From CNBC: Dow drops 1,000 points, Nasdaq craters 4% in global market rout. That’s on top of 2 really bad days in the market last week.

CNBC also reported that investors were having trouble logging into Schwab’s website. This could be the greatest gift for some of these investors.

Yes, It Hurts

I don’t mean to be cruel…I was distracted for a sec – heard Elvis somewhere in the back of my head.

A big pullback is painful. Not being able to log in could be frightening, but it could also help avoid a reactive decision that we may regret.

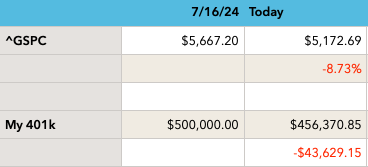

Let’s look at the numbers. On July 16, 2024, just 3 weeks ago, the S&P 500 closed at $5,667.20. Today, August 5 at 11am ish, the S&P is at $5,172.69.

What Does That Mean For You and I?

Hypothetical: Let’s say we’re in our 40’s and we had $500,000 in our 401k on 7/16/24. Pretty cool.

And because we have this invested for retirement, and retirement is a long way off, we have it invested 100% in a low-cost S&P 500 fund. In reality, we’d likely have some in bond funds, but for this hypothetical, let’s assume 100% in equity.

That means today, after an 8.73% decline in 3 weeks, we now have $456,370.85. We’ve lost over $43,000 in 3 weeks.

Let’s look at the math:

The S&P 500 is down 8.73%. If I subtract 8.73% from my $500,000 balance, that’s over $43,000. Yup, we got crushed.

Take a Breath

This is not an insignificant amount of money to lose. I’m not proposing that we take this lightly. But it can help to put this in context.

I have 2 thoughts, but first…

The S&P 500 is up over 8% in 2024!!

How’s that for a headline? It’s true, but it is not breaking news. We’ll get to this in a minute. But back to the 2 thoughts.

1 How Have My Investments Performed This Year?

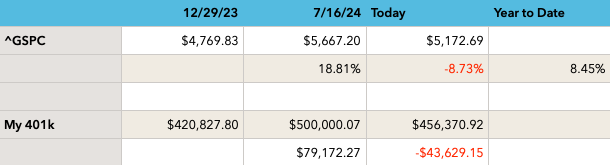

It always helps to put any large market movement in context. Even with the 8.73% loss in 3 weeks, the S&P 500 is still up 8.45% this year.

The S&P 500 Index (Ticker: ^GSPC) was up over 18% year-to-date in mid-July. Then it headed down quickly, but looking at where it is today v. 12/29/23, we’re up 8.45%. Doesn’t feel like it today, but we are.

Sticking with the hypothetical we started above, my 401k account balance would have closed out 2023 at about $420,000. 2024 had a strong run through 7/16, so my 401k balance had increased to $500,000. It had gained roughly $80,000. I earned that over the first 7 and a half months (by investing wisely in low cost S&P 500 funds and being patient).

It hurts to lose a chunk of that, but it helps to look at the larger context that I’m still ahead. Here are the details.

I’m down from $500,000, which stinks, but I’m up over $30,000 year-to-date.

2 Corrections Happen

Here’s a good article from our friends at the Motley Fool about market corrections.

The highlights are that:

- On average, the S&P 500 has declined by a double-digit percentage every 1.85 years since the beginning of 1950.

- More often than not, corrections reach their trough fairly quickly.

- History shows that investors’ patience can pay off big time.

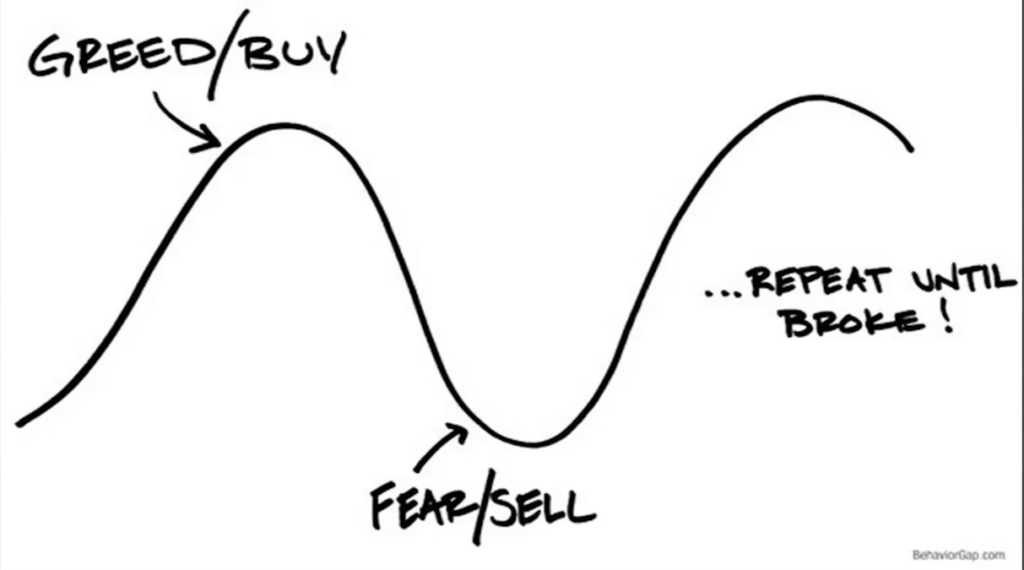

Check Your Emotions at the Door

I will not pretend that this is easy. It’s hard. And, while we get better with practice, it is never easy.

