I was not totally surprised to read this over the weekend at The Daily Upside.

The article is a worthwhile 3 minute read, but if you don’t have time (and who does these days??), here’s the premise.

Pensions

The first important point for all of us to understand is that pensions have gone the way of the dinosaur and they’re not coming back.

And while we’d like to blame the greedy, money-hungry, selfish and rich corporations for taking away a benefit that our parents and grand-parents depended upon, the truth is a little bit more nuanced.

Yes, corporations are greedy and profit-focused, but you would be too if you had to report your financial results every quarter to your owners and to the general public. But more on this later…

Pensions are just not viable today. Here’s why.

Back in the 1st half of the 20th century, life expectancy was a lot lower. When I was born in 1963, we expected the average US male (and US males made up most of the pension-owning population) to live to the ripe old age of 69. A worker who retired at 65, would likely receive about 4 years of 70-80% salary as a pension.

Today, that life expectancy has grown to 78. So instead of 4 years of pension payments, a company will need to make 13 years of payments. And this is for every employee who retires!!!

It’s just not viable. This is the same problem Social Security is facing. Social Security’s own trustees forecast that they may run out of money as soon as 2035.

We’re living too long. Which is nice, but creates financial challenges.

But a 401k?

I know. Everyone’s asking. Is this the best we can do?

I worked in the pension department of a small insurance company. We had dozens of actuaries and a whole investment team working on pensions.

With a 401k, we don’t get actuaries and we don’t get an investment team. We’re on our own.

A 401k is not ideal, but with a little knowledge and effort, we can do pretty well.

The Market

The Daily Upside article talked a little about this, and it is consistent with what I heard from lots of folks when I taught personal finance classes.

The market crash of 2008 was devastating. Many 401k s dropped by 50% or more. I know mine dropped 50% and I lost my job as well.

Many of us carry those scars.

But the market recovered all of those losses over the next few years and went on to new highs. We know that now. We didn’t back then.

What is the Market?

“I don’t trust the market.”

I heard this a lot.

I’d often follow-up with a question. “What is the market?” And some would say it’s big greedy corporations. It’s made up of large influential players that we don’t stand a chance against.

So let’s take a quick look because if we understand the market, it’s much easier to participate and take advantage of our 401k.

Indexes

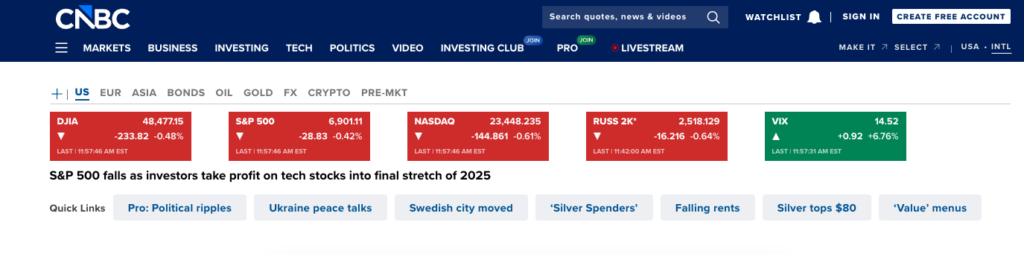

The market is down.

The DJIA (Dow Jones Industrial Average), the S&P 500, and the NASDAQ are all stock indexes. They are essentially a list of companies chosen by the index provider to represent a sector of the US economy.

