While I don’t know anyone who has kind words to say about their loan or their monthly payment, the fact is, loans are a necessary part of life when we need to buy a home, a car or pay for higher education. Understanding how they work will help you make better decisions about financing.

How Do Loans Work?

I always like to start with some analysis on the parties involved in the transaction. In the initial transaction, there are only 2, the borrower and the lender.

Borrower

The borrower. That’s us. We need money to help finance a purchase.

Lender

The lender is typically a bank or other financial institution that provides the capital to the borrower in exchange for monthly payments. These monthly payments consist of an interest portion and principal. Interest goes directly to the lender as compensation for providing the loan. Principal is applied to the loan balance and decreases what we owe to the lender. All things being equal, you would prefer a larger share of your payment going towards principal.

Business Model

Loans are good business for banks. They take in deposits from you and I. That money goes into our savings and checking accounts, and maybe CDs. They’ve got lots of money hanging around in these accounts. Loans are a great way for banks to use that money (the depositor’s capital) to generate profits. They take in deposits from customers and pay a modest interest rate and then loan that money out to other customers at a higher interest rate. There’s a bit more complexity, but this is essentially how it works.

Defaults

This business model works great until someone doesn’t make a payment. At that point the bank is on the hook for the remaining balance, and they get no more interest payments on that loan. One bad loan can offset all the profits from many loans. To compensate for this, the bank has to analyze loan behavior to determine how much interest to charge in order to both make a profit, and to maintain a reserve to handle defaults. See, they need an emergency fund just like us.

Credit Scores

One of the key metrics that lenders use to assess our ability to repay loans is our credit score. Click here for a detailed discussion on what a credit score is and how it’s calculated. Your credit score is derived by looking at your outstanding credit and your payment history. If you’re using a small portion of your available credit and you have a long history of making payments on time, you likely have a good credit score. You may have a poor credit score because you don’t have a lot of history. We’ll talk about this later.

Auto Loans

I looked a bit at auto loan rates and was a bit taken aback. They’re pretty high.

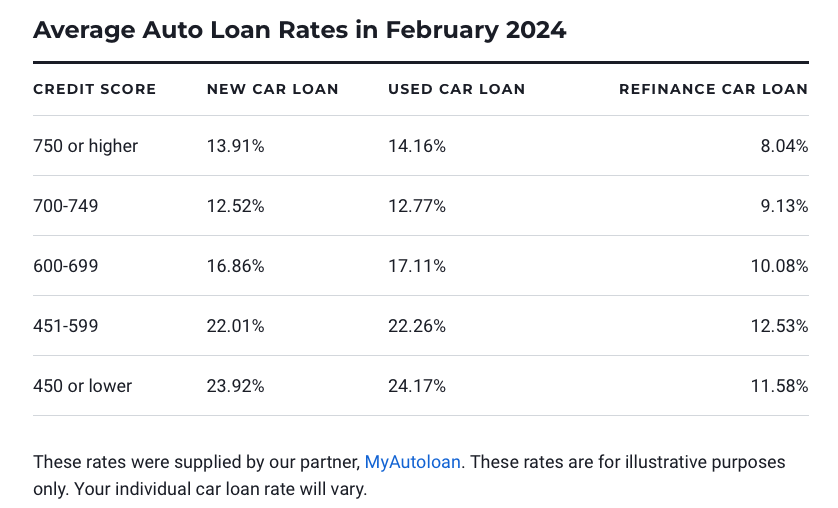

This is from our friends at US News. Click here for details.

Auto Loan Example

We’ll stick with auto loans for a bit. We’ll use some examples to look at what you’re paying and some alternatives to pay less in interest and more towards principal.

The average used vehicle price in the US is around $35,000, so we’ll use that for our examples. See more info here.

