What if I make an investing mistake? In this post, we’ll talk about mistakes, how they happen and what you can do about them.

Some of the younger folks in my personal finances classes have expressed concerns about making investing mistakes. And while being safe and cautious with one’s money is admirable, sometimes it can be a bigger risk to your financial future not to invest.

Why We Invest

For many of us, investing is not a hobby, it’s a means to an end. We take a portion of our capital and buy securities (stocks, bonds, mutual funds, treasuries…) with the expectation that we will benefit financially. With bonds, we expect to receive regular interest payments and then receive our initial investment back in full at the end. With stocks or funds, we expect to buy today and then sell in the future at a higher price as our investment grows in value. Either way, we hope to make money, else, why would we take on the risk of investing?

Example – 2008 Crash

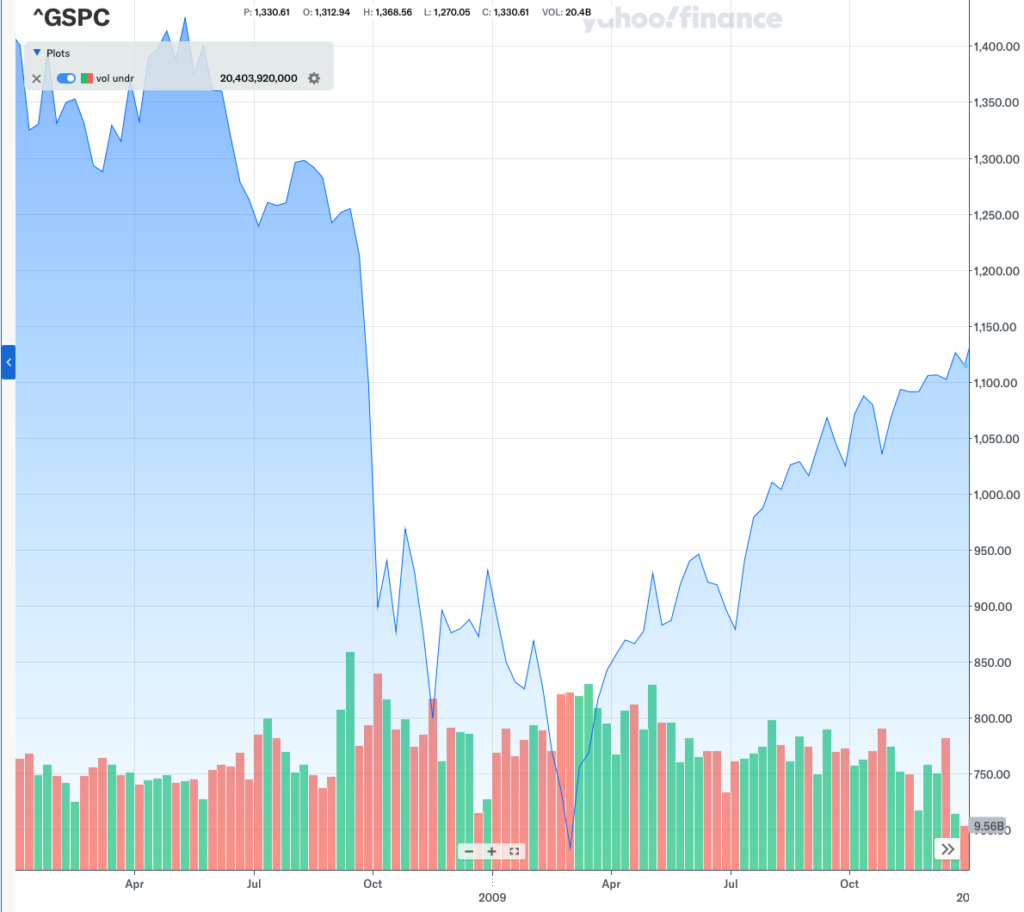

Let’s start with an example. Many of us remember the 2008 market crash. For those who’ve forgotten, let’s take a look at what happened to the S&P 500.

Ouch

Between July of 2008, and late May 2009, the S&P 500 Index, an index made up of the 500 largest US companies, fell roughly 50%. As an investor, if I had $50,000 in my 401k on July 1, 2008, my account balance would have been $25,000 in April 2009. That’s not why we invest. We invest because we want our investments to grow in value.

I Hear You

For many, I’m sure you are feeling that you just can’t take that risk. I get it. In 2008, I lost my job, my daughter started college, and my account balance was half of what it was a few months before. You don’t want to be in this situation.

