Yes, please!

I’ve written quite a bit about dividends and dividend paying stocks. I am optimistic about the long-term prospects for the US economy and for the S&P 500. I know there will be blips along the way, but overall, I expect an investment in the S&P 500 will build wealth in the long term.

I invest heavily in dividend paying companies, especially those with a track record of increasing their dividend payments. A dividend is cash in my pocket and is especially nice when the company’s stock price pulls back.

Bond Funds

But dividend paying stocks are not the only way to generate income.

I have a healthy dose of bond mutual funds and ETFs as well. A bond, as we know, is a loan. When I buy a $1,000 Walmart bond, I am lending Walmart $1,000 for a specified time period. Walmart agrees to pay me a specified percentage of the bond’s value per year until maturity, then I get my $1,000 back. Pretty cool, but less exciting (to me) than owning shares of a company.

I probably should write more about them, because they are especially cool for us retirees.

Risk

Most bonds are generally considered to be lower risk than stocks. But that doesn’t mean they are risk free.

Default Risk

The biggest bond risk is default risk. While it is pretty safe to loan money to Walmart, that’s not the case for all companies.

Investment research firms like Moodys and Standard and Poor are nice enough to analyze the financials of companies and rate them on their ability to make good on bond payments – both principal return at maturity, and the regular interest payments to bond holders.

These ratings help us assess risk.

It’s no guarantee, but it helps.

And generally, bonds are grouped into 2 major categories – investment grade and non-investment grade, or junk.

As bond buyers (i.e. we’re loaning the money) we are rewarded with a higher interest payment to take on the risk of investing in lower quality bonds.

Lower rated companies have a better chance of not being able to come up with the cash to make interest payments or to pay out bond-holders at maturity.

Interest Rate Risk

Interest rates change all the time. Back in 2020, many bonds were paying interest rates of less than 1%. In 2023, similar bonds were paying 5%.

This can be pretty impactful for bond holders.

Say I buy a $1,000 5-year Walmart bond in 2020 and I’m getting 1% interest. I get $10 per year in interest payments in 2020, 2021, 2022, 2023, and 2024. At the end of 2024, I get my $1,000 back and payments stop.

In 2023, that same 5 year Walmart bond was paying 5% interest. A bond buyer who bought in 2023, gets $50 per year – 5x as much.

This is a huge bummer for us as we are stuck with our 1% paying bond through 2023 and 2024.

But let’s say we are forced to sell our bond in 2023 to pay off our unpaid parking tickets, gambling debts or to make a child’s college payment. The bond’s face value is $1,000, we’ll get a cool thousand right?

Nope.

We’ll get $920.

That’s because no one wants a 1% return when they can get a 5% return.

We need to discount the price to compensate the buyer for 2 years of sub-par returns. The difference between our bond’s payment and the current bond’s payment is $40 (50-10) per year. The bond buyer will have 2 years of sub-par payments so we need to compensate them for 2 years, so 2 x $40 = $80.

We reduce the price of our bond to ($1,000 – $80) $920 so that any investor gets the same total return whether they buy our 1% bond or a new 5% bond.

When interest rates go up, the value of bonds go down because the interest that they pay is below current market.

The inverse is also true. As interest rates go down, the price of a bond goes up.

Bonds Are Not Risk Free

No bond is risk-free. US treasuries – issued by the US government are pretty safe. The US is unlikely to miss a payment or fail to pay back our principal, but interest rates will fluctuate and so will the value of a government bond.

And Walmart is a pretty reliable company. But who knows. We thought GM was pretty reliable in 2007.

Time is a risk as well. We may feel comfortable with a 5 year Walmart bond, but 20 years? A lot can happen in 20 years.

Half-Time Recap

Buying a bond is a loan to a company (or a government agency).

Bonds pay interest to the bond holder for the use of their capital and for taking on risk.

Interest payments vary based on the size of the risk that the bond holder is taking.

How Do I Get That $1,000 You Promised?

You thought I forgot.

In my 20s and all the way up until retirement, I invested my money largely in equities and mostly growth stocks and funds. I was willing to take big pull-backs confident that I’d be ahead in the long-run. I wavered a bit in 2008, but that’s another story.

Now that I’m in retirement, I want to reduce risk and I want a steady income to make up for the paycheck that no longer shows up every month.

And while dividend paying stocks are part of the equation, bonds are as well.

Today we’ll take a look at 2 very different bond mutual funds because either can help provide that $1,000 per month, or $12,000 per year.

