I’ll cut to the chase. The best way to get rich is by investing in great American businesses. Not all businesses. Businesses go bankrupt everyday. I learned that lesson with Yellow Trucking.

But an investment in the 500 largest publicly traded US companies has proven to be a pretty solid choice. You can read more about why I believe this is true, and why I believe it will continue to be the case, here.

62% of Americans Own Stock

I was reading an article on the Motley Fool site about how stock ownership is growing in the US. The article is worth a read to understand some of the demographics and trends. Unsurprisingly, stock ownership plummeted after the financial crisis but is recovering nicely.

This is good news. It’s hard to get rich off of savings account interest rates. We need our money to work for us and stock ownership is a great way to make this happen.

Average 401k Balances Are Up!

This is good news too. The S&P 500 has been on a solid run since 2009. A few pullbacks, but largely up and to the right.

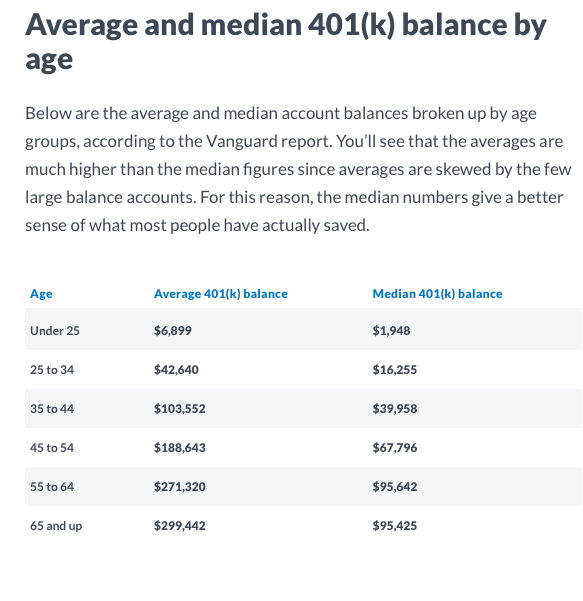

Here’s some info about average 401k balances from CNBC.

So, it’s not unrealistic for folks to have $100,000, or $200,000 invested in their 401k.

100K

So let’s take a look at some performance numbers for an individual with $100,000.

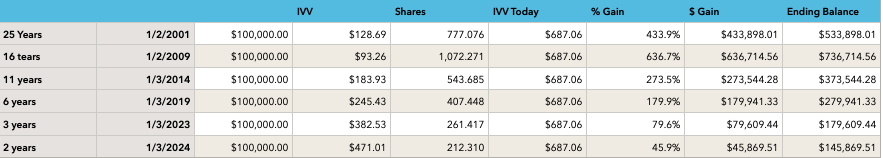

I’m using the iShares Core S&P 500 ETF (IVV) as an example. Any of us can buy shares, and if it’s not an option in your 401k, there is probably a similar S&P 500 fund available.

The table below looks at $100,000 invested on different dates in the past. We take the price of IVV in that day, divide $100,000 by the IVV share price to determine the number of shares we could buy, then we get the price today and multiply the shares we bought times the price today.

If I put $100,000 in IVV 2 years ago, I’d have $145,869.51 today. That’s a gain of almost $46,000. In 2 years.

If I go back 11 years, I gained $273,544.

Reality

Quick reality check…That’s not how most of us invest. We don’t show up with $100k, put it in a fund and go away.

It’s more likely that we’d start putting away a little at a time so we’ll look at that scenario in a second.

The point here is that once we’ve amassed a good chunk of change in our 401k. It can grow pretty quickly on its own.

That’s good news for us retirees who are no longer contributing.

A Little At A Time

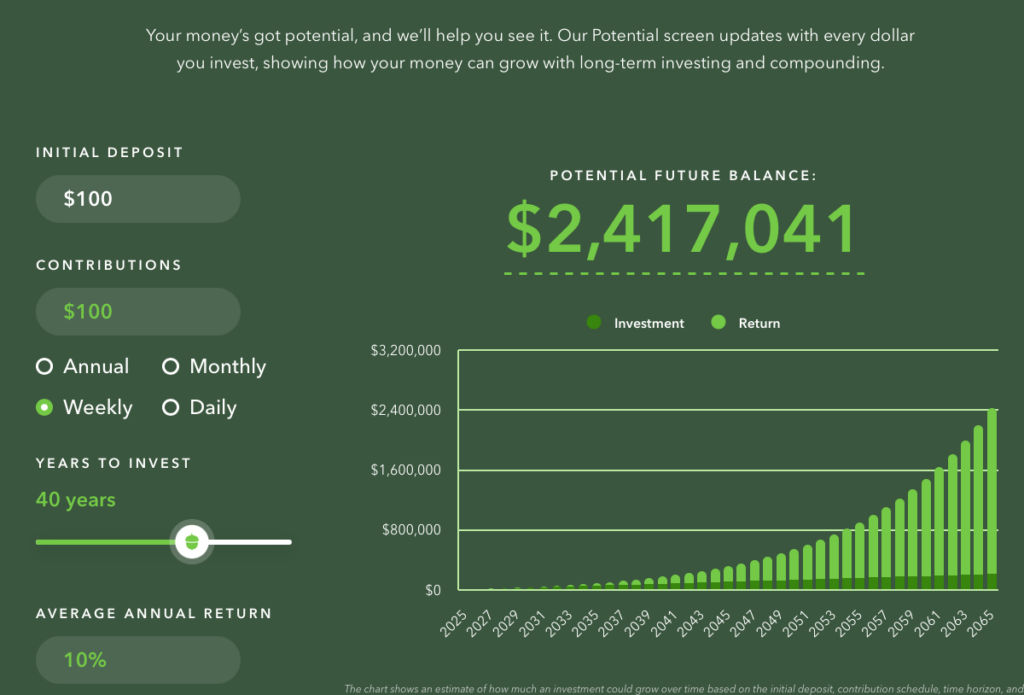

The more likely scenario is that we start saving in our company 401k sometime in our mid 20s or so. Let’s take a look at a scenario where we put $100 a week into an S&P 500 fund that grows at a rate of 10% per year.

Why 10%?

If you crunch the numbers going back to the early 20th century, the S&P 500 has averaged 10% per year with dividends reinvested. So it’s really not a stretch to think that this trend may continue.

So, we started at age 25, and when we’re ready to retire in 40 years at age 65, we’ve got almost $2.5 million.

The really interesting part is that we contribute 100 x 52 = $5,200 per year x 40 years = $208,000. The growth (the light green in the chart) is huge. Over $2.2million is market return. Read more about this in my compounding post.

And try it out at acorns.

Wrap Up

One final thought.

We’ve talked about IVV, an S&P 500 index ETF specifically because the S&P 500 tends to outperform world funds, small caps, emerging market funds, real estate funds, target date funds, most individual stocks, and most other types of funds over the long term.

It’s important to choose the right funds and history has proven S&P 500 funds to be a solid choice.

We’ll also probably hold some fixed income assets as well. They tend to provide slower growth but can iron out some of those rough patches like the 50% pullback of the S&P 500 that we saw in 2008.

You can read more about asset allocation here.

But the bottom line is that with some effort and some conviction, it’s not unreasonable to think that we can all build significant wealth over time.

Start early and we can be rich.

Start later and life and we can still build some pretty significant wealth.