So what exactly is a stock split?

It’s pretty simple. A company reduces the price of its stock, while simultaneously increasing the number of shares that each shareholder holds.

Pizza

Lots of experts like to use the pizza example.

The pizza represents the company.

Pre-stock-split, I have a pizza cut into 4 large slices. Each slice is 1/4 of the pizza. As a shareholder, I own 1 slice, or 1/4 of the company.

After the stock split, the same pizza (no one had a bite) is cut into 8 slices.

The company, represented by the pizza, is the same pizza both before and after. It’s just cut differently.

As a shareholder, I had 1 slice before, so I had 1/4 of the pizza. Post-split, I have 2 slices, but I still have 1/4 of the pizza. They’re just smaller slices.

Netflix

In today’s example, Netflix is the pizza. Yum!

Netflix just split its stock after market close on Friday, November 14. Let’s take a look at what happened.

First, Netflix lets shareholders (and everyone else) know.

While this article is from 3 days ago, the actual announcement was weeks ago, to give all the accounting and trading systems time to prepare.

Split Date

I said after market close on Friday November 14th, while the much smarter folks at the Motley Fool said Monday, November 17th.

We’re both right.

Trading and accounting systems will start to update shareholder records on Friday after the market closes.

They’ll do this over the weekend so that on Monday morning November 17, Everyone’s ready to trade at the post-split price.

Example

Back to Netflix. It’s splitting 10 for 1. We’ll talk about why in a minute.

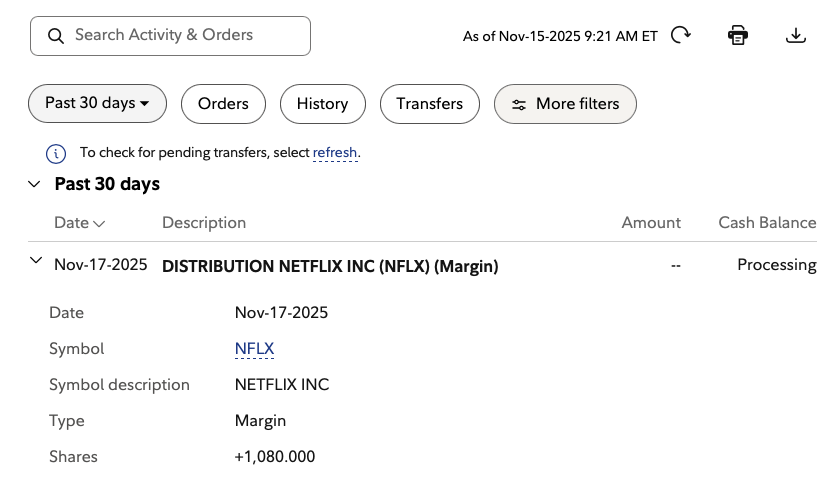

I woke up to see this in my brokerage account transaction history.

I had 120 shares of Netflix on Friday at 4pm.

Since Netflix is splitting by a factor of 10, and the price is dropping by a factor of 10, I need to have 1,200 shares to remain even. To adjust accurately, my broker adds 1,080 shares to my account. 1,080 + my original 120 = 1,200.

At the same time, all the trading and record-keeping systems on the planet are updating the price of Netflix.

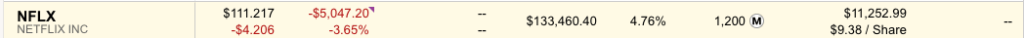

On my position page I see:

That’s the price in the first data column $111.217.

On Friday, before market close, I held 120 shares at $1,112.17 per share.

Today, I have 1,200 shares, but the price of each share has been cut to $111.217.

