I read an article this morning about a guy who had a family, $46k in credit card debt and he was considering raiding his IRA to pay down the debt.

While I applaud the initiative to address this, I think there are some things that need to happen first. There is little sense in bailing out the boat without first patching some of the holes. What’s to say we won’t be back in the same spot a year or 2 from now.

Credit Card Debt

While almost half of credit card holders pay in full each month, the other half are paying about 25% interest. And since the average cardholder debt is $6,000, they’re each paying $1,500 per year in interest payments. And maybe more if there are late fees involved.

These are only slightly better rates than Vito downtown offers.

So our subject with $46k in credit card debt is paying about $11,500 every year in interest payments. He’s setting that money on fire because he gets no value. And if he’s continuing to sock money away in his IRA, his investments need to yield 25% per year just to stay even. That’s unlikely.

Something needs to change.

Individuals v. Family

It is easier for me to make the decision to drastically reduce expenses when I’m single. Add in a spouse and kids and it gets exponentially harder. Don’t believe me, ask your kid to go without a cellphone or to skip a class trip.

This is why the whole family needs to be involved.

If we want to go to Disney, we need to pay down our debt and then start a new account where we put aside some money every week until we have enough to go.

Everyone won’t like it, but we need some family goals and we need to measure our progress. And there needs to be something in it for everyone.

Disney may be out of the question. Maybe it’s putting aside money for college.

Medieval

Most of my posts are about ways to save a few bucks here and there and to start to put aside money to build an emergency fund and to start investing. Today’s post is tailored to folks with extreme debt that need to plug the holes in the boat before they go under.

CellPhones

A family of 5 probably has 5 iPhones at $1,200 each and is paying about $200 per month for service. I asked Grok and he said

$180 per month is $2,160 per year and $21,600 over the next 10 years. And the kids are probably getting new phones every 2-3 years. Parents may be going 5 years or longer. So if the 3 kids each get 5 new phones over the next 10 years and the parents each get 3 new phones, that’s 15+6 = 21 new phones at $1,200 each or $25,200. Over the next 10 years, we’ve signed up for over $46,000 in cost for phones.

You can’t afford this.

Your first stop is to evaluate who needs a phone. Maybe our teenager does, but does the 7 year old?

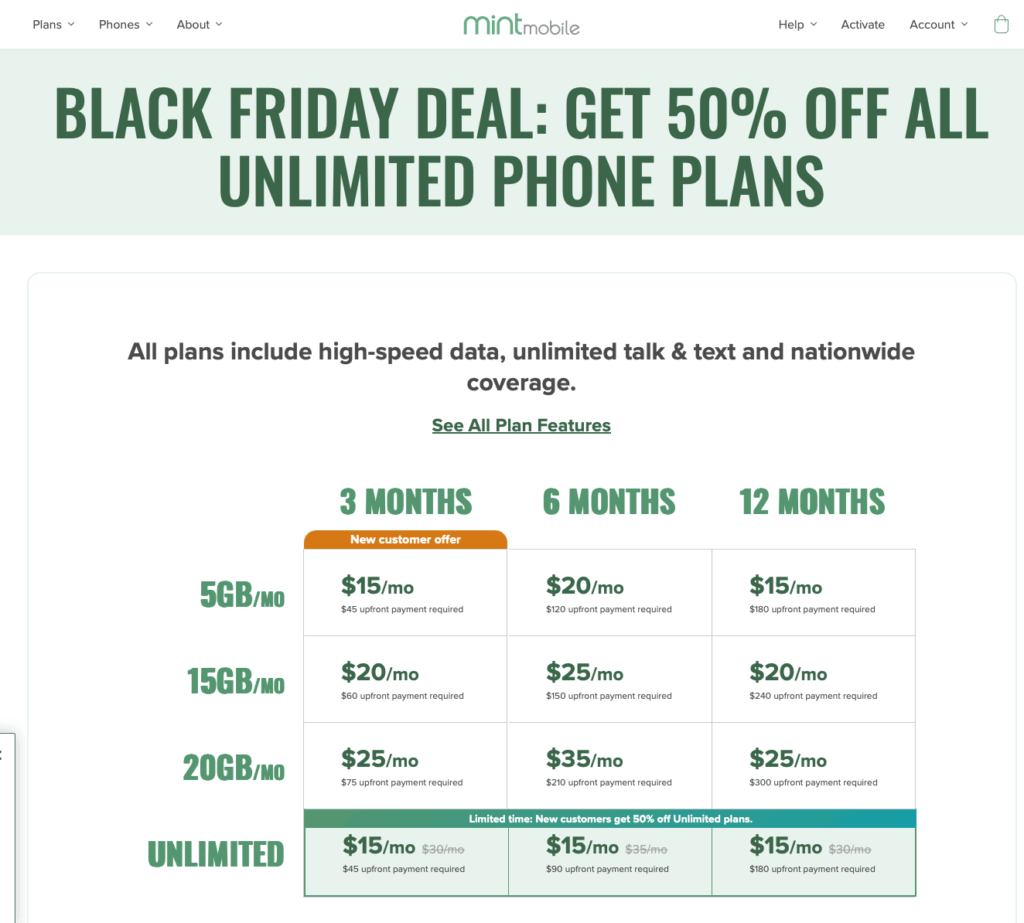

Your next stop is to change plans. MVNOs or Mobile Virtual Network Operators are companies that buy unused bandwidth from the big 3 – T-Mobile, AT&T and Verizon and resell it to us at a much lower rate.