T. Rowe Price Ultra Short-Term Bond Fund (TRBUX)

I typically buy CDs and Treasury bonds that have a duration of a year or less. I once locked in a 5 year CD rate of 0.5% right before inflation spiked and CDs started paying 5%. A lot can change over time and I prefer not to lock myself in.

Ultra Short bond funds feel the same way. They are willing to pass up some potential gains by making short term bond investments that will generally mature in less than a year.

Here’s what the good folks at T. Rowe sat about their Ultra Short Fund:

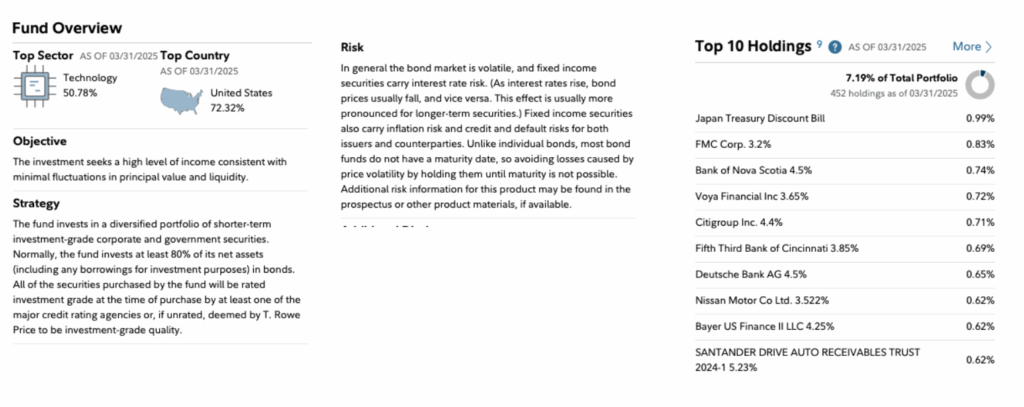

The fund has 452 holdings, so it is diversified. It’s only investing in investment grade debt. No junk. And it’s short-term debt so the risk is lower.

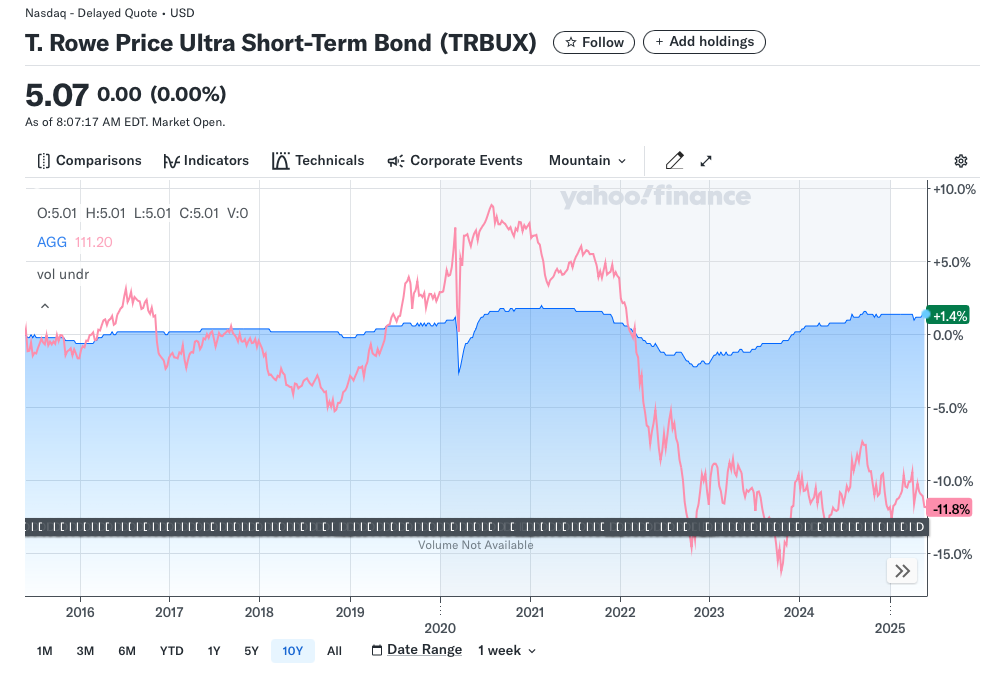

The price is fairly stable – take a look at the 5 year chart compared to the US Aggregate Bond Market ETF.

Today, TRBUX has a 5.02% yield.

Put $250,000 in TRBUX and you’ll have $12,550 per year in income. That’s over $1,000 per month.

Yeah, But Who Has $250,000?

Good question.