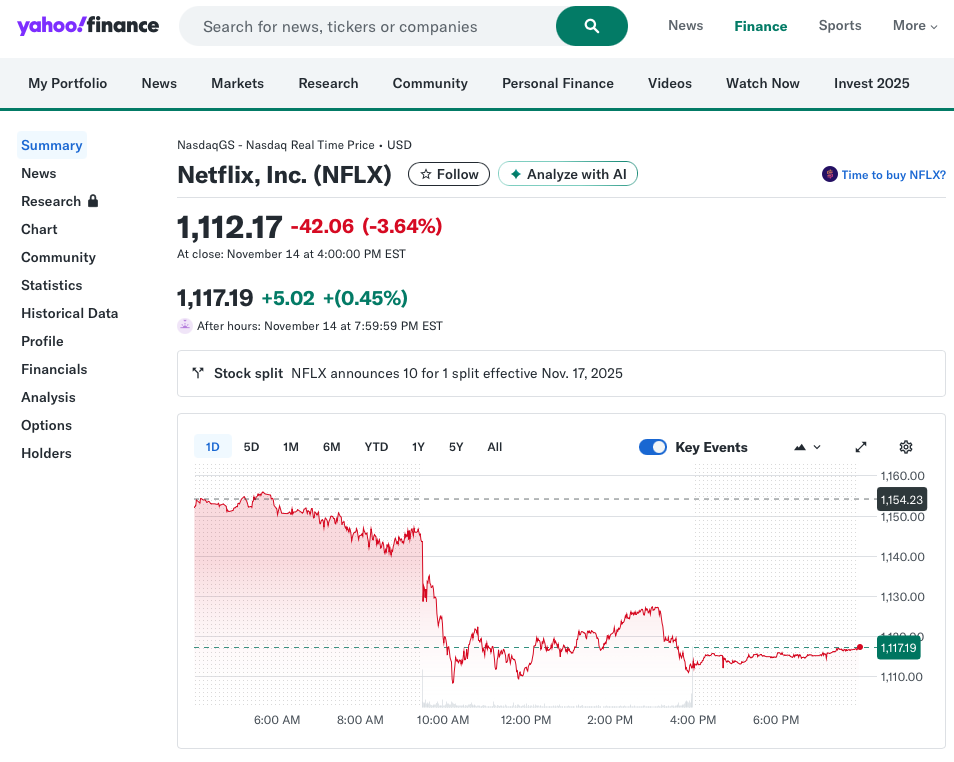

Yahoo hasn’t gotten the memo yet. They still show the Friday closing price.

I’m just kidding about Yahoo. They got the memo and they’re ready, but it takes a couple of days for the new data to flow through all the systems.

Think of all the places we see stock prices and the number of trading systems out there. This is no small feat to get them all aligned on the change without sending shareholders into a tizzy.

Imagine if Fidelity had not updated my shares on Friday night and I woke up to see my 120 shares valued at $111 each instead of $1,112. It would have appeared as if I’d have lost a fortune. And even worse, if on Monday, I sold my 120 shares because I panic’d over the huge drop. Everything would be out of sync.

Buy and Hold

While we’re here, let me put in a plug for buy and hold.

Netflix is one of my largest stock positions. Not because I invested a lot. I only invested $11,252.99. And that was over a period of several years.

I held onto those shares for years, and some were pretty bad years. I can remember Netflix being down 80% at one point. I sat on a loss for years until it recovered.

The hold part is hard.

While I’m enjoying the shares that I have that have increased in value, I did some panic selling of Netflix shares that I had purchased in 2003 and 2004. Imagine what they would be worth today? I’d be writing this from my yacht.

Holding for years and decades isn’t always a recipe for success, but buying a basket of stocks that we believe in and holding, while supplementing with some nice low-cost S&P 500 funds, can be a winning strategy. But volatility is the price we pay.

Why Do Companies Split Their Stock?

…and we’re back.

There are several reasons that a company may want to split its stock.

The biggest is that a lower share price may attract more investors.

At $1,112, many investors won’t be able to buy a share of Netflix. If I have $500 that I want to invest, I’m out of luck. That’s not true today – most brokerage platforms allow us to buy fractional shares, but 5 or 10 years ago, I’d be forced to either buy something else, or save up until I had enough to buy a full share.

More liquidity, lower share prices and thus more trading is good for the capital markets.

Index Membership

Who doesn’t aspire to be a member of the Dow Jones Industrial Average (Dow) or the S&P 500? As a company, that’s the ultimate in cool.

But some of the indexes have rules for membership in the index and one is price. This is especially important for the Dow, which is a price weighted index. A higher stock price, means the company has more influence on the daily price swings of the Dow.

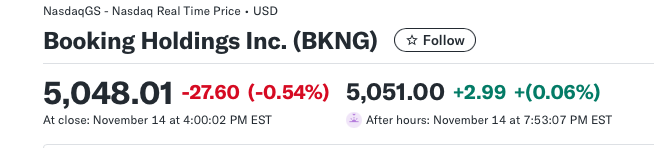

If all the dow stocks are trading in a range of $50 to $200, no one company has a huge influence, but add a stock like Booking Holdings that trades at $5,048 per share and it skews the index.

Options

I’m a huge fan of the covered call option to make a few bucks. Read my posts here, here and here.

I would not touch any other type of option with a 10 foot pole.

With covered call options, I buy 100 shares of a company, and then I sell the right to buy those shares at a specific price, on or before a specific date.

I could buy 100 shares of Bank OZK at $44.10 per share. It would cost me $4,410.00 to buy the shares.

I could then sell a December 19 call option with a $45 strike price on those shares for $1.20 per share. I’d net a cool $120 (remember, this is based on 100 shares).