Check out Mint Mobile

We just went from $2,160 per year to $900 and everyone still has unlimited data.

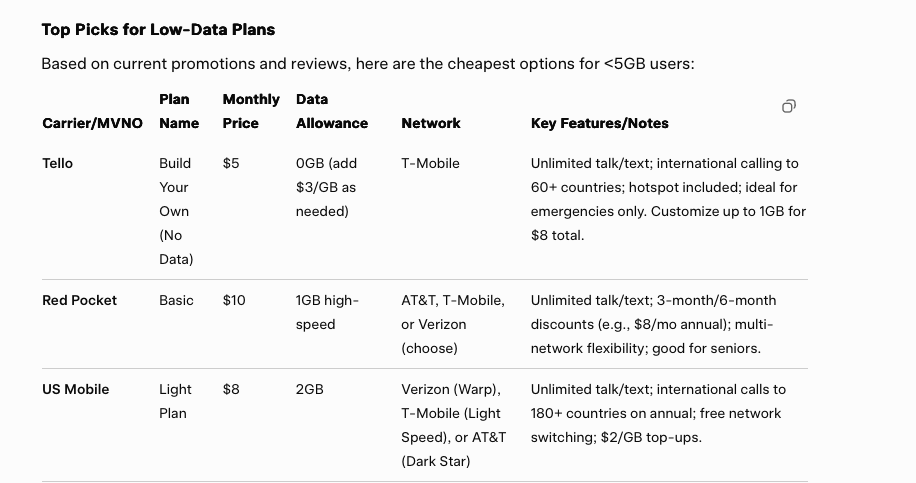

But let’s talk about the whole data thing. I bet we could survive with no or low-data.

All this info was provided by grok.com. Just ask about savings and he’ll be happy to find some for you.

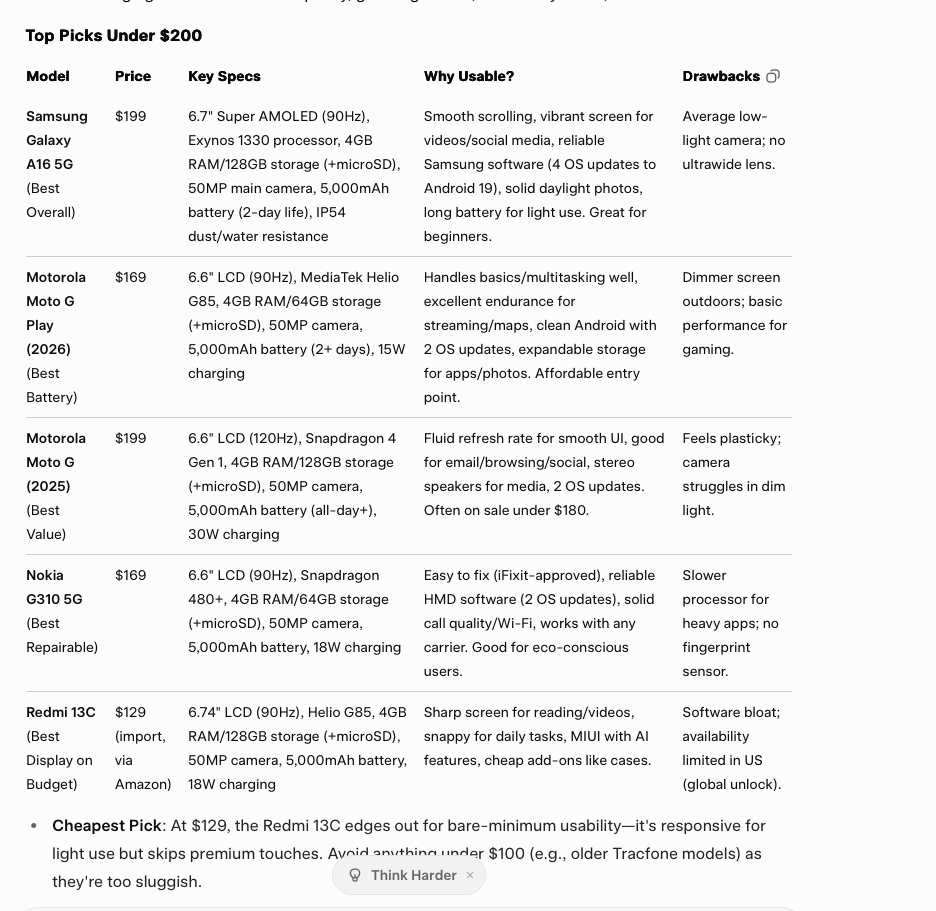

And while we all want the newest iPhone, we can get a perfectly usable phone for under $200

So assuming our family still gets 21 new phones over the next 10 years and we get the $15 unlimited plan for everyone, we’re down from $46,000 to $13,200.

