As you can tell from reading my posts, I’m pretty cheap. I love to save a buck and it kills me to pay more than I have to for something. If I can do it myself, I do. I’ve been cutting my own hair for 20 years. My buddies wouldn’t be surprised based both on my cheapness and my fashion sense. But, imagine what I’ve saved!

Investing

Thanks for sticking with me through the hair story…this does tie back to investing and you’re about to find out how. Isn’t that exciting!

Set it and Forget it

I love a 401k. It is truly set it and forget it investing. We set it up when we join a company, we choose a portfolio of investments, we set up a % to defer into the account each paycheck and we forget about it. The money comes out every paycheck and gets invested. This happens whether the market is up or down. More here.

Dividend reinvestment works the same way. Every time the company (or fund) pays a dividend, it is used to buy more shares.

Bargain Shopping

Set it and forget it is a passive form of investing. A decision is made up front and then it just keeps on truckin’. No further action required.

But if we have a brokerage account or IRA and we are investing on our own, we need to actively make decisions. This is true whether we’re buying stocks, bonds or mutual funds.

And we know that investing is about spending our hard-earned money on something today that we expect will be worth more in the future.

So, like everything else we spend on, we want to find a bargain.

Buying the Dip

There are a lot of investors who look to buy the dip. They wait for a stock to pull back and then they buy. That’s exactly how I shop for shoes. I may see a pair that I like. I compare prices. I use camelcamelcamel to track the price history on Amazon. I set up an alert for my price target and when it hits, I buy.

While it has worked well for shoes, pants and garden supplies, I’ve been less successful on stocks with this approach. When I buy on the way down, the stock always seems to manage to drop further, and further, and further. How do I differentiate a pullback from a death spiral. I learned my lesson with the now defunct Yellow Trucking.

Buy on the Rise

It cost $50 last week and it’s $62 today. Are you crazy??

Why would I pay more?

Great question for shoes, pants and garden supplies but not such a great question for stocks.

The reason why is that a stock represents a share of ownership in a business. And unlike pants, businesses are constantly evolving. And the stock market is very efficient at pricing businesses.

We hear that a lot, but let’s talk about what that really means.

Efficiency

Tesla (Ticker: TSLA) is up 5.01% today. Tesla got pummeled yesterday because Trump and Musk were fighting. It was down 14%. Last night it was reported that Trump and Musk had a call to mend fences. Stock pops.

With Trump and Musk at each other’s throats, Tesla is a less valuable company. Tesla relies on government incentives to sell vehicles. Buy an electric vehicle and get a tax break. That’s a less expensive vehicle for the consumer. We like less expensive. Tesla will sell more vehicles and make more profit with government incentives.

With Trump angry at Musk, there is a strong possibility that Tesla could be excluded from some incentives.

Tesla, as well as all US companies, is highly regulated by the US government. Read up on vehicle safety. The National Highway Transportation Safety Authority (NHTSA) carries a lot of weight. Angering the government can make it difficult and costly for any business.

Yesterday’s 14% drop comes based on an expectation that sales will likely be lower, business will likely be more costly, and thus the profit of the business will be less. Tesla becomes a less valuable company.

14% less? Who knows? Some of this short term churn is emotional.

With the fence-mending, things are looking up. Profitability may not be at as high a risk as expected. Stock pops.

The point is that investors are constantly taking in information and recalculating profitability. This is done with huge supercomputers that can read and recalculate pretty fast. Based on these calculations, investors are changing the price they bid for Tesla and holders are updating the price they ask to sell shares.

This gets factored in quickly. In a fraction of a second, the news is absorbed and the prices change. The market is efficient.

Why Do We Care?

We do because an increase in the price of a stock can mean that the business is more valuable. This is not always the case. remember Gamestop in 2020?

But let’s take a look at Amazon. Back in 2000, Amazon traded at under $5 per share. Today Amazon trades at $211.88.

100 shares of Amazon would have cost us less than $500 in 2000. In 2025, it would cost us $21,188.

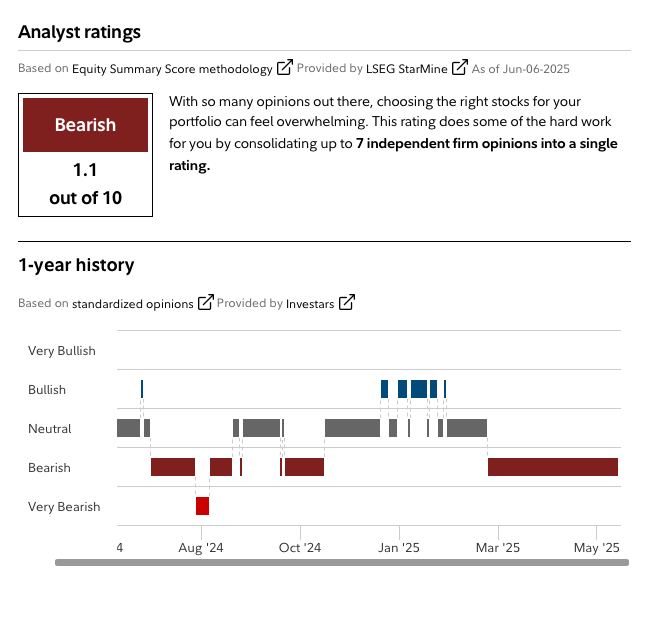

Many would say that’s ridiculous. It’s way over-priced. And many analysts do feel that way.

