We should be asking this about all the companies in our portfolio, not just our favorite.

And if this question doesn’t really interest you, I have a nice low-cost S&P 500 fund for you to check out. Take a look at iShares Core S&P 500 ETF (IVV).

OK, maybe that’s a bit snarky for a sunny Wednesday morning. But I stand by the sentiment.

Investing is a must for all of us. Whether it is through our 401k plan at work, our brokerage account, our HSA, or other account; bank interest (even when some high-yield savings accounts are paying 5% in annual interest) ain’t gonna do it.

The S&P 500 has returned about 10% annually over the last 100 years or so with dividends reinvested. And while you may get 4.8% today on a high yield savings account, remember back in 2020, when we were excited to get 1%, but more likely getting 0.5% in bank interest. Bank-interest was not a wealth-building strategy.

Back to the Point

That was a surprising and unusual digression for me. Sorry.

The point being, we need to invest in equities to build wealth. If you’re unsure why, most of my investing posts discuss this, but look here and here in particular.

But investing in equities does not mean we need to be a stock trader. A nice S&P 500 mutual fund or ETF will own shares of the 500 largest US companies. And the S&P 500 has been a wealth-building machine over the last 100 years.

But many of us enjoy a good research report. We’d like nothing better than getting a cup of coffee and sitting down for several hours to read everything management has to say about their business. Right?

I’m kidding. I like buying individual companies and I’m convinced that with 15 minutes developing a thesis, and some regular reading, any investor can make market-beating picks.

Evolving?

Oh yeah, right. That was the point. Sorry.

We’ve decided to invest in individual companies, we’ve done the work of creating a thesis on a company in which we’re interested, and we’ve invested. Now what?

Is your company evolving?

Netflix

I talk about Netflix a lot. Do a search on our site for Netflix and you’ll find 3 pages of posts that talk about the company. Check it out here. In particular, read the post Buy What You Know. I talk about how Netflix has evolved. DVDs, then streaming. Original series, and then supplementing their own content with popular titles from other providers. Last week they dipped their toe into live sports with the Tyson/Paul fight and had the largest streaming audience for any sporting event ever.

Netflix is evolving. Constantly.

Fastenal

My largest portfolio holdings are Amazon, Apple and Netflix. All 3 have had incredible growth over the last 20 years or so since I started buying shares, and they are fun to follow. Many of us love to read about the new iPhone or Apple Watch, or Amazon’s next business venture, whether it is planes, electric delivery vans or Amazon Web Services.

I also invest in a lot of boring companies like Fastenal so I can’t forget them. Many of us want some income and safety to offset our growth investments (that sometimes grow, and sometimes plummet in value). A stock like Fastenal can be a great investment for this.

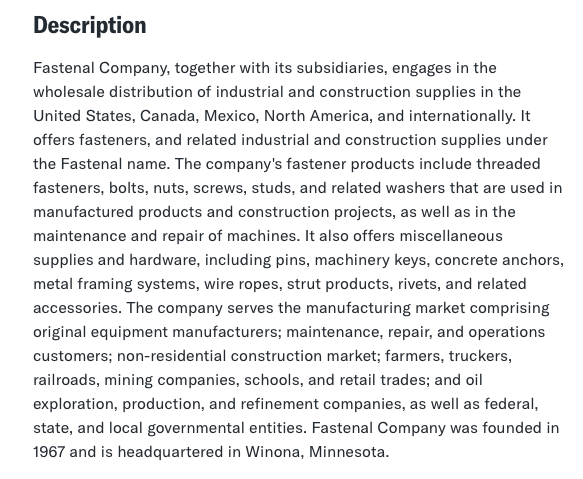

Here is the company summary on Yahoo Finance.

Congratulations if you managed to stay awake through the whole paragraph.

The point being, Fastenal is a pretty boring company that pays a 1.9% dividend. Does it need to evolve?

Yes

Every company in which we choose to invest needs to evolve. Even Fastenal.