And I’d argue there is still a lot of room to cut here.

Streaming

I’ll be blunt. None of us should be paying for streaming. That includes music and TV.

There is enough great stuff on Roku (free), Tubi (free), and Pluto (free) to keep us entertained. I’m dying to see Pluribus on Apple TV, but I’ll wait until a free trial comes along. They happen more often than you might think.

I also have a TV antenna. I can watch football live on the big 4 networks.

Apple Music and Spotify are nice. I can choose songs and make playlists. Pandora is free. A commercial here and there, but it’s free.

If you’ve got debt, you can’t afford to be paying for streaming with so many free options available.

Credit Cards

Go online and lock them.

Start paying with cash or check.

Stop paying for stuff you don’t need.

Autopay is a convenience, but we can still pay the old fashioned way. We need to revert to this until we’ve gotten our financial lives under control.

Many of us shop online to get the lowest price. But the reality is that we often buy stuff we don’t need because it’s so convenient. Drive to Walmart, or better yet a consignment shop and buy used.

Another benefit of locking the cards is that it will shut down all of the random items like apps, in-app purchases, movies and shows rented on Amazon or other sites and it will force a bit of discipline.

Groceries

Thursday is a big day at our house. That’s when the flyers arrive in the mailbox. My wife checks out Market Basket, Market 32 and Shaws. If it ain’t on sale, we don’t buy it. She routinely comes home from grocery shopping announcing that she got $150 worth of groceries for $50.

Dining and Drinking Out

It’s too expensive. Stop.

This is hard. I love to meet friends for a beer. I like to try new restaurants. But it is ridiculously expensive.

If we’ve got credit card debt, we have no business dining or drinking out. That money needs to be paying down our debt.

Once we’re in improved financial health, we can reconsider, but for now, stop.

Gifts

Black Friday is here. The holiday shopping frenzy begins. We buy a gift and we buy something nice for ourselves.

Many years ago, my family stopped buying gifts for everyone. We would do a grab on Thanksgiving. Everyone picked a name out of a hat and we bought only for that person. We had a $50 limit on gifts.

After about 10 years of this, we stopped gifts altogether. It’s a delight. It makes the holidays so much more enjoyable.

For the grandkids, my wife will pick up a toy at the consignment shop – most often they’re brand new and under $10, and we put a small amount in their 529 plans each month.

There is an awful lot of opportunity to cut back spending on gifts, especially if we’re paying off credit card debt.

Budget

This is a must.

This isn’t about software and tools, it’s about coming up with a list of what we bring in, and what we spend. Paper and pencil works just fine.

I like to do a monthly budget, but we need to be sure we account for items that we may pay annually or at other non-monthly intervals. For example, I pay my car and home insurance once per year for the whole year. I need to put money aside each month so I’m able to pay this in July when I renew.

For most of us, what comes in is pretty fixed. It’s our paycheck. But we may be collecting rent on rental property or have other ventures.

Then get a list of expenses. Pull credit card statements and checking account statements and see what we spend. Just pulling together this list will probably shock you.

And then make some decisions. Is this where we want to be spending our money?

The first item in the spending side of the budget needs to be an allocation to pay down debt. Even if it’s a few bucks, we need to make some progress.

2nd item is paying ourselves. We need to build our savings.

The rest is allocating what remains to the discretionary stuff.

Some finance professionals advocate for breaking down expenses between discretionary and non-discretionary. But if we’re in debt, it is all discretionary. Rent or mortgage too high? Move. Maybe we can’t eliminate the cost, but we can certainly reduce it.

The beauty of a budget is that we get to decide. It’s our money. We worked hard for it. We should make sure it is being spent on the things that are most important to us.

Wrap Up

If we’re not diligent, our money will find all kinds of ways to leave us.

It is unacceptable to be paying credit card interest. 25% or more per year is ridiculous. It’s time to make some changes.

That said, I know many things are more expensive today. My daughter’s friends are having a difficult time buying homes. Prices are out of control.

I was happy to read this morning that Jim Farley, the CEO of Ford Motor is increasing the salary he pays factory workers. He found out that many were working late night Amazon shifts to make ends meet so they were coming in to work exhausted.

This is great, but I wouldn’t expect this to catch on too quickly.

Difficult as it may be, our financial situation is under our control. We need to be making decisions about what we spend our hard-earned money on.

Good luck!