First off, easy for me to say. 78% of Americans report that they are living paycheck to paycheck. If I can’t pay my bills, how can I possibly save for retirement?

This is a national crisis in my opinion. That, however, does not make it a problem for our government to solve. I try and avoid political statements, but let me just say this; I’m not convinced that our elected representatives at any level will help us in any significant way. They seem to be busy with infighting, impeachments, kicking budget problems down the road, and other shenanigans. If they can’t fix the national debt, which is their problem, what would lead us to believe that they can fix our financial problems?

It’s Up To Each Of Us

The good news and the bad news is that each of us individually will need to solve this for ourselves.

The odds are that we will live into our 80’s and maybe even 90’s. We may say we’ll continue to work indefinitely but is that realistic? I’m 60. We get old and cranky. I don’t have the stamina or the patience I had at 30 or 40. I got laid off when I was in my 40’s. It took a year to find a new job. It was the financial crisis and finance jobs were scarce, but I was not the target demographic for most hiring. Try it at 50 or 60, or gasp, 70?

Take Control

I taught a course called Take Control of Your Finances! The course coordinator thought it was a bit much for a title, but the course was about teaching the skills required to take control. Personal Finance is an under-served area of our education, however, it is one of the most important factors in our success. Family and friends likely score higher, but if you can’t afford housing or your next meal, you’re in deep sneakers.

So let’s talk about what Take Control means.

3 Things

Aside from make a list (sorry Mary), 3 things is one of my favorites. 3 always seems to be the right number. It gives some variety, but it’s not too much to remember…anyway…

- Create a budget. You just have to. If you don’t make decisions about where your money goes, your money will decide for itself. It’s not that hard. Read my post. Email me through the contact page if you have questions. I’ll help. It’s that important.

- Set up an emergency fund. Start small, but keep putting money away. Have it close by and accessible and don’t invest it. You’re not interested in growth, this is for safety.

- Invest. You have to. We’ll talk more about this shortly.

Budget

As much as it may not feel like it, we choose where our money goes. We may feel like we’re stuck and we have no choices, but whether it is rent, a car payment, credit card payments, we choose. A budget starts with a list of what comes in and what goes out.

If you’re serious about taking control, you need to creatively expand the what comes in items and ruthlessly attack the what goes out items.

Emergency Fund

Financial experts tell us that we need 6 month’s of living expenses in our emergency fund. That’s a good goal, but make it a long-term goal. Start with a couple of bucks. Open an account just for this, or use a piggy-bank. This is money for when the car breaks down and you can’t get to work, or someone in the family has a health problem. You know, emergencies. They happen, and these things can put our budget at risk and then it’s a slippery slope from there.

Investing

Saving alone is not enough. If you manage to put away $5,000 per year every year over a 40 year career, you’ll have a cool $200,000. Certainly a nice chunk of change, but if you retire at 65 and live til 85, will $200,000 be enough? Probably not.

Investing can be scary, there are thousands of mutual funds to choose from. There are horror stories of people losing huge sums of money during the 2001, 2008, 2020, and other market crashes. I’m one of the stories. In 2008, I lost my job, my account values were cut in half, and my daughter started her first year in college. Freak Out!

Risk

Any investment has risk. Let’s talk about the risk and ways to mitigate.

