As investors, our goal is to buy something, watch the value grow over a long period of time, and then sell it for (an enormous) profit. No amount of research and analysis can tell us which investments will grow over time, so we typically buy at least 20 or so investments or we invest in a mutual fund that holds a basket of securities.

While some investors buy property, classic cars or baseball cards, today we’ll stick with stocks.

Over the past 40 years, I’ve been a net buyer of stocks. I’ve deferred as much of my salary as possible into my 401k and because investing is a hobby for me, I’ve taken some of my bonus each year and put it into a brokerage account to buy shares of companies.

And because retirement was in the future (at that time) it was important for me to grow my wealth.

Selling

Now, in retirement, I’m starting to sell some shares to pay living expenses, but I’ve also sold shares along the way. While, in general, I’ve found it better to hold my investments, there are reasons to sell.

Thesis Change

I keep notes on what I’ve sold and why. Far and away, the biggest reason for me to sell is a thesis change. As you may recall from my post on creating a thesis, before we buy shares of a company, we should spend a few minutes and write down the reasons we think the company will be a market-beater.

We also may want to note watch areas. Things we’re concerned about and we need to keep an eye on.

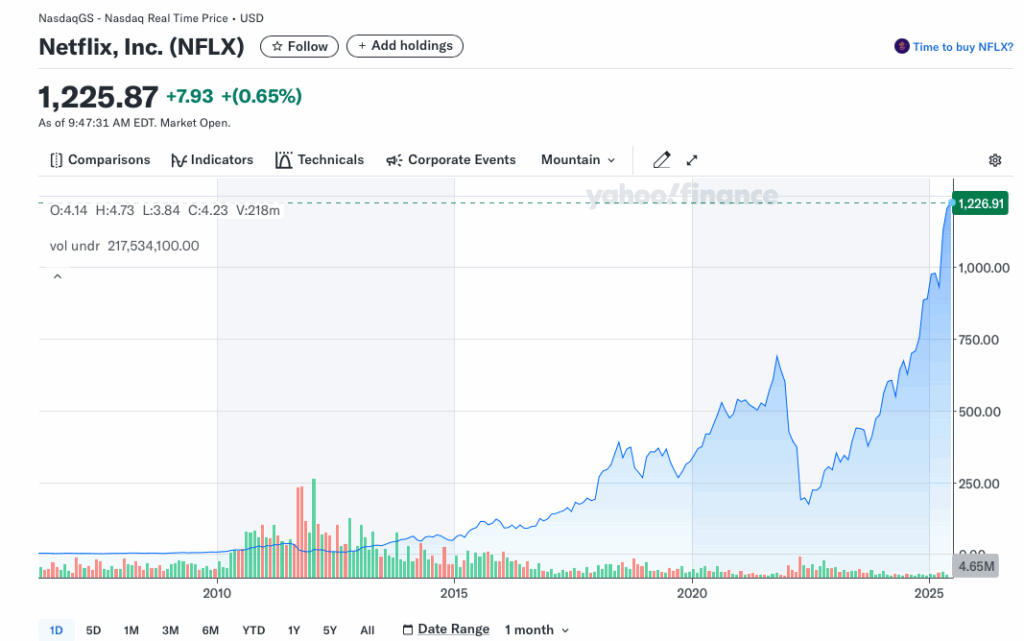

We know our company’s stock prices will be volatile. That’s the price of admission for any investor. I always look back at Netflix, one of the biggest winners in my portfolio. At one point, it pulled back 80%. Some of my purchases were in the red.

While my investment had lost money, my thesis hadn’t change, so I hung in there. That worked out pretty well.

There were some jaw-dropping (at the time) pullbacks, but I’m up well over 1,000%

What Signifies a Thesis Change?

Good question. Was it a thesis change when Netflix decided to split off its DVD business into a separate company called Quickster?

Could be. I saw it as a dumb decision, but I still believed in the brand Netflix had developed and the potential for moving from DVD to streaming. One bad decision (usually) does not signify a thesis change.

However, I did sell shares of Autodesk in 2024 when there was discussion of accounting irregularities. For a company like Apple, Amazon, or Netflix that I follow closely and have held for a long time, I may be more tolerant of accounting irregularities, but I’m not as familiar with Autodesk, so I decided to take some profits and run for the exit.

Accounting irregularities typically don’t happen without senior management being involved. While they could be a simple oversight, they could also mean that management is not being transparent with shareholders about the state of the business. This is unacceptable to me.

Autodesk shares are up 25% in the year since I sold. That’s a bummer, but I’m happy to be out because I’m not sure I can trust what their management is telling me.

