I’ve saved for retirement throughout my whole working career. Even when I had first started working and I was buying my first home and starting a family, I made sure to contribute to my 401k. To me, this has always been one of the great features of a 401k. The money magically came out of my paycheck and I learned to live on what was left.

As I became more successful, I deferred more and more to my 401k each year. I also started a brokerage account where I could save some additional money. I got interested in the stock market and started putting some year-end bonus money here to buy shares of cool companies like Amazon, Apple and Netflix.

My wife and I worked hard to pay off our mortgage. We both hate having debt. This gave us an additional chunk of money each month to invest.

Where Did The Money Go?

Duh! It wen’t into our 401k accounts and our brokerage account. I can log in every day and see it.

Planning for retirement was a bit stressful. I’m 56 years old and I’m deciding to resign from a job I’ve had for many years and assuming that the money I’ve saved will last me until I’m in my 90’s. How do we know for sure?

Luckily my brokerage site has a planning tool where I can enter my expenses, and some assumptions and it will help calculate my draw-down rate and my balance at end-of-plan (a nice way to say “when I die”).

So, I’m happy. I have a good chunk of change and a plan to invest and grow that looks like I’ll be able to afford food, shelter and maybe some golf until my time is up.

Passbook Savings

I remember my first bank account. My mom took me to the Beverly Savings Bank downtown and I opened up my own account for my paper-route money.

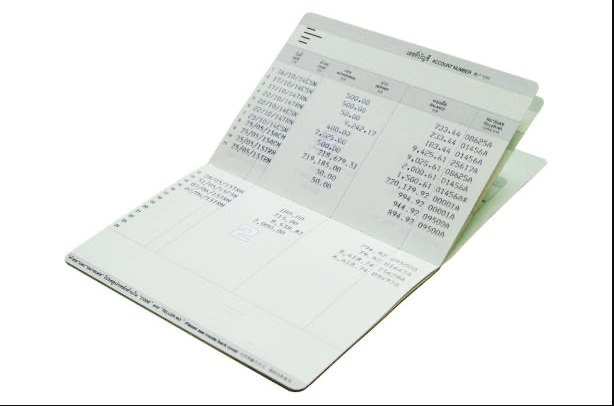

What a thrill as a kid to have my own bank account and to watch my savings grow. I had a passbook that looked like this:

Every week, I would bring my money to the teller window. The bank teller would take my money and my passbook and put the passbook into a machine that would add an entry with my deposit and the new total balance. Isn’t technology wonderful!

Today, It’s Different

Today, technology has changed a bit. This is all magic. I included the photo of the passbook because anyone who is my daughter’s age or younger would likely have no idea what I was talking about.

Today, our paycheck is direct deposited. Bills may pay automatically. We can largely put everything on autopilot. I recommend keeping tabs on this, but I’ve met many who don’t and just rely on the machines to get it all right. For those folks, go watch 2001: A Space Odyssey. Do you trust Hal to do your banking?

But What If?

What happens if the power goes out? OK, this happens sometimes, no big deal.

But, what happens if it goes down for a day, a week, a month??? Maybe longer.

How much money do you have? How do you prove it?

Start hunting for your passbook? It doesn’t exist.

Statements

Somewhere on your bank and brokerage website, is a page called Statements. You’ve likely never gone there. Even those of us who neurotically track every transaction (I’m logging in now to make sure that Amazon actually posted the credit for the return that it says it processed) rarely, if ever, go there.

Statements are antiquated. They show the beginning balance, all the transactions, and the ending balance. I can have the transactions texted to my phone so I can review them real time. A statement, pshaw.

And many of us now track this information in spreadsheets. It’s much easier to use and we can perform our own calculations to manage balances, income and expenses across several accounts.

Prove It

But again, when the power goes out, or the zombies come for us, how would we ever prove we had any money? If I show up at my bank or brokerage (if I can even find an office to show up to…) how do I prove I’m a customer? How do I prove what I own?

Wrap-Up

The zombie apocalypse is probably not coming. But the power may go out. And with the weather becoming crazier and hackers getting into everything, we need to think about our vulnerabilities.

For me, trusting that the machines will remember they have my money is a vulnerability.

This morning, I logged into every account and printed a year-end statement.

Will I ever need it? Will it help? Who knows.

But having my entire life savings living on a web page and trusting that it will be there when I need it seems a bit reckless.