I eventually got another job. It took exactly a year, and the new job paid a lot less than the old job. Times continued to be tough in the finance industry.

I had hired a financial advisor after losing my job. To say I was panicked was an understatement. I fired him in 2009 because he was too conservative and I believed I could do a better job managing my own money.

In 2019, I retired (comfortably) at age 56.

Life and the financial markets will throw you curveballs, and yes, it hurts and it’s scary. I lived through it and can share what I’ve learned. Another free lesson for you.

Budget, Emergency Fund & Investments

We need all 3. Start with a budget. See the post on budgets here. Left on its own, our money will go its own way. Rather than be surprised, we need to have a budget which tells it where to go.

An emergency fund provides protection when the car breaks down or when you find yourself out of work. Ideally, you’ll have enough to pay your bills for a few months while you search for a new job, but start small. Put a few dollars aside every paycheck. You may never need this money, but having it close by and readily available if disaster strikes can prevent a financial catastrophe.

Investments are a must. We’re all responsible to fund our own retirement. See post here. In order to grow our wealth, we need the returns that compounding delivers.

Investments

Which brings us back to why we’re here in the first place. We need the growth that investments can provide, but we don’t want to make a mistake.

Let’s look at a hypothetical scenario. Let’s go back to the 2008 crash. That’ll be fun.

It’s 2007. The S&P 500 has been strong since 2003 and investors are making a killing. I finally decide that I need to start investing so I begin contributing to my company 401k. We all know what happens next. The market drops 50%.

This is a huge problem if I’m retiring in 2008, 2009, or in the very near future. We’ll talk more about this in a bit.

If your retirement is further out, you could have slept through the financial crisis of 2008 and made out fine. Let’s look at some data.

A little more info on the hypothetical me in this example.

Hypo Background

This hypothetical example runs for a short period, 1/1/2007 – 12/1/2015 to demonstrate the impact of choosing to begin investing in one of the worst periods in our financial history.

More details…I’m 25 years old, I signed up for my company’s 401k in January 2007, and I contribute $100 per paycheck. I invest the entire $100 in the iShares Core S&P 500 ETF (ticker: IVV), a low-cost S&P 500 index ETF.

The table below shows the date of my paycheck (and the day my contribution went into the plan and I bought shares of IVV), the closing price of IVV on that day, the $100 of my buy, the # shares I got for my $100, the price of IVV on 12/1/2015, the value of those shares on 12/1/2015, the $ gain loss of that individual $100 purchase, and the % gain loss of that individual $100 purchase.

| Date | Close | Buy | Buy Shares | Price 12/1/2015 | Value on 12/1/2015 | Gain/Loss | Gain/Loss % |

