Congratulations! You have a new job.

At some point early on at our new company, we’re invited to a new hire orientation session where one of the key topics is benefits.

One of the best benefits that is often not given enough focus in these sessions is the 401k plan. Today we’ll go through the basics of how to use this plan to our advantage.

Retirement Savings Plan

A 401k plan (or a 403b or a SEP or a SIMPLE) is tax-advantaged savings plan. 401k plans exist to help us build the wealth that we’ll need to get us through our retirement years. Social Security likely won’t cover all of our expenses, and very few companies offer pensions anymore, so it’s up to us.

For those who want a deep dive into retirement plans (including pensions) click here.

Our Money

The most important thing to understand is that money that we put into a 401k plan is our money. We will have an account with a record-keeper and we can log in and see our account balances. This money may grow or shrink depending on market conditions, but what’s there is ours. If we decide to leave our employer, we can take our 401k with us.

Investments

We’ll dive deeper in a minute, but for now, it is important to understand that because the 401k is our plan and our money is invested, we are responsible for choosing investments.

Our employer and the record-keeper will offer a menu of mutual funds from which we can choose, but it’s up to us to choose the specific funds in which we will invest.

Tax Advantages

In order to encourage us to save for retirement, we’re given some tax advantages.

Most 401k plans allow us to choose between making Roth or traditional contributions.

Roth contributions are made after tax. That is, we are foregoing a tax advantage today for a future tax advantage. More on this in a sec.

Traditional contributions are made before tax. The contributions go into our 401k before taxes are taken out so it reduces our current income. Stay tuned for an example.

Both traditional and Roth save us on taxes and are great choices.

Contributions

Our plans are funded by employee contributions. That’s us. We defer some money from each paycheck which is deposited into our plan. Employee contributions can either be pre-tax (traditional) or post-tax (Roth).

If we’re lucky, our employer may make contributions as well. The 2 most common employer contributions are:

- Match – an employer may match our contributions up to a certain amount. For example, the employer may match dollar for dollar up to 3% of pay. We’ll do an example later.

- Profit Sharing – sometimes when companies earn profits, they share the profits with employees through profit sharing contributions to their 401k

While this may sound complicated, our company’s 401k record-keeper keeps track of all of this for us.

We’ll talk about some Roth v. traditional considerations because we’ll need to choose between the 2. As for employer matches and profit sharing, be sure to find out if your company offers these. They are free money, but only if we participate.

Taxes

Show of hands – who likes to pay taxes?

Right, no one. So this idea of a tax-advantaged retirement savings plan sounds cool, but what does it mean?

Let’s take a quick look at 3 tax scenarios. I promise it will be quick and painless.

After Tax (saving outside of a 401k)

If I were to save for retirement in an after-tax account like a standard bank or brokerage account, I receive no tax advantage.

My earnings on my paycheck are taxed. The state and federal government withhold from every paycheck and then at the end of the year, I file a tax return to pay any additional taxes I owe or get a refund if too much has been withheld.

I can choose to take some of my paycheck and put it in a savings or investment account. Since we’re typically only taxed once on ever dollar, I won’t pay taxes on the money I put in, since taxes were already withheld in my paycheck, but I will pay taxes on any dividends, interest or capital gains that the account produces. We’ll get a 1099 tax form each year for these and we’ll have to pay when we file taxes.

Tax Advantaged

Now, if I use my company’s 401k retirement plan to save, there are some tax advantages over a standard bank or brokerage account. And I’m typically allowed to choose whether I want to make traditional or Roth contributions. We’ll go through both because the tax advantages are different.

Traditional

If I choose to make traditional contributions to my 401k, these contributions are made pre-tax.

If my paycheck is $100 and I choose to contribute $10 to my 401k, the $10 comes out first and taxes are calculated based on an income of $90, which is the amount I received after the 401k contribution was taken out.

And if this is my weekly paycheck, then I’m putting $520 (52 weeks x $10) into my 401k and I’m reducing my taxable income by that $520.

Roth

If I choose Roth contributions, those contributions are post-tax.

In that case, I get the same $100 paycheck, I put $10 in my 401k, but I’m still taxed on the full $100.

That doesn’t sound like a tax advantage, right? But wait…

401k Growth and Distributions

We joined the 401k plan so that we could grow a nice little nest egg for retirement.

Aside from our, and our employer’s contributions, our money can grow in 3 ways:

- Interest – If we hold an investment like a CD, it will pay interest. If we have $100 in a CD paying 4%, we will get $4 per year in interest added to our 401k account.

- Dividends – Some, but not all, mutual funds pay dividends. Dividends may accumulate in the mutual fund and will be paid out to shareholders on a regular schedule.

