It’s 61 degrees and drizzly in mid-June, what else do I have to do?

Today I’m thinking about how my spending has changed. I wrote in an earlier post that I spend about the same in retirement as I did before. Those of us who were told that our expenses would decrease when we stopped working have been disappointed. I was thinking about that and I decided to do a detailed comparison. Oh boy! The fun starts now.

Account Aggregators

Simply put, an account aggregator pulls in all of our transactions and balances across bank, brokerage, credit card and loan providers and gives us a consolidated view. Aggregators also provide some budgeting, planning and comparison tools.

I was an early adopter of Mint.com. Mint no longer exists. Mint was part of Intuit (the Quicken maker) and when Intuit bought Credit Karma, Mint and Credit Karma’s products merged. I’ve heard good things about Credit Karma.

But I use Fidelity Fullview. If you’ve got a Fidelity account, you can use Fullview for free.

Aggregators are a mixed bag. The transaction aggregation and some of the tools they provide for budgeting and comparisons are valuable. But we’re turning over our data, and we’re also providing some sort of access to our financial accounts to the aggregator so that it can keep our transactions up to date.

There was an article in the Wall Street Journal years ago that demonstrated how easy it was for an aggregator, or someone who has access to the aggregator’s data, to piece this info together and build a very detailed overview of us. And some of these aggregators provide us with a “free” service in exchange for the ability to make a profit by selling our data.

It’s important to know who we’re dealing with and what the terms are before we click “Agree”.

I’ve used Mint and I’ve used Fullview. I understand the trade-offs and I was confident in Intuit keeping my data safe, and same for Fidelity. But make your own decisions.

The Comparison

Assuming we’re using an aggregator, it will have all of our spending transactions which it will categorize for us. Most do a remarkably good job at looking at a transaction and deciding it is a property tax payment v. a utility bill or a dining expense. Unfortunately mine is good at differentiating a sit-down restaurant from fast food so I get a harsh reminder every time I hit the drive-thru.

If we’ve been using the same aggregator for 2 years or more, it is relatively simple to ask the aggregator to compare our spending by category year over year.

I unfortunately switched a couple of times so it was a little harder. But luckily I have spending spreadsheets going back many years. I pulled up my 2019 sheet, and then got a download for 2025 year to date and annualized values.

I also had some work to rationalize categories because the aggregators did not categorize the exact same way.

But after an hour or so, I had my comparison. Yay!

I Spend How Much Now?

My projected 2025 number was huge. Really huge.

I got another cup of coffee, took a quick walk around the house to clear my head and then got back to the analysis to see what happened.

Inflation

Remember inflation. It typically averages around 3% per year.

This is a big deal. We will spend more every year because of inflation.

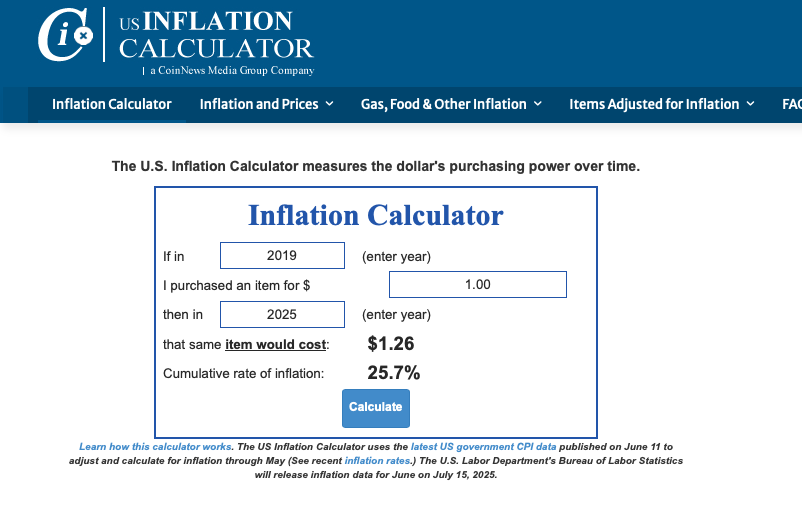

Even in an average inflation scenario, our expenses would be 18% higher after 6 years. That ain’t chicken feed. We need to factor that into our spending plan.

And as you may have noticed, inflation has been a bit higher than normal these past few years.

Luckily there is public data available on inflation rates and there are lots of calculators that will show you the value of a dollar adjusted for inflation. Check this out here.

So, I stop hyperventilating and adjust each line-item from the 2019 spending sheet to account for 26% inflation. I feel a little better, but I’m still spending more. A lot more!

