I have 106 different active investments. This includes stocks (69), equity mutual funds, bond mutual funds, IBonds, CDs, and Treasuries. That’s a lot.

I sold Autodesk (ADSK) recently because of some accounting hijinx. I like the company, but there are enough companies that aren’t investigating their own accounting practices, or, even worse, being investigated for their accounting practices, that there is no need for me to hold onto a company in this position. It may be no big deal, but it’s not a great sign that management is not on top of its accounting.

I made a 14% profit on the shares I sold so I’m happy. The stock price is up slightly since I sold, but I remind myself that I’m optimistic about the company and what they do, but I don’t need the risk. Best of luck to them, I’ll move on.

Do I Have Too Many?

But it got me thinking, do I have too many securities in my portfolio? 106 is a lot. Of the 106, the treasuries and CDs don’t take much ongoing energy, but the 69 stocks require some reading of articles and annual reports, as well as monitoring against my thesis. The mutual funds also require a periodic review to make sure I’m still happy with them and I have the proper allocation across asset classes.

But looking solely at the stocks that require the most attention and upkeep, I couldn’t find any that I was unhappy with. Realty Income (ticker: O) is a bit of a thorn in my side. My original purchase is down over 30% since I bought in January 2020. Even with dividends reinvested, and some subsequent purchases at a lower cost basis, I am still down quite a bit. But I love the monthly dividend payment and I like the company so I’m holding while I expect a turn-around when interest rates decline.

But I don’t have a compelling reason to sell any of the 69.

Am I Sure?

Never one to let sleeping dogs lie, I decided to look into this further, I made an interesting discovery. This will be a bit of a let-down based on the title of the post, but I discovered that only a handful of my stock positions account for the bulk of my gains. To be specific, looking just at stocks and excluding funds and other investments, 19 companies make up 80% of my gains. And the top 5 make up 50%.

I won’t keep you in suspense. The top 5 are Amazon, Apple, Netflix, Visa, and Costco. These are all positions that I bought 15-20 years ago and have held on through ups and downs, often buying more shares during down times.

So why bother with the other 64 companies? Why not just put all my stock investment in these 5? I have the bond funds, equity funds, treasuries and CDs to add some diversity and balance risk. Why not cut the 64?

Past Performance is no Guarantee of Future Results

Above is a link to an interesting article from thebalance.com. We’ve read this in every fund prospectus (even though none of us actually read the prospectus, we know it’s there). Just because my top 5 got me here (to retirement), doesn’t mean they’ll outperform for the next 20 years.

So let’s fact check that a bit. In 2018 as I was starting to think about retirement, I de-risked my retirement portfolio. I looked at the aggressive equity mix and decided to sell some high risk growth companies and move that money into more stable dividend paying stocks.

I won’t go into the details here, but inflation hasn’t been kind to that strategy as dividend stocks have become less valuable with treasuries yielding 5%, and real estate stocks are taking a dual hit because of empty office space.

Meanwhile, the shares of Apple that I sold are up 318%. The shares of Alphabet that I sold are up 202%. Amazon is up 115%.

And the Lesson is???

Unclear.

Past performance is not a guarantee of future returns. However, it is awfully hard to imagine a world where Amazon, Alphabet and Apple don’t play a large role. Can they continue to grow at the pace they have grown since 2018, since 2009, since…name the date? We constantly hear that they are so huge that they couldn’t possibly double from where they are, but they do. While I wouldn’t put all my eggs in this basket, I definitely want some there. Note, even though I sold my retirement account positions in some of these companies, they remain my largest portfolio positions.

So the lesson for me is that I let my winners keep winning. Unless there is an accounting scandal or a slowdown in the innovation that has made these companies what they are today, let them run. I may pare them back a bit if they become oversized positions, but I remain committed.

