To many people, a stock is something you trade to try and make some quick money, but a stock is a whole lot more than that. In this post, we’ll look at what a stock is and how it works.

First and foremost, a stock represents equity ownership in a company. When you buy a stock, you become an owner of a small piece of a business. As an owner, you have a voice in how the business is run and you participate in the profits of that business. Pretty cool, huh?

Let’s start with an example

Most of us are familiar with Coca Cola. Who hasn’t had a coke and a smile? But did you know that Coca Cola is a publicly traded company and you could become a part owner?

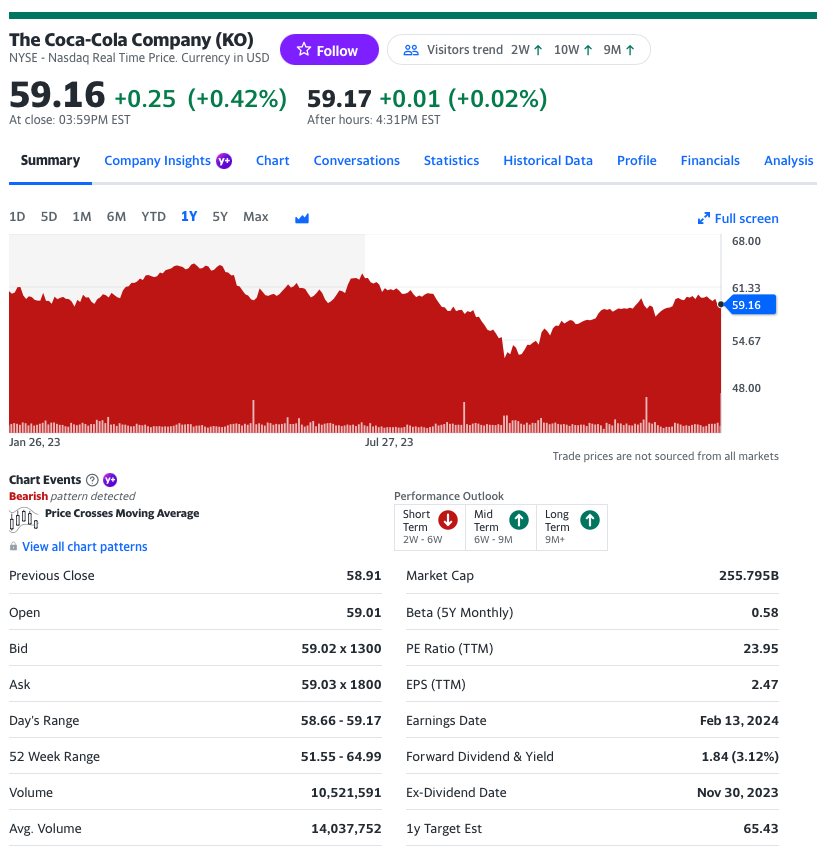

I’ve included a screenshot from yahoo finance which tells us a lot of what we need to know about this business.

- The trading symbol for the Coca Cola Company is KO. This is what you would use to get a price quote or to make a trade

- Skip down to the bid and ask info. The bid tells you that someone is offering to pay $59.02 per share for 1300 shares. The ask tells us that someone is offering to sell 1800 shares at $59.03 per share. At this point no trading will occur because the best bid and the best ask are a penny apart. At some point a bid will go up or an ask will come down and a trade will happen.

- Volume shows that today, over 10 million shares of KO were traded.

- Average volume tells us that on a typical day, over 14 million shares are traded.

- The Market Cap is what the market (investors) values KO at. The calculation is pretty simple. The closing price of KO is $59.16. There are roughly 4.32 billion shares of KO outstanding. 4.32b shares x $59.16 per share gives you roughly $255b, which is the market cap you see in the right column above. (note: Shares outstanding are not on this page – you would click on the details tab to find it)

- Beta tells you how volatile this stock is compared to the market overall. A beta score of 1 means it is roughly even with the market. A score of .58 means it is much less volatile than the overall market. This means that when the market moves 1%, you would expect KO to move .58%.

- PE Ration (TTM) is the price to earnings ratio for the trailing twelve months. This is calculated by taking the price now ($59.16) divided by the earnings per share. This is an important metric. You are buying a company to grow your wealth. A key factor in a company’s growth is its ability to earn profits. PE tells you how much you are paying for each dollar of earnings. This is extremely relevant in comparing the value of 2 stocks in the same industry, it becomes less relevant as you cross industries.

