For those who have read my prior posts on Intel and think I’m gloating, you are correct. While I’m taking a victory lap, there are some important lessons to learn from my Intel experience.

I Was Optimistic About Intel

Back in 2022, I had been reading a lot about the chip shortage. It was effecting cars and home appliances. Everything had gotten smarter – at least things had – and computer chips were in short supply. I looked at the situation and thought about whether this was a supply-chain issue that would be resolved at some point or if this was a sustainable trend.

In investing there are no sign-posts that answer these questions so we need to do our research and make an informed decision. I believed that computer chips would be in short supply for many years to come and our appetite to add them to cars, TVs, stoves and phones would be a long-term growth driver.

A Basket of Chip Stocks

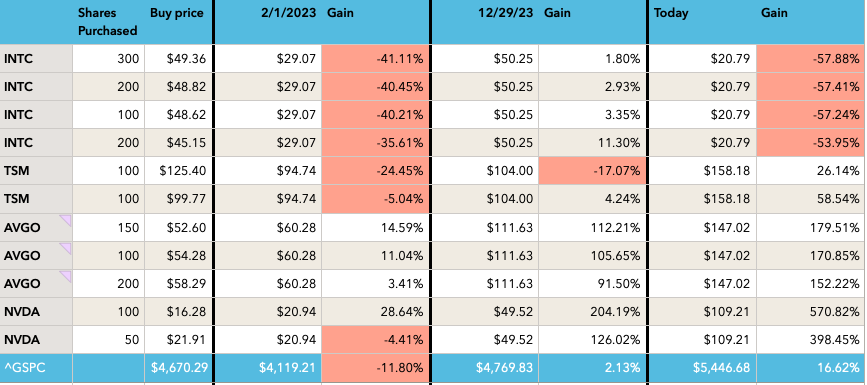

I wasn’t sure there would be one clear winner, so I bought shares of Intel (INTC), Broadcom (AVGO), Nvidia (NVDA), and Taiwan Semiconductor (TSM). Intel was my least favorite. It seemed as if its best years were behind it – more on that shortly – but it paid a healthy dividend and at the time, I was looking to move my portfolio towards income-generating equities. More on dividends here and here.

How’d I Do?

I generally buy stocks with the intent of beating the S&P 500. I have assets in Cash – my emergency fund and money I need in the next 5 years, and Fixed Income – some bond funds to pay me dividends for lower risk income, but I’m still looking to grow my wealth so I have significant investments in equities. More on Asset Allocation here.

Buying individual stocks is more risky than buying a low-cost S&P 500 fund. The fund consists of the 500 largest US companies. that’s some pretty good diversification. For comparison, I hold about 80 individual stocks.

But, overall, while some of my picks have under-performed, as a group, they have out-performed the S&P 500 over my past 25 years of stock investing.

With that out of the way, let’s look at how my chip stocks have performed.

Chip Stock Performance

The 1st 3 columns show my purchases in January and February of 2022 – how many shares I bought and what I paid. The next 3 groupings show how these stocks had performed after a year, after 18 months, and where do they stand today. At the bottom, I included the S&P 500 as my benchmark for comparison.

A year out, this group had performed poorly. I’m not sure why, but it seems like it often takes a year or more for my stock picks to outperform. Read more in the secret to building wealth.

Sell Intel!

Intel was the clear loser after 1 year. I remembered that I was skeptical in the beginning, but I was lured by the 5% dividend. Well, Intel had just cut its dividend to less than 2%. And, their turnaround efforts were going more slowly than management had hoped.

3 Quick Lessons

- Don’t buy stocks unless you have a high conviction in the business. Read more here. A lot of money has been made in businesses that have made a turn-around. None of it by me. Intel didn’t turn around and neither did Yellow Trucking – now YELLQ because it is in bankruptcy. Who am I to know whether a turnaround will work? Leave that to the pros. There are enough great companies out there that I do not need to fish this pond.

- Dividend cuts – While this is not always a sign of grave danger, it is a sign that we need to look further and we need to dust off our thesis with a more critical lens.

- It’s OK to sell after a major thesis change. While I like to hold for years, if the thesis (the reasons I bought in the first place) no longer hold true, it may be time to get out.

Intel is on Fire!

As you can see, the next 6 months were good to Intel. My shares, if I had kept them, would have been up anywhere from 2% to 11% since purchase, but some were up over 50% in that 6 month period. I wrote about my remorse here.

Not only is the stock up, but it is a media darling. Every article I read and all the podcasts are touting the impressive performance and the high likelihood that Intel returns to its former dominance. I’m an idiot.

More Lessons

Emotions have no place in investing. I may be an idiot, but if I react, I could be a much bigger idiot. My thesis changed, I made my decision, study the results and move on. Keep watching and learning, but don’t react.

Also, what makes the media and the podcasters so smart? The pundits know we have short memories so they tout the hot stocks. Very few in the media today are issuing warnings against Nvidia after its huge rise. Wait til it pulls back 50%. Read and analyze but don’t react. And remember which analysts and sites give you information that is valuable v. those that tell you the hot stock today.

