I had lunch with a friend today and we discussed my posts on covered call options. I realized that while I’ve talked about what they are and why we might use them, I haven’t written about how to actually start using them to earn income.

Before we get into it, let’s start with some background. Selling covered call options is a reasonably safe way to generate income. However, we are trading securities so this is not risk-free.

Covered Call Option

When I sell a covered call option, I am selling the right for another investor to buy shares of a security at a specified price on or before a specified date.

-NRG250926C155 is an example of a call option. Let’s break this down.

- Option trading symbols always begin with “-“

- The next series of letters is the trading symbol for the underlying security on which this option is based. In this case NRG Energy (Ticker: NRG)

- Next is the expiration date – 250926 is September 26, 2025

- C specifies this is a call option (v. a put option)

- 155 is the strike price

If I own this option contract, I have the right, but not the obligation, to buy 100 shares of NRG Energy for $155 per share on or before 9/26/25.

You’ll notice that I said 100 shares. Each option contract covers 100 shares.

You can read much more about covered call options here, here, here and here.

Execution

So, we’ve decided to stick our toe in the water and give this a try. We’ve read all the posts, so we know to always buy the underlying security shares first before selling the call option. We never sell naked calls. It sounds fun, but it’s not.

We also know we need to buy 100 shares of whatever underlying security we choose in order to sell 1 option contract. A single option covers 100 shares.

Choosing an Underlying Security

I need to buy 100 shares of a security. How do I choose?

Before buying, first make sure the security has options trading. Some don’t.

In my Fidelity account, the little chain-link symbol tells me that options are available, and I can click to see the option chain, which is a list of the option trades available for this security and the bid/ask prices.

We’ll get into the option chain in a bit but let’s stick with choosing an underlying security. Here’s my criteria:

- I always prefer to use a security I own. I own NRG so I’ve researched it, created a thesis. I’m committed, so if the security price pulls back, I’ll be happy to hold these 100 shares for a while. We could certainly buy shares of a company that is unknown to us, but we need to do the research first.

- Price – I need to buy 100 shares so Booking Holdings (Ticker: BKNG) at $5,450 per share isn’t a great choice. 100 shares will cost $545,000. Perhaps Fastenal (Ticker: FAST) at $47.46 per share is a better choice.

- Price range – I would likely not buy shares of NRG today in order to sell covered call options. I love NRG, but the stock price is up 88.43% this year. That seems a little extreme for an energy company. I’ll look for something that has not had such a huge run-up.

- Sentiment – My broker shows me what the analyst sentiment is towards each stock. I don’t usually pay a ton of attention to this because I’m investing in a stock for many years. But for a stock for option trading, I’m typically holding only a month or so, so I’m more concerned about the short term sentiment.

- Risk v. Return – I’m looking to maximize return and minimize risk. I usually pick a few companies that I’m interested in purchasing for covered call option trading. Then I look at the option premium to try and get the highest premium on what I feel are the safer companies. More on this in a sec.

Here’s the sentiment.

So, I end up with 4 or 5 companies that I’d be happy to add to my portfolio, that haven’t run up too high in price recently, with positive short term sentiment, and which pay a reasonable option premium.