But Keep Looking for the Next Amazon

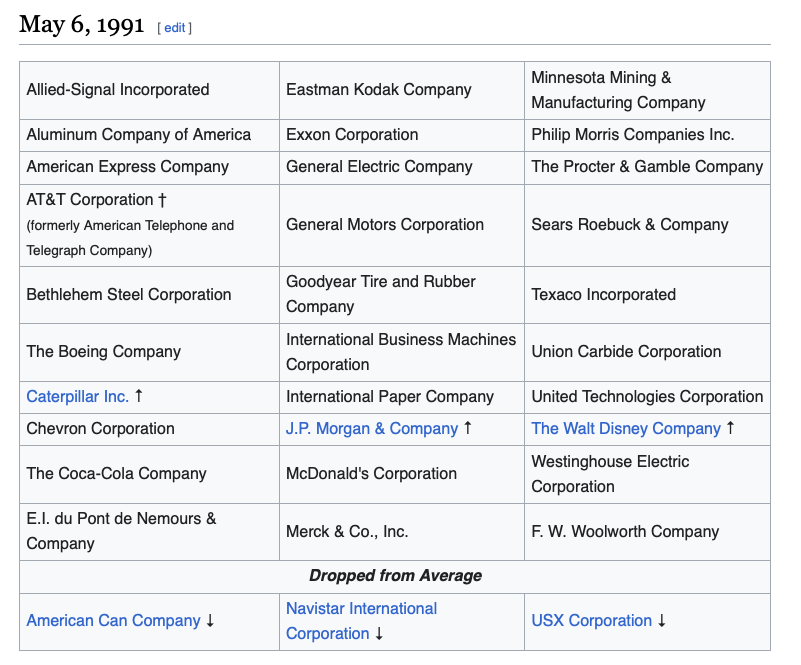

…or Apple, or Alphabet, or Visa or Costco. At some point, these companies will slow their growth. Inevitably some will die off. Look at the Dow Jones Industrial Average in 2024 v. 1991. 33 years can make a world of difference. See details at wikipedia.

Who would have bet against Sears Roebuck in 1991? Or Eastman Kodak, or Bethlehem Steel, or General Motors?

Things change. Be prepared.

Build Your Bench

Nike in the dow in 2024…who’d have thought? If you want to read a fascinating story about the growth of a business, check out Phil Knight‘s book Shoe Dog. It’s a great story and interesting reading.

Same for Salesforce. They build customer relationship management software. How did they become one of the 30 most important companies in America?

We don’t need to find all of these companies, we just need to find one or 2. And we’ll also find some losers – probably more losers than winners, but the losers can only go to zero. The winners can double many times over. My original Apple shares are up 5,043%. They’ve doubled more than 5 times. That’s the magic of compounding.

Ideas

Building your bench starts with ideas. Thinking about the need for better cybersecurity lead me to Crowdstrike (ticker: CRWD) in 2019. Thinking about the chip shortage and everything, including my new oven, going online, lead me to Broadcomm (AVGO) and Nvidia (NVDA) in 2020. Thinking about the next Amazon lead me to Mercardo Libre (MELI) in 2017. All of these have been big winners and I expect them to continue to grow. Someday these may replace Amazon, Apple and Netflix as my biggest contributors.

Broadcomm, Nvidia and Mercardo Libre also help offset the unfortunate investments I made in Lemonade, Chewy, Docusign and VF Corp, as well as a few others. I’ve lost 80% on some of the losers (ouch) but Mercardo Libre is up over 500% so that takes a bit of the sting away.

Wrap-Up

A small number of my investments have contributed an over-sized portion of my gains…so far. And amazingly, Amazon, Apple, Netflix, Alphabet, Visa and Costco continue to grow, despite constant warnings about how much bigger they can get.

However, if we look back on history, seemingly unstoppable companies like Sears Roebuck and Eastman Kodak die off along the way. Things change. Sometimes the change is gradual, but sometimes it comes seemingly overnight.

Keep searching for new ideas. Where are the opportunities? What companies are poised to succeed? Then dig in and create a thesis.

Some ideas will fly, others will not. It’s impossible to know which are which.

I suspect in 20 years I will re-write this post. I will again find that a small number of investments will have produced a huge percentage of my gains. But I suspect none of the names will be the same. And I bet at least one of my big winners will have gone the way of Sears.

Stay tuned for my update in 2044.

Let me know what you think.