In 2008, when I lost my job, my daughter started college, and the market dropped 50%, I panicked and sold everything. Huge mistake. I’ve done better since.

Be greedy when others are fearful and vice versa….that’s crap. It’s taken out of context and no one I know, professionally or personally does this. I prefer “don’t try and catch a falling knife.” We’re down 8% in 3 weeks, who’s to say we won’t be down another 8% in another 3 weeks?

Ride it Out

I prefer to ride out the volatility. It’s OK to watch, but don’t react. Learn which of your holdings are the most volatile, look into why. There are many lessons to be learned. If you feel compelled to buy on sale, create a buy spreadsheet. List the symbol and the price you would have bought at. Come back in a few months. Were you right or were you wrong? What did you learn?

Always Have a Shopping List

On the front page of my massive spreadsheet, I have a shopping list. I keep it up to date regularly. It has a list of companies that I am interested in and the price at which I would consider buying.

A while back, I posted about a rough day in the market. I made mention of one of my favorite tech companies, Arista networks (Ticker: ANET). The stock was down big. It was at prices not seen since…the week before. It was a big pull-back for the stock, but was it really a bargain? It wasn’t a bargain last week, so is it really a bargain today at that same price? It’s easy to lose focus on the big picture, especially in the heat of market madness. Set a plan in advance.

In my shopping list, I’d like to buy more shares of Arista Networks at $183 per share. Arista is at $310 right now so it needs to drop 40% before I’m interested. I love the company and I’m holding the 208 shares I have and I’m expecting them to grow. At some point, I may update my buy price target and I may raise it based on company performance, but for now I hold and wait. Arista may never get back to my buy price, but that’s OK – other companies will.

I have 20 other companies on the shopping list. All are a lot closer to my buy price than they were 3 weeks ago. None of them have hit my buy price so I’m holding steady.

Re-Evaluating Amazon

I’m re-evaluating Amazon. Investors were not happy with Amazon’s earnings, but Amazon Web Services continues strong growth and Amazon’s advertising revenue went from nowhere a few years ago to a significant portion of revenue. I’m holding the shares I have and increasing my expectations, and I’m evaluating whether I’d be excited to buy at a higher price point than I had been thinking.

I’m not buying today, or tomorrow, but I’m reading a bit and thinking about a new target.

Wrap-Up

Pullbacks are scary. Whether you are a novice or a seasoned investor, when your account balance plummets, you’re concerned.

That said, the S&P 500 has gone on to new highs every time there has been a pull-back.

Keep score. I may over-use this term, but it is important to keep score at several levels. I keep score on every trade. What’s my return, what’s the benchmark I’m competing against, and how is my performance against that benchmark?

Don’t forget the big picture. How is my net worth? Regardless of the market gyrations, where is my net worth this year, has it grown, shrunk? The S&P 500 is up, so I should be up. Am I?

How is my net worth compared to 2019? That’s when I retired. At that point, I decided I had enough money to retire. How am I doing against that? If my net worth isn’t continuing to grow then my retirement plan may not be working.

Stick to your knitting. It’s OK to be worried about a recession, continued inflation, the election, wars and other turmoil. It’s only natural for us to be worried, but we shouldn’t let it force us to react. Take a deep breath, hold strong and update your shopping list.

Update 8/24/24

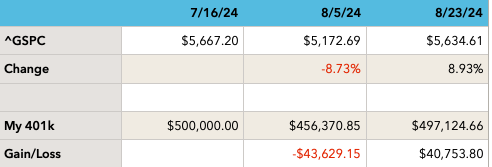

it’s been a little over 2 weeks since the madness of 8/5/24. What’s changed? Let’s take a look at our table with an update with S&P 500 prices for Friday’s close.

It’s been a strong 2 weeks, and we’re back to where we started. A jaw-dropping 8% loss in early August followed by a nice 8% gain in the 2nd half of August.

This doesn’t always happen, but it is not that rare. The markets best days often happen in close proximity to the markets worst days. Those who sell during a pullback often miss the subsequent bump. These folks wait for the market to “stabilize” and miss out on the next big gain. Here’s an article from the Motley Fool with some facts to back that up.

Here’s a less-technical analysis.

Going back to my cruel comment about the investors who couldn’t log into Schwab’s website. Doing nothing is often the best strategy in investing. Choose your investments well, and let them run. The market will fluctuate wildly. As an investor, we need to know this going in. For over 100 years, the S&P 500 has been a wealth-building machine. It’s more likely than not that this trend will continue. Be patient.