| 2007-01-01 | $144.03 | $100.00 | 0.694 | $204.87 | $142.24 | $42.24 | 29.33% |

| 2007-02-01 | $141.30 | $100.00 | 0.708 | $204.87 | $144.99 | $44.99 | 31.84% |

| 2007-03-01 | $142.34 | $100.00 | 0.703 | $204.87 | $143.93 | $43.93 | 30.86% |

| 2007-04-01 | $148.48 | $100.00 | 0.673 | $204.87 | $137.98 | $37.98 | 25.58% |

| 2007-05-01 | $153.55 | $100.00 | 0.651 | $204.87 | $133.42 | $33.42 | 21.77% |

| 2007-06-01 | $150.51 | $100.00 | 0.664 | $204.87 | $136.12 | $36.12 | 24.00% |

| 2007-07-01 | $145.71 | $100.00 | 0.686 | $204.87 | $140.60 | $40.60 | 27.86% |

| 2007-08-01 | $147.62 | $100.00 | 0.677 | $204.87 | $138.78 | $38.78 | 26.27% |

| 2007-09-01 | $152.97 | $100.00 | 0.654 | $204.87 | $133.93 | $33.93 | 22.18% |

| 2007-10-01 | $155.13 | $100.00 | 0.645 | $204.87 | $132.06 | $32.06 | 20.67% |

| 2007-11-01 | $148.75 | $100.00 | 0.672 | $204.87 | $137.73 | $37.73 | 25.36% |

| 2007-12-01 | $146.74 | $100.00 | 0.681 | $204.87 | $139.61 | $39.61 | 27.00% |

| 2008-01-01 | $137.54 | $100.00 | 0.727 | $204.87 | $148.95 | $48.95 | 35.59% |

| 2008-02-01 | $133.75 | $100.00 | 0.748 | $204.87 | $153.17 | $53.17 | 39.76% |

| 2008-03-01 | $132.23 | $100.00 | 0.756 | $204.87 | $154.93 | $54.93 | 41.54% |

| 2008-04-01 | $138.61 | $100.00 | 0.721 | $204.87 | $147.80 | $47.80 | 34.49% |

| 2008-05-01 | $140.39 | $100.00 | 0.712 | $204.87 | $145.93 | $45.93 | 32.72% |

| 2008-06-01 | $128.00 | $100.00 | 0.781 | $204.87 | $160.05 | $60.05 | 46.92% |

| 2008-07-01 | $127.05 | $100.00 | 0.787 | $204.87 | $161.25 | $61.25 | 48.21% |

| 2008-08-01 | $128.94 | $100.00 | 0.776 | $204.87 | $158.89 | $58.89 | 45.67% |

| 2008-09-01 | $116.82 | $100.00 | 0.856 | $204.87 | $175.37 | $75.37 | 64.52% |

| 2008-10-01 | $97.39 | $100.00 | 1.027 | $204.87 | $210.36 | $110.36 | 113.32% |

| 2008-11-01 | $90.12 | $100.00 | 1.110 | $204.87 | $227.33 | $127.33 | 141.29% |

| 2008-12-01 | $90.31 | $100.00 | 1.107 | $204.87 | $226.85 | $126.85 | 140.46% |

| 2009-01-01 | $82.97 | $100.00 | 1.205 | $204.87 | $246.92 | $146.92 | 177.08% |

| 2009-02-01 | $74.21 | $100.00 | 1.348 | $204.87 | $276.07 | $176.07 | 237.26% |

| 2009-03-01 | $79.62 | $100.00 | 1.256 | $204.87 | $257.31 | $157.31 | 197.58% |

| 2009-04-01 | $87.69 | $100.00 | 1.140 | $204.87 | $233.63 | $133.63 | 152.39% |

| 2009-05-01 | $92.81 | $100.00 | 1.077 | $204.87 | $220.74 | $120.74 | 130.10% |

| 2009-06-01 | $92.35 | $100.00 | 1.083 | $204.87 | $221.84 | $121.84 | 131.93% |

| 2009-07-01 | $99.17 | $100.00 | 1.008 | $204.87 | $206.58 | $106.58 | 107.48% |