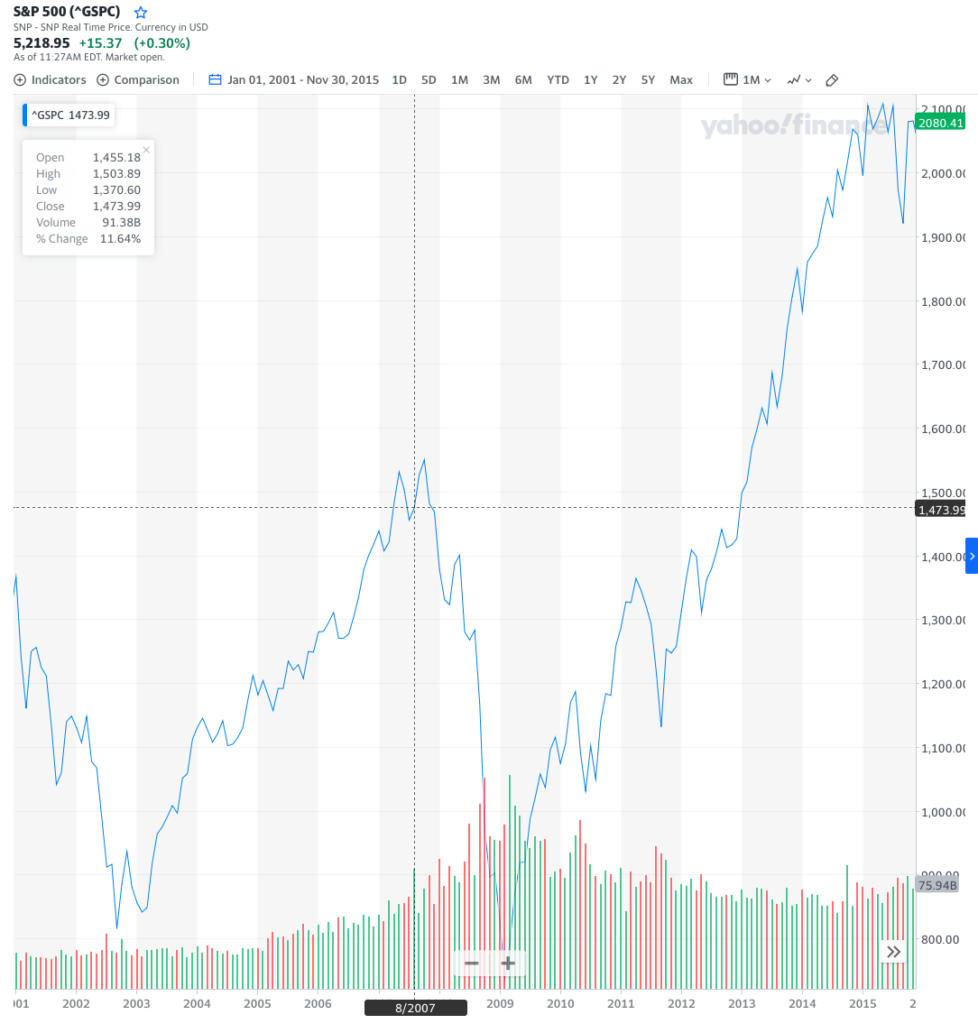

The risk for us is that our investment will lose value. Usually the loss of value is outside of our control. In 2008, the financial crisis began. The S&P 500 dropped over 50%, and did not fully recover for several years. But it did recover. It’s now quite a bit higher than the pre-2008 high, or the 2013 recovery point. Look at the chart below.

S&P 500

When I talk about the market, I usually refer to the S&P 500. This is an index comprised of the 500 largest US companies. An index is simply a list. Standard and Poor’s maintains a list of the 500 largest companies in the US and assigns them a weighting in the index based on their market capitalization (size). Apple is really big so it makes up a much larger portion of the results of the index.

I am bullish on the S&P 500. It has returned about 10% annual returns with dividends reinvested over that last 100 years or so. That means, if you bought an S&P 500 fund in 1924 (not sure there was one, but go along for the ride), You would have earned 10% per year on average, assuming you reinvested all of your dividends to buy new shares of the fund.

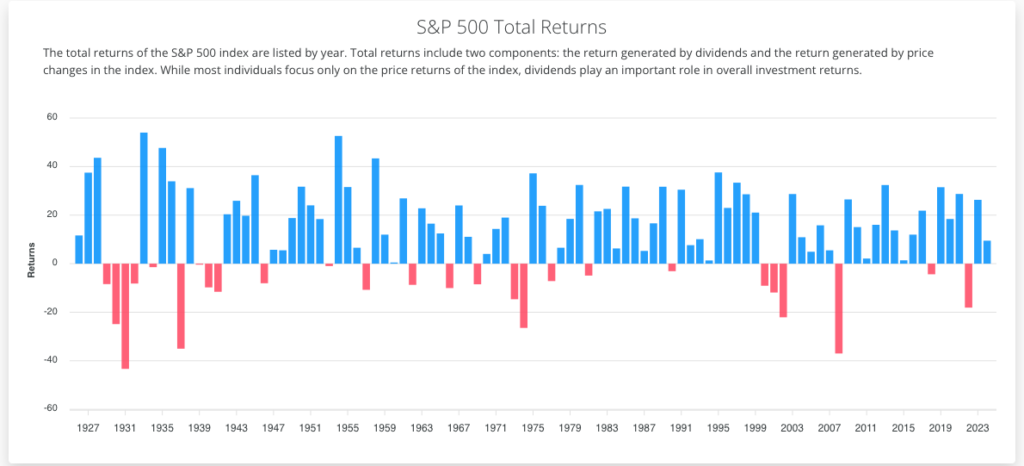

Be Careful of Averages

Averages help us to zoom out and take a look. However, if you zoom in, you see the ride isn’t smooth. See chart below from slickcharts.

