In my personal finance classes, and even in my posts, I can feel people’s eyes starting to glaze over when I start to talk about budgets.

They’re no fun. Most of us don’t want to be an accountant. And accountants are paid for what they do, why would we want to do accounting-stuff in our free time?

I’m with you. Let’s look at this differently.

Where Did It Go?

At the end of the month, did you ever ask yourself “where did all the money go?”

We just spent the majority of our waking lives for a whole month working. We weren’t with our families, or golfing, or learning something new. We worked.

We should have something for that. Yet, instead I have unpaid bills and credit card debt.

What happened?

Let’s Find It

Usually, after we say “where did it go?” we’re on to the next thing. We have kids to drive around, shopping to do, a home or car to repair, or we’re back to work. We get distracted by life.

Not today.

We’re going to find where it went.

How Does it Escape?

We’ll make a few lists today. I love lists.

The first one is a list of exits. List all the ways that money gets out.

For me, there are a few.

- Credit cards – I have 4

- Amazon Prime Visa – it gets me 5% back on every Amazon purchase

- Fidelity 2% Cash Visa – it puts 2% of every dollar I spend back into my checking account each month

- Discover It – 5% cash back categories – varies by quarter

- Apple Card – just because the card looks cool. I use it about once a year

- Checking account – I autopay bills from here and 2 or 3 times a year, I write an actual paper check

That’s it! Easy.

Where Does it Go?

If you don’t have online access to your accounts, set it up now. This will save time and we can get rid of all that paper that shows up every month. I can go online and see transaction history going back years. I can search. Compare that to rifling through a shoe-box filled with old statements.

Now we make list number 2. Where does it go?

It helps to pull up our recent statements and take a look.

Mine goes a few places

- Mortgage/rent

- Cell phone and internet

- Electric

- Credit cards – I have to pay for the stuff I charged

- Trash pick-up

- Gym membership

- Home, Car, Umbrella insurance bundle

- Health and dental insurance – I’m retired. I have to pay out of pocket – yuck!

- Pet insurance

- Water and sewer

- Groceries

- Home supplies

And don’t forget the ones that aren’t monthly

- Federal and state taxes

- Excise tax

- Property tax

- Home heating oil

- Vacation

- Home improvement

I Love a Good Spreadsheet

I like to take all of this and put it into a spreadsheet. If we’ve gotten online access, we can download and manipulate the data from the different accounts to get it into a single sheet.

I know this takes some time and it is a little cumbersome.

But we’re not building a budget. We’re just answering the question we ask ourselves all the time. “Where does it go?”

Account Aggregator

You may have found it cumbersome or a complete pain in the a$$ to download this info, get it in the same format and then consolidate it into a spreadsheet.

I hear ya.

An account aggregator will do this for you. And it works 24×7 on this so you’ll always be up to date.

It is not free however. We trade a little bit of privacy and security for the convenience. The account aggregator has access to our spending transactions. To link our accounts, we have to put in our account ID and password. We’ll need to decide for ourselves if we’re OK with that.

I use 2.

Most of my financial accounts are at Fidelity, so I use their Fullview aggregator. I also test drove credit karma’s solution so I have that active as well.

With both, I can look at one screen and see all my transactions across all credit cards and saving and checking accounts in one place. I can download them to a spreadsheet if I like.

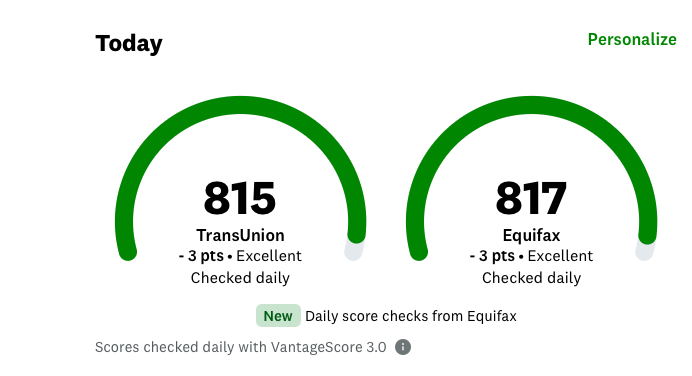

They also have some budgeting tools and credit karma tells me my credit score on the dashboard.