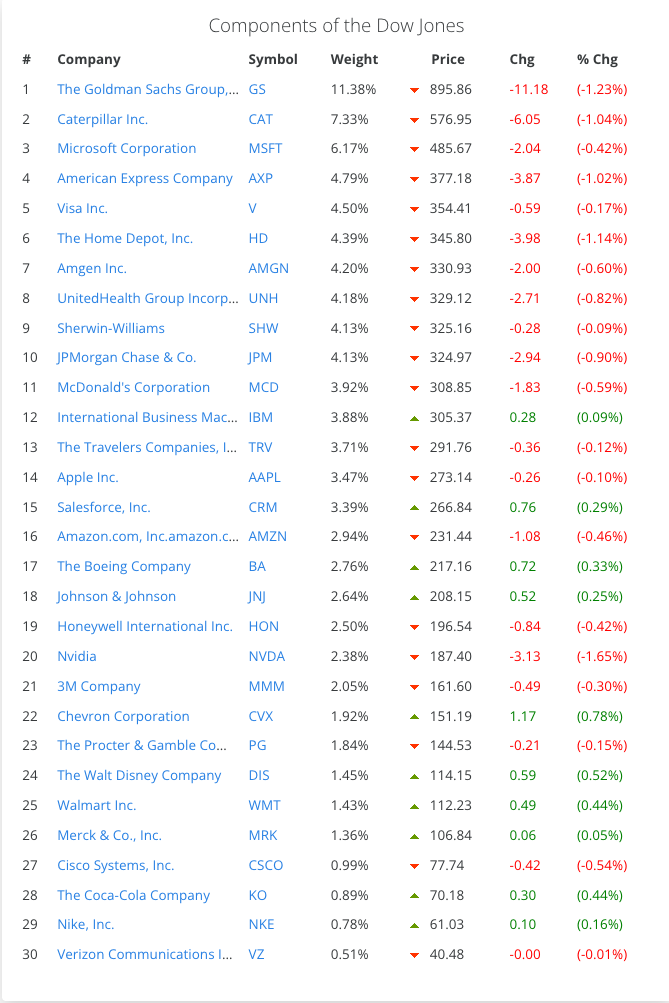

We’ll take a look at the Dow because it’s only 30 companies as opposed the S&P 500, which is 500.

Here are the Dow companies.

Many familiar names here. Dow Jones updates this list periodically to remove companies that are becoming less relevant and adding companies that have a larger influence on the US economy.

Here are some recent changes reported by CNBC.

The Dow is Down

Look at the far right column in the Dow component list. The Goldman Sachs Group, which makes up 11.38% of the index, is down 1.23% today. Many of the other companies are down as well. IBM is up a small %, but it only makes up 3.88% of the index so it has a much smaller influence than Goldman Sachs.

It’s important to understand that when we say the market is up or down, we’re often referring to an index being up or down and the index is a reflection of the individual companies that make up that index. In the case of the Dow, it’s down because Goldman, Caterpillar, Microsoft, American Express, and lots of other companies in the Dow are down today.

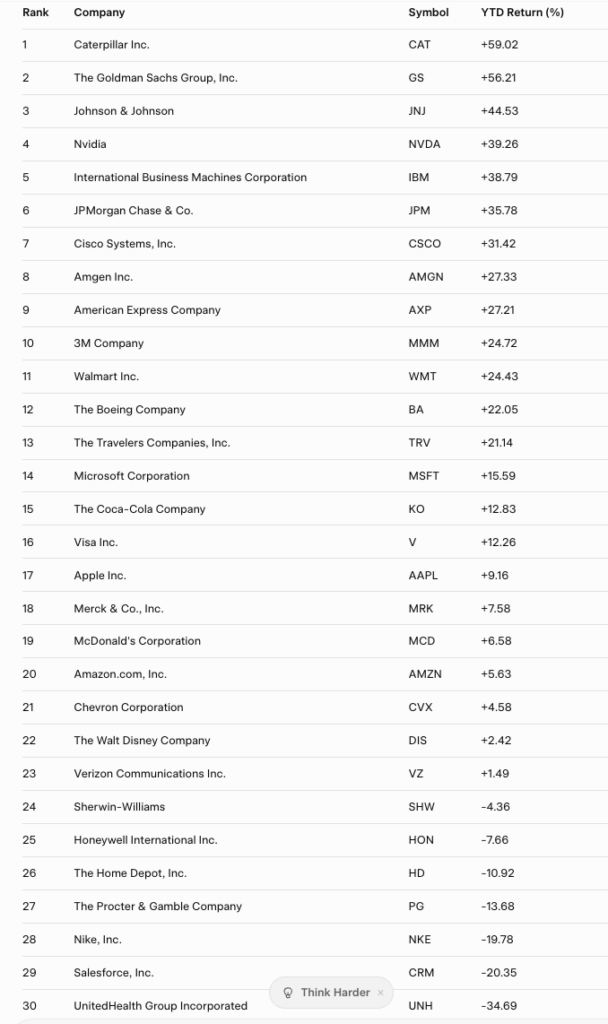

Let’s look at a YTD view. Here’s what Grok told me about the individual Dow component performance YTD (today is 12/29/25)

Caterpillar and Goldman Sachs performed quite well, while Salesforce and United Health did not.