Choosing the One

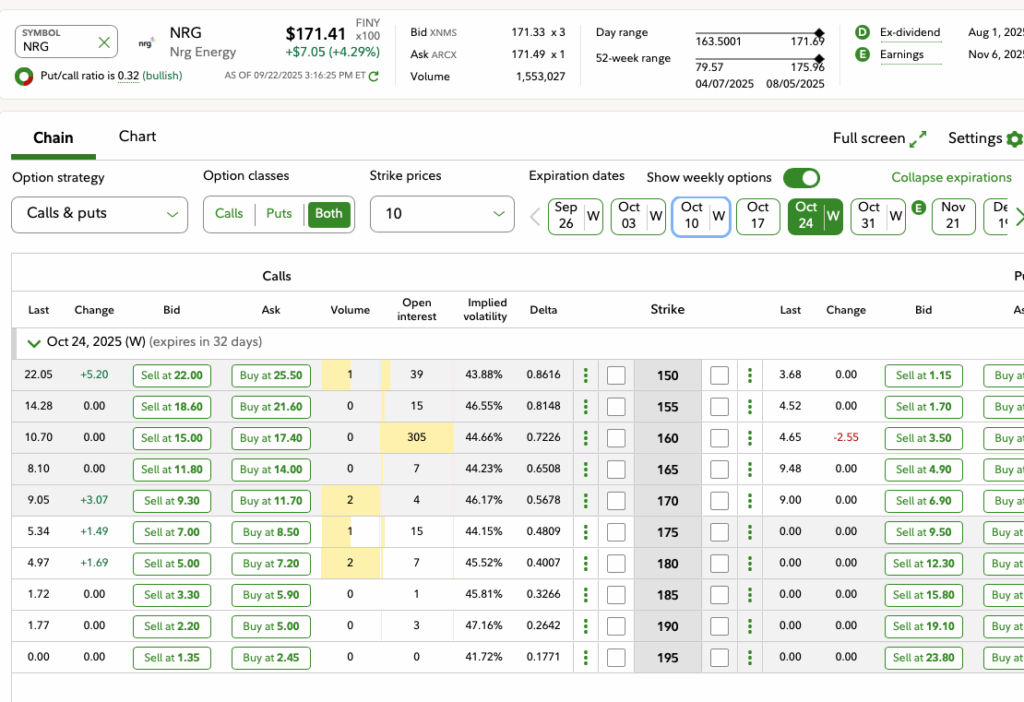

Let’s say NRG is one of the stocks I’m considering. I click on the option chain and I see:

I see that NRG’s current stock price is $171.41. I’m showing calls and puts by default. Calls are on the left. I’ve chosen to show only October 24 expirations. We could do Sep 26. Oct 03….up into next year. But I’ve found the sweet spot for me is about 30 days. This gets me the highest premium for the shortest amount of time.

Since we’re selling covered calls and our goal is to make money, we always sell calls with a strike price higher than the price at which we paid for the underlying security.

It’s very easy to start selling options for strikes lower than the price we paid to get a higher premium. The higher premium looks cool, but then we end up losing on the stock sale so we end up losing more and more money. Stick with strike prices above buy price to stay safe.

In this case, we’d buy NRG for $171.41 per share. It would cost us $17,141 for 100 shares. We’d sell the Oct 24, $175 call option for $7.00.

We’d get $700 immediately in option premium. That’s a $700/$17,145 = 4.08% return. Sweet! For One Month! Annualized would be 4.08 x 12 = 48.96%.

On October 24:

- If NRG closes below $175 (say $160), nothing happens. We keep the $700 and the 100 shares

- If NRG closes at or above $175 (say $200), we still keep the $700 and we sell our shares for $175 each or $17,500.

Sell to Open

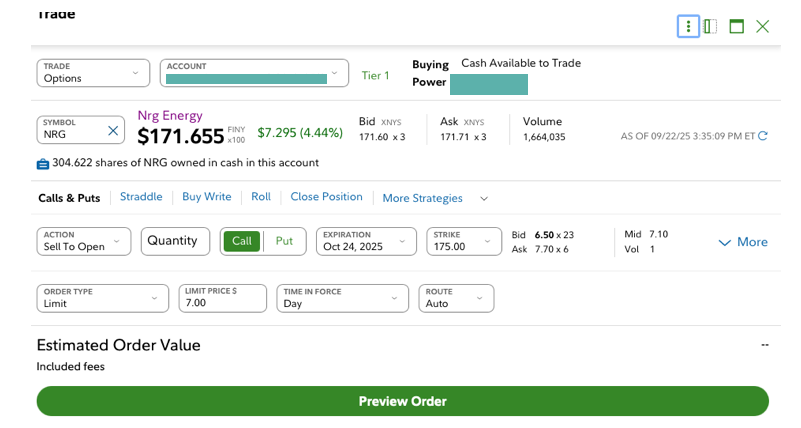

When we click on the little Sell at 7.00 button we see:

We are selling to open a contract. We’re the seller because we are getting the premium and giving up the option to buy. If we had a change of heart later, we could buy to close. We would pay money to purchase the contract and close out the option.

