Most of us have a 401k, an IRA or a brokerage account. If we do, we probably have had to select mutual funds (I’ll use the term mutual fund to cover both funds and ETFs as they’re similar). Today we’ll talk about some of the things we need to look at before making that choice.

While this may seem hard, and a lot of the material that fund companies provide makes it seem harder than it should be, in just a few clicks, we can compare the key data elements and make a reasonable choice.

Goals

Before we can choose a fund, we need to define our goals for this fund.

Duh, right, I want to make money.

But let’s get more specific, and let’s use an example.

I am 62 today and could live into my 90s. I have money invested in a growth fund that I expect will be quite volatile, but I expect in 20 or 30 years, my shares will have increased in value significantly.

I have a good chunk of money in a municipal money market fund. I bought my shares years ago for $1 per share. They are $1 today. They will almost certainly be worth $1 20 years from now.

But, the municipal money market fund pays me a 3% annual dividend that is tax free. I hold these shares in my brokerage account. I don’t reinvest the dividends. I use the monthly dividend to pay bills. And since it is state and federal tax exempt, I pay no taxes.

Both funds make money, but very differently. They serve different goals.

Spend a few minutes to think about your goals before investing in any fund.

Holdings

This is always the first stop for me. It’s like flipping to the back of a mystery novel to see how it ends.

This tells us a lot about the fund. Let’s take a look at the Fidelity Blue Chip Growth Fund (FBGRX).

Some pretty popular companies here.

Going back to my goals, I tend to favor S&P 500 index funds. You can read about it here.

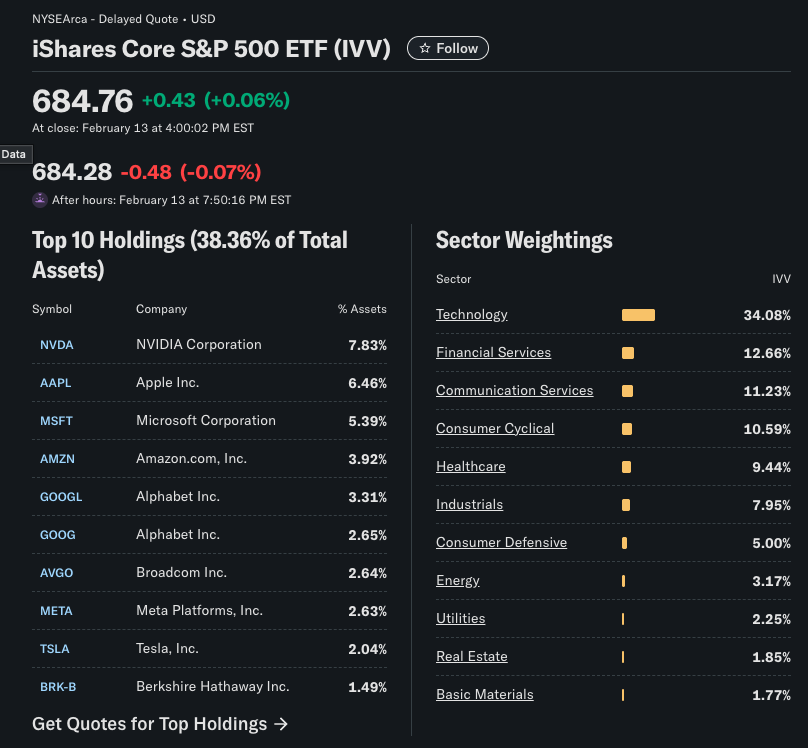

Because I have a lot invested in the S&P 500, I’m typically choosing funds that hold different companies. Let’s take a look at the holding of an S&P 500 fund.

A lot of the same companies in the top 10 of both the S&P 500, and the Blue Chip growth fund.

I’m also a little concerned about the lack of energy stocks in the Blue Chip Growth Fund. I’m excited about energy lately (read here) and I’d like to have a larger allocation.