The point here is that the market is not some unknown entity that randomly moves up and down. Market moves are the result of real public company’s price movements.

And why is this important you ask?

It’s important because we can think about Amazon, Apple and McDonalds and Visa and make a case for why they might be up or down in the coming year.

The kids keep buying those damn iPhones, and every time I go to the McDonalds drive through there are 5 cars ahead of me. And I can’t drive down the street without swerving into oncoming traffic because of a parked Amazon van.

It’s easier to evaluate a real brick and mortar company rather than speculating on something so nebulous as the market.

I’m Not Giving My Money To…

Name your company, but I’ve heard this quite often as well.

Folks in my classes have stated that they don’t want to invest because they don’t want to give their money to a large corporation that they don’t trust. This turns out to be a pretty common misconception so let’s take a look at what really happens when we invest in a company.

If I go to my brokerage site and I buy 1 share of Goldman Sachs, the good folks at Goldman Sachs are not involved. They don’t know about my trade, they don’t benefit in any way and they certainly don’t receive any of my money.

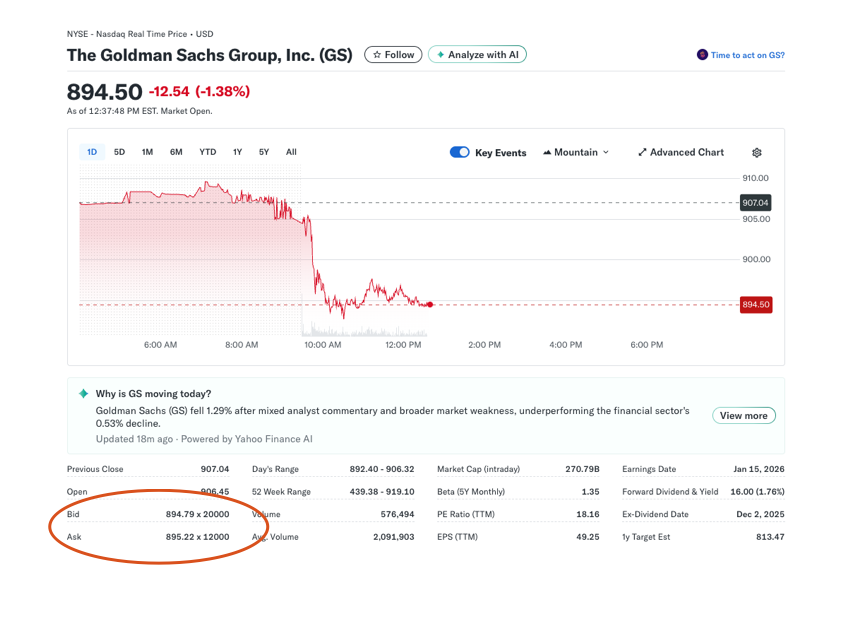

Here’s what really happens. I first go out to check the price of Goldman Sachs.

We usually focus on the $894.50, but that is the price of the most recent trade. That’s history.

What’s important is the bid and the ask prices.

Some investor has 12,000 shares that he’s willing to part with for $895.22 per share. That’s a bit more than the last trade. This is the best offer available right now. There are lots of other investors out there who may be offering different amounts of shares at higher prices, but the quoted ask is the lowest price available right now.

And we have another investor who is willing to buy as many as 20,000 shares at a price of $894.79. He’s offering more than the last trade but less than the lowest ask.

No trading is happening at this particular second, but bids and asks will be adjusted and a trade will happen. It always does.

So, let’s say we’re OK with $895.22 so we buy our 1 share. We get 1 share of Goldman Sachs. Our broker takes $895.22 out of our account and pays the investor who holds the 12,000 shares. He now has 11,999 shares plus our $895.22.

What About Goldman?