- Forward dividend and yield tells you that as a shareholder, you will receive $1.84 per year in dividends for each share you own. That $1.84 represents a 3.12% yield on the $59.16 value of your share (1.84/59.16).

- Ex Dividend date is Nov 30. There are 4 important dates related to dividends:

- The dividend declare date is the date that the company announces that it will pay a dividend along with the details of that dividend payment

- The record date means that every shareholder of record (owner) at the close of business on the record date is entitled to a dividend payment

- ex dividend date is the 1st day that the company is trading without the dividend as part of the company’s assets. All things being equal, the company’s stock price will decrease by the value of the dividend on this date.

- the pay date is the date when the dividend is paid out to shareholders. It will either show up as cash in your account or you may choose to reinvest dividends, in which case, the dividend will be used to buy more shares of KO.

Company Ownership

So now that we know a little bit about the Coca-Cola Company, let’s talk about what it means to be an owner. You can be an owner with only 1 share of KO. You could go out tomorrow, pay roughly $60 and own 1 share. As we discussed, there are over 4.32billion shares of KO outstanding so you own 1/4.32billionth of the company. You likely won’t be moving into the corporate headquarters anytime soon.

But you are an owner. As an owner, you will receive a proxy statement to vote at company meetings. You will vote for things like the board of directors, the company’s executive compensation package, and any resolutions that other shareholders may have submitted for the shareholders to vote on.

As an owner, you also participate in the company’s profits. When a company earns money, there are really only a few things they can do with it. They can invest it to grow the business (buy more buildings, hire employees, etc.), they can pay down debt, they could give it away (many companies donate to charity, fund scholarships, etc.) or finally, they can give the profit to the owners.

Great, right, more profits to the owners – damn 1%…..wait a minute…we own 1 share. We are owners.

Ownership Benefits – Dividends and Buybacks

Here are 2 common ways that companies will pay the owners. The first is a dividend payment. We learned a little about this above. Companies that pay dividends typically commit to paying the dividend every year and often strive to increase the dividend annually. KO is a great example. It is a Dividend King. Dividend Kings are companies that have increased their dividend for 50 or more consecutive years. KO is at the stage of its business lifecycle where it is a well-known and successful brand. It generates a ton of cash, but it is no longer growing quickly – it’s pretty big already. It needs to do something with that cash so it pays it to the owners in the form of a dividend.

The second way a company can return capital to shareholders is to buy back shares. KO has 4.32 billion shares outstanding. It could take some of that money and buy shares on the open market and destroy them. Why would they do this??? Reducing the share-count makes each remaining share more valuable. Let’s say KO buys back 1 billion shares. There would then be 3.32 billion shares outstanding. You now on 1/3.32billionth of the company – that’s a bigger piece. And all the earnings multiples improve. For example, the earnings per share on the screenshot above are 2.47 – that means that over the trailing twelve months, KO earned $2.47 for every share. If you reduce the share-count, the earnings per share increases. You now own a more valuable company.

Capital Gains and Losses

Capital gains and losses are an important part of company ownership. Let’s look at an example. Say you bought 1 share of KO a while back for $50. From the quote above, we see that KO is now priced at $59.16 per share. Your $50 investment has increased in value by $9.16. That $9.16 increase is called a capital gain. If you choose to hold onto that 1 share of KO, it is an unrealized capital gain. If you choose to sell your share today, you will receive $59.16, of which $9.16 will be a realized capital gain. This is important for a discussion we’ll have in a later post on taxes.

Similarly, you could have a capital loss if the you paid more for the stock than it is currently worth.

Growth Stocks and Value Stocks

You’ll hear people categorize stocks as growth or value….What does this really mean?

Growth Stocks

Don’t be fooled by the name. Growth stocks are not guaranteed to grow. Growth stocks are typically fairly young companies that have aggressive plans to grow their business. When you invest in a growth company, you are willing to accept that the company may have no profits today, it may even be losing money, but you expect that it will grow significantly every quarter and at some point will become extremely profitable.

It’s hard to determine the value of a growth company because its balance sheet looks awful. It usually has lots of debt, to go along with the low to no profits. What you should expect to see is significant growth in revenue and customers every single quarter. These are the companies that drop 20%, 30%, or 40% in a day when they miss on growth projections at their quarterly earnings release. Growth companies have a high beta. You’re in for a rocky ride. Growth can be huge, but there is no guarantee they’ll achieve their goals.