If you invested in 1983, you’d be excited. The S&P 500 went up every year for the next 8 years. What if you invested in 1999. Imagine 3 straight years where your account balance went down, down, down. And the final year drop was over 20%. How long would you last before you took your money out?

Investing takes perseverance. It also takes a sound allocation strategy.

Allocation Strategy

This sounds complicated but it’s really not. In order to not freak out and sell everything when the next 1999 hits – and it will – we need to be sure we are not risking money will need in the next few years. Equity assets (read post here for more) are assets in which the holder is an owner. If you own 1 share of Walmart stock, you are an owner of Walmart, the corporation. If you own a share of an S&P 500 fund, you own a tiny piece of each of the 500 largest US companies.

Assets you’ll need in the next 5 years or so, shouldn’t be in equities.

In early 1999, a friend sold his house. He and his family moved to temporary housing while their new house was being built. He told me he had a huge sum of money in the bank from the sale that was sitting and waiting until he had to put it down on the new house. As a then brilliant investor, fresh into my investing career, I told him he was crazy not to buy stocks. He could make a fortune. Luckily he ignored me. Remember what the market did in 1999?

My friend had an allocation strategy. Money that you need right away, or for the next 5 years, shouldn’t be in equities. Short term needs should be in cash. Having the money ready is far more important than earning a return.

Bullish on the S&P 500

I didn’t forget, I just wandered off…Our economy continues to grow. We keep having babies. I have a new granddaughter on the way, how cool is that? We buy diapers, strollers, clothes (constantly). Apple keeps coming out with cool stuff that people have to have. They sold 232 million iPhones in 2022. Check here. I sit at Starbucks every Saturday. They can’t make drinks fast enough. The US economy seems to be doing well.

Foreign Exposure

And you get this too with the S&P 500. Travel overseas and you’ll find Starbucks, McDonalds, Dominos Pizza, iPhones, and lots of other stuff that is courtesy of the 500 largest US companies. These same companies are continually increasing their revenue from non-US sources.

How Much Will the S&P 500 Grow?

Will it average 10% per year with dividends reinvested over the next 100 years? No one knows. But until I see evidence of a sustained slow-down in the US economy, I’m bullish.

