That’s a troubling thought. Happy New Year to you too!

So, how do I know this?

I’m mister tinfoil hat. I don’t trust anyone online. Or anywhere.

I use a password manager. No duplicate passwords. All passwords look like this: @NqiieeMF3V3LpV_n3pm6VXHkoe-9. I use a VPN, even at home because I don’t trust myself.

I was notified in 2024, that my SSN was on the dark web.

How Did it Get There?

You can read more here about the National Public Data breach. 2.9 billion (billion with a B. That’s not a typo). 2.9 billion records, including SSN were exposed.

Fun Fact: There are 332 million people in the US as of the 2022 survey. Chances are we’re all part of this breach.

Who is National Public Data? I don’t use them? Well if you’ve ever had a job, you may have. If you’ve never had a job, feel free to drop out and read our post on ball-hawking. If you have had a job, stay tuned.

National Public Data provides data for companies that perform background checks. Every job I’ve had, including the car dealership, has done a background check on me. These people are security professionals. You’d think these guys would have their act together. You’d be incorrect. 2 of these companies have notified me that they’ve exposed my data.

But National Public Data. 2.9 Billion.

Chances are, your data is in this.

How Do I Know?

CNBC has published some info on this. Read here. You can go here or here to perform a lookup to see if you were involved. Do not enter your SSN – it’s optional

And even if you weren’t involved in the 2.9 billion records here, remember the Equifax breach? Over 150 million (I know millions, who cares – right?) of people had their personal data exposed. Equifax is another company we’re supposed to trust.

Trust???

And while we’re on that, we’ve talked about Equifax, Transunion and Experian. These are the 3 credit reporting agencies. They keep track of all of our loans and credit cards and show potential lenders whether we are making payments on time and how much debt we have. We can trust them right?

Did you know that they can sell our data? Read this very unsettling article from our friends at clark.com.

That’s unfortunate.

Credit Freeze

If you do only one thing in 2025 to protect your wealth, please consider a credit freeze.

What’s a credit freeze you ask?

We talked about how Equifax, Transunion and Experian maintain records on our loan and card activity and provide this info to lenders (and apparently anyone else who calls) to determine if we are credit-worthy. A freeze tells them that they cannot give out our info – to anyone.

This is cool. They can’t sell our info for profit, and if anyone contacts them to get our credit history, they are not allowed to give it out.

This alone is a nice protection for us.

Additionally, since creditors – banks who provide loans and credit card issuers – will not be able to verify our credit history, they will not issue a card or loan in our name (using our SSN). This means that someone who has purchased our info on the dark web or bought it from a legitimate data broker cannot get credit in our name. Yay!

Please note that since our credit is frozen, we cannot apply for a loan or card either. We’ll need to unfreeze our credit first.

Some Clarifications

We need to freeze our credit at all 3 agencies. Equifax, Transunion and Experian.

Credit freezes are free. We can set them up and turn them on or off as much as we’d like.

The easiest way is to set up a free account at each of the sites and then use this login to enable or disable a freeze.

Fraud Alerts are similar, but not as secure. They are free as well. Per Transunion:

Paid Products

The credit agencies, as well as other companies (like Norton Lifelock) offer paid products that provide additional monitoring and may make updating security freezes easier. We’ll talk more in a sec, but remember, the basic security freeze offered at no charge provides the protection that most of us need.

I actually am a huge fan of the paid services. Many provide dark-web monitoring and tools we can use to alert us if our SSN, credit card number, bank account, email, phone, and other personal info appears on the dark-web. They also monitor all the various breaches and provide info on how to determine if we were impacted, and what to do about it.

What I don’t like is paying for these services, or paying for anything that I don’t have to.

To be clear though, I would never ever subscribe to a free identity protection service. “Free” services like gmail and others are only free because the provider sells our info to make a buck. This kinda defeats the purpose for fraud protection. Be wary of free services.

But You May Not Have to Pay

I am currently a member of at least 4 of these services. I pay nothing. Someone pays for me. How nice, right? Who’s paying?

