I read a fabulous article this morning titled This is how much money you’d have made if you bought Apple shares instead of a new iPhone every time it was released. Here.

The article says: “If you had bought Apple shares worth of every new iPhone model on Apple event day from 2007 , you would have converted 17,000 dollars to 367 million dollars.” Is that true? We’ll get to that in a second.

Opportunity Cost

We’ve talked about opportunity cost a bit in prior posts. Simply put, it is the value that we forgo when we choose not to do something. In this particular case, it is the value of the Apple stock shares that we have missed out on by choosing to buy a new iPhone instead of investing our money in shares of AAPL.

Every financial decision we make has an opportunity cost. While life is about more than maximizing the value of every financial decision, it always makes sense to think about the opportunity cost. With that said, let’s take a look at the article.

$367 million

The premise of the article is that if we compare 2 scenarios:

- I buy every iPhone model every time it comes out

- I don’t buy any iPhones, and instead I buy shares of Apple (AAPL)

Not entirely realistic, but it’s an interesting exercise to think through.

Quotes like “If you wanted to know just how much money you could make if you invested in stocks instead of a new iPhone every year, luckily you don’t have to do any mental maths yourself – Sumit Behal posts about finance on X and he’s done all the hard work for us.” make me uncomfortable. I’ll do the math myself.

The Math

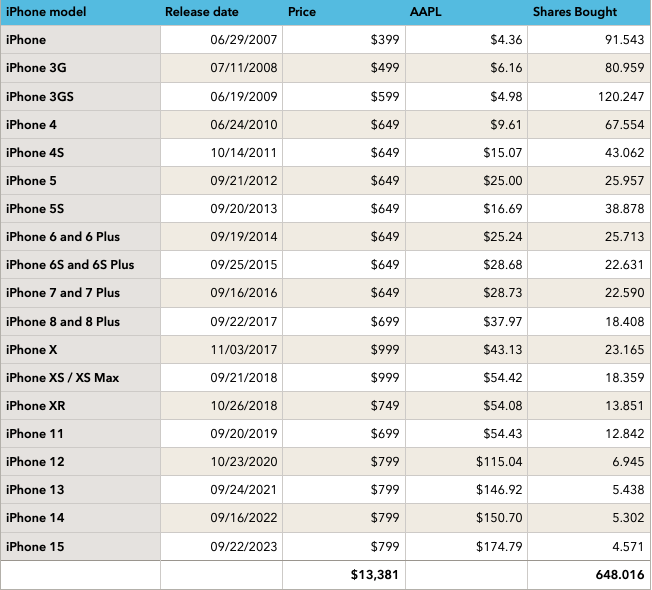

I started here to find every iPhone released. I’m going to scale this back a bit and assume we’re not buying the 3 SE models, and that we buy the least expensive iphone released – not the more expensive pro or the pro max.

I then looked up the price of each iPhone version here.

Finally, I used the STOCKH function to get the historical price of AAPL on each iPhone release date, and divided the price paid for that model iPhone by the stock price of AAPL to determine the number of share I would get for my money.

I then took the total number of shares bought and multiplied by today’s stock price to see how much I might have had.

Here’s the Table

I would have spent $13,381 if I bought all the major updates. It’s mostly a phone per year with a mid-year update for the X and XR. That’s a lot of phones. It’s also not allowing for any trade-in for my old phone.

How Much?

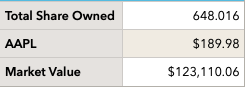

If I had skipped each iPhone purchase and instead bought shares of AAPL on the iPhone release date, I would have 648.016 shares of AAPL. At today’s price of $189.98 per share, I’d have $123,110.06. Not the $367 million that I’d been promised, but a pretty healthy nest egg.

Alternative Scenarios

I ran a similar scenario where I got a 30% trade-in on my old iPhone. In that scenario, I end up with $94,000.

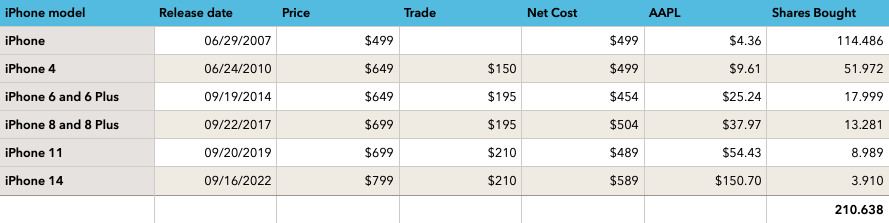

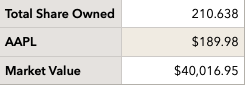

I then ran a more realistic scenario where I only bought a new iPhone every 2-3 years. Under the same assumptions where I did not buy the phone but instead bought AAPL shares, I would have $46,413 in AAPL stock. I re-ran this scenario to include the 30% trade-in and I am left with $40,016 in AAPL stock.

Less Frequent Upgrade with Trade-in

Summary

First thing to remember: Never read just the headline. Secondly, if someone offers to do the math (or maths, if they’re British), politely say no thank you and do the maths yourself.