Value Stocks

Value stocks tend to be stocks of older, reliable, low-growth companies like KO. Often they are great businesses whose high growth days are behind them. It’s easier to value them. They have lower PE ratios, and they often reward shareholders through dividends and share buybacks. They likely have years of consistent performance metrics to help you assess their long-term prospects. Again, there are no guarantees that these companies will increase in value.

Let’s take a quick example to demonstrate. Tesla (TSLA) and General Motors (GM) both sell cars. GM sold roughly 6 million vehicles in 2022. GM has a market cap of roughly 52 billion dollars. Tesla sold roughly 405,000 vehicles in 2022, about 5 and a half million fewer vehicles than GM. Tesla has a market cap of 610 billion dollars. Tesla’s market cap (value of the company) is 10x greater than GM, even though it sells far fewer vehicles. Investors are willing to pay a huge premium for shares of Tesla (compared to GM) because they expect that over the coming years, Tesla is going to grow much faster than GM. We’ll dive deeper into this in an upcoming post, but for now, I think it is helpful to see a real life example of growth v. value.

Investing in a Businesses

I’ve intentionally used the words business and company rather than stock. This is because I think it changes our mindset. There are lots of folks on social media who are trading stocks, and they are happy to tell you about huge gains they’ve made. More power to them, but there are few winners in this game, and it is a game. This game is won (easily) by trading firms. These firms have supercomputers that analyze all technical data of all companies to search for minute discrepancies in the bid/ask spread. They trade huge volumes of shares in hopes of making a small profit over and over throughout the trading day. These firms move their computers close to the exchange to have a sub-second advantage over other traders. How can we compete?

Here’s the secret. We don’t. Instead we invest in businesses that we plan to hold for the long-term. KO is a fantastic example. If you invested $10,000 in KO in 2000 and you re-invested every dividend to buy new shares, you would have over $40,000 today. That’s a gain of over 300%. Will KO continue to be a great investment? Who knows. It certainly has some headwinds. Fewer and fewer people are drinking sodas. I’m not advocating for KO, but I am advocating for finding businesses that have a strong brand, a competitive edge, a solid balance sheet, and I love companies that pay a dividend. It’s hard to watch our companies lose value – they all do at some point, but it is so much easier if you are receiving a dividend along the way.

In Closing…

The key point to remember is that owning a stock is owning a piece of a business. Before you invest in a business, you need to make sure you understand the business. What does it do? How does it make money? How much debt does it have? Is it growing? How does this business compare to similar businesses in the same industry? Who is running the business?

The good news is that today you can find all this info with a few clicks. Go to your brokerage website or to Yahoo finance, and it is all right there. Your brokerage website will likely have research reports on publicly traded companies so you can find out what professional analysts are saying about the company and the industry.

Owning a business is risky. Companies can make bad decisions, can lose money and can go bankrupt. A company that has paid dividend for years may decide to cut the dividend payment or terminate it entirely.

Even great business go through downturns. I just went through a painful one with one of my largest holdings, Amazon. It’s been a great long-term winner for me, so I bought more shares in 2022 at about $120 per share. Over the next few months, it dropped steadily and at one point hit $84 per share. That’s a 30% drop. I’ve done my homework on Amazon, I’ve held shares for almost 20 years and I believe in the business. Sticking with a company that drops 30%, 50% or even 80% (I’ve had a few 80% drops) is painful, but it is easier if you understand the business and can assure yourself that the reasons you purchased the company in the first place still hold true.

Owning a business, or many businesses can be rewarding. There is risk, but I don’t want to discourage you. If you do decide this is right for you, I would first recommend 2 books.

- One up on Wall Street by Peter Lynch – Peter Lynch is a legendary investor who managed the Fidelity Magellan fund and beat the market for many years. He’s a great storyteller and the book is informative and a pleasure to read.

- The Intelligent Investor by Benjamin Graham – This is a must-read to understand how to evaluate companies. It is a tough read. Power through, it’s important info and it’s worth it.

Owning businesses is easy today. Most brokerages will allow you to trade at no cost, and will allow you to buy fractional shares of a company. Let’s look at an example of what it means to buy fractional shares. Booking.com (BKNG) is one of my favorite travel sites and (in my opinion) a solid investment. I’ve help it for many years. BKNG trades for $3,547.22 per share today. You may be interested in investing but may not want to pay over $3,000 just to buy a single share. Most brokerages will let you buy $100 (or any amount) worth of BKNG.

If you want to invest in companies but this seems too difficult and time consuming, mutual funds are a great alternative. You still need to do some work. Read my post on mutual funds to learn more.