Reinvesting dividends in the mutual funds or in the companies that we love can be a great way to super-charge our earnings. While I realize this, I was surprised to see an example today. You’ll have to wait for it though.

Dividends

Many companies pay a dividend. High growth companies typically do not as they are spending every available nickel to grow their businesses.

Mature companies often pay dividends. Companies like Coca Cola or Walmart are mature businesses that bring in a ton of cash. Think about the cash registers at Walmart, or the number of folks ordering a coke at the drive-thru. Companies like Walmart and Coca Cola have a problem. They can’t spend that cash fast enough.

Companies, their management teams and their boards of directors have a responsibility to spend their capital wisely. When there are fewer great ideas than there are dollars coming in, there are only a couple of things they can do.

They can pay down debt, or they can give some money to the company owners. As shareholders of the company’s stock, or of the mutual funds that hold shares of the company, we are entitled to some of that money.

Coke

Coca Cola (Ticker: KO), pays a dividend of $2.04 per share per year.

Coke has been around since 1886, and is a leader in the world-wide non-alcoholic beverage industry. No kidding, right?

If we own one share of KO, we’ll get $2.04 per year. But if I have $50,000 of my retirement money invested in Coke, I own 737 shares and I’m entitled to an annual dividend of (2.04 x 737 = $1,503.49). Now it’s getting interesting.

If I own a nice S&P 500 index fund, that fund owns shares of Coke. Coke will pay its dividend to the fund and the fund will accumulate all the dividend payments from all the companies it invests in, and will distribute a payment to fund shareholders.

Reinvesting

My broker will most likely allow me to choose whether I take my dividends in cash, or reinvest them to buy more shares.

If I hold Coke directly, I can reinvest my Coke dividend and buy more shares of Coke.

If I hold a mutual fund, when that fund pays a dividend, I can reinvest that dividend to buy more shares of the fund.

As a retiree, I see the benefits of both. I like to take some dividends in cash to help pay my bills. But I like to reinvest the dividends of my favorite companies and we’ll talk about why in a sec.

My brokerage lets me specify my cash v. reinvest choice either by account or by individual security.

Surprise

So here is today’s (nice) surprise.

Broadcom is up big yet gain today. This seems to be happening often.

As you may remember, I bought shares of Broadcom, Nvidia, Taiwan Semiconductor and Intel back in 2022. I was excited about computer chips and didn’t see a clear winner so I bought a basket. Intel was a huge disappointment and I sold it, but the rest of the basket is doing well.

When I took a peek at my spreadsheet today, I saw the $ amount that I had gained in Broadcom, and I saw the breakdown of how much came from dividend reinvestment.

Initially, I said “Oh, cool. Over $10,000 in dividends.”

Then I said, this must be a mistake. Broadcom pays a small 0.7% dividend and I’ve only held it for 3 years. There’s no way I could have made $10,000 in dividends. That must be a mistake.

It Wasn’t

I bought my Broadcom shares for about $20,000. I’m getting a dividend of .7% which is about $140 per year. I’ve held it 3 years so I should have gotten about $420. Right???

Wrong.

And here’s the cool thing about dividends in growing companies.