I have quite a few shares of Amazon which makes it my largest portfolio holding by far, so I’m not buying shares. But that said, I am more optimistic about Amazon than any company in my portfolio.

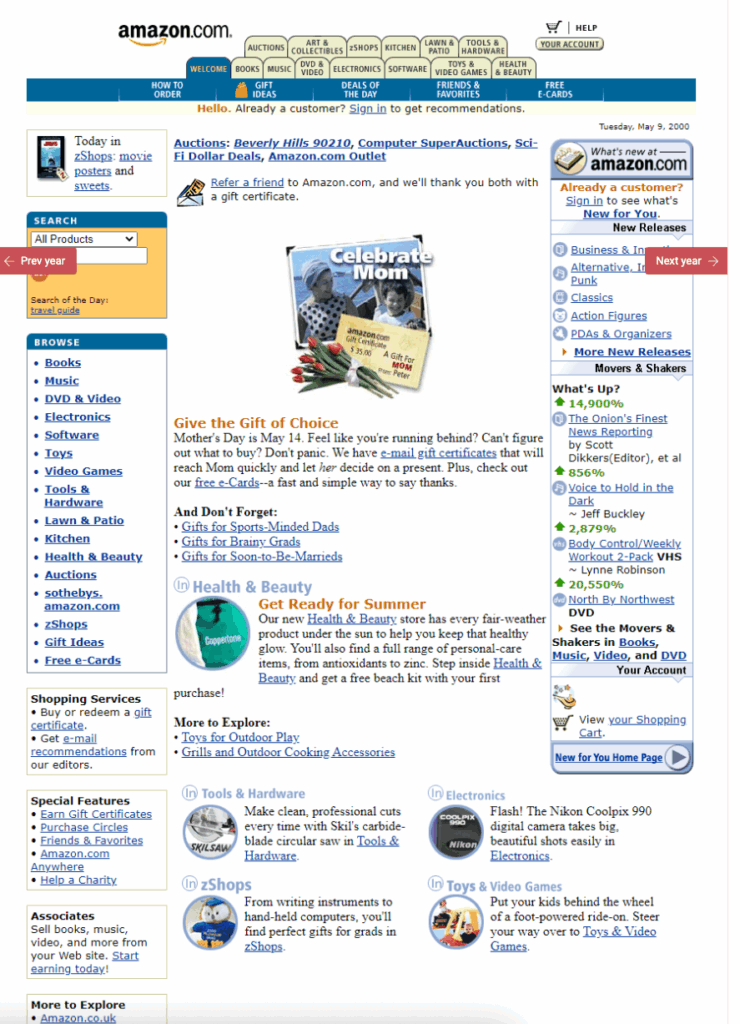

Here’s what Amazon looked like in 2000.

Check out here to have some fun and see Amazon in different eras.

Since that time, Amazon started becoming a selling site for other companies. It’s stopped relying on UPS, Fedex and USPS and is now the biggest shipping company in the world. It started selling Amazon webservices – basically a technology timeshare for businesses that don’t want to or can’t afford to set up their own technical infrastructure. Amazon now makes a significant profit from advertising.

I would argue that the business value has grown more than the stock price increase.

Higher Price Doesn’t Mean Bad Deal

While it does for pants, not so (sometimes) for companies. Our company has evolved. $100 today could be a better deal than $50 last week.

I bought an over-priced company called Axon Enterprises in February. It’s got a sell rating with most analysts. Its price to earnings ratio is 191. The stock price is up 35% since I bought. I continue to watch and anticipate buying more shares soon at an even higher price.

I’ve had better luck buying on the way up. Wouldn’t we rather buy a growing company as opposed to a shrinking one. A pullback could be a buying opportunity or it could be a stop on the way to bankruptcy. It’s really hard to tell.

But it was pretty clear to me all along that Amazon was going somewhere. Easy to say now, less so in 2000, but while signs of profitability were not there, signs of business growth were.

Wrap Up

It’s really hard for us to pay more for something than we need to. In my family, this has been ingrained in us since birth. We had little so we were careful.

So when Amazon cost $5 and now sells for $211, it’s hard for us to buy.

But remember, Amazon is not a pair of pants. It has changed. It bears very little resemblance to the Amazon in 2000 that sold books online and had recently expanded into a few other lines.

Amazon now sells everything. They sell other retailer’s stuff too – and make a killing doing it. They deliver through a fleet of planes and trucks. Their logistics are best in class so they can be more efficient and cheaper. They continue to try new things and launch new businesses like Project Kuiper.

I wrote about this in The Dangers of Anchoring on Price. It’s an important concept so I thought it deserved some love today.

I wonder if Bezos/Amazon will get into the space/satellite market?