If we choose to go with an account aggregator, it can simplify our lives, but we should do some research and decide if we feel safe before jumping in.

Back to the List

Mystery solved.

I know exactly where my money went. Down to the penny.

One observation I had years ago was “Holy crap, I’m spending how much on home internet, cable and landline?”

I streamed on Netflix and Amazon prime and hadn’t had a call in years on my landline, so I canceled those services and saved $100 per month.

I bought a TV antenna. It’s a little klugy, but I can watch football on live TV over the air. For Free! Yes, it still exists.

What’s Surprising?

Once we have the list, it’s pretty easy to take a look and see what jumps out.

Some financial experts tell us to break the list into discretionary and non-discretionary. I don’t like this. It’s all discretionary, it just depends on what we’re willing to do.

The cable one was an easy one for me. It didn’t cause too much pain and saved $100 per month. That’s $1,200per year. $12,000 in ten years. And that doesn’t include the growth if I invest it. More on this later.

Insurance is a big ticket item. I shop for new insurance every year. Our insurance company counts on us being both loyal and lazy. One of my friends has had the same car and home insurance provider for over 40 years.

Often shopping for new insurance, we’ll get an enticing offer to join (in hopes that we’ll stay for 40 years). If it starts to creep up, we can switch again.

I’ve saved as much as $1,500 per year shopping for a new plan. 2025 was the first year in many where I couldn’t find a better deal.

Extra Credit

I read a story about a couple in Chicago who got fed up with their expenses and their debt. They sold both of their cars, moved to the suburbs and commuted into the city by bike.

That’s drastic.

Some folks look at housing and other big ticket items as non-discretionary. It’s all discretionary, it just comes down to what we’re willing to do to get our financial house in order.

Budget

This one kind of snuck up on us.

We’re almost there.

Now that we have the list of everything we spend money on, we can make some decisions.

And for each item, we need to ask 2 questions

- Do I need this? Or at least really want this.

- Can I get it cheaper?

- Bonus question: Could I find a way to live without this?

Depending on our financial goals, we’ll need to decide how ruthless we want to be in assessing if we’re willing to pay for these items, and how much we’re willing to pay.

Team Sport

If we’re single with no kids and we’re doing this on our own, it’s pretty simple.

Once we’ve got others involved, this needs to become a team sport.

I have friends who have tried to institute a budget, but it’s hard when kids or spouses may not be committed.

Step 1 in getting the team aligned is to discuss financial goals. As I typed that, I knew it was a mistake. Please don’t ask the family to sit down at the kitchen table to discuss their financial goals. Sounds like everyone needs to prepare a powerpoint presentation.

Keep it simple:

- Do you think we’ll stay in this house forever or will we want to upgrade/downgrade?

- We’ve talked about a trip to Europe. Is this something we want to start saving for?

- The kids want to go to Disney. What can we do to put some money aside? Involve the kids in this discussion!

Make these discussions part of your routine.

One of my buddies put a sheet up on the fridge. Everyone in the family needs to record their spending. Even him.

Saving

It’s important to find ways to save.

We can be drastic like the folks in Chicago, but there are lots of creative ways to save without upending our lives. My wife and I continue to save a ton by doing our own home improvements – she’s downstairs redoing the kitchen as I type. We regularly shop for lower prices for cell phone plans, insurance, and anything else we buy. My wife uses coupons and reads the flyers. We have an extra freezer in the basement, buy what’s on sale, and save hundreds of dollars a month.

I’ve written some posts on saving ideas here and here.

Goal Based Accounts

Once we’ve done the hard work of identifying savings, we need to make sure those savings go towards our goals. If we don’t watch over our money, it will go its own way.