- My Signature Visa card (which also gives me 2% cashback on every purchase) provides free-to-me Norton Lifelock protection. As a card holder, all we need to do is sign-up.

- My Discover card provides a dashboard that shows me SSN inquiries and other identity alerts.

- My Apple MasterCard provides identity theft protection from McAfee similar to Norton lifelock

- AAA offers a similar service called ProtectMyID – offered by Experian

I’ve got a couple of others because every time a company has a breach, they tend to offer free identity protection to those impacted. Lucky for me, my info has been breached many times by many different companies. So, I have lots of protection.

Creditkarma also offers a free service. Gasp! Free?

Yup, makes me a little nervous as well. But CreditKarma is owned by Intuit, a company with a solid reputation. At some point, I’ll look into this further and report back, but if you don’t have AAA or a credit card that pays for the service for you, it may be worth a look.

Wrap Up

Someone has your SSN, and your mother’s maiden name, and the name of your 3rd grade teacher. It’s unfortunate but it is likely true.

It’s best to accept this. If your info isn’t out there now, it will be soon. Embrace this and protect yourself today. A security freeze with each of the 3 credit bureaus is a great way to do this.

Here’s some info that will help.

Example

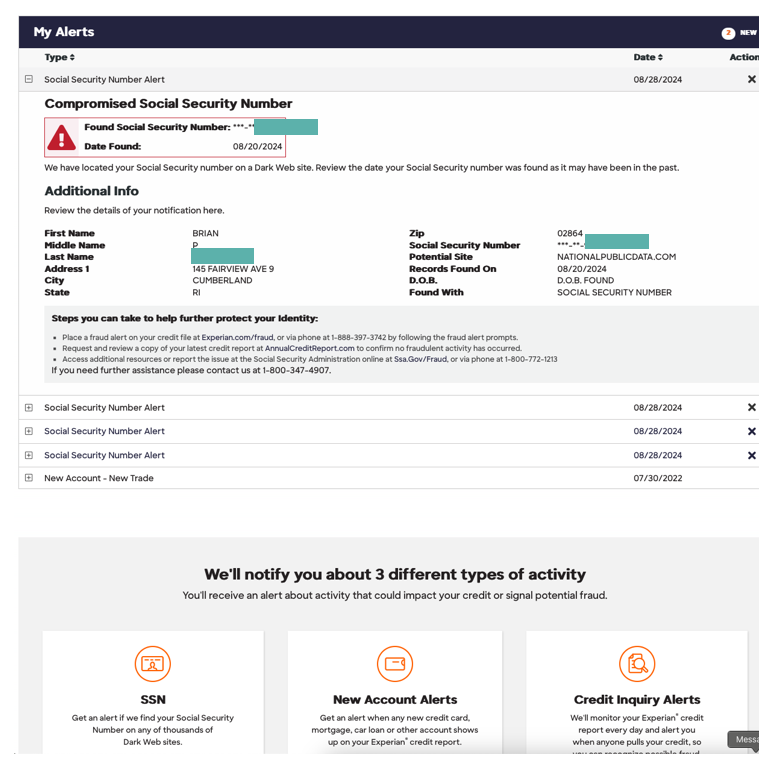

Here’s what one of the protection services looks like. Again, I get this free with my no-annual-fee discover card.

I log in at Discover.com and navigate to Security/SSN, Inquiry, New Accounts and I see:

…our old friends National Public Data.

And I haven’t lived at 145 Fairview Ave since 1989, so these records go back a ways.

Stay Safe.