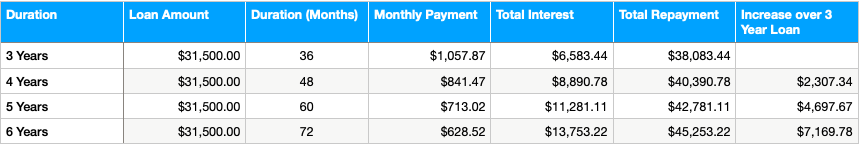

Let’s say I have a credit score of 725 and I’m buying a vehicle for $35,000 and I’ve saved $3,500 to use as a downpayment, so I’m borrowing $31,500. Below is a chart showing how much I’d pay for a 3,4,5 and 6 year loan.

As you would expect, the longer the loan duration the lower the monthly payment. Lower payments are good, that helps us stick to our monthly budget. Just be aware of the overall cost. On a 3 year loan, we pay $6,583 in interest. Extend this to 6 years and we’re paying $13,753. That’s $7,000 more in interest.

I used a calculator on the Nerdwallet site to generate these numbers. Try it here.

I wrote a post on car buying here, so I won’t rehash all the tips, but I would like to talk about a few as it relates to loans.

Do Your Homework

Most importantly, do this work at home before you first go to a dealership. It only took me a couple of minutes with google to find the average vehicle price and the average loan interest rates. I added a quick search for interest calculators and came across Nerdwallet, which is one of my favorite sites, and plugged in some numbers.

In the heat of the moment, after you’ve found your dream vehicle, but the monthly price is out of reach, the car salesman will likely suggest a longer term loan. You may say I’m willing to pay a few more years without totally realizing the extra interest you’re going to pay. Work this out in advance.

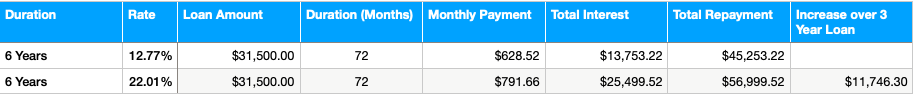

Interest Rate With a Lower Credit Score

Sticking with the 6 year loan, I compared the interest rate we would pay if our credit score was 725 v. a credit score of 525. For a 6 year loan, we would pay an additional $11,746 in interest. At $25,499, the total interest is almost the price of a car.

This doesn’t seem right, but remember, the lender is assessing your ability to repay based on your credit score. The likelihood of you making all of your payments is lower and they need to be compensated for taking on this additional risk. But, there are things you can do.

Improve Your Credit Score

Read the full article here, but we’ll go through a couple of ideas to help with your auto loan.

- Build a credit history. Get a credit card and start using it. I mentioned this above, but your score will be low if you have limited or no history of debt repayment. Get a credit card, spend well below your credit limit and pay back the full amount on time every month.

- Become an authorized user on the card of someone with good credit. If you have a parent or someone with good credit, ask them to add you on their account, you can piggy-back on their good credit and improve your score.

- Get your free copies of your credit reports from Experian, Transunion and Equifax here. Make sure these are accurate. Challenge any errors. Errors are more common than you might think and can damage your credit score.

- Go to your local bank or credit union. To most lenders, you are a name and a credit score. If you have a good relationship with your local bank or credit union, they may be more willing to offer a loan at a lower rate.

- Take the high interest rate loan, but ensure that you can refinance with no penalty. After several month’s of repaying the full amount on time, start shopping for alternative financing. You’ll likely get a better rate.

Wrap-up

We’ve focused on auto loans, but the same principles apply to student loans, home loans and other debt. Your credit score has a big impact on the rate you’ll be offered. Work to bring your score up. Start now so that when you need to borrow, you’ll be in good shape.

Do your homework and understand the likely alternatives you will be offered. Make sure you understand the ramifications of trading a lower monthly payment for a higher overall total cost. It may be worth it to you, but make this decision in the comfort of your own home, not while sitting in front of a lender.

Loans are a necessary part of life for many of us. Understanding how they work will help you use them to your advantage.

Thanks for reading and let me know what you think.