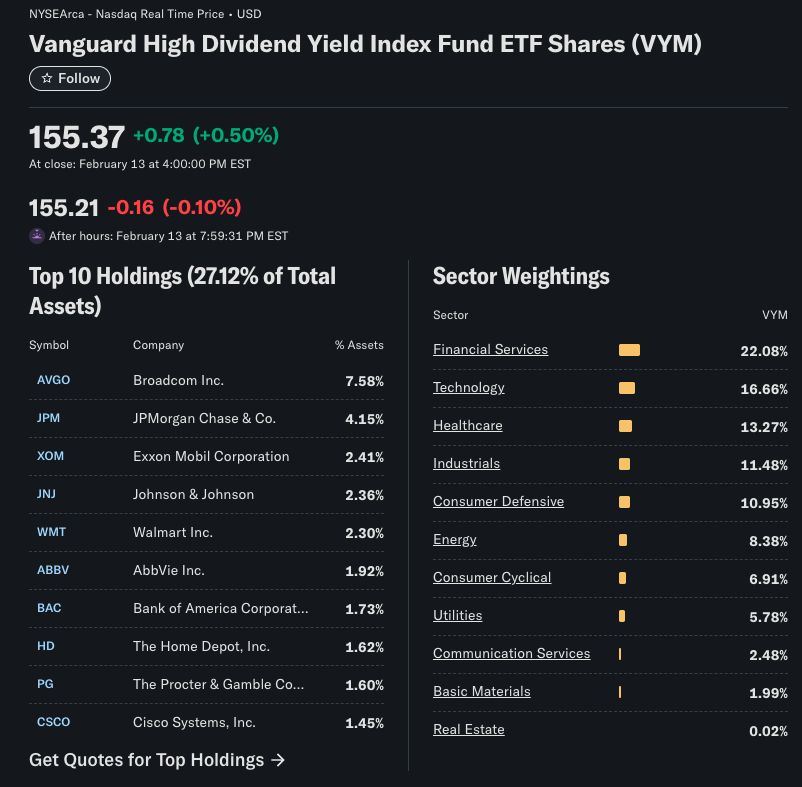

I ended up choosing the Vanguard High Dividend Yield Index Fund ETF Shares (VYM)

It offsets my S&P 500 fund nicely. It only has 1 overlap (AVGO) in the top 10. It also has a little higher energy exposure and has Exxon Mobil in the top 10.

If we’re familiar with the companies, the top 10 holdings can tell us a lot. They can also help us avoid thinking we’re diversified by holding a few funds only to find that all of them have the same top 10 holdings.

Expense

Mutual funds are a great way to get diversification for a reasonable cost. We also get either professional management (with active funds) or we follow a broad market index (with passive funds).

But neither is free.

While we don’t write a check to pay for fund expense, a small piece of our mutual fund gains go to pay these expenses. You can learn more about how a mutual fund works here.

Every fund is required to tell you how much of your earnings are going towards paying expenses. You’ll see it in the expense ratio

There it is on the bottom right of the Yahoo finance page. 0.06% or $6 per year for every $10,000 invested, is going toward fund expenses. The fund calculates this for us and holds back the money, but it is important to know what we’re paying.

As a general rule, actively managed funds are more expensive than index funds. And the complexity and the type of assets that the fund invests in can impact cost. So it’s important to compare the expenses of one fund against the expenses of similar funds.

And while expenses seem like a small amount, over a period of many years, a small difference in expense ratio can make a big difference in returns.

FINRA (Financial Industry Regulatory Authority) has a fund analyzer that helps compare the impact of fees among different funds. Try it here.

Profile

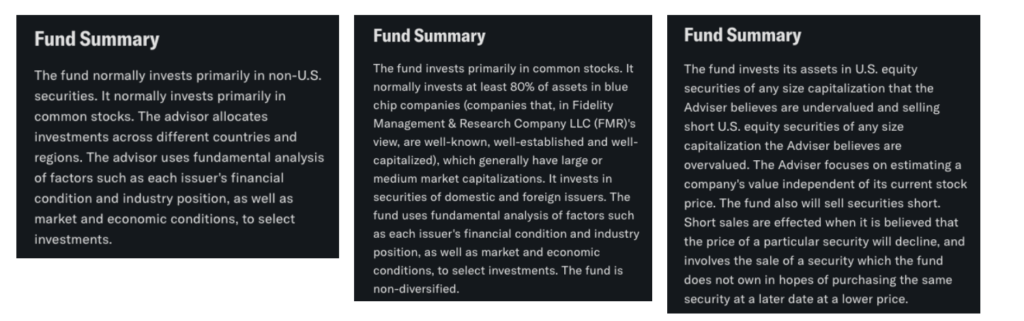

The profile is a brief paragraph describing te investment philosophy of the fund. Here are 3 examples from 3 different funds.

We can tell where the fund invests. The first is non-US, while the last is US only. The one in the middle invests in large and medium cap companies. The 3rd holds short positions.

We can look at the fund prospectus to learn more, but the profile alone gives us a 30 second overview of how the fund invests.

Performance

But in the end, this is really what we’re looking for. We’re told past performance is no guarantee of future returns, but what else do we have to go off of?

When I applied to college that asked for my grades. I tried to tell them “past performance…” but they still wanted them.

Yahoo finance, and brokerage sites, make performance info easily available.