- Capital Gains – We expect that the mutual funds that we buy will be worth more in the future than they are worth today. That increase in value is called a capital gain.

Let’s take a look at how our account grows, and how we take the money out once we retire.

Whether we choose traditional or Roth contributions, we won’t pay taxes during our working career as long as we don’t take the money out. Taking the money out is called a hardship withdrawal and we’ll encounter a penalty AND we’ll pay taxes. We try and avoid this at all costs.

If we invest well, which we’ll talk about shortly, our 401k will grow over the years. And even though some of our investments may pay dividends, interest or capital gains along the way, we will not have any tax implications – for now anyway.

Roth

Remember our Roth, we got no tax advantage on the contributions. But, and this is a very big deal, because we paid taxes before the money went into the account, there are no taxes when we take the money out. There are no taxes on the contributions or on any of the gains.

Employer contributions, however, are currently handled differently in a Roth. Even if we make Roth contributions, any company match or profit sharing contributions will be held separately and will be taxed as ordinary income on distribution.

This changes with the SECURE 2.0 act that passed recently, but to my knowledge, no record-keepers have implemented the changes, so it’s a little fuzzy. The intent is that employer contributions would be tax-free as well.

Traditional

Traditional contributions grow tax deferred. There are no taxes paid while the account is growing. Once we retire and we start taking money out, we will be taxed at ordinary income rates for every dollar we take out.

We saved on taxes throughout our working career, but we’ll be taxed at ordinary income rates once we withdraw.

How Do I Decide?

401ks are complicated. And decisions like Roth v traditional have no right answer.

Because of this, many of us defer putting money into a 401k while we wait to find the time to figure this out. Don’t wait!

Both traditional and Roth are awesome. We’re saving and we’re getting a tax advantage. Choose either and you win.

To really win, choose early. The sooner we start saving, the wealthier we’ll be. Look at the story of Al and Peg in the compounding post.

Factors

In general, if we think our tax rate will be higher in retirement than it is today, a Roth is a great choice. We pay taxes today at what we expect to be a lower rate, and we pay no taxes years down the line when we withdraw.

If we think that when we’re retired our income will be lower and our tax rate will be lower, it may make sense to take the tax benefit today and make traditional contributions and pay the taxes in the future.

2 other considerations

- If we invest well, our earnings will grow to be significantly more than the total value of all contributions. By choosing a Roth, we’re paying taxes on the contribution, but never on the earnings.

- To counter this, for traditional contributions, since we’re not paying taxes today, we can theoretically afford to put more money into the 401k. Those additional contributions could grow over time to exceed the Roth tax benefit.

The Right Answer

Try a surf and turf. Why not do some Roth and some traditional. I did. It worked out nicely.

While plans may not allow you to split your paycheck into Roth v traditional contributions, we’ll generally be able to switch from Roth to traditional or vice versa at our annual benefits enrollment.

And remember, both are awesome. Pick one and start now.

Investments

Here’s the other area where people get stuck. We’re given stacks of information with tables and figures and we’re expected to choose which investments are right for the next 40 years of our investing life.

Before we choose investments, we first need to make a much simpler decision. How much time do we want to spend researching investments and choosing funds. We’ll do multiple choice.

- None

- Very Little

- A few hours today and a few hours once per year

Make your selection. I’ll also let you know that option 3 is not necessarily any more profitable than 1.

If you chose 1, congratulations. Choose a target date fund and never think about your 401k again until you retire.

