The old guys and I have been debating whether buying property is a better investment than the S&P 500. As always, I think the answer is “it depends” though not for the reasons you may think.

Property

Of the 4 of us in the discussion, all of us own our homes. 2 of us own more than 1 property.

The great thing about owning a home is that you can live in it. The value of my home has gone from $222k when I bought it 25 years ago to $600k in 2008, then it crashed to under $300k overnight, now it is back around 600k.

Ask me how I feel about that, I’ll give you a resounding “who cares”

While it would be nice if my home appreciates in value, that’s not the priority. It’s where I live.

The S&P 500

The S&P 500 has averaged a 10% annual return with dividends invested over the last 100 years.

The problem with this is that it is an average. And it is over a 100 year period.

As investors in an S&P 500 fund, each of us will have a different experience depending on when we buy, when we sell and what we do in between.

S&P 500 v. Other Equity Investments

This is important.

In most of my posts, I talk about performance when invested in a nice low-cost S&P 500 fund. But your 401k may not have an S&P 500 fund, and you may choose a fund that you think is similar, but is quite different.

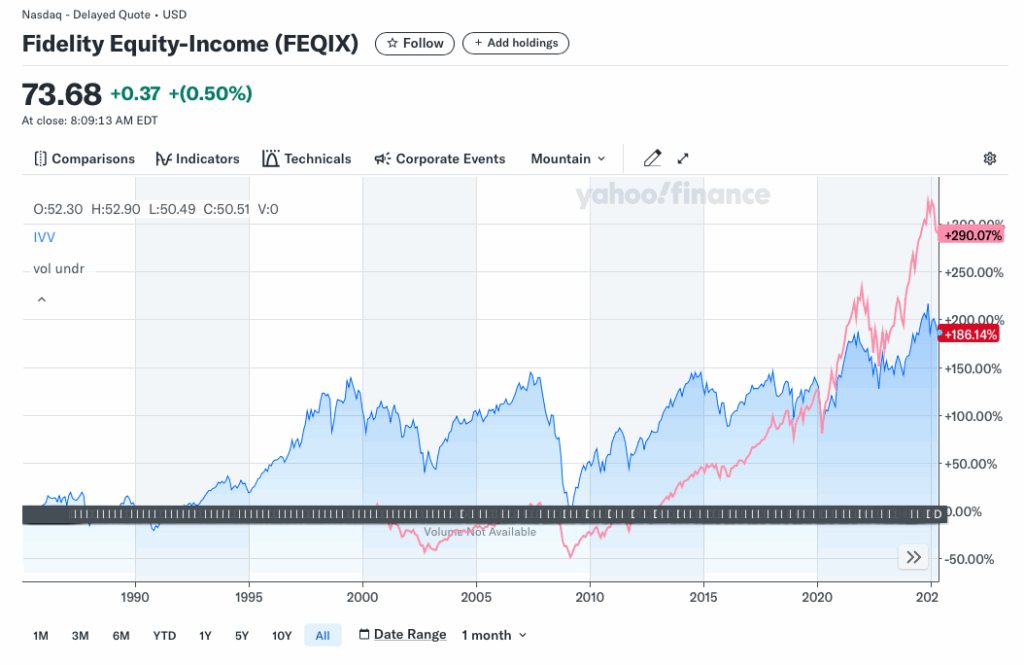

Let’s look at a quick example. Let’s say I invested in the Fidelity Equity Income fund. Sounds quite similar. Let’s take a look at the performance of this fund v. the ISHARES S&P 500 index fund. The ISHARES Fund is in pink.

That’s a pretty significant difference.

And say you picked a global fund or an emerging market fund. Those have hugely underperformed the S&P 500.

Here’s a comparison of an S&P 500 index fund in pink, an emerging market fund in blue, and a global stock fund in green.

And these are all low-cost funds. If you end up choosing a fund with a high expense ratio, you could under-perform by a much larger factor.

All equity funds don’t perform equally.