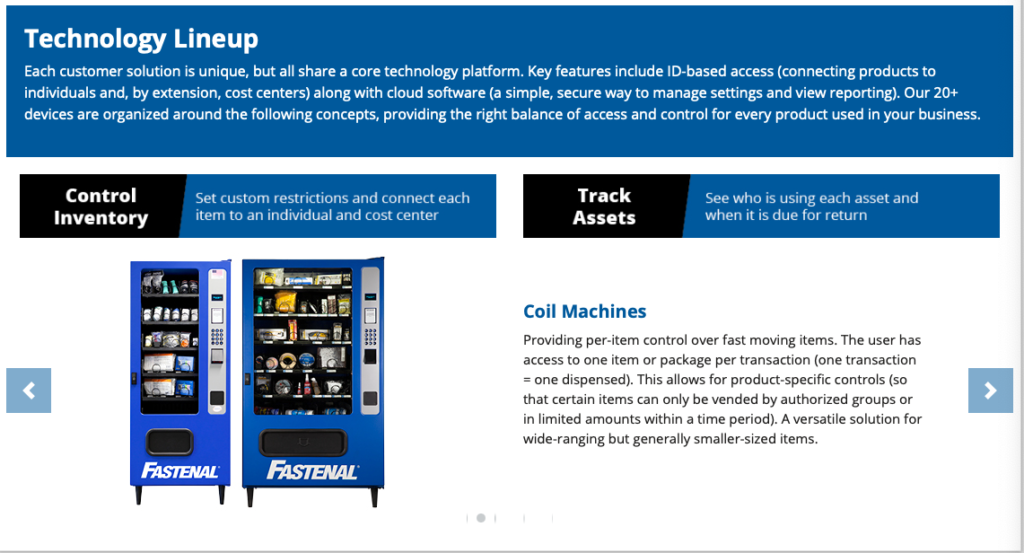

This is from Fastenal’s website. Fastenal started with putting their “stores” directly inside a customer’s factory so that they could sell items directly to the folks using them. Then they figured out they could put vending machines all over every customer’s site. These machines provide an automated delivery system with inventory tracking and control. And customers only buy what they need.

I learned this reading their annual report. Read the details here. This makes Fastenal an interesting and evolving company that I want to own and follow.

Altria

Yuck, Cigarettes.

A lot of folks don’t like to invest in companies whose products they don’t like. And cigarettes have done quite a bit of harm, so there is a lot not to like. I respect that.

I’m not entirely sure how I feel about owning Altria as a company, but I bought 400 shares a while back. I love the 7.3% annual dividend, and on top of the dividend, my shares are up over 20% since I bought them in late 2022.

Here is Altria’s website.

I get a kick out of this. The company was founded in 1822 and makes a killing getting people addicted to tobacco and building customers for life.

Altria is Evolving

It is evolving. While cigarettes are still quite popular and lucrative in other parts of the world, the US is catching on that they may not be great for us. You can see the disclaimer at the top of Altria’s website that says A Federal Court has ordered Altria, R.J. Reynolds Tobacco, Lorillard, and Philip Morris USA to make these statements.

But, good for them. They are evolving. I’m not convinced their heart is in it and I’m not sure they’ll really evolve, but it is important for companies that we own to be evolving. Otherwise someone will eat their lunch.

Wrap-Up

Back to my favorite Netflix…they came out of nowhere and destroyed Blockbuster.

Read more here.

Same for Uber destroying Taxis.

As investors, our primary goal is to build wealth. We’re taking our hard-earned money and buying something that we expect to be worth more money years later when we sell it.

As an investor, I want to be sure I’m making smart investments. I create a thesis before I invest. Many investments get thrown out in the thesis stage.

If they pass the thesis and I choose to invest, I read annual reports (for at least 15 minutes), news stories and listen to podcasts to keep up on the companies in which I’ve invested. Like Netflix and Fastenal, I want to be sure that they are continuing to evolve and grow.