The average 401k balance for folks 65+ is $279,000.

And that’s the average. There are quite a few lower than that and quite a few higher.

Also, it doesn’t take into account IRAs that many folks hold and it doesn’t factor in social security payments.

So could folks find $250,000 to invest in TRBUX? Maybe, maybe not. Should we invest all of our money in TRBUX? Definitely not.

So what’s your point?

My point is this.

There are many investment options out there. For retirees, a fund like TRBUX may have a spot in our portfolio. It is a relatively low-risk investment and today it is generating a pretty solid 5% annual return.

I sold some stocks and put $50,000 in. I’ll earn $2,500 per year, or $208 per month. That’s pretty nice. And I’ll likely get most, if not all of my $50,000 back when I sell my fund shares.

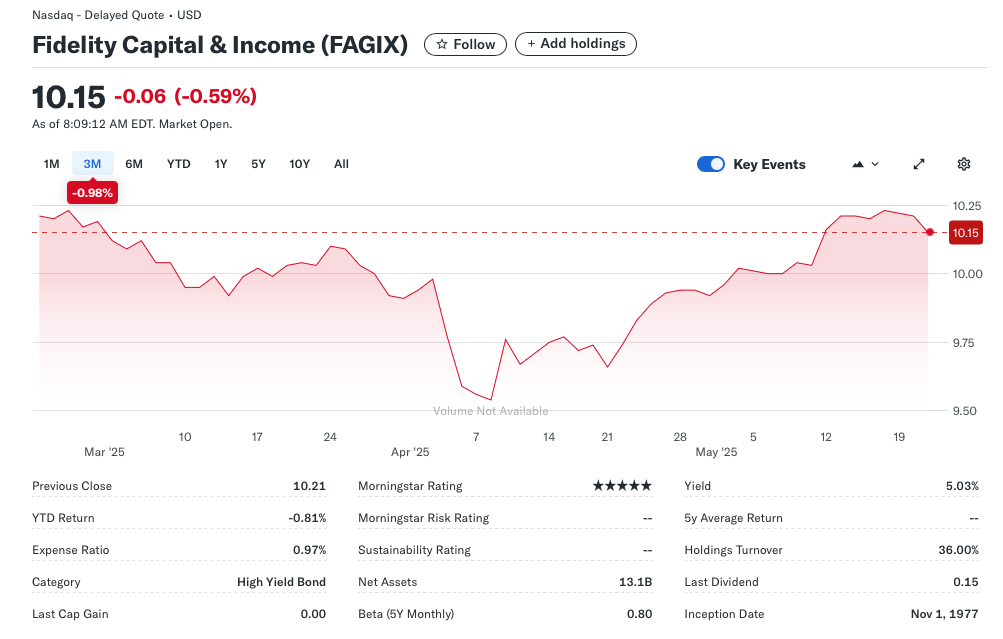

Fidelity® Capital & Income Fund (FAGIX)

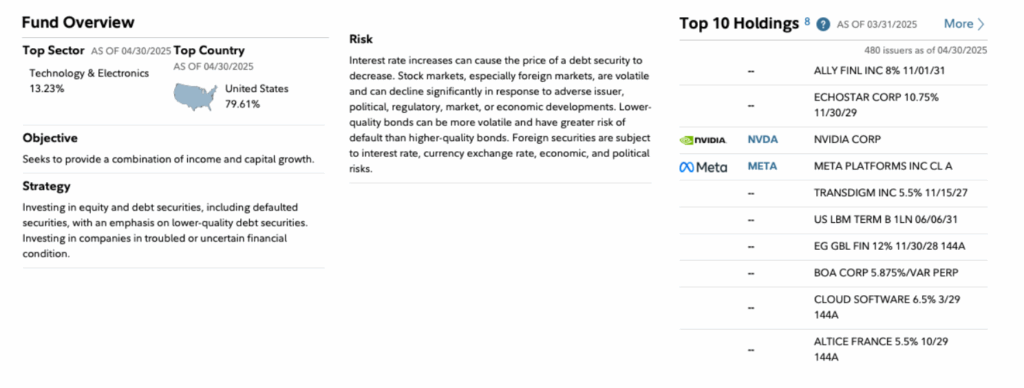

FAGIX is another of my favorites. This is a hybrid fund that invests in both stocks and bonds.