Taxes

My wife and I are retired. Our income is $0. We should be killing it in tax savings. But we’re not. What gives?

2 things.

First off, taxes are a pay-as-you-go system. That means, we need to pay our taxes as we earn income. To avoid penalties, we need to have paid 90% of our taxes before we file.

While working, our employers typically handle this. We get a paycheck and state and local taxes are taken out. At the end of the year we may pay some money if we haven’t withheld enough or we could get a refund.

But now in retirement, no one is withholding. And while I don’t get a paycheck, I am selling some assets and taking capital gains, I’m getting dividends and interest, and I may be taking distributions from retirement accounts. If I’m taking from a traditional 401k or IRA, my money was pre-tax going in, it grew tax-deferred for years, but now Uncle Sam gets his piece. Anything we take out is taxed at our ordinary income rate.

So, no paycheck, but I do have income. And if you’ve read my prior posts, you know to pay estimated taxes based on this income.

Roth Conversion

This is the 2nd thing under taxes.

Traditional 401ks and IRAs are great savings vehicles. But as I mentioned above, we need to pay taxes when we withdraw.

Not so with a Roth 401k contribution or a Roth IRA.

With a Roth, we pay taxes before we contribute the money – no tax advantage today – but it grows tax free. When we take the money out, we’ve already paid taxes on the principal, and the interest is tax free so $0 tax bill. Big Yay!!

Roth didn’t become cool until long after I started retirement saving. I have some Roth 401k contributions (your record-keeper will keep track for you) and I’ve rolled them into a Roth IRA. But most of my retirement money is traditional – I’ve not paid taxes – so I’ll take a big tax hit when I withdraw.

So, because I expect tax rates will increase in the future (how can they not with our ever-escalating national debt), I am taking advantage of what I expect will be lower rates today and converting a little money from traditional to Roth each year. This means I have a good-sized tax bill today, but there will be no taxes when I take the money out years from now.

But, the point of all of this is that I’m paying taxes today on those converted amounts. This is the 2nd reason why my tax bill is higher than I’d expected.

Health Insurance

I am not yet 65, so I need to buy my own insurance. My wife is younger than me, so we’ll be doing this for a while.

Health insurance cost is ridiculous. We have a high deductible plan and we pay about $2,000 per month.

We’re both pretty healthy so we get our annual physical for free and pay for most other stuff, which luckily has been minimal.

But, I keep reminding myself that we’re protecting ourselves from a catastrophe.

In 2020, I had some dizziness. Luckily we were still on my wife’s (0 deductible) health plan because I had a battery of tests, including MRIs, and other very expensive diagnostics. This would have cost thousands without insurance.

My $2,000 per month provides the coverage in case either of us have a very expensive health event.

And also, a High deductible health plan makes you eligible to contribute to a health savings account (HSA). An HSA is the best retirement savings plan in existence today. Read more here.

Other Observations

Inflation, Insurance and Taxes were the big items. But some other things are notable.

Recreation and travel are up – big surprise. Not huge, but we play more golf and we have taken more trips. One year we spent a month down south in the winter. This year we did short trips to Key Largo and Nantucket (in January – never during peak) and we’ll probably spend a week away this summer. With more time and our health (for now) we’re doing more.

Auto Fuel is way down. We drive a lot less. This also helps on auto insurance. Though not by comparison. Insurance costs seem to increase at a much faster rate than inflation.

While I shake my fist at the insurers (and I invest in them), I understand. My wife’s car had a small dent. In years past, they’d pull the dent, buff it out and repaint. Today, safety standards required a full door and fender replacement. What should have been a $500 repair cost $10,000.

I also spent a lot this year on 5 additional solar panels and 2 batteries. While this is a sizeable outlay, it will pay for itself after 6 years and from that point on it’s all savings. I look at this as similar to the Roth conversion. I am taking a hit today to offset a bill that I expect will be much higher in the future unless I take action today.

Wrap-Up

Unless we hire a good financial advisor (and I’m on the fence here. For some it may be worthwhile, but it’s costly and with a little effort, any of us can do this on our own), we need to actively manage our finances.

Managing our spending is a big part of this, and it’s the part we have the most influence in. I can’t control what the S&P 500 does, or interest rates or inflation, but I can control what I choose to spend on.

Understanding how my spending changes year over year and pre-retirement v. post gives me some insights. I’d rather proactively make these decisons today rather than being forced to make a more difficult decision (like which brand of cat food to eat) in the future.