That’s harsh.

I’m not trying to make you feel bad, but we need to dig into this.

Why Do We Invest?

We invest to make money. That’s it.

For equity investments, we buy something today with the expectation that it will be worth more at some point in the future.

For fixed income investments, we provide capital to an organization or entity that promises to pay us a fixed rate of return for a fixed period of time and then return our capital in full.

Asset Allocation

As investors, we decide on an asset allocation. In its simplest terms, this means how much of our investment will be in equity, fixed income and cash.

A common rule of thumb is that our equity allocation should be equal to 100 – our age. So I’m 62, my equity allocation should be (100-62=) 38%, according to this rule.

For my particular situation, I think this rule is a bit outdated, so my equity allocation is currently at 60%.

Read more about asset allocation here.

Back to Our Story…

It’s important to understand why we invest and it is essential to know about asset allocation.

So, in my case, I’m investing to make money to provide for my spending in retirement, to support all of our home projects and to fund my golf addiction.

My equity allocation is 60% because I have a long-term horizon – more than 10 years and I believe equities are a safer bet in the long term than fixed income. But I still like having some fixed income for diversification and to provide a steady stream of income.

So, let’s say I had $500,000 invested for my retirement at the start of 2024. With 60% in equities, I would have started 2023 with $300,000 in equities. And since I love a nice low cost S&P 500 fund, all of my equity money would be invested in iShares Core S&P 500 ETF (IVV)

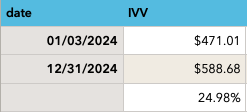

Here’s what happened to IVV in 2024

It began the year at $471.08 per share. By the end of the year, the share price was up to $588.68, which is 24.98% higher than where it began the. year.

That means my $300,000 had grown by (300,000 x 24.98% = ) $74,947.45 to $374,947.45.

Your Turn

Go to your trusty spreadsheet or your brokerage account statement. Look at what your equity balance was at the end of 2023. Look at what it was at the end of 2024.

If it wasn’t 24.98% higher (excluding any contributions you made), you got some ‘splainin to do.

Don’t Feel Bad

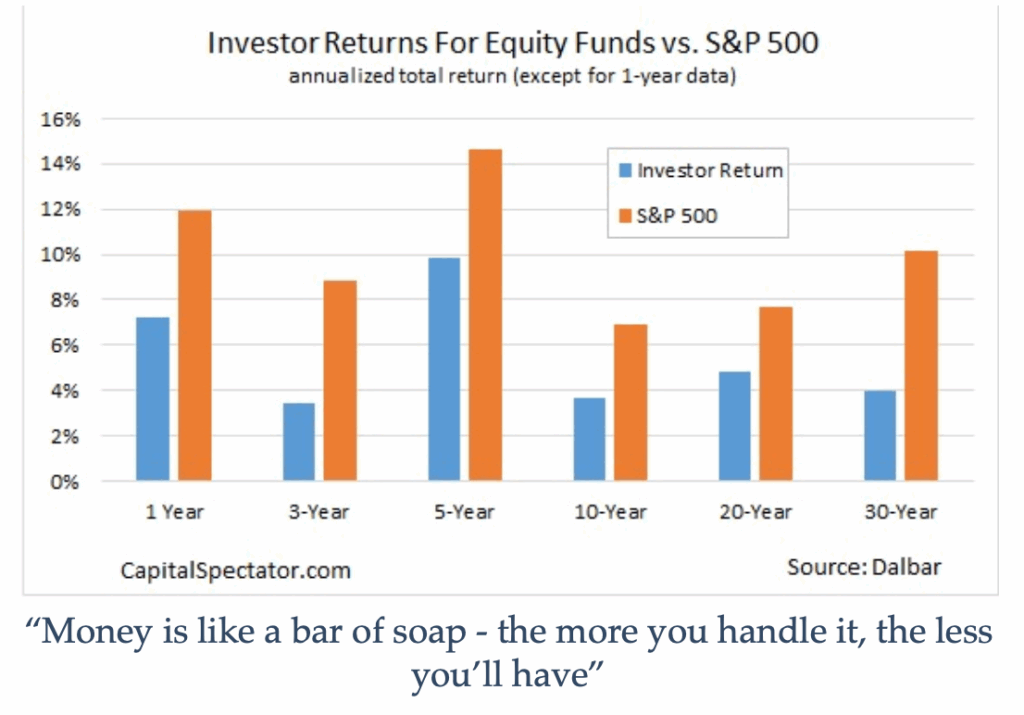

Most investors trail the market.

This shows us that everyday investors are lagging the performance of the S&P 500 in all time periods. That means we’re losing out.

There are 2 simple reasons.

- We get involved in complex funds we don’t understand because an advisor or friend told us to

- We try to hop in and out of funds to catch the latest hot performer

The Fix

Want to fix this? Want to bring the blue line up to the orange line? Here’s the secret. Invest in an S&P 500 Index Fund.

But My Advisor Says…

- You need diversification

- You need emerging markets or international exposure

- You need many different funds – small caps, large caps, mid caps, micro caps, tech funds, healthcare, energy…to be sure you capitalize on the next wave

What You Say

- I am diversified. I hold Amazon, Alphabet, Walmart, Costco, ExxonMobil, Chevron, General Mills, Starbucks, McDonalds, Nike and 490 other companies in my S&P 500 fund.

