In 2020, when I retired, I found myself in the awkward position where I was old enough to retire (I thought) but too young for Medicare. While Medicare has its own complexities (read more here), it is significantly cheaper than buying your own insurance.

It was a fascinating journey. Here’s what I learned.

Cost

Before making the decision to retire, I did some insurance shopping on my own. I also talked to some friends who had retired before they were 65 and eligible for Medicare, so I was prepared for an additional $20,000 per year expense to pay for insurance for my wife and myself. Regardless of the plan you choose, health insurance will be a big expense.

Mass Health Connector

I live in Massachusetts so I started my search at Mass Health Connector. Here is how they describe themselves.

Basically, mahealthconnect.org is the place for Massachusetts residents to go to shop the federal government’s Affordable Care Act (ACA) health insurance marketplace. The big benefit in shopping here is that they have access to our income (they get it from the social security administration) so they can calculate if we are eligible for any government subsidies.

Subsidies

For most of our careers, my wife and I both worked so it wasn’t often that we were eligible for any type of subsidy. I was quite excited when I was unemployed in 2008 and 2009 as I was able to collect unemployment. Nice to get a little back.

But remember, if we’re retired and we’re shopping for insurance, our income is really low – at least compared to our working years. Maybe we’ll qualify???

Per the Health and Human Services site, one of the goals of ACA is to “Make affordable health insurance available to more people. The law provides consumers with subsidies (“premium tax credits”) that lower costs for households with incomes between 100% and 400% of the federal poverty level (FPL).

Here’s some more info on the Federal Poverty Level.

The way I read this is that FPL for a husband and wife is $20,440 in 2024. 400% of FPL is about $80,000, if my income is below that, I am likely eligible for a subsidy – sweet. There is also the line “Income above 400% FPL: If your income is above 400% FPL, you may now qualify for premium tax credits that lower your monthly premium for a 2024 Marketplace health insurance plan.”

Seems a little squishy, but the MA health connector will calculate this for you. Probably best to double-check their math.

No Subsidies

In 2020 when I retired, my wife decided to continue working. That put my dream of subsidies on hold, but opened up 2 new avenues to think about.

COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) is legislation that in some cases requires our employer to continue to offer us health care coverage through their plan for a period of time after termination. Read more from the Department of Labor here.

My situation was a little complicated. Here’s what happened.

I retired.

We had health insurance through my company so I was eligible for COBRA coverage through my company for up to 18 months. COBRA rates are quite expensive (since the company is no longer paying the lion’s share) so we decided to move to my wife’s plan through her employer.

COBRA is a one time decision. My decision to decline coverage prior to my retirement means that I could not go back to my employer and get coverage, even within the 18 months that was initially offered.

We decided to enroll in my wife’s company plan. My retirement was a qualifying change so we were eligible to enroll right away. Typically, plans only allow changes during their annual open enrollment period.

Shortly after, my wife decided to change jobs.

Her new employer had lousy insurance, so we opted to enroll in COBRA coverage before she left her original employer. We were offered 18 month’s coverage under her company’s plan. The rates were high, but the coverage was excellent.

If you are enrolled in your company’s plan and you leave the company, you will likely be offered the opportunity to extend your coverage under the plan for up to 18 months. The company will not subsidize so be ready to pay the whole portion yourself. For us, it was about $1,900 per month.

Private Insurance

While many use MA Health Connector or their state’s, or the federal government’s ACA plan site, we can also shop plans directly with Insurance providers. I went out to some of the biggees in my area – Tufts Health, Harvard Pilgrim, Reliant, and a few others to get quotes. More on this in a bit.

Metal Plans

I found the options and choices overwhelming. Plans are grouped as Platinum, Gold, Silver or Bronze. In general, their groupings signify how much of the healthcare cost will be passed on to the insured (us). See here from healthcare.gov for more detail. However, to make it even more complicated, within each Metal category, there are different coverages, benefits, co-pays, deductibles and out-of-pocket maximums.

Keep Reading, It Get’s Better

Not my fault, I’m a victim like you. It seems like it shouldn’t be so complicated, but it is.

Requirements

I found it helpful to stop reading for a bit and think about my requirements. Why am I getting health insurance in the first place? While this seems like a dumb question, here’s what I thought about.

The main reason I want insurance is that I don’t want to get wiped out by a major medical problem. In 2020 and 2021, while I was still on COBRA coverage with my wife’s prior employer’s excellent plan, I came down with some very strange dizziness. I saw neurologists (3), cardiologists, audiologists, and a whole bunch of other doctors. Each one wanted tests, so I did several MRIs, X-Rays, ectocardiagrams, stress tests and several tests that I can’t spell or pronounce.