Goldman get’s nothing.

Goldman Sachs went public in May of 1999. This is also known as their IPO (Initial Public Offering).

Leading up to May 1999, Goldman would have worked with an investment bank to do a road-show and drum up interest. Investors would have committed to buying shares of Goldman.

At the IPO, Goldman goes from being privately owned to having it’s shares trade on an exchange. The initial buyers from the road-show are actually paying Goldman to own a piece of the company. Goldman got a lot of capital to grow its business and investors got a piece of the company.

Goldman takes its money in May 1999 and goes away to do business.

All trading that takes place after May 1999 involves investors buying and selling shares from one another, but does not involve Goldman.

Investors

Yahoo finance tells us that Goldman has roughly 300 million shares outstanding. With our 1 share purchase we now own 1/300millionth of Goldman.

But we are owners. We’ll be invited to vote at shareholder meetings. We’ll have a say in executive compensation and other important topics. And we’ll participate in profits.

Goldman pays a yearly $16 per share dividend. We’ll get 4 quarterly payments of $4.

If Goldman generates improved earnings in 2026 as it did in 2025, its share price will go up and we’ll participate in capital gains.

As an investor in Goldman, we are owners. We bought our share from another investor not from Goldman.

Mid-Term Summary

OK, we’re halfway through. Nice work getting this far.

- Pensions are gone and they’re not coming back. And now we know why.

- The market is not some ethereal entity that goes up and down for no reason. The market typically refers to indexes and indexes are made up of real companies. Market movements are the result of investor’s bids and asks for those companies. Bids and asks are based on investor expectations for earnings growth.

- All trading on the exchanges (also known as the secondary market) is done investor to investor. The companies being bought and sold are not involved and don’t benefit.

Building Wealth

Now that our pensions have gone away, it’s up to us to build wealth. Social Security may play a role in funding our retirement, but it’s having its own troubles.

If we look at the wealthiest people in the world, they’ve typically made money by building a business. The Waltons in Arkansas are one of the wealthiest families in the US. Sam Walton started Walmart and that worked out pretty well.

Love him or hate him, Elon Musk has started quite a few companies. Paypal, Tesla, xAI, SpaceX, The Boring Company…Each of these started as an idea and grew into a multi-billion dollar corporation.

How about Taylor Swift? She controls quite a few companies that manage her empire. She employs thousands of people. Her Eras tour brought in between 1 and 2 billion dollars. She’s got marketing, PR, Logistics, and many other companies that make this happen, along with the albums, movies, videos, T-shirts and other swag.

Taylor and her empire as well as The Boring Company and SpaceX are privately held, but Tesla, Walmart and many other companies are public, which means they’ve sold shares to the public and those shares can be bought and sold on an exchange through our favorite broker.

Whether it’s the Waltons, Buffet, Gates, Bezos, Musk or Taylor, most folks who have built staggering wealth have done it by starting and growing a business or 2.

How About Us?

Unfortunately we’re not all cut out for this type of work, but that doesn’t mean we can’t build wealth. Read my post here to learn about a secretary who amassed an $8million fortune.

Our 401k is a great way to build wealth.