Dividend Growth

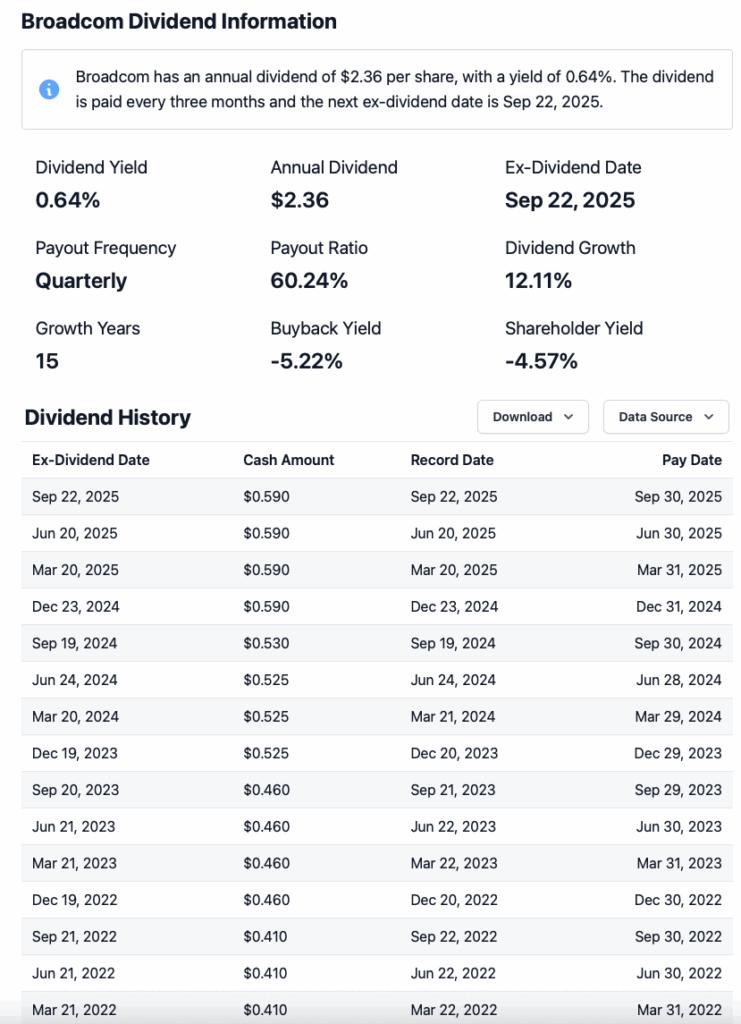

Many companies grow their dividend. When companies are successful, they bring in more cash, so they pay more in dividends. Here’s Broadcom’s dividend history.

Some nice growth, but that’s not enough to account for $10,000 in dividends in 3 years.

Compounding

Compounding, simply put, is interest on interest. Here’s a more eloquent discussion on compounding.

Let’s look at an example.

I bought 450 shares of Broadcom in January of 2022. My first dividend was in March of 2022. You can see by the chart above that I got $0.41 per share, so $184.50.

At that point, I could have taken the $184.50 and spent it, and then waited 3 months and I’d get another $184.50. Dividends are awesome.

Or, I could do what I did and reinvest the dividend in more shares. This is the cool part.

On March 29, 2022 when that dividend was paid, the price of Broadcom was $62.55. So my $184.50 bought (184.5 / 62.55 =) 2.95 shares.

Today, Broadcom closed at $369.57, so those 2.95 shares are worth $1,090.23.

Would you rather have $184.50 in cash in March 2022, or $1,090.23 worth of Broadcom shares today?

As you can see from the Broadcom chart, the company has done quite well, so this scenario repeated itself.

Wrap Up

I love reinvesting dividends in great companies. Broadcom shocked me, but I’ve done the same with Apple and Starbucks. Reinvesting dividends is a great way to regularly buy a few more shares of the companies that we love.

Broadcom is a bit of an anomaly due to its recent AI fueled run, and it will likely return to earth at some point. With Starbucks and Apple, I’ve bought shares through dividend reinvestment when they were cheap, and I’ve bought shares through dividend reinvestment when they were expensive.

But 15 years later, the results look pretty good. Overall, I’m dollar-cost-averaging and I’m accumulating shares of great companies.

As a side note, I’ve sold 250 of my original 450 Broadcom shares. On 2 separate occasions I asked myself if the company was overvalued. I wasn’t ready to sell, but I took some profits.

I’m thrilled with the return on the 200 shares (232 with dividend reinvestment) that I own, but I really wish I still had the other 250.

Anyway, while taking dividends to help pay expenses is attractive, dividend reinvestment can really fuel some incredible growth.

No reason we can’t do a little of both.