I had excellent insurance. No co-pays and no deductible. I’m not paying a nickel, but I see the charges online and it is scary. Imagine if I had to pay this myself.

I don’t like paying a co-pay and I’m not fond of deductibles, but I really can’t afford to be wiped out by medical costs due to a serious and prolonged illness, so my key requirement is to cover me for catastrophic loss.

At one point during my dizziness episode, I wasn’t getting much info from my local neurologist, I asked for a referral to a neurologist at Mass General in Boston. I live in an are that has some of the best hospitals in the world. I realized that another of my requirements is that my wife and I will be covered for services at Mass General, Dana Farber, Brigham and Womens, or any of the other great hospitals, if we need them.

Other Items

Other than the mysterious dizziness episode, my wife and I have been very lucky with our health. We don’t have any regular prescriptions that we take and we don’t typically see doctors beyond our annual physical.

It’s a good idea to put together a list of medical expenses. Even things like co-pays for regular physical therapy can get expensive. When shopping for plans, some will likely cover more services, even within the metal level you choose.

Now that we have an understanding of requirements, it is easier to compare plans – we know what’s important to us.

Deductibles

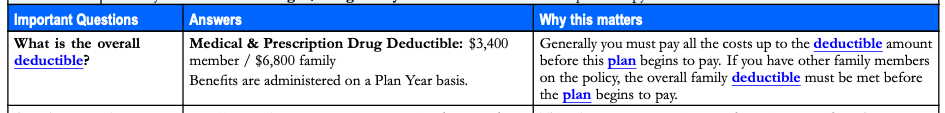

Most plans have a deductible. This is the amount that we need to pay on our own before the plan starts making payments. I’m shopping for myself and my wife so I’m looking at both the individual deductible and the plan deductible.

My plan shows me this

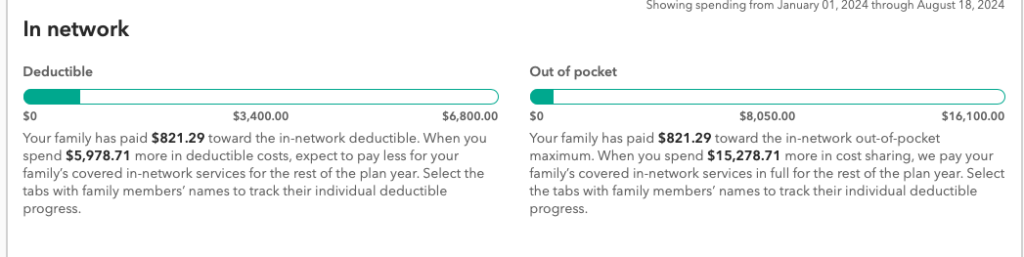

I also get a nice little dashboard on the plan website that tracks my progress toward the deductible.

Good News Bad News

The good news is we’ve been pretty healthy. We have paid very little for healthcare this year. The bad news is that we’re not getting a heck of a lot for our $1,400 a month that we’re now paying for our Harvard Pilgrim Health Plan. Note: our COBRA expired a while back and we bought this plan direct from HPHC.

But, I need to remind myself that my requirement is to cover us for catastrophic loss and to allow us to be covered if we use the great Boston hospitals.

Costs

Because we have not hit our deductible, we are paying the full cost. The plan covers preventative costs, so our annual physicals were covered, but the other visits were not.

There does seem to be some funny business related to costs. Here’s an example:

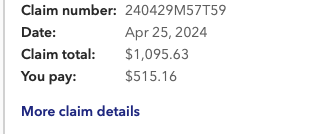

I see this on my HPHC dashboard. It looks like the amount billed by this doctor is $1,095.63, but I pay only $515.16. When I click in to more claim details, I see that the “allowed amount” is $515.16. Allowed by who?

For every claim I have, the amount I paid was much lower than the billed amount and the insurance company did not pay anything.

I don’t understand this. I like it, but it can make insurance shopping more difficult. It’s hard to know what I’ll spend next year if I’m not sure why these allowed amounts are lower, and will they change next year. May not be important but just makes this more confusing.

Out-of-Pocket Limit

This is another important number to know. I’m most concerned about catastrophic loss, so it is important for me to know what is the most I’ll pay for health care if something goes wrong. My plan tells me:

In planning for retirement, I knew my emergency fund needed to be able to support $15,000 in annual medical expenses. My plan will cover me beyond that, but if my wife or I have a health emergency, we could be on the hook for $15,000.