Mutual Funds

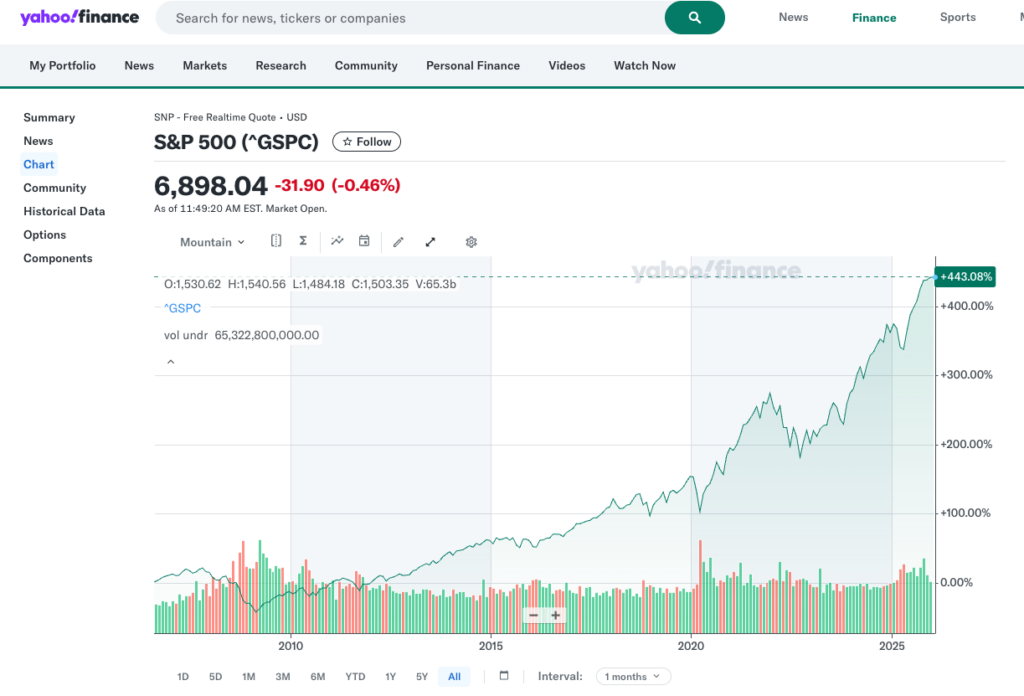

Every 401k plan has a menu of mutual funds from which participants can choose. Mutual Funds are investments that provide us with a basket of securities. For example, an S&P 500 fund will invest in the 500 largest publicly traded US companies. This includes companies like Walmart, Coca Cola, Nike, Apple, Amazon, McDonalds and Starbucks. When we own an S&P 500 fund, we own a little piece of all of these companies and we participate in their dividend payments and in their capital gains or losses.

And while the S&P 500 has had some rough years, like in 2008 when it dropped 50%, it has averaged 10% annual returns with dividends reinvested over the last 100 years.

This isn’t luck. It’s because we keep having babies, buying diapers, formula, car seats, and then iPhones and cars and… you get the picture. We keep innovating and growing. More on the S&P 500 and why I continue to be optimistic here.

How Do I Choose?

An S&P 500 fund is a solid choice for long term growth. But as we near retirement, we’ll want to take some gains and move our money into less volatile assets. This is a process called asset allocation.

If this seems challenging, many 401k plans offer target date funds. Target date funds manage our asset allocation for us.

Let’s say I’m 25 years old and starting my 401k. I intend to retire somewhere around 2065, 40 years from now, when I’m 65. My plan likely has an investment option called something like Target Retirement 2065.

The Target Retirement 2065 fund will be heavily invested in equities today because fund participants have 40 years to grow their wealth. As we get closer to 2065, the fund manager will reduce the equity allocation of the fund and increase the fixed income and cash allocations so that the fund will be less volatile and preserve assets that we’ll need to fund our spending in retirement.

If we’re 40 and we’re retiring in 2050, there’ll be a Target Retirement 2050 fund for us.

It’s Our Money

This is a very important point.

Money that we put into a 401k belongs to us. We’re not giving it to anyone. It is in a separate account with our name on it and it belongs to us. We make investment decisions, and if we choose to leave our company, that account goes with us.

This is true for money we contribute. It may not be true for money that the company contributes, for example an employer match or profit sharing. Employer contributions may be tied to a vesting schedule and may not become ours until we’ve been employed for x # years.

But any money we put in belongs to us.

Wrap Up

A 401k retirement plan is a fantastic savings vehicle. Money comes out of each paycheck so we’re constantly adding to our retirement fund and because we contribute regularly, we are dollar-cost-averaging, which simply means that we’re buying some shares when the market is up and the cost is high, and some when the market is down at a lower cost.

We can generally choose between traditional and Roth contributions. Both are tax advantaged and we win either way, but traditional gives us a tax advantage today, while the Roth gives us a tax advantage when we take the money out.

For more on mutual funds, read my post here.

For more about retirement plans, click here.

Here are some thoughts on how to participate in a 401k plan.

And finally, some info on compounding to see how our wealth can grow.

A 401k plan is a fantastic benefit. Take advantage.