Intel

Intel was my big thesis change. I was excited about chip stocks and bought a basket of chip companies – Intel, Broadcomm, Nvidia, and Taiwan Semiconductor.

I was a little suspect of Intel, but it had a new business plan and it paid almost a 5% dividend.

A year or so after I bought, Intel was lagging. It was always 1 quarter away from seeing improvement and then it cut its dividend. I sold. Major thesis change. You can read more about my Intel journey here.

If we invested because the company promises a turn-around but it never happens, even when its competitors are thriving, that’s a thesis change.

When one of the reasons you buy a company is because it will pay you a healthy dividend to help you wait for the turnaround, and then it cuts that same dividend, that’s a thesis change.

Intel is out. That one paid off. While I lost money, I would have lost twice as much had I hung in. And luckily the other stocks in that basket have more than made up for Intel’s losses.

Partial sales

So, thesis change and accounting irregularities are signs that send me running for the exit door. I typically sell all shares and move on to another great investment idea.

But there are times when I will sell a portion of my position in a company.

Overweight

I’m not talking about the few too many pounds we put on over the holiday. I’m talking about when a company succeeds and the stock price skyrockets and one day we look at our top holdings and we’re surprised.

This happened recently with Crowdstrike. Crowdstrike is a cybersecurity company. As you may have heard, putting stuff on the internet is tricky. Hackers are everywhere and companies spend a fortune on security experts to protect them. Crowdstrike has become a leader in the industry. You can tell because their CEO is often quoted anytime there is a well-publicized cyber incident.

I bought a few shares of Crowdstrike back in 2020. It had a brief pullback last year during a heavily publicized bug in its software that caused worldwide outages, most notably involving Delta airlines. It has more than recovered since.

My initial investment in Crowdstrike is up more than 300%. That’s awesome, but Crowdstrike became one of my top holdings. When it had a bad day or week, or month, it really impacted my portfolio. I love Crowdstrike, but I needed to reduce its impact, so I sold almost half of my shares.

I made money, which is good, I still had a sizable position which is great because I remain optimistic. My thesis hasn’t changed. But it is now a more reasonable % of my holdings.

It’s up over 65% since I sold just a few months ago.

I could be sad because of the lost gains from my sold shares, but instead, I’m thrilled because my remaining shares have increased in value by that same 65%, and I can sleep at night knowing I’m not overly exposed to one company.

Rules are Meant to be Broken

As a rule, I have an idea of how large a % of my portfolio that I’m comfortable with any company comprising. I have a spreadsheet that tracks the % of portfolio, and for stocks, the % of each stock’s value in my overall equity holdings. Typically when I’m getting well over that limit, I’ll sell a few shares.

I hate to sell some of the shares in companies I love, but it really tests my conviction when a company hits an inevitable slump. If it’s a smaller % of my portfolio, I’m more able to ride it out.

But, I’ve broken that rule many times over for Apple, Amazon and Netflix. I follow these companies closely and read about them regularly. I have super-high conviction in all 3.

In 2022, Amazon pulled back from $169 per share to $82. That’s more than 50% for those scoring at home.

While I was concerned, at no point did a consider selling. I have such faith in these companies that I’m OK with them being a huge part of my portfolio.

Raise Cash

Now that I’m retired, sometimes I’ll sell investments to raise cash. I need to pay bills and there’s no paycheck showing up every week.

This can be tricky. Do I sell a stock that’s lost money? I can get out of a losing investment and there could be a tax advantage if sold in my after-tax brokerage account. But I hate to do this unless my thesis has changed.

So often I sell a winner. In 2024, I sold a large chunk of Amazon shares. They were up big, so I took a large long-term gain which was nice. But I paid taxes on the gains. Long-term gain taxes are much less than short-term gain taxes, but still taxes – yuck!

So I sold more shares than I needed at the time so that I could put some cash aside to cover the taxes.

Wrap Up

As investors, we’re looking to grow our wealth. Most of our focus is on choosing appropriate investments and watching them appreciate over time.

But there are times when we need to sell. And we need to be just as thoughtful about selling as we are about buying because selling at the wrong time can be just as dangerous as buying the wrong security.

I’ve found that it is helpful to keep a thesis on each investment. Stock price changes alone should not be a reason to sell. I only sell when my thesis changes.

I’ll also sell to help keep my portfolio inline. If one investment grows to become a much larger percentage of my portfolio than I had anticipated, I may sell a few shares and take some gains.

Now that I’m retired, I also need to sell investments to fund my spending. This is a more complex process of assessing which asses to sell and how to plan for tax consequences. We’ll talk more about that on another day.