I like to look at performance in 2 ways

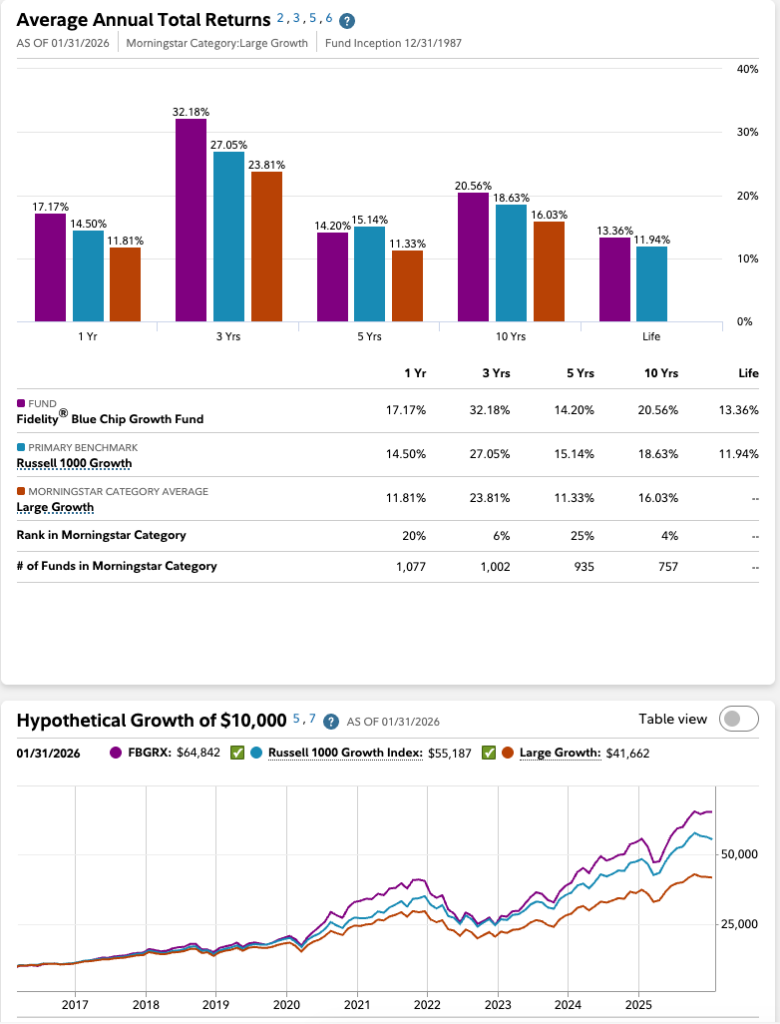

- Performance v. Benchmark – Every fund has a benchmark. For performance assessment, independent research companies like Morningstar choose a representative index to compare the fund to. As an investor, we’d like our fund to beat the index, or at least keep pace with it. Yahoo calls this the category – for FBGRX, the category is Large Growth – and we can see that for some periods we’re ahead of the category, some behind.

- Performance v. S&P 500 – this is my personal comparison. The S&P 500 is made up of the 500 largest publicly traded US companies. That’s a solid group that includes Amazon, Apple, Microsoft, McDonalds, Disney, Starbucks… The S&P 500 has gained on average 10% per year with dividends reinvested over the last 100 years. That’s a pretty good record. In my mind, an alternative fund has to have something pretty special in order for me to consider it over an S&P 500 fund.

It’s also important not to just look at recent performance. Many of us fall into the trap of jumping into this year’s hot investment fund. It’s had a huge run-up and we don’t want to miss out so we sell shares of a laggard and buy the hot fund.

Reversion to the mean is a real thing. Last year’s laggard will often outperform. Last year’s hot fund rarely has a second market-beating year. This isn’t always the case, but it happens quite often.

Performance Analysis

My brokerage website shows me this view of performance.

I’d be willing to put some money into this fund. It regularly beats its benchmark. That’s good.

But wait, how does it perform v. a nice S&P 500 fund like the iShares Core S&P 500 ETF (IVV)

Not so hot. And the expense ratio for Fidelity Blue Chip is 0.61% v 0.03% for IVV. That eats into performance, a lot.

I’m not saying don’t buy FBGRX, but I do think we need to have a compelling reason for choosing it over an S&P 500 fund.

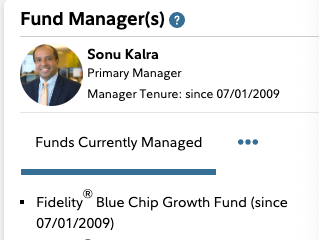

Manager

I’ll give you a nickel if you can name the portfolio manager for any of your funds.

Most of us can’t. That’s OK.

For a passive index fund, that’s a trick question. There is no portfolio manager, the fund buys whatever is in the index in the exact quantities specified by the index. A computer model manages the fund.

But for an active fund, we don’t necessarily need to know who the manager is, but we want to know how long he or she has managed the fund. If the fund manager is new, that 10 year performance number doesn’t mean much. It’s not his (or her) performance.

Target Date Funds

Target date funds are passively managed funds that regularly adjust their allocation. And each one has a target date. They’re generally used in retirement accounts so the target date is the expected retirement date.

If I’m 25 today and planning to retire at 65, I have 40 years to work and save. I’ll choose the target retirement 2066 fund.

The 2066 fund will be heavily invested in equities when I’m 25. As I approach retirement, it will adjust its holdings so the fund has more cash and fixed income to reduce volatility and lock in gains.

And in 2066, the fund will typically dissolve and all assets will be distributed. At that time we’ll buy an annuity, invest in a mix of funds, or throw a huge party.

Wrap Up

Selecting mutual funds can be daunting. There are thousands to choose from, which one or 2 is right for me?

First decide what’s going to make us happy – do we want growth over many years, current income? Do we want to match a market index or do we have a great idea that we’re willing to take a risk on?

Spend a few minutes thinking about this. Write it down.

Then it only takes a few minutes to search for some funds, compare performance and expenses, and decide.