This morning I read More car buyers stretching out their auto loans—but longer terms come with trade-offs on CNBC.

Let’s take a look at why I believe we’ll be unhappy.

Vehicles

New vehicle prices are insane. Per the CNBC article, new vehicle prices are above $50,000. And since Americans love big trucks and SUVs, the prices could be even higher.

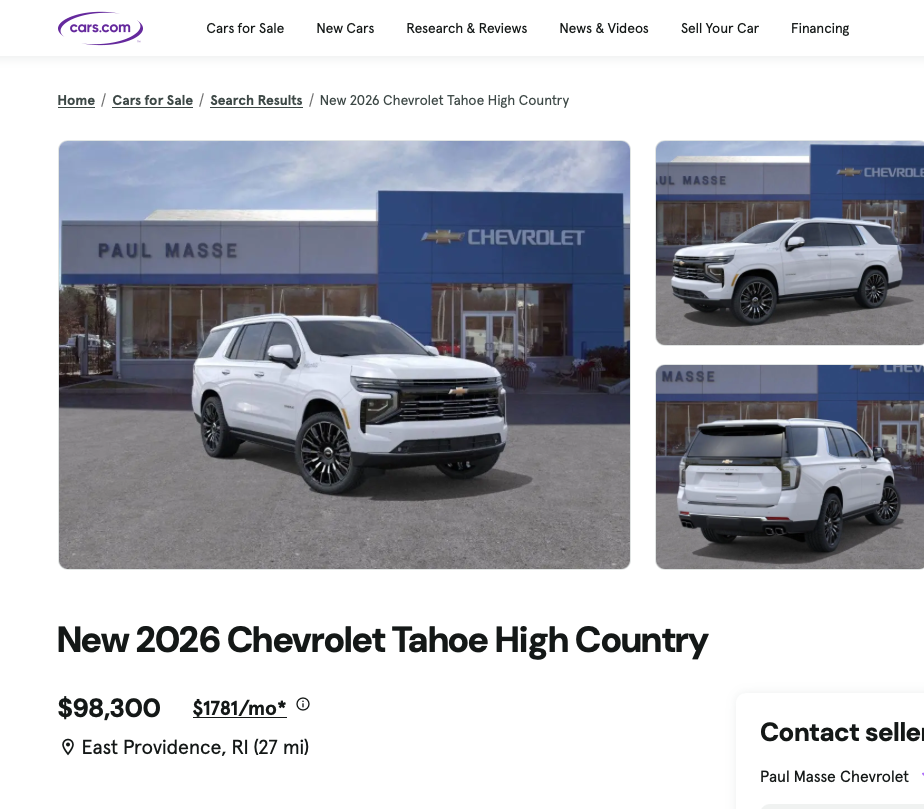

How about a Nice Chevy to haul the family around?

Yes, I picked out an expensive example, but wow.