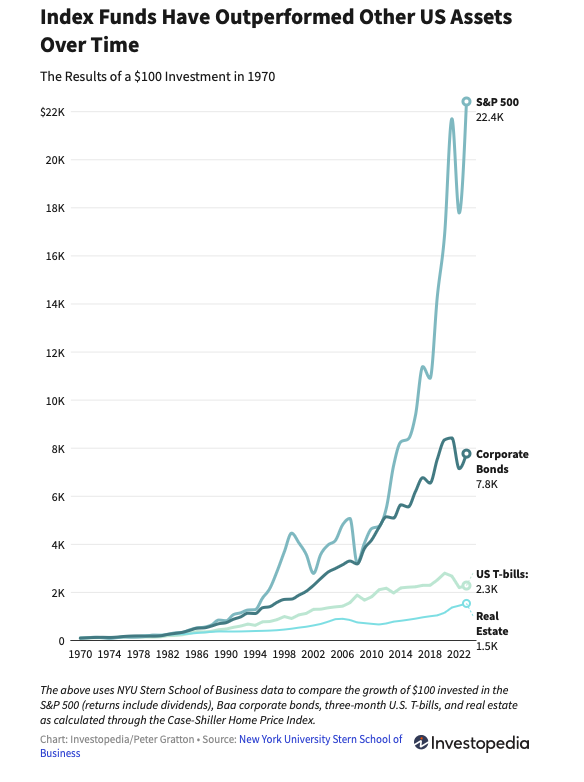

What’s Investopedia got to say?

I’m glad you asked. Check this out.

And you can read the article here.

Timing is Everything

While the charts are informative, the timing of your purchase and sale, and what happens in between can make a huge difference.

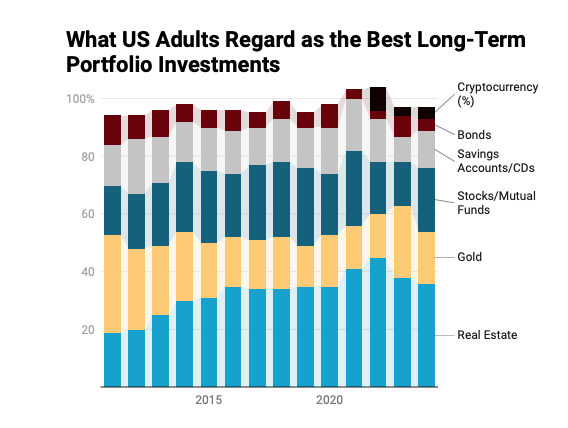

In the same investopedia article, it says that most US adults feel that real estate is as good an investment as stocks and stock mutual funds.

And There’s More

When we buy property we also need to factor in any mortgage interest we may pay over the life of the loan, any property taxes we’ll need to pay, upkeep, repairs… All these expenses impact our profit.

Wrap-Up

Interesting info.

Who’s right?

It depends, and it doesn’t really matter.

Often, we get too hung up on what’s the right answer. A friend at work once told me that in almost all situations, pretty good is good enough. I think he’s right on.

Owning property can build wealth. Owning stocks can be wealth. Owning a low-cost S&P 500 fund can build wealth. Which is best? Depends on a lot of factors but I wouldn’t let perfection get in the way of good.

And having something we can see, touch, live in, or rent out is pretty nice. An S&P 500 fund can build wealth, but while we do own a minutely small portion of the companies within the S&P 500, it’s not like we own something tangible.

That means something too.

Will share yet another “lesson learned” moment, as mentioned earlier we manage 5 units, and are currently 3 months into yet another unexpected vacancy (this time when a tenant bailed out on a lease mid-winter).

While legally we could pursue recourse in the courts, we realize that path is all but pointless as our time and $’s spent on legal counsel would almost never be recoverable.

So while I still feel it was a path worth taking for us both at the time, the current “cost of entry” for rental properties and the endless unscheduled challenges to cash flow make it a debatable investment.

Caveat emptor….

Good information. I don’t think I’ll be buying rental property.

My original thought was to have two homes and migrate with the seasons. The money would be secure, but it looks like there is a penalty versus investing the money. It would be a nice luxury, not a great investment. And maybe the winters here aren’t so bad after all.