Duh. Or if you’re a Simpsons fan, Doh. Either way, I’m sure you get it. But how big of a problem is debt? For today’s post, I’m going a little outside of my typical personal finance scope and talking about some reading I’ve done recently.

I Don’t Have Any Debt!

I can hear some of you now – myself included, until I started researching for today’s post – saying “I have no debt!” For many of us, we’ve practiced good financial habits, we’ve avoided debt. Earlier in our careers, we may have needed to borrow for a car, a home, or for education, but we worked diligently to pay these down and now in our old (ish) age, we’re happily debt free, or getting close to it.

Are You Sure?

Did you know that the US National Debt is now over $34 trillion? I realize that number is meaningless because most of us, myself included, can’t even imagine what $34 trillion is. My reaction is “that’s a big number”, and I move on.

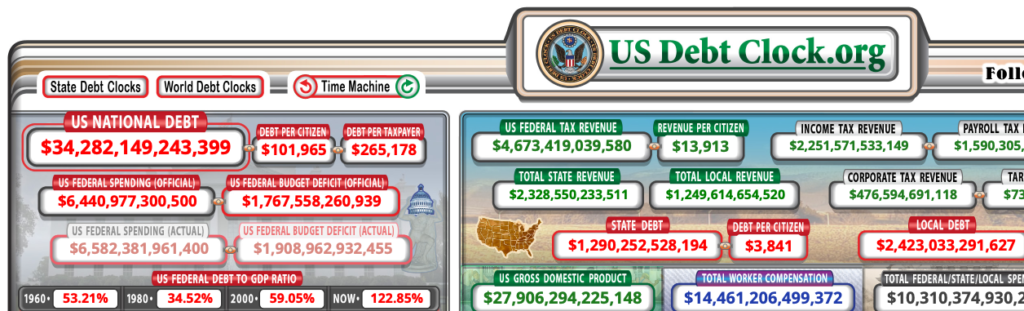

But, let’s talk about numbers we can understand. Let’s start with a picture because it’s more fun.

This is a real-time display that you can access anytime you like here. The good folks at US Debt clock.org have broken down the debt to how much belongs to each citizen, and how much belongs to each taxpayer. For all those debt-free folks out there who pay taxes, $265k of that debt belongs to you.

This is Not a Political Post

Like many of you, I do have political opinions, but if I do my job (hobby) well, you will never know my political stance. Our national debt is a problem for each of us and for our nation.

How Much Debt is a Lot

Because the 34 trillion number was inconceivable for me, I started to do some research on how to measure debt. I’m an investor and part of my research of various companies is looking at their balance sheets and assessing their debt. Apple is generally considered a pretty healthy company. People seem to like their stuff and are willing to buy about $400 billion worth of their stuff every year. But, Apple has debt. $123 billion dollars worth of debt. Again, really big numbers and really doesn’t help me put debt in perspective. But note that their debt of $123 billion is less than their revenue of $400 billion.

Let’s go look at US GDP or Gross Domestic Product. GDP is the total value of all goods and services produced. In 2023 the United States GDP was around $27 billion. Click here. Our debt is over 120% of GDP. I couldn’t find any reports that showed me what a healthy debt to GDP ratio was, and I saw a lot that downplayed this and referred to other countries whose debt was higher. Japan’s debt is 217% of GDP.

My mom would have said that just because the other kids are doing it doesn’t mean you should.

Historical US Debt to GDP Growth

You can find this chart here as well. As a nation, we were hanging out in the 33% – 55% range for a while and somewhere around 2008, we hit the gas. This is not surprising, things like recessions and pandemics create the need for higher government spending.

Unfortunately, it looks as if we never reeled this back in. For those who enjoyed the stock market run-up in 2009 – 2020 ish, we remember things were pretty good. Jobs were strong, inflation was low…what happened? Why didn’t we pay down some debt?

A quick head-ruffle for the readers. The American consumer paid down quite a bit of debt during this period. Nice job!

This is Not Political

You can certainly look at the table above and go to your archives and see who was president, who controlled the house, who controlled the senate…we’re not going to do that.

Is Our US Debt Level a Problem

Yes!

We take the term “Backed by the full faith and credit of the US government” pretty seriously. We meaning the majority of the population of our planet. US government bonds are considered virtually risk-free. I own lots of them. You probably do as well. Many countries hold US debt because they are confident that the US can make its interest payments and return their original investment at maturity.

For all you investors out there, you may have recognized that to combat inflation, the government raised interest rates. Inflation is a big problem (no kidding, check my grocery bill) and despite the number of times we’ve had inflationary periods, economists don’t have a lot of tools in their belt to fight it. The primary way is by reducing the money supply. They do this by raising interest rates. This gets boring fast, so I’ll stop here.

Higher interest rates mean investors are now getting somewhere around 5% for a 1 year US treasury bond. Several years ago, this was less than 1%. Yay – right.

Who has to pay that higher interest rate? Not a trick question…the US government. As the US government continues to issue new debt to fund all of their programs: education programs, interstate highways and bridges, solar credits (thank you), the military… they are now paying more than 4x the interest charges. Good for treasury buyers, not so much for the US debt.

Not My Usual Post

This is not my typical post, but I did some reading today and it was on my mind. Hopefully someone from the US government is reading my post on saving. Especially the part about saving for something before buying.

Anyway, I hope it was interesting and helped put the huge number in perspective. If not, hopefully you jumped quickly to another post that dealt more with personal finance. Let me know your thoughts. Is this sort of post interesting or should I stick to my knitting?