| 2009-08-01 | $102.80 | $100.00 | 0.973 | $204.87 | $199.29 | $99.29 | 96.59% |

| 2009-09-01 | $106.01 | $100.00 | 0.943 | $204.87 | $193.26 | $93.26 | 87.97% |

| 2009-10-01 | $103.97 | $100.00 | 0.962 | $204.87 | $197.05 | $97.05 | 93.34% |

| 2009-11-01 | $110.30 | $100.00 | 0.907 | $204.87 | $185.74 | $85.74 | 77.73% |

| 2009-12-01 | $111.81 | $100.00 | 0.894 | $204.87 | $183.23 | $83.23 | 74.44% |

| 2010-01-01 | $107.66 | $100.00 | 0.929 | $204.87 | $190.29 | $90.29 | 83.87% |

| 2010-02-01 | $111.05 | $100.00 | 0.900 | $204.87 | $184.48 | $84.48 | 76.08% |

| 2010-03-01 | $117.34 | $100.00 | 0.852 | $204.87 | $174.60 | $74.60 | 63.57% |

| 2010-04-01 | $119.24 | $100.00 | 0.839 | $204.87 | $171.81 | $71.81 | 60.23% |

| 2010-05-01 | $109.70 | $100.00 | 0.912 | $204.87 | $186.75 | $86.75 | 79.08% |

| 2010-06-01 | $103.46 | $100.00 | 0.967 | $204.87 | $198.02 | $98.02 | 94.74% |

| 2010-07-01 | $110.69 | $100.00 | 0.903 | $204.87 | $185.08 | $85.08 | 76.87% |

| 2010-08-01 | $105.79 | $100.00 | 0.945 | $204.87 | $193.66 | $93.66 | 88.53% |

| 2010-09-01 | $114.49 | $100.00 | 0.873 | $204.87 | $178.94 | $78.94 | 68.95% |

| 2010-10-01 | $118.89 | $100.00 | 0.841 | $204.87 | $172.32 | $72.32 | 60.83% |

| 2010-11-01 | $118.81 | $100.00 | 0.842 | $204.87 | $172.43 | $72.43 | 60.97% |

| 2010-12-01 | $126.25 | $100.00 | 0.792 | $204.87 | $162.27 | $62.27 | 49.33% |

| 2011-01-01 | $129.15 | $100.00 | 0.774 | $204.87 | $158.63 | $58.63 | 45.40% |

| 2011-02-01 | $133.62 | $100.00 | 0.748 | $204.87 | $153.32 | $53.32 | 39.91% |

| 2011-03-01 | $133.01 | $100.00 | 0.752 | $204.87 | $154.03 | $54.03 | 40.62% |

| 2011-04-01 | $136.94 | $100.00 | 0.730 | $204.87 | $149.61 | $49.61 | 36.22% |

| 2011-05-01 | $135.31 | $100.00 | 0.739 | $204.87 | $151.41 | $51.41 | 37.99% |

| 2011-06-01 | $132.42 | $100.00 | 0.755 | $204.87 | $154.71 | $54.71 | 41.32% |

| 2011-07-01 | $129.81 | $100.00 | 0.770 | $204.87 | $157.82 | $57.82 | 44.54% |

| 2011-08-01 | $122.64 | $100.00 | 0.815 | $204.87 | $167.05 | $67.05 | 54.67% |

| 2011-09-01 | $113.69 | $100.00 | 0.880 | $204.87 | $180.20 | $80.20 | 70.54% |

| 2011-10-01 | $125.80 | $100.00 | 0.795 | $204.87 | $162.85 | $62.85 | 49.96% |

| 2011-11-01 | $125.40 | $100.00 | 0.797 | $204.87 | $163.37 | $63.37 | 50.54% |

| 2011-12-01 | $125.96 | $100.00 | 0.794 | $204.87 | $162.65 | $62.65 | 49.74% |

| 2012-01-01 | $131.77 | $100.00 | 0.759 | $204.87 | $155.48 | $55.48 | 42.10% |

| 2012-02-01 | $137.32 | $100.00 | 0.728 | $204.87 | $149.19 | $49.19 | 35.82% |

| 2012-03-01 | $141.21 | $100.00 | 0.708 | $204.87 | $145.08 | $45.08 | 31.93% |

| 2012-04-01 | $140.28 | $100.00 | 0.713 | $204.87 | $146.04 | $46.04 | 32.82% |

| 2012-05-01 | $131.85 | $100.00 | 0.758 | $204.87 | $155.38 | $55.38 | 42.00% |

| 2012-06-01 | $136.75 | $100.00 | 0.731 | $204.87 | $149.81 | $49.81 | 36.43% |

| 2012-07-01 | $138.45 | $100.00 | 0.722 | $204.87 | $147.97 | $47.97 | 34.65% |

| 2012-08-01 | $141.88 | $100.00 | 0.705 | $204.87 | $144.40 | $44.40 | 31.29% |

| 2012-09-01 | $144.40 | $100.00 | 0.693 | $204.87 | $141.88 | $41.88 | 29.00% |

| 2012-10-01 | $141.48 | $100.00 | 0.707 | $204.87 | $144.80 | $44.80 | 31.67% |

| 2012-11-01 | $142.71 | $100.00 | 0.701 | $204.87 | $143.56 | $43.56 | 30.52% |