Target Date Fund

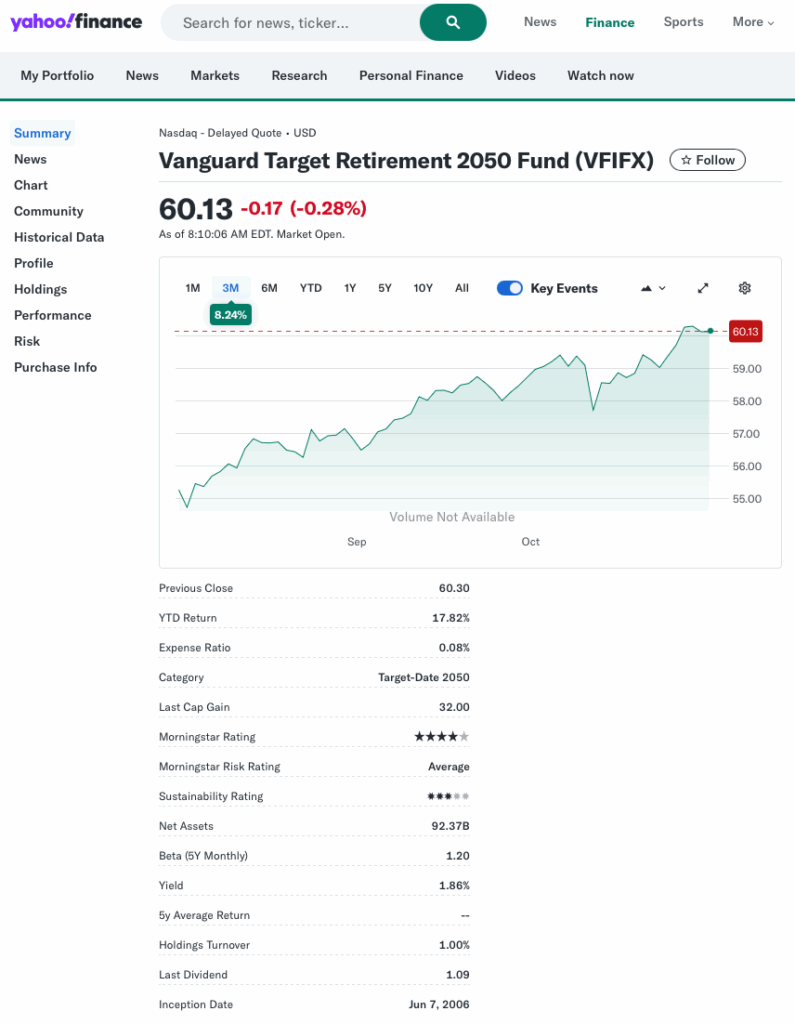

A target date fund will look something like this.

The key is the date in the name of the fund – for this one 2050.

This fund is for folks retiring in 2050. Vanguard also has a 2045, a 2055, a 2060, and lots of others.

This fund will hold a mix of bond and stock mutual funds, that will give us exposure to many different sectors, regions and markets.

Since 2050 is 25 years away, the fund is invested aggressively. As we get closer to 2050, the fund will adjust its holdings to become more conservative.

Bonds v. Stocks

Stocks (equities) have historically returned more than bonds (fixed income), but bonds are less volatile. As an individual investor, we want to invest heavily in stocks when we have a long time horizon and rotate into bonds as we come closer to needing to take the money out for expenses. This is a process known as asset allocation.

If we choose a target date fund, we don’t need to choose any other investments. The target date fund handles this for us.

Very Little Effort

If we choose to be a little more involved, but we want to limit our time, we may want to choose a nice low-cost S&P 500 fund and a nice bond index fund.

The S&P 500 is a list of the 500 largest publicly traded US companies. It contains Apple, Amazon, Google, McDonalds and Caterpillar, and 495 other companies.

The S&P 500 has returned 10% annually on average for the past 100 years or so with dividends reinvested. More on the S&P 500 here.

That means that if we put our money in an S&P 500 fund and we keep contributing for 20 years, history tells us that we’re likely to average 10% per year. But the S&P 500 is volatile. Some years it is up 30% other years it is down 30%. That’s why we migrate towards bonds, which are less volatile, as we near the date when we need to withdraw.

