It’s in the high 90’s here in Central MA and it’s too hot to be outside, so I’ve been spending some time with my spreadsheets. Boy, I hope it cools off soon…anyway, I decided to take a look at my investment performance over the years. While overall I’ve done well, there are some definite patterns in my investment winners and losers.

I Like Tech Companies

Tech companies like Apple, Alphabet (Google) and Netflix have been huge winners for me. I also include Amazon, Visa, Master Card and Booking Holdings in the tech grouping. Amazon sells stuff, but it is also a shopping platform, and it’s amazon web services. Visa and Master Card are in the finance sector, but they use technology to process huge amounts of card transactions efficiently and profitably. Booking is a travel/vacation company that helps us find hotels, rentals, and trips via a robust shopping platform. Booking is currently annoyed because the EU wants to classify them as a tech company. Read more here.

The Other Ones

Those are the companies that I like to talk about, but in perusing my buys and sells yesterday, I was reminded that I’ve gotten a little over-excited about a number of tech companies.

I’ve written about how I was impressed with Amazon and Netflix early on. They offered a service that no one else offered and I was completely confident that they would turn a profit someday and be leaders in their respective worlds. I continued to buy more shares on post-earnings dips.

Yesterday’s tiptoe through my trade history reminded me that this has not always worked well for me. During the tech peak in 2020 when we were all stuck at home, I got excited about ROKU – everyone’s going to be watching TV all the time – right? I was excited about Fiver (FVRR) a tech company that matched up gig economy tech workers with those who needed things done. I thought Lemonade (LMND) would revolutionize the insurance industry.

Each of these, and a few other tech companies, became 70% plus losers for me.

Dividends

I got excited about dividend stocks as I was nearing retirement. My search focus was on strong US brands that paid a high dividend yield. I still created a thesis for these companies before I bought, but I relied a little too heavily on the dividend yield in my evaluation.

I did pretty well with Bank OZK – a small regional bank out of Arkansas, Prudential Financial, and Blackstone. At the time I bought them, they all paid a more than 4% dividend yield. All 3 have rewarded me with pretty solid capital gains as well.

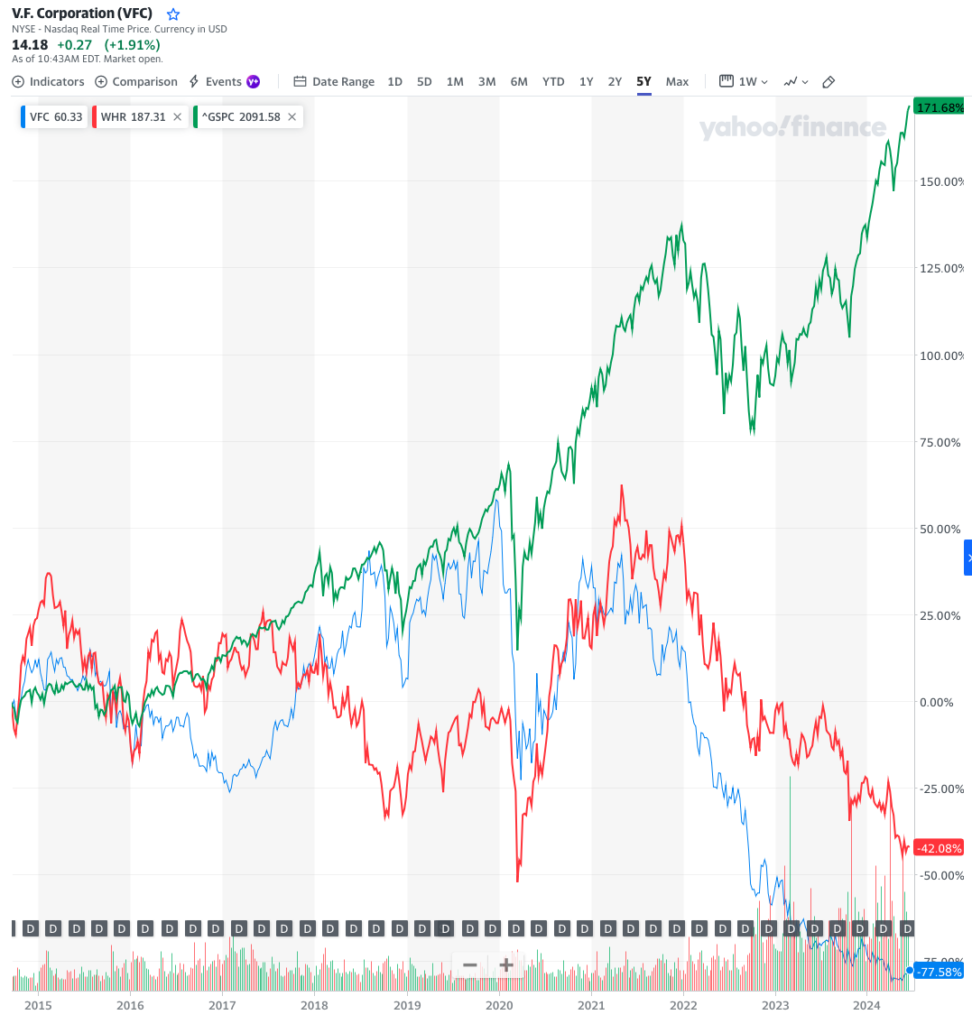

But I also took it on the chin with 2 companies I really liked VF Corp, maker of North Face and Vans, and Whirlpool, maker of many great home appliance brands.