| 2012-12-01 | $143.14 | $100.00 | 0.699 | $204.87 | $143.13 | $43.13 | 30.13% |

| 2013-01-01 | $150.46 | $100.00 | 0.665 | $204.87 | $136.16 | $36.16 | 24.03% |

| 2013-02-01 | $152.50 | $100.00 | 0.656 | $204.87 | $134.34 | $34.34 | 22.52% |

| 2013-03-01 | $157.36 | $100.00 | 0.635 | $204.87 | $130.19 | $30.19 | 19.19% |

| 2013-04-01 | $160.45 | $100.00 | 0.623 | $204.87 | $127.68 | $27.68 | 17.25% |

| 2013-05-01 | $164.30 | $100.00 | 0.609 | $204.87 | $124.69 | $24.69 | 15.03% |

| 2013-06-01 | $160.88 | $100.00 | 0.622 | $204.87 | $127.34 | $27.34 | 17.00% |

| 2013-07-01 | $169.55 | $100.00 | 0.590 | $204.87 | $120.83 | $20.83 | 12.29% |

| 2013-08-01 | $164.40 | $100.00 | 0.608 | $204.87 | $124.62 | $24.62 | 14.97% |

| 2013-09-01 | $168.90 | $100.00 | 0.592 | $204.87 | $121.30 | $21.30 | 12.61% |

| 2013-10-01 | $176.69 | $100.00 | 0.566 | $204.87 | $115.95 | $15.95 | 9.03% |

| 2013-11-01 | $181.96 | $100.00 | 0.550 | $204.87 | $112.59 | $12.59 | 6.92% |

| 2013-12-01 | $185.65 | $100.00 | 0.539 | $204.87 | $110.35 | $10.35 | 5.58% |

| 2014-01-01 | $179.17 | $100.00 | 0.558 | $204.87 | $114.34 | $14.34 | 8.01% |

| 2014-02-01 | $187.34 | $100.00 | 0.534 | $204.87 | $109.36 | $9.36 | 4.99% |

| 2014-03-01 | $188.14 | $100.00 | 0.532 | $204.87 | $108.89 | $8.89 | 4.73% |

| 2014-04-01 | $189.54 | $100.00 | 0.528 | $204.87 | $108.09 | $8.09 | 4.27% |

| 2014-05-01 | $193.87 | $100.00 | 0.516 | $204.87 | $105.67 | $5.67 | 2.93% |

| 2014-06-01 | $197.00 | $100.00 | 0.508 | $204.87 | $103.99 | $3.99 | 2.03% |

| 2014-07-01 | $194.25 | $100.00 | 0.515 | $204.87 | $105.47 | $5.47 | 2.81% |

| 2014-08-01 | $201.96 | $100.00 | 0.495 | $204.87 | $101.44 | $1.44 | 0.71% |

| 2014-09-01 | $198.26 | $100.00 | 0.504 | $204.87 | $103.33 | $3.33 | 1.68% |

| 2014-10-01 | $202.99 | $100.00 | 0.493 | $204.87 | $100.93 | $0.93 | 0.46% |

| 2014-11-01 | $208.58 | $100.00 | 0.479 | $204.87 | $98.22 | -$1.78 | -0.85% |

| 2014-12-01 | $206.87 | $100.00 | 0.483 | $204.87 | $99.03 | -$0.97 | -0.47% |

| 2015-01-01 | $200.87 | $100.00 | 0.498 | $204.87 | $101.99 | $1.99 | 0.99% |

| 2015-02-01 | $212.21 | $100.00 | 0.471 | $204.87 | $96.54 | -$3.46 | -1.63% |

| 2015-03-01 | $207.83 | $100.00 | 0.481 | $204.87 | $98.58 | -$1.42 | -0.69% |

| 2015-04-01 | $209.85 | $100.00 | 0.477 | $204.87 | $97.63 | -$2.37 | -1.13% |

| 2015-05-01 | $212.58 | $100.00 | 0.470 | $204.87 | $96.37 | -$3.63 | -1.71% |

| 2015-06-01 | $207.22 | $100.00 | 0.483 | $204.87 | $98.87 | -$1.13 | -0.55% |

| 2015-07-01 | $211.76 | $100.00 | 0.472 | $204.87 | $96.75 | -$3.25 | -1.54% |

| 2015-08-01 | $198.75 | $100.00 | 0.503 | $204.87 | $103.08 | $3.08 | 1.55% |

| 2015-09-01 | $192.71 | $100.00 | 0.519 | $204.87 | $106.31 | $6.31 | 3.27% |

| 2015-10-01 | $209.05 | $100.00 | 0.478 | $204.87 | $98.00 | -$2.00 | -0.96% |

| 2015-11-01 | $209.87 | $100.00 | 0.476 | $204.87 | $97.62 | -$2.38 | -1.14% |

| 2015-12-01 | $204.87 | $100.00 | 0.488 | $204.87 | $100.00 | $0.00 | 0.00% |

| $10,800.00 | 78.799 | $16,143.55 | $5,343.55 | 49.48% |

What Does This Show Us?

Let’s start with the summary. If I slept through the financial crisis and woke up in 2015, my $10,800 total investment would be worth over $16,143. I gained $5,343 and got a 49% return. Not bad for beginning my investment at one of the worst periods in history.

