In a few posts, I’ve mentioned how investing is a hobby for me. I read company annual reports and analyst research reports for fun. Kinda sad.

But while I laugh at this, it is a big part of the reason I was able to retire at 56. Let me explain why. And I promise, we won’t read any reports.

Hobbies

Our hobbies often cost us money. Whether it is golf, the lottery, poker, ballroom dancing, or paddleball, we may need to buy equipment, pay for court time, buy a membership, or take on other expenses. Even a do-it-yourself hobby has costs. We may save money on projects, but we need to buy tools and supplies.

While there is a cost, think how dull life would be without our hobbies.

Investing

Somewhere around 1999, many of my co-workers were making a killing in the stock market. While I was suspicious, it got me thinking. I work for an investment company so I should really have a better understanding of investing. I’ve always contributed to my 401k, but that was it.

I opened up a brokerage account and bought a handful of stocks.

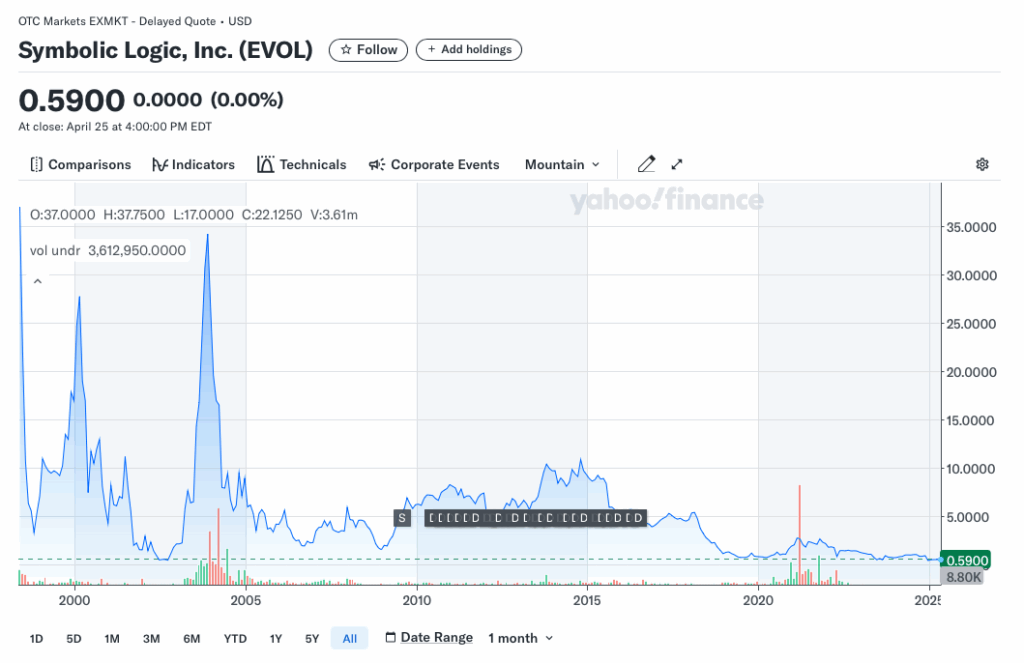

I went on a vacation with friends and met a guy who gave me a hot tip on a company called Evolving Systems. It was going to the moon. I bought some shares with a couple hundred dollars.

It looks like it’s still around with a new name. Lipstick on a pig.

I bought at one of those peaks on the left and quickly lost most of my investment.

This was the first of many costly investment lessons.

The 2nd lesson didn’t cost me a dime. All of my co-workers lost their shirts in 2001 when the internet bubble burst.

Netflix

Not all of my early lessons were painful. In the early 2000’s, I discovered Netflix DVDs by mail. Loved it. I invested. That worked out pretty well.

But whether it was Netflix or Evolving systems, I watched and read and tried to understand what made one company great and others less-than-great.

I found an investing newsletter that I thought gave me helpful analysis that even I could understand. I subscribed (I know…another subscription, but I felt it was necessary).

I started reading, and I started creating watch lists. I’d enter the companies I wanted to invest in and the shares I’d like to buy and I’d watch. For some of my higher conviction ones, I actually bought a few shares. At this point my total investment portfolio was probably less than $1,000.