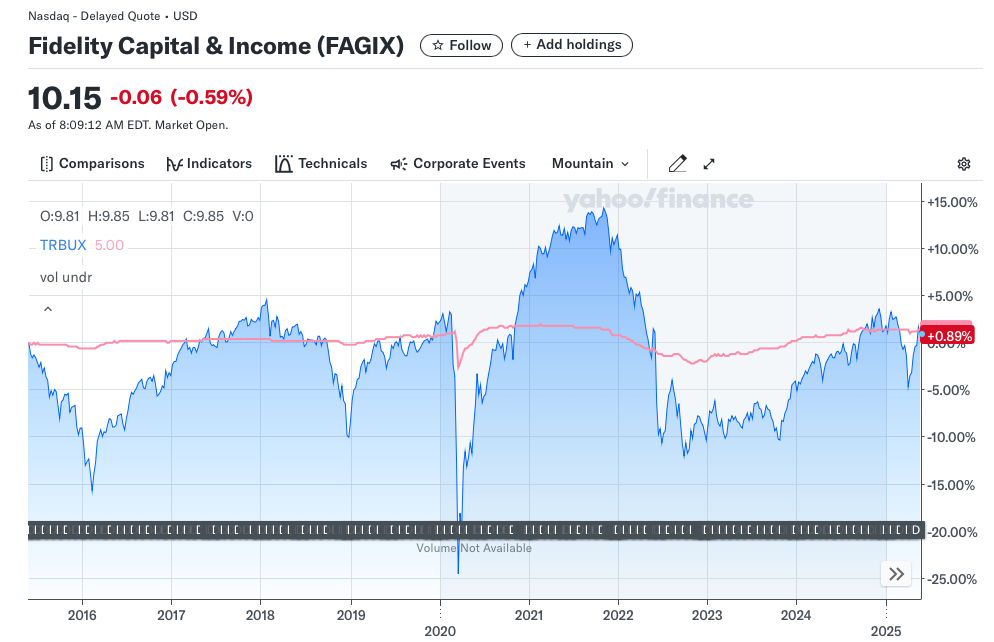

And as you can see, it is quite volatile compared to TRBUX.

and the fund pays 5.03%

FAGIX invests in junk bonds so there will be some defaults. It hopes to make up for this with capital gains from equity investments. It has a higher risk, but has provided a higher total return over time than TRBUX.

Wrap-Up

I talk mostly about stocks and equity investments, especially nice low-cost S&P 500 funds. But for us retirees, some boring bond funds can provide some much needed monthly income along with reasonable stability.

And to be clear, I’m not advocating for putting an over-sized chunk of your portfolio in either of these funds. TRBUX has interest rate and default risk, along with other risks outlined in the prospectus. And when rates drop, our monthly payment drops as well.

FAGIX is a higher risk investment. It invests in Junk bonds and has some equity positions in addition to its bond portfolio.

And if you are a retiree with a large 401k balance, either of these funds, or both, may be good choices to provide some regular income along with some nice low-cost S&P funds that provide longer-term growth.

Post-Wrap-Up

After mulling this post over for a day, I almost deleted it.

I hate catchy headlines like “How Would You Like $1,000 per Month?” And I’m not thrilled about how this posts pushes readers to 2 funds. In my posts, I try to educate but not advise.

But, I didn’t delete it. These 2 funds are a key part of my portfolio – the part that creates regular income. Just about every day, I get a payment. Either one of my dividend stocks pays their quarterly dividend, a bond fund pays their interest, a cash fund pays their monthly accrual, or a CD pays out interest.

I have an asset allocation strategy where I have a (smaller than when I was working) piece of my net worth in equities, a larger piece in bond funds, and a sizable piece in cash and cash alternatives.

TRBUX and FAGIX are major holdings for me in the bond fund group.

TRBUX is low risk. Today it pays a high rate of interest, but when and if the fed rate pulls back, that rate will drop. However, it will still likely pay a higher rate than CDs or treasuries.

FAGIX has been a long-time favorite. It invests in higher yield junk bonds. It offsets its default risk with investments in equities. It’s much higher risk than TRBUX, but over the years has paid a somewhat higher rate.

Both funds provide regular income. They do it in different ways. Having diverse investments in our portfolio means that we’re ready for anything. All of our investments won’t be the best at any one point in time, but we’ll be prepared to weather different economic scenarios.

Think about your asset allocation and about your needs. We all need our investments to grow. More so for the 20 year olds than for me at 62. We all need some cash for emergencies and to pay our regular expenses. Bonds and bond funds provide a regular income stream along with a reasonable expectation of return of principal.

I’m happy to introduce readers to 2 funds/investment possibilities they may not have thought of. But please don’t mortgage the house and put $250,000 in either of these. Assess your needs and develop a smart asset allocation strategy, and consider these in your bond allocation.