The price of IVV on 7/1/2007, when I first invested was $144.03. It went slowly up to $155 on 10/1/2007, and then the drop started. On 2/1/2009, the price was $74.21, less than half of the 10/1/2007 price. Holy cow!

The price did not exceed $144 again until 1/1/2013.

While I Slept

Because the $100 came out of my paycheck every month, I didn’t really think about it, which means I didn’t panic and stop my investment. 2/1/2009 was a disaster, the price was down almost 50% from when I started investing. But I bought more shares on that day.

on 2/1/2009, I got 1.348 shares for my $100, whereas I only got 0.694 shares for my $100 on 7/1/2007. The lower price on that day meant my account balance was scary, but also meant that the shares were on sale. Who doesn’t love a bargain?

Today’s Value

We’re pretending today is 12/1/2015 and the price of IVV is $204.87. All of my shares are worth $204.87. The shares I bought for $74.21 on 2/1/2009 have increased in value by 237.26%.

Take a look through the table and you can see my experience with every individual purchase.

Dollar Cost Averaging

Dollar Cost Averaging is a strategy for investing over time to lower the average cost you pay for a share of a security. In this example, I’m buying shares of IVV and because I’m regularly buying a small number of shares once a month, my average cost per share is lower than the high and higher than the low.

I kept buying whether the market was up or down, and because my payroll department and 401k provider handle this for me, I don’t have to think about it. In the chart above, I bought some shares at $144.03, some at $74.21, and some at $212.21. In total, I made 108 purchases at an average cost of $146.10. Dollar Cost Averaging is a strategy for putting your purchases on auto-pilot and mitigating the high prices you’ll pay at some point with the lower costs when the price is down.

Summary

This is actual data. The hypothetical example demonstrates the experience of an investor who buys $100 worth of shares of IVV on the first of each month and continued through December 2015. Even though it was one of the worst financial crises in history, over time, this investor comes out ahead.

Risks

Let’s go back to risks. What if this investor needed to take the money out for an emergency on 2/1/2009?

At that point, the investor has about 13 shares, he’s spent $1,600 on those shares, and they are worth (13 X $74.21) $964.73. Not Cool.

Mitigation – Asset Allocation

Investors take risk, that’s part of the job. But we need to mitigate that risk and in this situation our mitigation is done by adjusting our asset allocation. Equities are a volatile asset class. You can read more here and here. Money that you will need in the next 5 years (or so) should not be in equities.

If this investor planned on needing the money in 2009, then around 2004, he would have been moving from equities to fixed income and cash.

Mitigation – Emergency Fund

That’s great if the investment is for a planned expense, but what if an emergency comes up? One of the biggest investment risks is being in a position where we need to sell an investment at an inopportune time. Good investments tend to grow over time, but their prices can vary widely in the short term. Having an emergency fund can prevent us from having to sell assets in a down market.

But What If…

That’s great, but what if the market doesn’t recover? This is all historical info and we all know that past performance is not indicative of future gains. It’s in every mutual fund prospectus.

Optimism

I am optimistic about the future. I read a lot about how bad things are here in the US today and I read a lot of history too. Things were pretty tough during World War I, World War II, Vietnam, 9/11, the great depression, and during lots of other tragedies. America has done a pretty good job of facing adversity and coming out the other end successfully.

We continue to have babies. We buy diapers and formula and car seats. Apple sells a ridiculous amount of iPhones and other cool stuff. We continue to innovate and grow and as long as we continue, our economy will grow. It may grow faster or slower, who knows, but I’m confident it will grow. That means I’m confident that the 500 largest US companies will continue to grow, and that means that a low-cost S&P 500 mutual fund will likely be a good investment.

Wrap-Up

We’re all afraid of making a bad investment. For many of us, we fear buying in too high. We don’t want to buy and then see an extended period where our value decreases. For me, I like to look back at the data and see what would have happened. What would have happened if I invested at the worst possible time in my investing career? It turned out OK 8 years later.

As investors, we all make mistakes. We learn from them and do better next time. We can mitigate the risks by having a solid budget, building an emergency fund, and dollar cost averaging.

In my opinion, the biggest mistake is not investing at all. The opportunity cost of not investing can be huge. Read the posts on compounding and investor mentality to learn more.

*What’s Happened since 2015?

A footnote to our hypothetical example above where I stopped contributing in December of 2015. At that point I had 78.799 shares and they were worth $16,143.55. Today, the price of IVV is $520.28, so those shares are worth $40,997.54.

Thanks for reading. Let me know what you think.