I like to set up goal-based accounts.

One of the benefits of technology modernization is that it is easy for us to have lots of accounts. I can go out now and within minutes set up a few accounts on fidelity.com – and you probably can on whatever institution you use.

I can set up a Disney account, a Europe Account, a pay-down-my-credit-card account, an Emergency Fund account…

I can automate transfers to these accounts or I can move in money when there is an opportunity. If it is a short term goal (within the next 5 years) I probably want to have my goal account money in cash and fixed income, but if it’s a longer term goal, maybe we buy shares of a nice low-cost S&P 500 fund and let our money grow. Read about this in asset allocation.

And if our goals change, it is simple to either rename the account, or move money from one to another to adjust.

Budget

That’s your budget.

Find out where your money goes, decide if this is where you want it to go, and if not make some changes.

I’m not going to tell you what you can and can’t spend your money on. That’s up to you.

But I will tell you that this process can save you thousands of dollars per year.

Think about that.

Creating a budget and managing our finances could be more lucrative than getting a part-time job!

Growth

There aren’t a lot of wealthy people who have built their fortune by socking cash away in a savings account.

Warren Buffet said: “If you don’t find a way to make money while you sleep, you will work until you die.”

Read the post what is a safe investment for more details.

To summarize, money that we need in the near future can’t be invested, We have low-tolerance for volatility. But while a nice savings account provides us safety for our short-term needs, it may be an unsafe place for our longer-term goals.

This is because it won’t grow. And we likely can’t save fast enough to reach that goal. Let’s look at an example:

Growth Projection

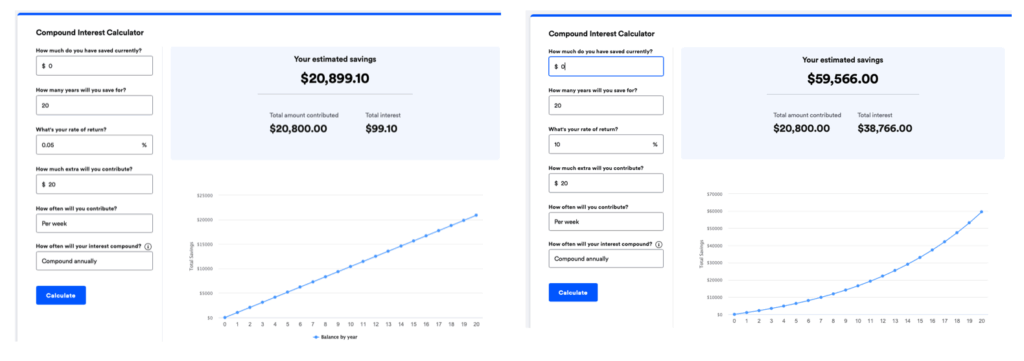

We’ll compare 2 scenarios.

I wrote in the safe investment post about the Bank of America platinum savings account that paid 0.05% interest. We’ll compare that to an S&P 500 mutual fund. The S&P 500 is not guaranteed to increase in value, but it has grown at an average rate of 10% per year for the last 100 years with dividends reinvested. It’s been down 30% some years, up 30% in others, but over long periods of time, it tends to average 10% per year. That’s a good track record.

For more, read how do I know the S&P 500 will go up?

In the 2 tables from bankrate.com, we’re comparing what we’ll have in our account after 20 years if we start with zero, and put in $20 per week. On the left is the 0.05% Bank of America savings, and on the right is a 10% average annual return S&P 500 fund.

The difference is dramatic. Go to bankrate and try different scenarios.

For more, read the posts on compounding and the secret to building wealth.

Wrap Up

While the idea of creating a budget may sound daunting, a budget is a guaranteed way to make sure your money is going where you want it to go. Why do you think every compnay on the planet has a budget?

We should be making decisions about where our money goes. If we don’t take charge of our finances, our finances will be happy to make the decisions on their own and we may not be pleased.