Bonds

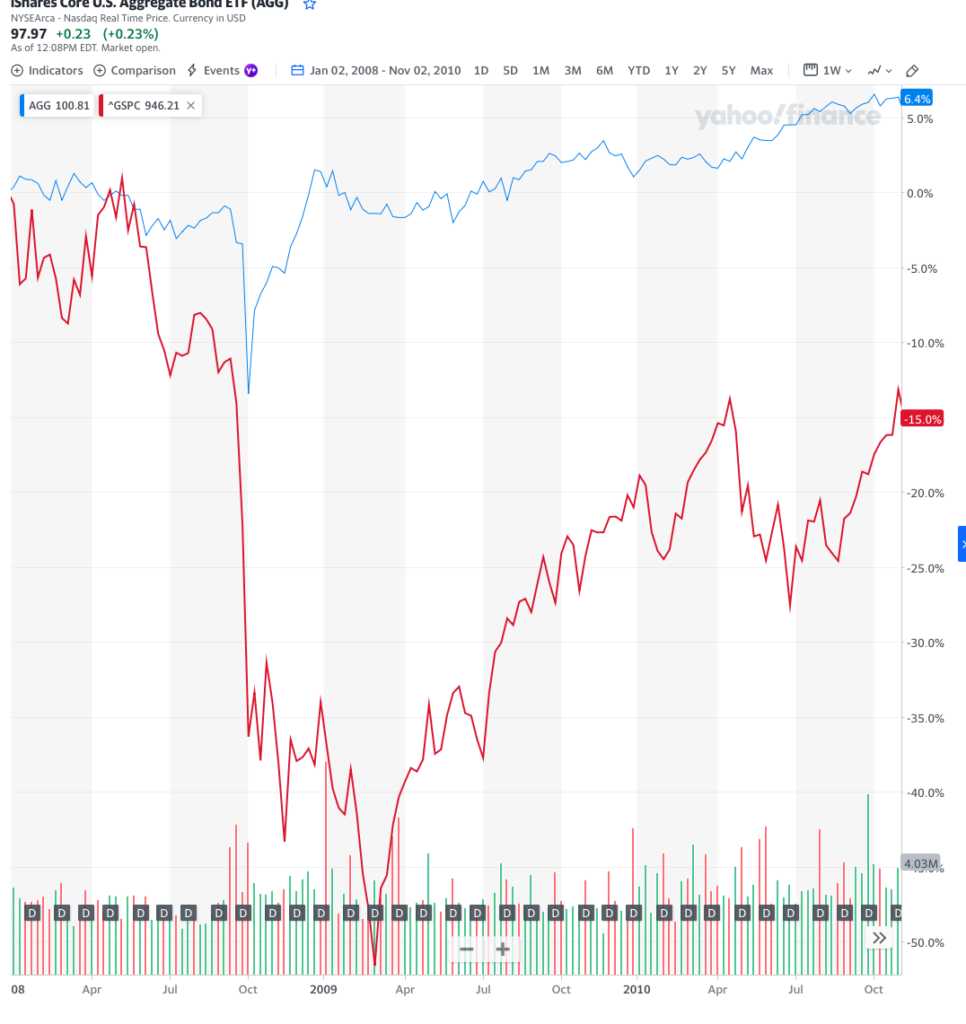

Bonds are another investment option. They can be a little complex, so I tend to stick with bond funds or ETFs and let the experts pick the securities. Let’s look at a US Aggregate Bond Index ETF v. the S&P 500.

You’ll notice that the bond index dipped in 2008, just like the S&P 500 did, but it fell far less, and it recovered more quickly. A bond index fund is typically less volatile, but is also less likely to produce the large gains over time that we’ve seen with the S&P 500 index.

Inflation & Bond Prices

I want to add an important addition to the subject of bond funds being less volatile. During periods of high inflation, like we’ve seen the past few years, bonds loose value quickly. Let’s look at a quick example to see why.

Let’s say I bought a 30 year treasury in 2020 for $10,000. This treasury bond pays 2% interest ($200) per year. This is considered a safe investment as it is backed by the full faith and credit of the US government. This is low risk. I buy in 2020. I get 2% interest every year until 2050, and then I get my $10,000 back. I’m thrilled. In 2020, 2% was a good rate. High yield savings accounts were paying 0.5%.

2 years later, inflation is in mid-swing and 30 year treasuries are paying 5% ($500 per year in interest). If I’m holding my bond for 30 years, I don’t care. Good for the new buyers, they get a higher payment. But if I need to sell, no one will pay full value for my bond that yields 2% when they could get a nice new bond that pays 5%. I will need to reduce the selling price by the difference in bond interest – over 30 years – to sell my bond. The 5% bond gets $300 per year more. Over 28 years (I bought mine in 2020) that is $8,400. I need to sell my bond for $1,600. Ouch! So that’s why bonds and bond funds took it on the chin as inflation went higher and higher.

Ready to Invest

So we’ve covered a bit about investing. We all need to invest to grow our wealth. Read the post on compounding to learn more. Savings alone won’t do it. And we know not to risk money we’ll need in the next 5 years. We need to set aside some money and put it in some low-cost S&P 500 mutual funds.

Defined Contribution Plans

The best way to do this is through a defined contribution retirement plan at work. Read my post here to learn more about these plans, features, and investment options. Many companies offer a 401k plan, or similar retirement plan. The beauty of these is that you can opt to set aside a portion of your pay to be directly invested into the plan. This is a great way to save and invest because once you set it up, it works on its own.

Your plan may also have a match. This is free money. My company matched dollar for dollar up to 3% of salary. This is an unnecessarily complicated way of saying that for every dollar I put into the plan, the company will give me a dollar and put it into the plan along with mine. Once I’ve contributed 3% of my salary, they’ll stop matching until next year, when they’ll start again. If your company offers this, make sure you at least contribute enough to get the full match.

Or…

If your company doesn’t offer a defined contribution retirement plan, set up your own Individual Retirement Account (IRA) at a broker like Fidelity, Vanguard or Schwab. You can likely set up payroll deduction at your company to deposit some of your check in this account.

Wrap-Up

It kills me when I read articles like this morning’s where I hear that 78% of Americans are living paycheck to paycheck. This is a horrible position for folks to be in, and it will only get worse as we near retirement age. While the government may come up with a way to save us, I wouldn’t hold my breath. I suspect it is up to each and every one of us to make sure we have something put aside.

If you find yourself in this situation, start with a budget and be ruthless. Then start an emergency fund, and then find a way to put some money aside for investment. I’ve written several posts about saving ideas. Check out here, here, and here.

If you have questions, or I can help, please post a comment or send me a note through the contact page.