Still a Hobby

I had my 401k. I was contributing the max and investing in low-cost index funds.

My brokerage account was for my hobby.

At bonus time, I’d kick in a few dollars more and buy some shares of the companies on my watchlists. And I started to find other ways to put money aside to buy stocks.

Still Learning

And I’m still learning today. In many posts, I talk about the lessons I’ve learned from Under Armor, Shopify, Intel and Amazon.

I’ve written about how to get valuable insights from a company’s annual report in less than 15 minutes. Check out here, here, and here.

I also realized how important it is to have an investment thesis. I also found out that this can be done in about 15 minutes. Read more here, here, and here.

…And Then…

Somewhere along the way, the few thousand dollars that I started putting aside had grown into a good chunk of change.

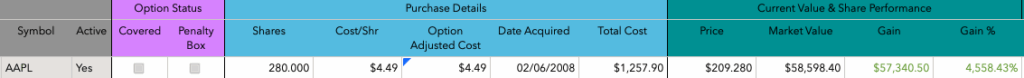

Here’s just one example. I bought an iMac computer in 2007 and got excited about Apple. And while Steve Balmer at Microsoft and many analysts were busy writing off the iPhone, I thought that given what Apple had done with the iPod, there could be something here.

I bought a few shares.

I was optimistic. This was a big purchase for me. I ponied up $1,257.90 to buy shares. 15+ years later those shares are worth $58,598. And that’s not the whole story. Apple pays a dividend, which I automatically reinvest in more shares, so my actual gain is higher than this.

(To clarify the table above, the Market value column is the # shares purchased (280) times the current price ($209.28) so it excludes any additional shares I’ve received via dividend income. My actual shares held is much higher because of the dividend reinvestment.)

I have plenty of stocks I’ve owned that I’ve sold after a 90% drop. This hurts. But a great company like Apple can double many times over and can make up for a lot of poor decisions.

The Differentiator

I made good decisions and bad decisions about which stocks to buy and which to sell. Early on, I made more bad decisions than good.

But looking back, the differentiator for me was making the decisions in the first place. Instead of spending my money elsewhere, I was taking small amounts of money on a regular basis and using it to buy stocks. With practice and reading, I got better at this, but the extra money that I was finding to invest beyond my 401k made a huge difference.

Time also makes a huge difference. Every company I’ve invested in has pulled back at some point. Netflix ix one of my favorites, but the company made some bad decisions at one point and pulled back more than 80%. I was committed, and I gave it time. Netflix went on to be a huge winner.

A Hobby?

Another co-worker – somewhat smarter than the first group of internet stock guys, started a hobby investing in real-estate. He saved up and bought a 3 decker rental home. Today he owns quite a few buildings and has long since left his job in finance behind.

Thinking back, I’ve come across a number of people whose hobbies have been lucrative. Whether it is creating YouTube videos, selling on eBay, buying rental properties or doing some handy-man work on the side, a hobby can be a money-maker.

Wrap-Up

For me investing is a hobby.

Today, I read the annual report for Axon enterprises. Axon is the company that makes Tasers. They do a whole lot more, but that is a story for another day.

But I learned some interesting stuff from the report. This got me to start looking through some analyst reports to learn more about what Axon does and how well it does it. To me this is fun and interesting.

I bought shares in February of this year and they’re up a little since then so that’s fun too.

To me, investing is a great hobby. Opening a brokerage account is free. Brokers typically provide research reports for free. Every company has a website we can visit for free. And most public companies have an investor page where we can learn about the company and read annual reports.

And we don’t need lots of capital to start. I have positions I’ve started with less than $100.

Mutual Funds

Here’s a tip. You don’t need to pick great companies to build wealth. A low-cost S&P 500 mutual fund or ETF has been a proven wealth builder over the past 100 years or so. This is a great way to get your feet wet and start to learn.

Get Started

The key is to start. There’s a Warren Buffet quote about how if you don’t find ways to make your money work while you sleep, you’ll work til you die.

I’m lucky that I’ve worked in the investment industry and have had the opportunity to learn. Investing is also something I’m interested in, so I prioritize the time I spend here and I’ve prioritized finding money to buy shares of companies I’m interested in.

It’s nice to have a hobby that adds to my balance sheet.