When December 19 rolls around, if the shares are trading above $45, the option buyer will pay me $45 per share and take the 100 shares. I make an addition $0.90 per share, so $90 on the sale.

If the shares are trading below $45, I keep them and the option expires. I still keep the original $120.

I love Netflix. Let’s sell a covered call on Netflix.

Before Friday, I would have to buy 100 shares at $1,112.17 per share. It would cost me over 100 thousand dollars!!! I love Netflix, but not that much.

But come Monday, Netflix is trading at $111 per share. I can pick up 100 shares for $11,000 – roughly. That’s reasonable.

Reverse Split

In a stock split, a company is reducing its share price.

In a reverse split, the company is increasing its share price and lowering the shares outstanding.

Dying companies do this.

Once a stock price get’s below $5 per share, it becomes a penny stock and they no longer trade on an exchange. Bad things typically happen next.

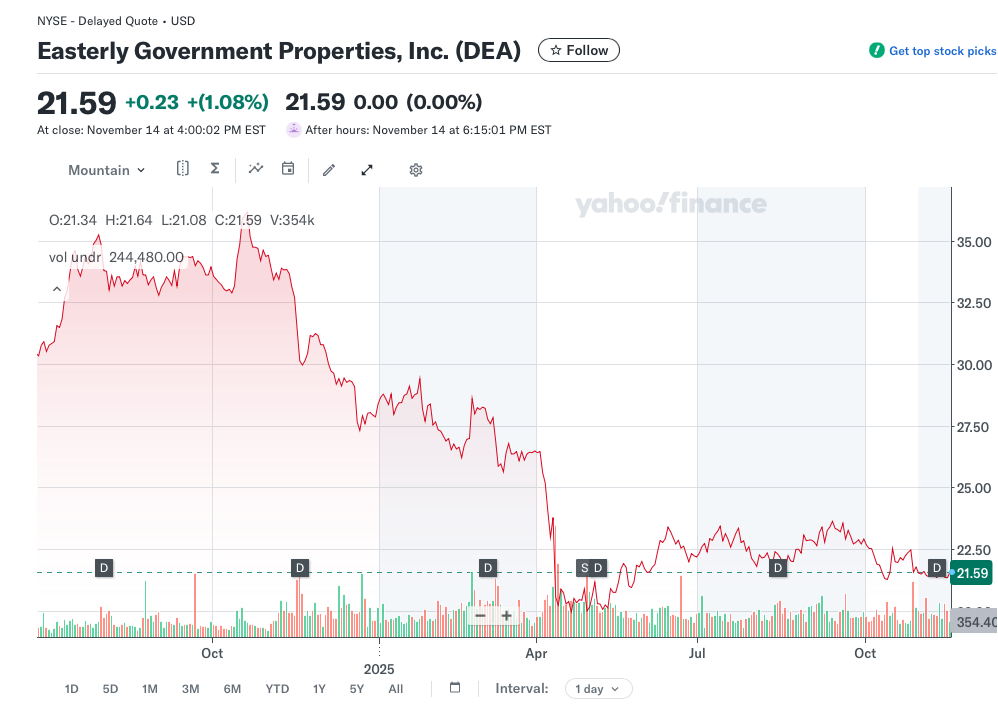

I sold shares of a company called Easterly Government Properties (ticker: DEA) prior to its 4:10 split in April 2025.

I bought DEA for its roughly 8% dividend but still lost $9,617 in total on my investment. DEA is a REIT that sells office space to the Government. COVID, slow return to the office, government layoffs and the shut down have not been good to DEA.

DEA seemed like a winner to me pre-Covid. By 2024, I gave up. It has continued down over 30% since I sold.

While I love buy and hold, when the thesis changes – and Covid was a thesis changer for many companies – it may be time to get out.

A reverse split is not necessarily a thesis changer – it’s mostly a non-event just like a split, but it may be a good indicator that it is time to reexamine the company.

Wrap Up

For buy and hold investors, stock splits are meaningless. Same pizza.

For the exchanges and the capital markets, they’ll be more liquidity, so that’s good for them.

With fractional share trading on most brokerage platforms, we weren’t prevented from investing, but that wasn’t true a few years ago. And psychologically, some investors are turned off by a high price tag for a single share.

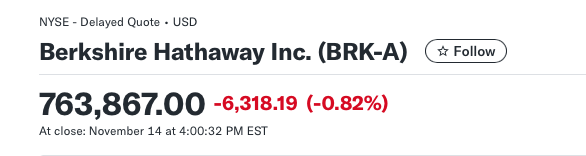

Berkshire Hathaway A shares anyone? $763 thousand for 1, but we could by 1/100th of a share.

And I’ll probably buy 100 shares of Netflix and sell a covered call in a few weeks. There’s sometimes some craziness right after a split, so I’ll let things settle.