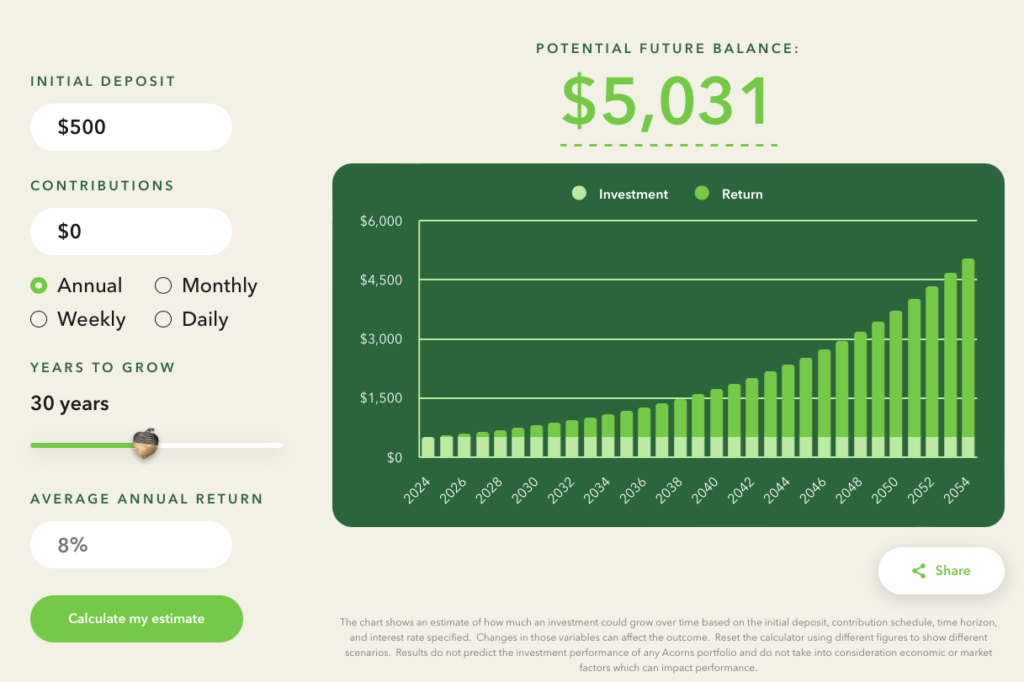

However, this exercise is a great demonstration of opportunity cost in action. Any time we choose to spend money, we are also making a choice not to save or invest that money. It’s worth doing some quick calculations to see what that impact might be. I love the acorns calculator, here.

If you’re thinking of making a 1 time purchase for $500, see what you might have in 30 years if you invested that money in a low-cost S&P 500 mutual fund instead.

You might have $5,000 after 30 years, assuming an 8% annual return.

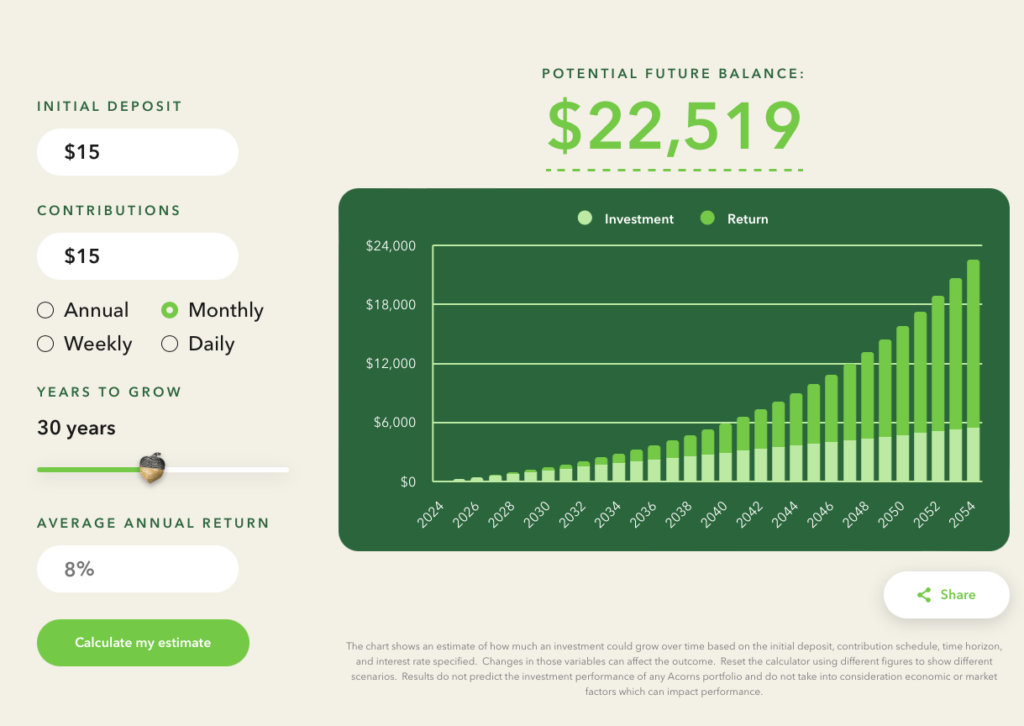

How about that $14.99 per month streaming subscription? Deciding to live with the free services (Roku, Crackle, Pluto and many more) and invest that money instead could leave you with $22,000 in 30 years.

The spending decisions we make are not solely based on finances. We should travel, we should play golf. Life is meant to be enjoyed. But opportunity cost should be a factor we consider in every spending decision we make, because the consequences can be huge.

We all have subscriptions: icloud storage, streaming, music…these costs can add up and the opportunity cost of not investing that money can be huge. Look at the impact of investing $14.99 per month for 30 years. Stay tuned for an upcoming post on this.

Please let me know your thoughts.