Let’s look at a picture

Long Term Winners?

Are VFC and WHR long term winners? No. Part of my thesis was that the stocks would be very slow growers but would pay a healthy – more than 5% dividend. At the time I bought, interest rates were less than 0.5%. I was happy to live with many years of no capital gain, but a steady 5% return.

Inflation

OOPS. I hadn’t really thought about inflation. Inflation did 2 things to these companies.

First, their dividends didn’t look so great when a treasury or CD was paying 5% interest. Why take the risk of owning a stock when you can buy a treasury or CD and get your 5% annually plus a guarantee of your money back?

Second, as interest rates went up, it became harder for these companies to raise capital, and as consumer prices increased, you and I bought fewer large appliances and fancy clothes.

My investment thesis imploded. VF Corp actually cut its dividend. Whirlpool went from being profitable to not. Slow to no growth became big losers. Whatever dividend I was getting paled in comparison to my 50% loss on Whirlpool and my 70% loss on VF Corp.

Yes I sold. My only consolation is that Whirlpool fell 17% since I sold and VF Corp fell 29% since I sold.

What Did I Learn?

I remember when the economy blew up in 2008, a whole bunch of new regulation came out in the banking sector. Every now and then we hear about banks taking the stress test. Essentially, the bank needs to go through a worst case scenario and assess what it would mean to their business and assess whether they could survive.

I’m a retired english major who can barely get through a very simple version of a balance sheet, so how would I ever do this with a company in which I’m considering investment. That’s not worth the time and effort even if I could do it.

True, but it isn’t that hard to look back at the company’s history and see how it has fared during tough times in the past. I recently updated my thesis on John Deere. One of the things I love is that the company has been around since 1837. That’s a lot of history to look back on.

I need to be more critical of the dividend companies in which I invest.

Tech Companies

I’m not sure what I learned here. I read once about how Venture Capital firms continue to throw ridiculous amounts of money at many, many businesses in hopes of finding a single winner. In the venture capital world it is a bigger sin to miss out on an Uber, Facebook, We Work (before it went sideways) or other rocket ship than it is to lose billions of dollars on a bad idea. One great (or lucky) idea can more than offset dozens of bad investments.

I have shares of Apple that are up 4,585%. I have shares of Amazon that are up 2,583%. That makes up for a whole lot of ROKUs, Fivers and Lemonades.

I also hold shares of a few tech companies like Crowdstrike, a security platform in which I invested in 2020. I bought shares at $259 a share, watched it go way up, go way down for a long time and way up again. What’s the difference between the business of Crowdstrike and Fiver? Why did Fiver’s stock price never recover (yet)?

The most frustrating part of investing is never knowing how the story ends. 10 years from now, Fiver may be up 5,000% and Crowdstrike, Amazon and Apple could have all gone to zero. Not likely, but who knows?

I Did Learn Something

Actually 2 things.

Keep Score

I learned that as an investor, it is important to keep score. I have a few posts that help with this here and here. I find it helpful to look at my investment decisions, evaluate how they’ve performed and compare them to my thesis. This provides me with areas I need to dig into more deeply and causes me to update my thesis. If a security is not performing as I’d expected, like VFC or WHR, it’s not necessarily a reason to sell, but it is a reason to update my thesis and maybe put the security on a watch list to ensure the business does not deteriorate further.

Equity Diversification

I also learned that I need to continue to invest in a lot of companies. I have 67 companies that I am invested in. I have a thesis for each and I update it regularly. I also understand that I will be wrong sometimes. Again, being wrong for a period of time is not necessarily a reason to sell. Holding on to Crowdstrike was a good idea. VF Corp cut its dividend and it also spun off some of its more profitable (though less cool) brands. This, for me, was a reason to sell.

I’ll add a third…maintain a healthy position in low-cost S&P 500 funds or ETFs. I’ve done well with stock selection and I’m pleased with my overall performance. I’ve learned from my mistakes so I believe that I continue to be a better investor. But, I also don’t want to be eating cat food in my 80’s so I rely on diversification to limit my risk. S&P 500 funds provide easy equity diversification.

Diversify Across Asset Classes

I also diversify across asset classes by keeping a large cash position (which is getting about 5% interest – yay!), investing in treasuries and IBONDS, and putting some money in corporate and municipal bond funds.

Thanks for reading. Let me know what you think.