It’s Proxy season again. If we invest in a number of companies, we’ll likely find quite a few emails in our inbox telling us to Vote Now! While this may look like a scam, it’s not. This is the time of year when companies issue their annual reports and invite shareholders to vote on key business items and attend the company meeting.

It looks like this.

I’ve written other posts on reading annual reports, so I won’t cover that again here. Check out how to get valuable insights in under 15 minutes here, here, and here.

Costco

So, why do I love Costco, especially during this annual report season?

One simple answer is that it has performed well, but so have many other companies like Visa.

I bought my first shares of Costco in February of 2011. I paid $60.92 per share. Today, those shares are priced at $989.35. That is a (989.35 – 60.92 = 928.43) $928.32 gain per share. But that doesn’t tell the whole story. Costco pays a dividend of $4.46 per share per year. Costco has also rewarded shareholders with several special dividends. These are exactly what they sound like. A company has extra cash and decides to reward shareholders with a 1 time special payment. The last one was in 2022 and it was for $15 per share. Read more about Costco’s special dividends here.

Costco has been a fantastic investment over the past 13 years.

Shareholder Friendly

Costco is generally regarded as a shareholder friendly company. Shareholder friendly companies are transparent about goals and operational results and work hard to reward their shareholders. You can read more here.

Costco takes it one step further. It is a stakeholder friendly company. Costco recognizes that success is dependent on its customers, its suppliers and its business partners so it acts in the best interests of all stakeholders. Easy for me to say. Read more here.

I heard a story once where Jim Sinegal, the co-founder and prior CEO called a supplier and told him he (the supplier) needed to raise his price on an item. Sinegal’s logic was that allowing his stakeholder to make a reasonable profit would build a more sustaining business relationship.

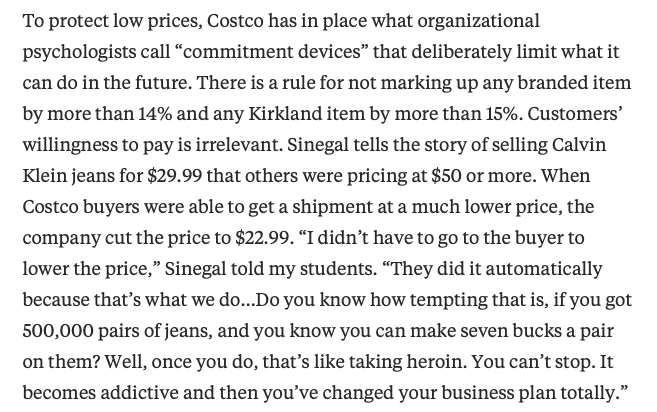

And here’s a great story of treating the customer as a stakeholder from the HBR article

Annual Reports

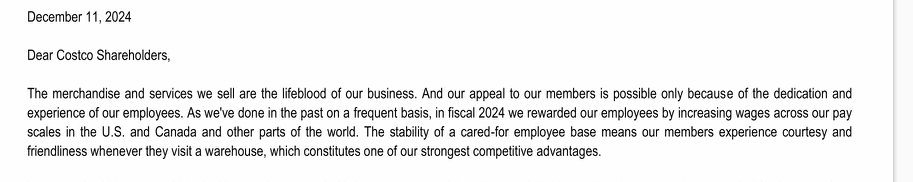

Back to the annual report – where we started. Here’s the first paragraph of Costco’s annual report:

I am also a huge fan of Visa. I bought shares of Visa in 2012, and their performance has been pretty similar.

Both have done incredibly well.

Visa’s annual report starts with a few charts and graphs and begins with:

2 Very Different Reports

To be clear, as an investor, I like both companies. Over the past 10 years or so, both have outperformed the S&P 500. I don’t plan on selling shares of either anytime soon.

But the Costco report is enjoyable to read through (ok, skim through) where the Visa one is no fun. I skimmed the Visa one for 5 minutes and then went to some research reports on my brokerage website to help me interpret.

Costco on the other hand tells me quite a bit.

It’s 2nd paragraph gets into net sales and net income and other fun stuff, but the report tells me a lot about how the company leaders run the business and make decisions – what their priorities are. That’s something you may not get from every report.

Wrap-Up

Visa and Costco were the first 2 reports that I got this earnings season. It was interesting to see how differently their CEO’s decided to make their personal statements. Visa is a more typical report. Costco seems a bit like the Berkshire Hathaway report I wrote about in THE GREATEST 15 PAGES YOU’LL EVER READ.

As shareholders, what do we really know about these companies. I try and use the products of the companies I invest in and I visit their stores (if they are retail shops). Starbucks, Amazon, Apple, Netflix, Costco, Home Depot, Chipotle, T-Mobile, Texas Roadhouse, and Lemonade are all companies that I’ve invested in, but I also feel like I know them a little bit as a customer.

And while Visa processes my credit card transactions, I can’t say that I have a relationship with them. Not in the same way that I do with the others. And I’m not a Costco member because the closest warehouse store is a ways away from me.

So for these lesser-known investments, it’s nice when they show us a bit about their culture in their annual report, or in interviews with publications like HBR.

Take a few minutes to read the reports, and take a look at what you’re being asked to vote on. Both will give you valuable insights.