Back in March, I wrote a post where I decided to back up my love for the S&P 500 with real money. You can read the post here.

I did this for 3 reasons:

- I believe we are all responsible for growing our wealth. Pensions are long gone for most of us so it’s up to us to build a nest egg to sustain us in retirement.

- Saving alone will not build wealth. The 0.5% APY (Annual Percentage Yield) or lower that a bank savings account pays is not sufficient.

- We need to invest in equities. And while the S&P 500 is volatile, it has a proven track record of long-term performance. I believe we all need to have some money invested in equities and the S&P 500 is an easy way to do that. Read more here.

That said, investing in equities is scary. Everyone has their own story but mine is pretty simple.

My Story

I have worked in finance and technology throughout my career. The 2008 financial melt-down was a bad time to be employed by a financial firm. I was laid off.

- The market (my 401k and investment account) were down somewhere around 50%

- I was no longer receiving a paycheck and didn’t know when I’d be working again (it took a year for me to find a job for significantly less money)

- My daughter started college. College is expensive, and the value of her 529 plan had dropped along with the market.

I reacted like many would. I panic’d a bit, sold equities (I couldn’t keep watching the value of the money I had go down every day), and hired a financial advisor.

Hindsight is 20-20

Looking back, these were bad decisions.

All of the stocks, and mutual funds that my wife and I sold in 2008 and early 2009 are much higher today.

Our advisor was too conservative. He under-performed the market in 2009 and we decided to let him go and manage our own money in 2010.

Our net worth is up over 700% since then.

Here’s why:

- My wife and I are both big savers. We sock away a large chunk of our paychecks. Read some of our saving tips here and here.

- We’ve prioritized investing in equities.

- We’ve built an emergency fund which gives us the freedom and security to invest in equities and ride out the market volatility,

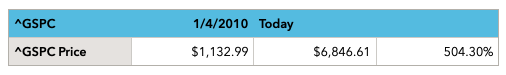

The S&P 500 is up about 500% since January 2010.

2 Reasons for our outperformance

- We prioritize saving and using those savings to add to our emergency fund, and to increase our equity stake.

- We add to our investments regularly whether the market is up or down. We never wait for a pullback to add money. Sometimes this has hurt is in the short term, but looking back today, it has been a winning strategy.

- Dividend reinvestment is a great way to do this. When stocks or funds pay a dividend, it is automatically used to buy more shares. Same for a 401k plan – we add money and buy more sharers on every pay day.

Put Your Money…

I learned a lot of what I know about finance from experience, but I’ve also been lucky to have worked with some great teachers in my 35 year financial career. I’ve had the opportunity to work with the folks that run mutual funds, who make the trades for the fund managers, and the folks who build financial plans for customers. What a great way to learn.

None of this is taught in schools.

So, it’s easy to write about it, but why not put my money where my mouth is, buy some shares of an S&P 500 fund and see what happens.

I tried this in February 2025. Things went poorly right off the bat. You can read the dirty details here.

And I wrote again in July and things were back on track. Read it here.

Today

It’s now been over 8 months. What’s going on? Here’s a picture.

The S&P 500 has done pretty well.

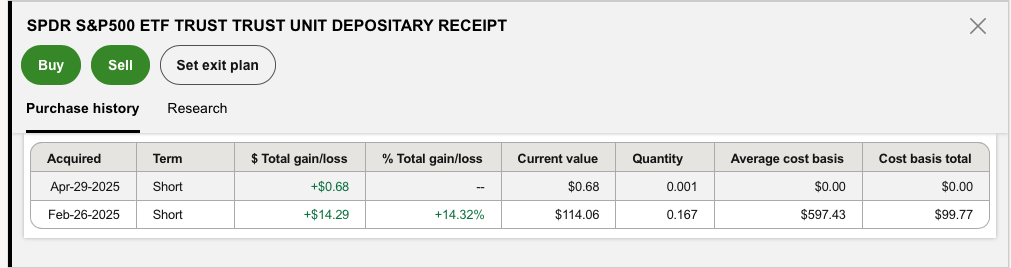

Here’s a look at what my investment is doing.

My February 26 purchase is up 14.29%. My $100 is now $114.06. I could take it out today and spend it or let it grow.

I also reinvested (automatically) the April 29 dividend. I bought 0.001 shares with the dividend payment.

Regular Investment

I’m kicking myself for not setting up regular investments along with the dividend reinvestment.

