I wrote a little about dividends here and here. The first post is about why dividend stocks have a place in your portfolio and how a company handles dividends. This is great, but what if I own a mutual fund. Does that pay dividends?

Maybe, let’s take a look.

Mutual Fund

A mutual fund is a basket of securities. Why would we want this?

I enjoy researching companies and following news on many companies. I can feel many of you starting to yawn and I suspect I just lost a few dinner-party invites with that statement.

For those who have better things to do, it would be great to have a person or a computer that would do the hard work of researching companies and analyzing balance sheets for us.

Well, that’s a mutual fund.

Active v. Passive

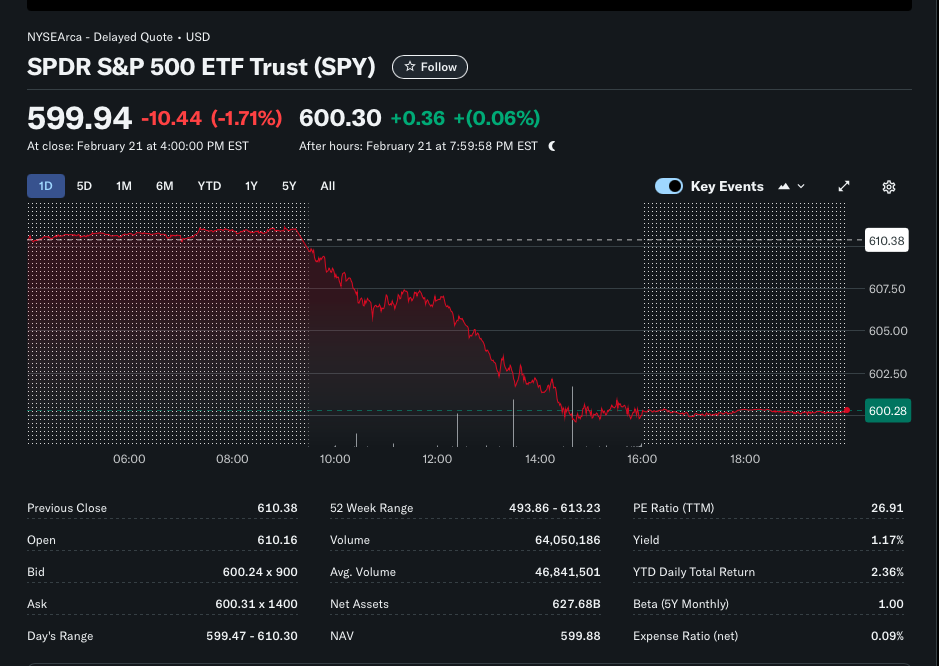

Active funds have a portfolio manager or portfolio management team that picks stocks. A passive fund replaces the portfolio manager(s) with a computer model. An example is an S&P 500 fund like the SPDR S&P 500 ETF Trust (Ticker: SPY).

A company called Standard and Poor creates this index. It’s essentially a market cap weighted list of the 500 largest US companies. Market cap weighted just means the bigger companies have a bigger position in the index.

Every S&P 500 index fund and ETF buys shares of each of these 500 companies in the exact ratio as specified in the index.

Dividends

And yes, many funds and ETFs pay a dividend. This is because some of the companies that the fund holds pay dividends and the fund is required to pass these on to the fund shareholders. Let’s take a look at how that works.

Company Dividends

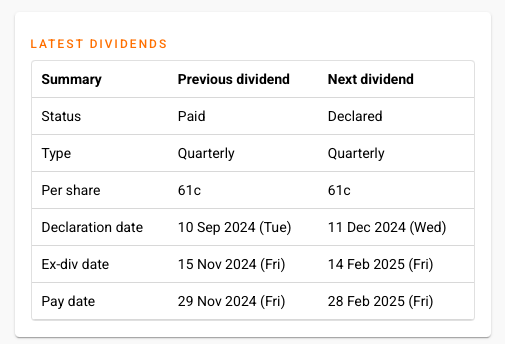

Let’s take a look at Starbucks (Ticker: SBUX). Here’s the dividend info from dividendmax.com.

Declaration Date

On December 11, 2024, the management of Starbucks announced that they would pay a dividend of $0.61 per share to every Starbucks shareholder. Companies tend to do this right around quarterly earnings time. Companies also work really hard to continue paying dividends and to increase them each year. More in this in the dividend post.

Record Date

Not listed in the chart above, but a very important date. On the record date, the record-keeper creates a list of all the Starbucks shareholders. Any shareholder who holds shares at the close of trading on the record date is entitled to the dividend. Buy shares the next day, you’re out of luck. Wait til next quarter.

Ex-dividend Date

Also important. This is usually the next business day after record date.

Companies like Starbucks are putting money aside throughout the quarter, because they know they’ll need to pay a dividend to shareholders. This money is set aside, but is still on the company’s balance sheet and is still included in the company’s assets.

On the ex-date, the company takes this money off of its balance sheet and hands it over to a trustee to prepare for the process of distributing the dividend.

The dividend is not a trivial amount of money. Starbucks has 1.14 billion shares outstanding. Each share is entitled to $0.61. That’s over $600 million coming off the balance sheet. All things being equal, the stock price will drop by 61 cents per share amount on the ex-date because the company has essentially lost that value.

Pay Date

This is the fun one. This is the date that the dividend goes out to shareholders. If I hold 100 shares of Starbucks, I’ll get $61 on the pay date. It magically shows up in my brokerage account.

Mutual Funds

So how does this impact my SPY fund?

SPY fund holds Starbucks. Starbucks is in the S&P 500 so all S&P 500 funds hold shares. So SPY is entitled to 61 cents for every share it holds. SPY holds over 13 million shares of Starbucks, so it receives a nice dividend payment.

While the nice folks at State Street Global Advisors would love to put this cash in their pocket, that’s not how this works. The shareholders of the fund are entitled to the dividends.

When Do Fund Shareholders Get Paid?

If I own Starbucks shares directly, I get paid on the pay date. Fund shareholders need to wait a bit. Here’s why.

The SPY fund holds 500 companies. Many of them pay dividends. It’s likely that on any given day one or 2 of the companies in the index is paying a dividend. It would be a bit of a burden (and expense) to pay these out to fund shareholders every day.

So instead, the fund puts these assets aside – similar to the way Starbucks did. On a regular basis, usually quarterly, funds will pay out all accumulated dividends.

How Much Will I Get Paid?

It would be really hard to figure out how much the fund is getting in dividend payments and what our share would be. But the fund is nice enough to tell us what its yield is.

SPY yields 1.17%. The record-keeper figures out the dividends it expects to get from its holdings and represents that as a percentage. So at $599.94 per share, I will get 1.17% X $599.94 = $7.019 per share each year.

Wrap-Up

Dividends are an important part of an investing portfolio, especially for those of us in retirement who are looking for income. And while dividends are paid by companies, mutual funds that hold dividend paying stocks will pass those dividends on to shareholders.

This is true of the SPY, as well as some higher dividend yield funds like Vanguard High Dividend Yield Index Fund ETF Shares (VYM), which has a yield of 2.64%.

And the great thing is that the mutual fund or ETF will calculate and pay this to all shareholders, along with doing the hard work of managing your assets. It’s a pretty good deal.