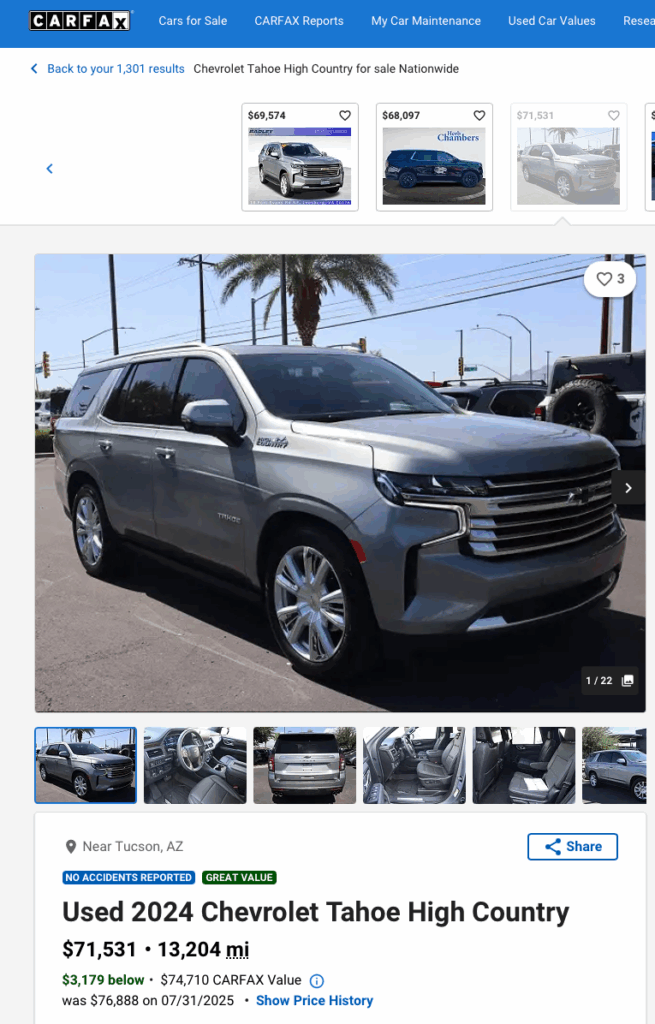

The point is new vehicles aren’t cheap, and used lightly owned are scary high as well.

Here’s a great value. Last year’s model with 13k miles. Over $20,000 off of the new price. Just $71,531.

OK, we got it. They’re expensive.

Loans

And even if we’re in the $50,000 range, most of us aren’t pulling that kind of cash out of our wallet. We’ll need a loan.

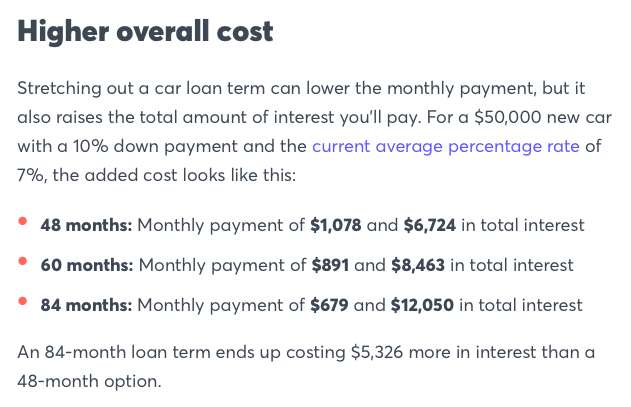

The CNBC writer was nice enough to do some math for us. Here are some sample loan scenarios.

I love how we advertise loans in months. It makes it seem less daunting. Do the math. 84 months is 7 years. Seriously.

Example

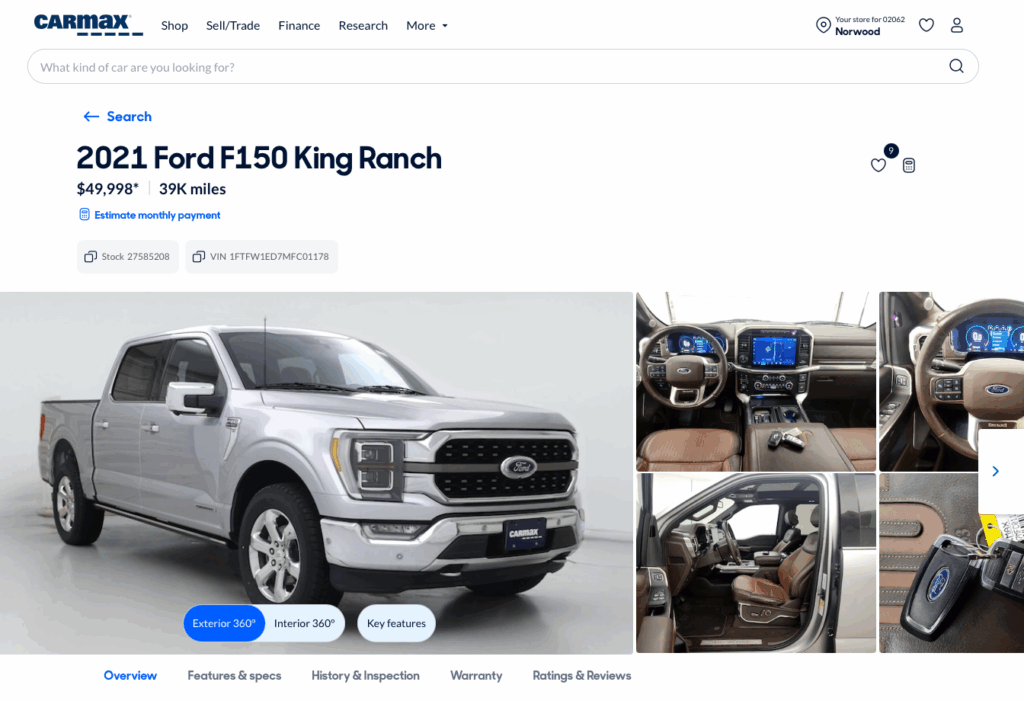

So for my $50,000, I’m going with a nice Ford Truck.