We bought 100 shares, so we are selling 1 contract. And our limit price is $7.00. We’ll sell at or above $7.00. We can see the current bid is 6.50 but the ask is 7.70. A new ask from us for 7.00 is likely to sell right away because the next lowest ask is 7.70. But we never know for sure.

Sold

Once we’ve sold, we’ll see something like this in our brokerage account

I mentioned that NRG seemed a little high at $171. I actually bought 100 shares and sold a covered call last month when the price was $153. I also already had 204.622 shares that I’m holding long and not writing calls against because I love NRG.

Below the NRG position, we can see the 155 call. I bought shares at $153 and sold the covered call contract that allows someone to buy them at 155. The yellow NE tells us it is near expiration. It expires on Sep 26 – this Friday.

We Don’t Trade

Selling covered calls for premium is fairly safe. Trading options is not.

The NRG call option has value. I sold it on 8/18/25 for $5.37 per share or $537 for the 100 share lot. NRG was trading at $153 at that time. NRG is at 171 now – quite a bit higher.

Wouldn’t you like to buy 100 shares of NRG for $155 right now? Of course we would. We could turn around and sell it for $171 and make a quick $1,600 profit.

That covered call option that I sold for $5.37 is now worth $17.50. I’ve essentially lost $1,212.67 because I sold the option for a lot less than it is worth now.

We can see a correlation. The stock price is up about $1,600. The option value has increased by $1,212. The dollar amount is similar, but because the cost of the option is much lower ($537 for my option sale v, $15,300 for the 100 shares of NRG), the % change of the option is exponentially higher.

Some investors trade options so that they can experience an exponentially higher gain with the same $ investment. They can also experience an exponentially higher loss.

With naked calls, our potential loss is unlimited.

This is why we do not trade options and we stick with covered calls at strike prices above our initial share purchase.

Price Swings – Don’t React

Just as knee-jerk reactions in stock or fund investing often cause pain, the same goes for options.

If we are buying shares specifically for option trading (meaning that if we’re optimistic about a company, we’re buying some shares and holding them and not selling call options against these shares) and we’re taking a reasonable premium for the option trade, we shouldn’t care about price swings in the underlying security or in the option.

Having second thoughts and deciding to buyback our NRG call at $17.50 after selling it for $5.37 is a recipe for disaster. Remember, it’s x 100 so we got $537 and we buy for $1,750. That’s a quick 200% loss.

Stick to your knitting.

What’s Next?

Our broker handles everything.

In most cases, 3 things can happen.

- The option expires because the underlying security doesn’t close at or above the strike price. The option disappears from our account positions and we see an expired transaction in our history.

- The underlying security closes at or above strike and our broker sells the shares at the strike price, credits our account with the proceeds and the shares covered and the option are removed from our account positions.

- Infrequently, the option holder may choose to exercise the option before the expiration date. This may happen after a big run up in the underlying security price, or may happen just before the ex-dividend date because the option buyer wants to be the shareholder of record on record date so that they can get the dividend payment. This works just like #2, but on a non-regular Friday option expiration day.

Wrap Up

I find covered call options to be a nice way to make a few extra bucks.

There is risk. Even if we only buy underlying stocks that we like and research thoroughly, and we always sell option contracts at strikes above our purchase price, we can still lose money.

Stock prices of great companies can do crazy things.

I bought 100 shares of Amazon for covered calls in 2022. Shortly after, Amazon’s stock price pulled back and stayed down for months. I got a small premium for the initial sale, but I was unable to resell options for a while because the price had dipped so far below my purchase price.

I held on until the price recovered, but sometimes the price doesn’t recover. Whirlpool and VF Corp didn’t recover. I took some premium and then lost far more than the premium when I had to sell the shares at a loss.

This is one reason I like to stick with companies with lower share prices. I can diversify my option trades so that if one tanks, it may be offset by others.