Don’t Beat a Dead Horse

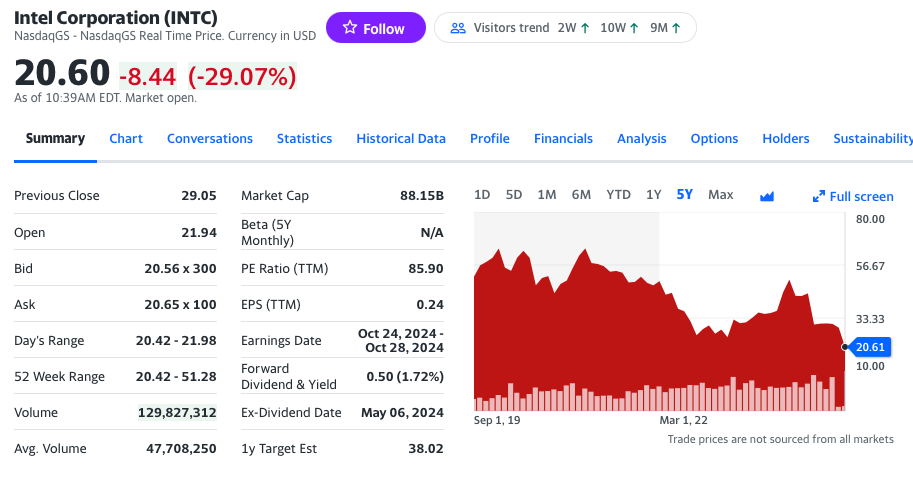

I won’t belabor the point, you can read more here. Intel stock drops, the media turns against it, and at one point, one author questions where the CHIPS Act money is an incentive or a bailout. Intel is way down and the other chip stocks are up. Today after earnings, Intel drops another 29% Ouch!!

I’m Sometimes Wrong

Gasp!

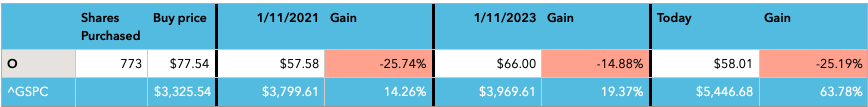

Have I mentioned Realty Income? After. I retired, I was on the hunt for great dividend investments. Companies with a track record of strong earnings and a history of raising their dividend. Realty Income (Ticker: O) fit the bill. It’s even called the monthly dividend company. How could I go wrong?

It was such a great opportunity, I invested more than I ever have in one company in a single shot. Usually I dollar-cost average, but I wanted in on the 5% dividend.

Let’s compare my large 2020 purchase with the S&P 500.

I’m down 25% after a year, a little improvement but still down 14% after 2, and now down 25% again.

It’s been 4 years, why haven’t I sold? I lost more on this investment than I did on Intel.

Thesis (and Dividends)

The simple answer is my thesis has not changed. I’m optimistic about the company. It has great tenants who tend to renew their leases and it issues net lease agreements, meaning the tenant is on the hook for most expenses. It generates a lot of cash so the dividend seems safe. What has chaged is inflation. Higher rates have not been kind to REITs and to companies that pay a dividend. Who wants to take the risk of Realty Income, which pays a 5% dividend, when treasuries pay 5%? That’s crazy-talk.

COVID also hasn’t been kind to REITS. The return to the office is slow. This has an impact far beyond offices. There are fewer people in cities and this impacts other businesses.

Oh Yeah, and I’ve also gotten over $13,000 in dividends from Realty Income. This does not offset the losses, but it softens the pain a bit. And I continue to believe the share price will rise above $80 once inflation slows a bit more, rates come down, and more folks return to the office. None of these are guaranteed, but I’m willing to be patient.

Every Company Doesn’t Need to Beat the S&P 500

Gasp!! – again.

I thought you said you expected your stocks to beat the S&P 500, otherwise you’d just invest in an S&P 500 fund? True, mostly.

I have a handful of companies – Devon Energy (Ticker: DVN), Altria (MO), Realty Income (O) – that I expect to lag the S&P 500. This is not the case for Apple, Amazon, Alphabet, Netflix and Visa, I expect these companies to beat the S&P 500 over time. But for a small few, I’m OK with not beating. Here’s why.

Annuities

Did you ever think about buying an annuity? I have. It sounds nice. I trade some money today for a stream of income in the future. Guaranteed money. Who doesn’t love a guarantee, especially when I’m retired and no longer earning income?

But, when I looked closely, I’m relying on the health of an insurance company. What if it goes under (remember AIG?) I’m also buying a payment stream in the future but comparing it to the buying power today. Let’s say I buy an annuity that gives me $2,000 per month. Sounds great. How much will $2,000 buy in 2044?

My investments in DVN, MO and O pay me almost $10,000 per year in dividends. I expect them to under-perform, but not go to zero. Compare that to the annuity that will have no value after the last payment is made.

So, maybe it’s OK to have some slow growth companies if they provide a steady stream of income to help us pay our bills. We still need a healthy dose of growth stocks to build wealth, but in my situation, some low-growth dividend payers have a place in my portfolio.

Wrap-Up

The most important point to take from this is that I was right about Intel.

Ha Ha, no…it’s nice to be right today, but who knows what will happen in 2 years, 20 years, 50 years. But there are some important lessons about building a thesis, continually testing business results against your thesis, having conviction for the companies in which we invest, and being suspicious about events like dividend cuts and their implications.

As investors we will be wrong sometimes. I don’t know that Realty Income will be a good investment, but boy, wait for that article and the happy dance if it does…

As I write this, Shopify, one of my favorite companies and a solid gainer in my portfolio, is down 31% this year. Starbucks, another favorite of mine, is down to the same price it was at in 2019.

I believe I was right to sell Intel. I was right when I bought more Amazon shares during pull-backs in the 2000’s. I believe I’ll be right in sticking with Realty Income. I keep score, so I know that overall, looking at all my buys and sells, my equities have outperformed the S&P 500. This takes work – building a thesis, monitoring results, having conviction, and not letting emotions play a role in investing decisions.

A Final Thought

This is true for stock investments. To choose individual stocks that have a solid chance of outperforming the S&P 500, we need to do some work. Many of us enjoy this.

But if you want to build wealth, all you really need is time and a low-cost S&P 500 fund or ETF. Time is a must. Read more on compounding here. And read more about why the S&P 500 has been a winning investment and will likely continue to win here.

Good luck and let me know what you think.