Happy July 4th. We’re celebrating independence day for us and for our nation. Burgers, dogs, potato salad and maybe some fireworks later. Sweet!

If you’ve kept up with my posts, your probably on your way to financial independence as well. There are over 200 posts on everything from saving, investing, stocks, bonds, buying hearing aids and finding the best products to keep your car clean.

Sometimes I run out of financial topics and explore unchartered waters.

The best way to get an introduction to the site is through the home page. Click or tap the dancing dollar sign to get to the home page from any page on the site.

Here’s what part of the home page looks like

On the actual home page, the pink words are click-able to get you started on these key topics.

We’ve also got a navigation bar up top to filter posts.

Put Your Money…

So, without further ado, today’s topic.

A few month’s back, I wrote a post called Put Your Money Where Your Mouth Is. Yup, it’s in pink, so you can click on it and read the post in all it’s glory.

Here’s the cliff notes version. History shows us that over the last 100 years or so, the S&P 500 – the 500 largest publicly traded US companies – has been a great place to put your money. In the post, I link to a couple of other posts where I explain why.

Anywho…I decided that I’ve written a lot about the topic so it was time for me to have some skin in the game. Spoiler, I already do – I have 60% of my assets in equities, a good chunk of which is in nice low-cost S&P 500 funds.

For the post, I took a nice crisp hundred dollar bill and purchased a fractional share in the SPDR S&P 500 ETF (SPY).

Timing is Everything

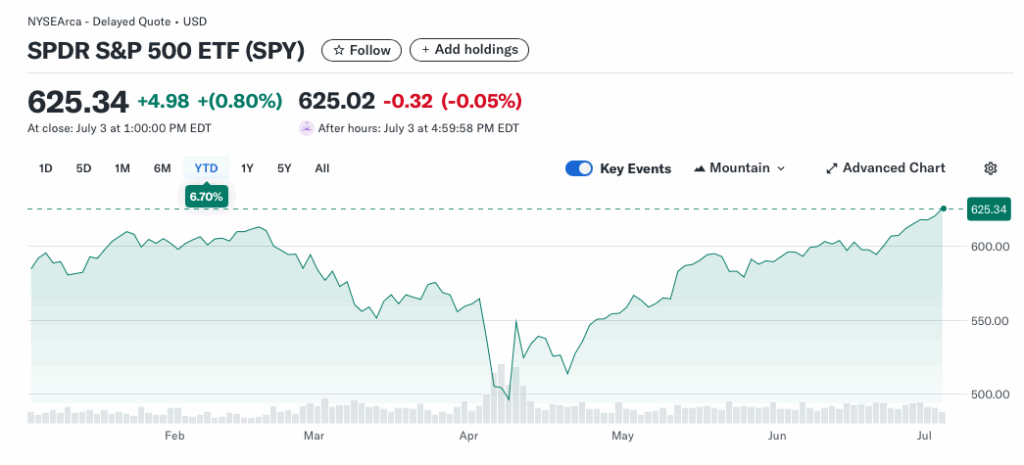

I wrote this post on Feb 26, 2025. Take a look at what happened right after my purchase.

My timing could not have been worse. I followed up with a 2 week assessment here. I bought shares at $597.43 per share. At my 2 week update, they were at $562.81. A couple of weeks later they were at $496.48.

“Put Your Money Where Your Mouth Is”…great idea.

Today

If you take a look at the chart above, today, we’ve recovered from our losses and then some. Let’s take a look at our brokerage site so there is no funny business.

The first line shows my overall holding in SPY. In the position history, I see 2 lines. The bottom line is the 0.167 shares I bought on February 26 for 597.43 per share. On April 29, I got a dividend, which was automatically reinvested in more shares. It’s only .001 shares, but the current value of that purchase is 62 cents.

Back up to the first line…I’m positive on this position. The current value is $105.05, but I only paid $99.77 for the original shares. $105.05 – $99.07 = $5.98 gain. Sweet. That’s a $5.98 / $99.77 = 5.993% gain.

Wait a minute…

My brokerage page says I have a $5.28 gain which is 5.29%. What gives??

Well, I’m glad you asked. The 5.993% gain is real. I put in $99.77 and I have $105.05 now. That’s my real gain.

But the dividend reinvestment clouds things a bit. Here’s why.

Tax

Dividends are taxable, whether we reinvest or not. My broker is responsible for tracking the taxability of my account positions, and for providing tax statements to me and to the IRS at the end of the year. Big thanks to my broker so that I don’t hav eto do it.

My broker records that dividend of $0.63 as a new purchase. This is important. It now shows this as new money upon which I’ve already paid my taxes. In other words, that $0.63 won’t be part of my capital gain. And as we know, when we redeem shares, we need to pay capital gains tax on all of our gains.

If our broker didn’t reflect the $0.63 as a new purchase, that money would be included in the capital gain and we would be taxed on it twice – once as a dividend and once as a capital gain. That’s not cool.

Tax Deferred Accounts

Just a quick note.

If that dividend occurs in a tax deferred account like a 401k or an IRA, the broker may not break it down the same way. My broker records it as a purchase, with a $0 cost.

I see the transaction, but there are no current year tax implications. For a tax deferred account, I pay no taxes as it grows, but we pay ordinary income taxes on withdrawals whether the money is principal, dividends or capital gains.

Wrap Up

So, happy July 4th. I’m ahead on my put your money... investment.

As investors, we don’t know what the market will do. I’m shocked as we sit here today. We have relatively high inflation, little clarity on tariffs, cripling national debt, war raging in the Ukraine and sometimes in Iran, how can the S&P keep hitting new highs? It makes no sense.

What I do believe though is that the US has a resilient and inventive economy. We thrive on a challenge. That’s why the S&P 500 businesses have continued to grow and build wealth for those of us who hold S&P 500 index funds and ETFs.

We’ll go through up cycles and down cycles and it will be hair-raising at times, but that’s the price of admission for being an investor. If it were easy, everyone would do it.

We protect ourselves with a solid asset allocation strategy.

After the 1st 2 weeks of my SPY investment, I did not expect to be ahead on this purchase so quickly. But I did expect to be ahead years from now.

We’ll keep watching.