- Many of these 500 companies earn revenue outside the US. I can vouch. I bought a hamburger at McDonalds in Hong Kong and had a Starbucks in Shanghai. I avoided the McDonalds in India because of the whole no-cow thing, but many of my team members were big fans of KFC, which is part of Yum! which is an S&P 500 company.

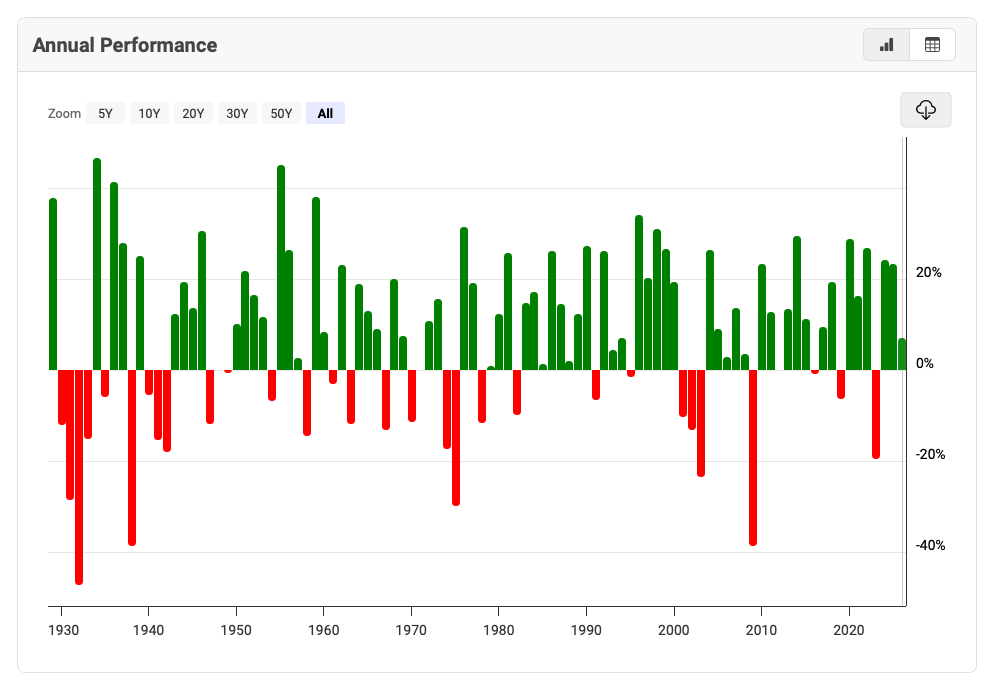

- The S&P 500 has returned on average 10% per year since 1928 (with dividends reinvested). If I had invested $1,000 in 2007 before the market crash wiped out about 50% of its value, I’d still have over $4,400 today. The S&P 500 is up over 345%. How’s that wave?

- And bonus #4 for your advisor….You’re Fired!

Wrap Up

I’m a little hot under the collar with this one. I don’t make a dime off of this blog and I’ve made a total of $180 for the dozens of financial ed classes I’ve taught. I do this because now that pensions have gone the way of the dinosaur, we are all responsible for funding our own retirement. And for most of us, no one taught us how.

As an investor, every one of us deserves to have earned 24% on our equity investments in 2024. And 25% in 2023. Sure we lost in 2022, and other years as well. Sometimes we’ve lost several years in a row. Check out the S&P 500 return by year from macrotrends.

As an investor, if you want to hire an advisor, that’s fine, just be sure that after paying their fee, your equity positions are beating the S&P 500. If not, maybe you shouldn’t be paying for their advice.

And if you have a favorite fund or stock, put it to the test as well. If you hold it for 5 years or so and it’s trailing the S&P 500, and your investment goal is to make money, why not just invest in an S&P 500 fund?

Will the S&P 500 continue to go up like it has for the last 100 years, probably, but there is no guarantee. Read my post here to see why I’m optimistic.

Some Additional Thoughts

I walked away and took a breather and have some clarifications.

While I stand by the spirit of the message here, I am not advocating that if our investments under-perform in any given year that we need to change them out.

As a rule, any investment that we’ve researched and we are committed to should be held for 5 years unless something (accounting scandal, or major thesis change) occurs.

And the equity investment I’m encouraging you to consider is an S&P 500 fund. Compare your equity performance over time to an S&P 500 fund and if it is not doing better then it’s time to think about why not an S&P 500 fund?

I also recognize that many, like myself are investment enthusiasts. Sometimes we take a risk on a stock, or bitcoin, or a fund that could be a huge winner, but maybe not. That’s OK.

The key here is to take a limited risk. I have some money I put in Grayscale Bitcoin Mini Trust ETF (BTC). It could be great, or I could lose everything. My investment was less than 1% of my equity holdings.

Crypto could be huge. I’ll put a few dollars into a Bitcoin ETF and watch what happens. But more than 99% of my equity holdings are in investments that have a high likelihood of building wealth over 5+ years.