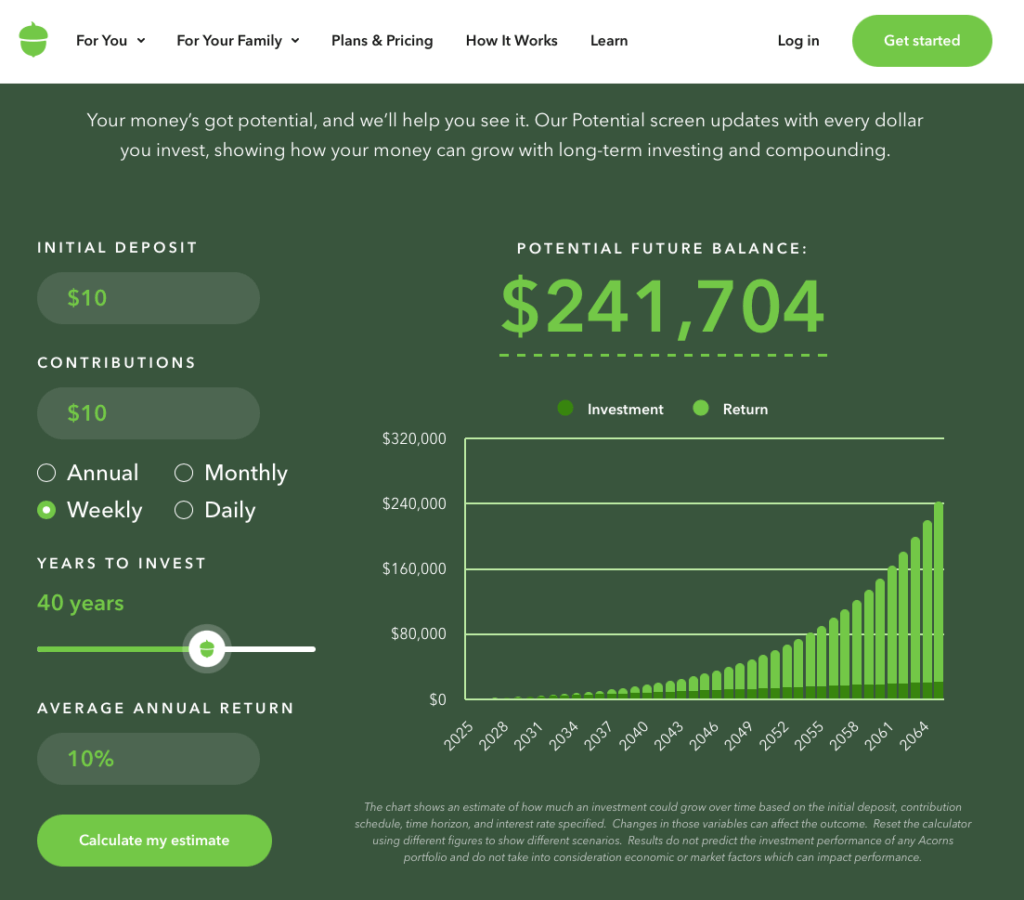

Assuming the S&P 500 continues to deliver 10% on average, here’s what our $10 per week might yield after 40 years. Try it yourself at acorns.com

And if we’re putting away $100 per week, we could have over $2 million.

But this option involves choosing a stock index fund, a bond index fund and assessing our asset allocation once per year as we get closer to retirement. But we’ll need to read a prospectus or 2 to understand what our index fund is all about.

Option 3

Option 3 assumes we’ve got a little knowledge of funds and investing. Even if we don’t, spend a bit of time with my finance basics posts and you’ll know enough to do this yourself.

With option 3, we’re going to read some prospectuses, do some research and we may allocate more of our portfolio to sectors, markets or economies that we expect have higher growth potential.

This also includes an annual check-up where we evaluate whether we want to make any shifts in our strategy.

Option 3 is more effort, and there is no guarantee we’ll make good choices, but it gives us the opportunity to be more involved in actively managing our retirement assets.

Risk

Remember, our 401k is a retirement asset. We start our 401k as early as possible. We don’t expect to withdraw until retirement, and even then, we’ll take a little out each year, but a good portion remains invested.

Because we have a long time horizon, we can take more risk. This doesn’t mean betting it all on a high-risk fund, but we can tolerate some market volatility in exchange for higher long term gains.

A good rule of thumb is to take 100 – our age to determine the % of our portfolio that should be in equities (stock). At age 20, we should be 80% in equity.

Choosing ultra conservative investments may stop us from suffering short term losses, but will prevent us from growing the wealth we need to fund our retirement.

Matching Contributions

I mentioned above that some employers offer matching contributions.

This is free money that we only get if we participate.

If the employer matches dollar for dollar up to 3% of salary, what that means is that for every dollar we contribute to the plan, our employer will also contribute a dollar.

But, they can’t afford to throw away money so they set a limit. In this case 3% of salary. So if I make $100,000 each year, once I hit $3,000 in contributions, my employer will stop contributing on my behalf until next year.

But that’s a free $3,000. We need to make sure we contribute enough to get the full match.

For example, if I’m contributing $2,500 per year, I’ll get $2,500 in employer match, which is awesome, but I’m losing out on an additional $500 from my employer.

Wrap Up

A 401k is a gift.

It is a tax-advantaged way to save for retirement. Uncle Sam has vey few tax loopholes for the average Joe. This is one. Don’t let it pass you by.

Can’t choose between traditional and Roth? Both are awesome. Try one. Change your mind, most plans allow you to change your future contributions.

Starting now is a much better plan than starting tomorrow. For those who didn’t go to the compounding post and read the Al and Peg story, here’s the cliff notes version.

Al starts saving at 22. Peg waits until 34. Al stops contributing at age 34 and Peg contributes until she’s 65. Al contributes less than half of what Peg does but ends up with more than twice as much.

Saving early matters.

Target date funds are a great option for many of us. Professional fund managers build a portfolio of mutual funds for us and they adjust the allocation as we get closer to retirement.

It’s not as hard as it may seem. Good luck!