High Deductible Health Plan (HDHP) & Health Savings Account (HSA)

We talked about deductibles above. Our insurance company pays no benefits until we hit our deductible so we want a plan with a low deductible, right??? While that is generally true, insurance companies offer plans called high deductible plans. More here from healthcare.gov.

Insurance companies like these plans because the deductible is higher so they don’t have to pay as much. We like these plans because they tend to cost less and they come with a Health Savings Account (HSA). I included a link to a post with more info, but we love the HSA because it has a triple tax advantage. More on this in a sec.

An HSA is an account we as insureds, set up with our broker. We put our own money into the account, up to an IRS annual limit, and we report this contribution on our taxes to get a current year benefit for each year we contribute. This money grows tax free. When we take the money out, as long as we use it for qualified medical expenses (and old folks like us have lots of qualified medical expenses) it is not taxable. Triple tax advantage.

An HSA is a great way to save for future medical expenses. Because of its tax advantages, it is an outstanding investment vehicle. Mine is invested in a low-cost S&P 500 fund and I don’t ever take money out. I pay my medical expenses with savings so I can leave the HSA to grow and get the full benefit of the triple tax advantage.

An HDHP with an HSA could be a good option to build savings to cover future medical expenses.

Back to Metals

Now back to the metal categories. This is a good place to start. In general, a bronze plan will cover 60% of our medical costs, a sliver, 70%, a gold 80%, and a platinum, 90%. We now need to make some guesses about how much we’ll spend on healthcare. If you use an account aggregator, this is easy (more on aggregators in our budget post) otherwise grab your bills, checkbooks, credit card statements and see what you spend.

Or, your current health plan may have this info available to you on its website. Take a look.

In my case, my wife and I spend very little on healthcare so there is not a lot of difference between a 60% benefit and a 90% benefit, however, there is a big difference in the monthly premium for a bronze plan v. a platinum plan.

And remember, you’ll be on the hook to pay out-of-pocket up to the deductible before any plan (platinum, gold, silver, bronze) starts paying benefits.

Having a good idea of what you spend will help you decide whether the extra cost of a higher tier plan is worthwhile.

Quick Example

Above on my HPHC website, you can see that I’ve spent $821.29 year-to-date on health care expenses. This includes co-pays at the doctor’s office and bills for services. This is out-of-pocket money that my wife and I have spent this year.

Because we haven’t hit our deductible of $6,800 for an individual and $16,100 for the plan, our insurance has not paid any benefits.

Regardless of whether we had a bronze plan or a platinum plan, no insurance company payments would have been made. The platinum plan would likely have a lower deductible, but it is unlikely that it would have a deductible less that the $821.29 we’ve spent.

Everything Else

Once we’ve chosen our metal tier, we can then compare the deductibles and out of pocket max within that metal tier to find the best plan. While they should be similar, there may be differences. There will often be differences in how prescription drugs are covered. If you take a number of expensive prescriptions, it may be worthwhile hunting for a plan that has a higher prescription drug benefit.

MRIs were important to me a few years ago as I had a few while addressing my dizziness. There was a difference among plans within metal tiers on how much co-pay was charged for MRIs.

Be sure to go back to your requirements and your medical history to see what services you are most likely to use and compare plans to make sure your getting the best coverage.

Cost

My HDHP is costing me about $1,400 per month. That feels like a lot, but it protects me from catastrophic loss. I also get an HSA, to which I will contribute $9,300 (the family limit of $8,300 + an extra $1,000 for over 55 years old). More on limits here.

Some of the plans I looked at were over $2,500 per month.

While monthly costs are good for comparing 1 plan to another, I like to multiply by 12 and see what I’m paying per year.

My HDHP costs me $1,400 X 12 = $16,800 per year. The $2,500 plan would cost me $30,000 per year. That’s a huge difference in premiums. Do I have $14,000 in medical expenses that would be reimbursed by the more expensive plan to make it worthwhile?

And finally, don’t forget to check with your local ACA site. You may qualify for credits based on your income. Don’t let free credits pass you by.

Wrap-Up

That’s a lot. Shopping for insurance is hard, but remember, this decision is not permanent. Just like when we were working, our private plans have annual enrollment at the end of every year. If you have buyer’s remorse, you can change plans for next year.

The options and features are overwhelming. Make sure to spend some time on your requirements before you shop. Knowing that prescription coverage is important, or low MRI co-pays are a must will help prioritize.

Use mahealthconnector or your state’s ACA site to see if you qualify for subsidies.

Consider a high deductible plan with a health savings account. You can put the reduced premium amount into the health savings account and let it grow. This is a good option if your medical expenses are low..

This just scratches the surface, but it should be enough to get you started. Good luck and I’d love to hear experiences, or suggestions.