We all want to be part of the next big thing. In the 90s it was internet stocks. Today it’s AI.

But how do we get in early? How do we spot the opportunity before it becomes (here’s the dreaded term…) overbought?

Investing v. Gambling

It’s important to understand the distinction. Let’s look at an example or two.

Today on CNBC

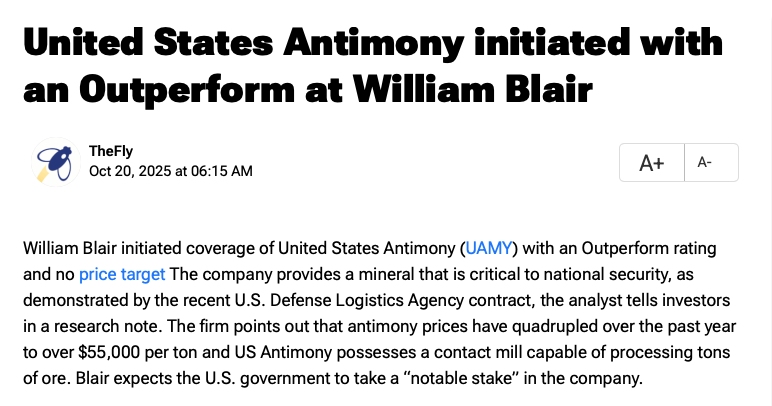

Recently, rare earth stocks have been hot. Check out United States Antimony Corp.

Who?

I’ve never heard of United States Antimony. But William Blair likes them, and seemingly at any price since they rated them outperform with no price target.

What’s All The Excitement?

The US gets much of its rare earth minerals from China. This has been in the news lately as China trade tensions have escalated and tech and defense firms have stated concerns about their ability to obtain these minerals.

So that’s a catalyst. The minerals are in demand. Supply constraints are likely. Perhaps this is an opportunity?

Investment Goals

In order to evaluate whether this is an opportunity, we need to revisit our investment goals.

My investing goal is to grow my wealth over time. This has been my goal since I started investing in my 20s.

I buy bond funds for income, dividend-paying stocks for a mix of income along with some growth potential, growth stocks for their longer term potential for market-beating gains, and nice low-cost S&P 500 funds for their solid track record of gains.

I know my equity investments will be volatile, but I expect they’ll be worth more when I’m in my 80s and 90s, which is 20+ years away.

For me, I need to analyze the China situation and see if investing in rare earth mineral companies here in the US makes sense.

Maybe Not

You probably guessed this.

My time horizon is 20 or more years.

A lot could happen between the US and China over the next 20 years.

And I really don’t know much about rare earth minerals. I’m not sure exactly how they are used, whether there are alternatives, where else in the world they’re produced – though I do remember something about the Ukraine having some and the US wanting to include them in part of a Russia deal…

So this doesn’t scream opportunity for me.

My Opportunities

I’ve talked about at least 2 in my posts.

In 2022, I got excited about computer chips. We were deep into the supply chain problems caused by Covid and companies couldn’t get enough chips. Even appliance makers like Whirlpool were impacted. You can read more here.

Here’s why I was excited. Computer chips are in everything. My car, my phone, my AirPods, my fridge, my washer and dryer…you name it, if it is electronic, it’s probably controlled by a computer chip.

And I don’t see this changing. I expect more things will be controlled by computer. That’s a trend that’s been around a while. Look at the evolution of Siri and Alexa and smart homes.

I bought a basket of chip stocks and they pulled back for the 1st 6 months, but are on fire now.

The first 6 months was a bummer, I’m feeling good now, but I’m really planning for outsized growth from this basket in 2042 and beyond.

Energy

More recently, I posted about opportunities in energy.

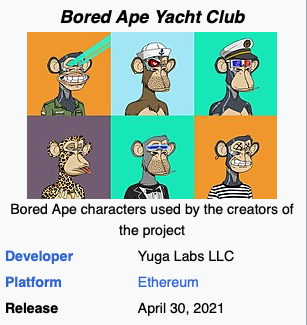

We keep using more energy. AI is getting the spotlight and it could be huge, but it could also be a fad like the metaverse. Remember when people were paying millions of dollars for virtual homes and for virtual pictures of apes?

AI could be a real catalyst and seems to have some staying power, but either way, people really seem to like energy. We like our homes warm and well-lit. We keep buying stuff (all of it run by computer chips) that work off of electricity. Despite what you’ve heard about electric car sales, we see a lot more EVs on the roads today.

My energy basked started down, has rebounded nicely, pays a nice dividend, but most importantly, I believe that these companies will be worth much more in 2045. Maybe not all of them, but some will.

Opportunities for Others

So while my investing goals are more traditional, I also need to recognize that there are other types of investors who have different goals.

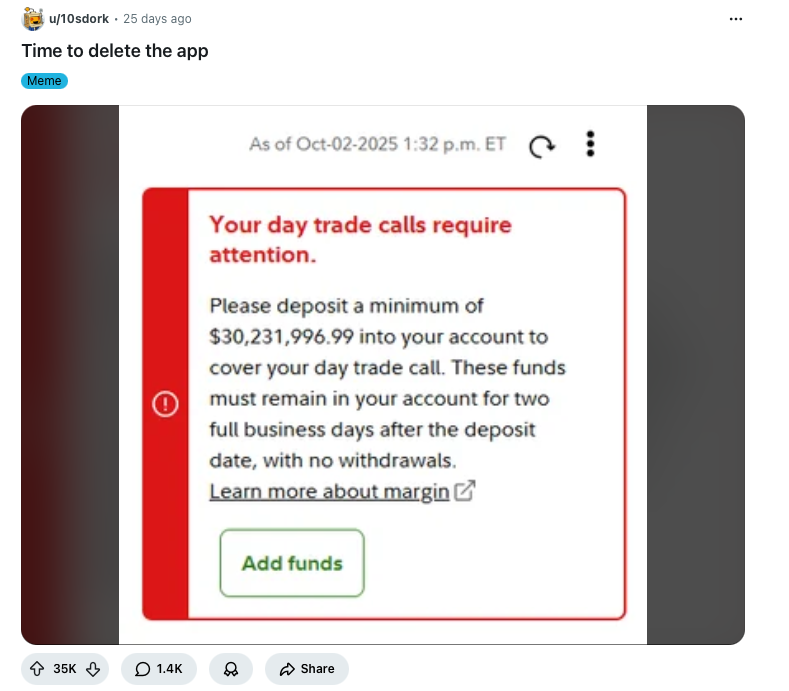

For some, it’s the excitement and the opportunity to make a quick killing.

or not.

Visit the wallstreetbets reddit site and you’ll see a different investing world.

Wrap Up

What is a financial opportunity?

For me, where I’m looking to generate current income while building long term wealth, I’m constantly looking to spot sustainable trends. Ideas that will last 20 or more years.

I love a company like Caterpillar that has been around since 1925 and has a proven track record.

That’s why I like computer chips and energy. There’s a proven track record of consistent and increasing, demand.

Rare earth minerals, specifically those from China…I’m not sure there is a sustainable trend. Even if tensions with China stay high. Can’t we get these minerals elsewhere? Are there alternatives? I don’t know enough about it.

But then again, If I’m just hoping to get in and out and make a quick buck or 2, maybe it’s worth it. While this seems like gambling to me, and I rarely gamble with my money, this is OK for some.