariff story plays out a bit more.

Good news lately in the S&P 500 for sure, but let’s keep our eyes open.

Second realization is the importance of income generation, even when the amounts seem minuscule in comparison to our unrealized losses. It’s hard to get excited about $582 when I’m down $25,000 for the day.

Great, thanks to the dividend, I’m only down $24,418.

That’s one way to look at it, but the reality is, as long term investors, we expect the pullbacks on the way to larger gains. The unrealized loss of $25,000 is not real unless we sell.

The $582 is cash in our pocket. Buy yourself something nice.

3rd bonus realization…I spent the week watching my 9 month old granddaughter. There is a lot more to life than finance, the economy and politics. If it’s making you seasick, tune out. Spend time with friends and family, play some golf, or take the dog for a long walk.

Have some fun.