It’s got some nice features.

Those seat massagers look sweet.

I go home with a nice truck and a rested back, but I’ve got a 7 year loan. I’ll be on the hook to write a check for $679 every month until November 2032.

November 2032

I have a hard time committing to a bank CD for a year. I’m now committing to a truck for 7 years.

Let’s imagine what my situation will be in 2032. Where will I be working, or will I be retired? How old will the kids be? Will I be making college payments? Braces? A lot can change.

I use the braces example because I had a guy come into Carmax when I was working there. He was selling his pick-up because his kids needed braces.

Life happens.

My Truck

My truck is a lightly used 2021 with 39,000 miles.

If I average 12,000 per year which is pretty standard, in 2032, my truck will have 123,000 on the clock. That’s a lot.

It will probably have some dents and dings and maybe some tears in the seats…it will look like you’re normal 11 year old 123,000 mile truck.

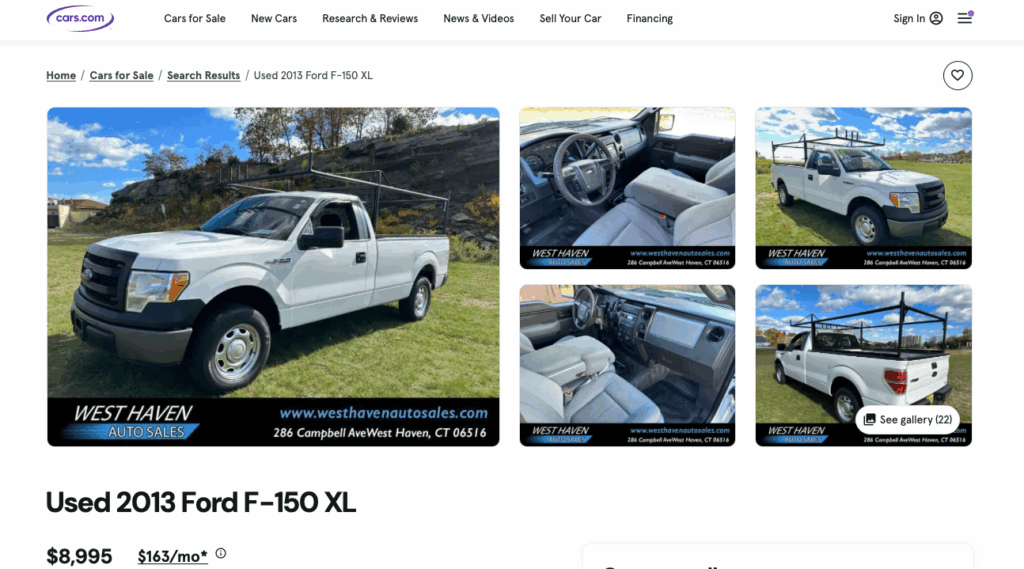

It will look something like this.

It actually looks a lot better than I expected. The problem is we’re still paying $679 per month. For this truck.

We’re paying $679 per month for 7 years. While that sounds OK when we’re looking at a nice shiny newish truck, be sure to consider how we might feel paying that for an 11 year old truck with 123,000 miles on it. Because that’s what we’ll be driving after owning the 2021 F-150 for 7 years.

Comparison

But that’s not the worst part.

When we made the deal, we agreed to $679 per month for 7 years based on our comparison to other vehicles available today. Based on looking around today, this 2021 F-150 looks pretty sweet.

How will it compare to a 2032 F-150, or a 2029, or even the 2027 that will be out next fall?

That seat massager looks like something from the Jetsons today.

In 2032, we’ll probably have self-driving trucks with lay-flat seats, tv screens on the underside of the roof, and lots of stuff we haven’t even thought of yet.

But we’re still paying $679 for our 2021 F-150. We have to press a button to unlock the doors and we have to lift a handle with our hand, and maybe even insert a key fob to start. Those seat massagers are cool, but they only handle the back.

Wrap Up

Most of us are very good at making current day comparisons, but not so good when we try and project into the future. It’s only natural. The future is unknown.

And honestly, I can’t tell you how much cooler the 2032 trucks will be than the 2021.

But, if we’re making a $50,000 purchase today and we’re committing to pay $679 per month, every month for 7 years, we owe it to ourselves to think this through.

Where will we be in 7 years? Will I be happy continuing to make payments on this vehicle?

Good luck.