Updated 1/6/25

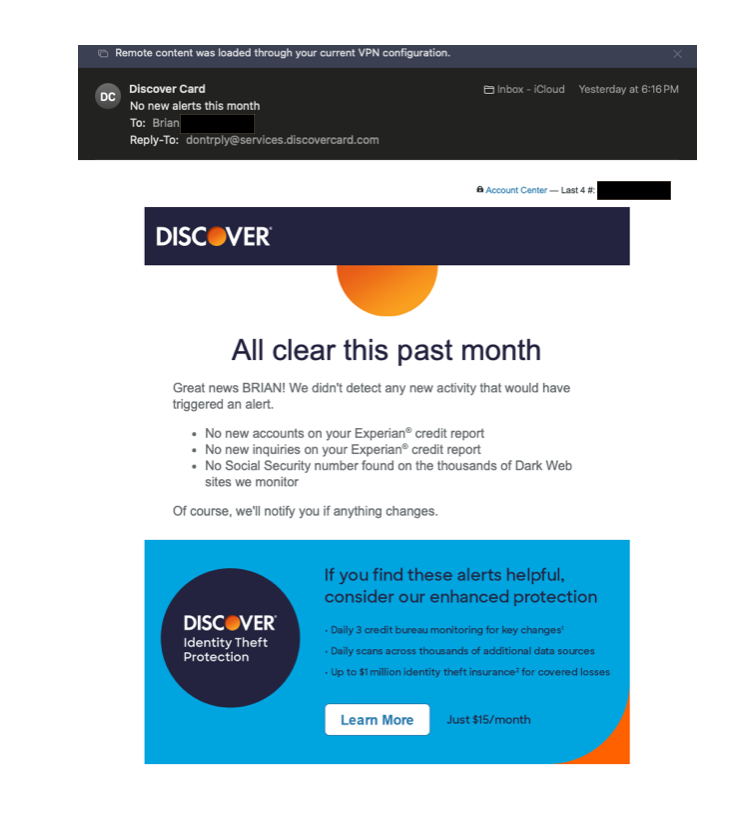

For all of those who don’t need an extra task on their task list, let me show you how easy it is to monitor your safety, once you subscribe. Here are 2 emails I’ve received over the last few days.

Nothing to do here. No one set up a new credit or loan account in my name, no inquiries (there better not be because of my credit freeze), and the “no social…” is wrong. We know from above that my SSN is definitely making the rounds on the dark web. This is why it can be useful to have more than one service. Especially if they are free-to-you.

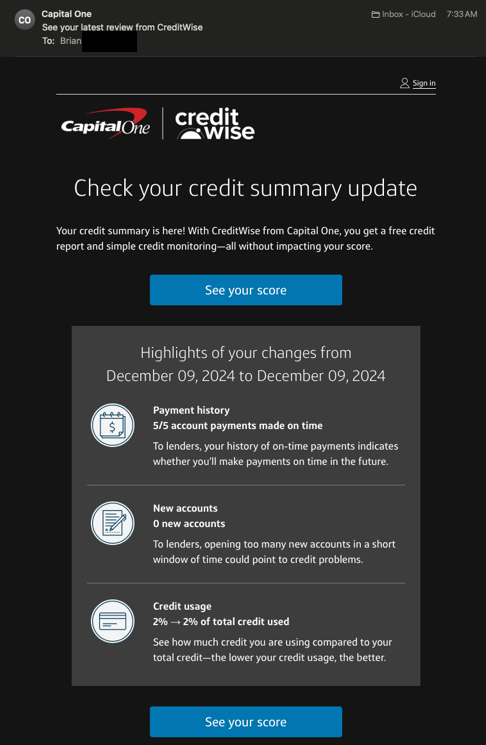

Capital One

My apologies, I forgot about Capital One. I have a high yield savings account with them which gives me free monitoring. Here’s the monthly email I received:

This has the added bonus of showing I’ve made all of my payments on time. Of course I have. I auto-pay everything and verify after the payment processes. This also tells me I’m only using 2% of my available credit. Having a high credit limit and keeping our balance low will do wonders for our credit score.

For all of these – Discover, Capital One, Norton…I get a monthly email which shows the highlights. I can then log in (not click…never click anything in an email) to see details.

The bottom line is that once we sign-up, we’re done. The monthly emails give us the highlights so that we can react to anything suspicious. We can get more info if we like, but the email tends to be sufficient.