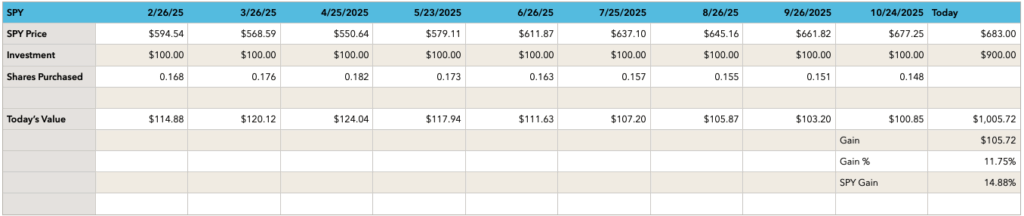

But let’s look at what would have happened if I had added $100 every month.

There is a column for each month since 2/26, and a column on the right for today.

I used the stock function to get the price for each of the dates in the header column.

The row below shows the $100 I (theoretically) invested and the shares purchased is calculated by dividing the $100 purchase by the price of SPY to get the number of shares I purchased on that day.

Today’s value uses the current price of SPY to calculate the current value of the shares purchased on that day.

The Today column shows

- The price of SPY today

- The total of $900 I would have invested if I had put $100 in every month

- The total I have now – this is the sum of the current value of each purchase

- The gain of $105.72

- Which is 11.75%

- Which is lower than the SPY gain since 2/26/25

Observations

The SPY price fluctuated between a low of 550 and a high of 683. I bought some shares at relatively high prices and some at relatively low prices.

This is dollar cost averaging. I’m not always getting the best (lowest) price but I’m also not always getting the worst (highest) price.

And my average price gets me a solid return of 11.75%, but not as good a return as if I’d put in the whole $900 on day 1.

But This Has Been a Crazy Year

Tariffs are on. Tariffs are off, Inflation, National Debt, and then the whole AI craze, it seems like every day something drives the market in one direction or the other.

I disagree. This year is not unlike last year, the year before, or any year you may want to pick. CNBC needs stories to get us to visit their website, so yes, there is a story every day. Next year at this time, I suspect we will have forgotten most of the big stories of this year. What were the big stories of November 2024? I don’t remember either.

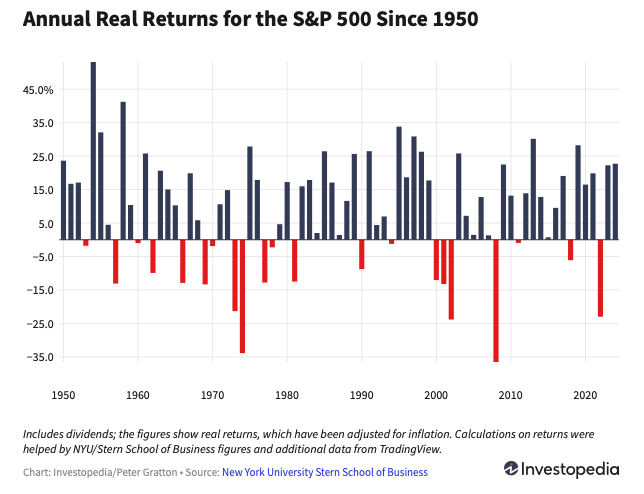

And the S&P 500 is volatile. It has big up years – it was up over 20% in both 2023 and 2024. I bet you forgot. You were staring at your screen in November 2024, watching the gains. No one remembers.

Here’s my favorite chart

Very few of us remember 2023 or 2024, but we all remember 2008.

Which can be a problem. The painful memories of the bad years last, while the memories of the good years fade quickly.

All the years are crazy. And volatility will always be with us.

But patience and perseverance has paid off and will likely continue to pay off.

That’s what the Put Your Money… post is all about.

Wrap Up

Our financial future is our responsibility. Pensions are mostly gone. Congrats to those that have them, but most of us don’t.

Social Security will help, but won’t pay all of our bills.

The US government is $38 trillion is debt. Don’t expect them to help.

Coffee Rich told me that Suze Orman now says we need $7million for retirement. That sounds like a lot.

I’m not sure that’s accurate, but Fidelity tells us that medical expenses in retirement will be close to $200,000. We may need long term care at some point. And rates at golf courses seem to go up every year. We’re going to need to build some wealth so we’re covered.

A savings account at Bank of America ain’t gonna do it.

We need to invest in equities. We can start small, make regular additions, but starting early matters. Read more here and here about the magic of compounding and the difference time can make.

And for those old folks like me who are in our sixties and thinking the time ship has sailed, we’re going to need money when we’re in our eighties. That’s 20 years away. Invest in equities today for the money we’ll need in 2045.

And as we start to invest, we’ll also need to think about asset allocation. Read about it here and here.