There has been a lot of excitement about taxing the rich via a tax on unrealized gains. Check out this article from CNN here.

The title says:

Ignore Social Media?

In general, I agree with this strategy. Social media is a breeding ground for misinformation.

The CNN article is clear that the proposed legislation targets taxpayers with a net worth greater than $100 million. I fall under this threshold as do many of my readers.

So We Can Rest Easy?

CNN also states that this legislation is unlikely to pass.

The $100 million threshold and the fact that it is unlikely to pass are good news in terms of risk to you and me. That’s good news, right?

But we need to keep our eyes on this type of legislation. Let’s talk about why.

Taxes

When we think about taxes, there are 2 prominent items to consider.

Debt

First is our national debt. You can read more here.

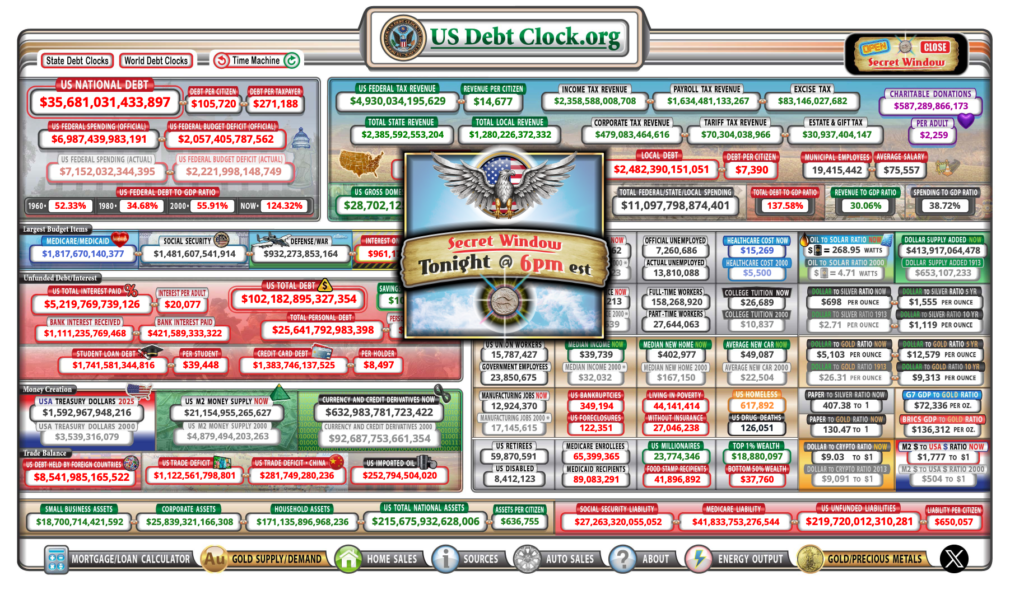

Or check out the government’s debt clock here.

There’s lots of great info here. Our debt is more than $35 trillion. Our annual tax revenue is about $5 trillion.

If we fired every government employee, stopped paying interest on treasury securities, stopped all federal paving, bridges and infrastructure projects, shut down the military and diverted all of our tax revenue towards paying down debt. We could pay this off in 7 years.

Now, that’s just silly. There’s no way we could do this.

In fact, we continue to spend more and more. Congress can’t agree on a budget so we keep passing interim spending bills to avoid a shut down. We keep coming up with new spending programs like the Inflation reduction act – which didn’t seem to reduce inflation because it injected more money into the system while the fed was trying to remove money by raising interest rates.

We also want student loan forgiveness, additional aid to families, Ukraine support, and more funding for the bump in immigration.

Whether you feel these programs are necessary or not, they all cost money and without a budget in place, the only way to fund them is by taking on more debt.

Debt is likely to grow. The only way to address this is by raising taxes. Or maybe a government bake sale?

Millionaire Tax

The millionaire tax proposals that are floating around try to address this by taxing unrealized gains. We’ll talk more about this in a sec, but the thing that worries me is that our government rarely finds a tax it doesn’t like. If the millionaire tax brings in more revenue, how long do we think it will be before we start expanding the scope of this tax and it starts to hit the rest of us?

Mini Wrap-Up

Just a quick recap. US Debt is higher than it has ever been. This is true when measured by $ (35 trillion) or by % of GDP (around 124% – you can see this number on the debt clock). Read more here.

We don’t have an effective budget in place to reduce debt or to handle any of our new legislation, executive orders, or any new spending.

Without a budget in place, and one that includes some spending cuts, the only thing the government can do to reduce debt, or to fund new programs, is raise taxes.

Millionaire Tax (again)

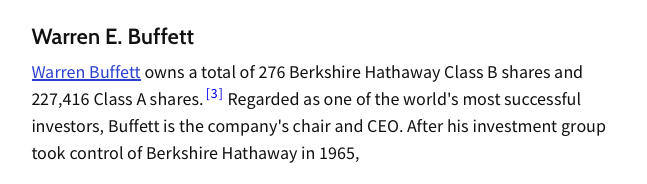

This is why the millionaire tax is so attractive. Warren Buffet (who seems less polarizing than other billionaires) has over $145 billion according to Forbes.

Let’s get our hands on some of that excessive wealth. Let’s tax him and his buddies.

The problem is that Warren’s salary is $100,000 per year. Read here. Even if we move him into a 100% tax bracket, this only brings in $100,000 in taxes.

Most of Warren’s wealth is tied up in shares of Berkshire Hathaway. Read here.

Berkshire class A shares closed at

…so 227,416 shares X $693,839 per share = $157 billion-ish. That’s even more than Forbes has him at!

So how do we tax Warren to get a piece of that?

Unrealized Gains

The way we want to do this is by taxing his unrealized gains.

Today, we only pay paxes on realized gains. When we sell a stock, bond, mutual fund, house, antique car, painting, or any other item, we pay taxes on realized gains. In simple terms, we subtract the purchase price (cost basis) from the sale value, and that is the realized gain amount. We are then required to pay taxes on the realized gain.

If we want to tax unrealized gains, we need to take a look at the stuff people own, establish a value for it, subtract the cost basis and then tax them on the appreciation.

In Mr. Buffet’s example, we’d need to get his cost basis for his Berkshire A shares and subtract this amount from the $157 billion. This would give us his unrealized gains and we’d make him pay taxes on that amount. We’d also have to assess his home, paintings, and other stuff since we want to apply this fairly to all unrealized gains.

Price Drops

Berkshire A shares have had a pretty good run this year. They are up over 20%.

Let’s say next year there is a pullback. Berkshire A shares drop 10%. Mr. Buffet’s ownership value drops by $15.7 billion to around $142 billion. He’s already paid taxes on $157 billion so I would expect that the federal government now owes him a substantial payment for that $15.7 billion drop in value that he’s already paid taxes on.

And if there is a stock market pull back, it is likely the housing market may pull back and his home value may decrease. We may owe him some money for that as well.

RecordKeeping

As you can see, this is a record-keeping nightmare. For both the government and for tax payers. Warren can afford a new accountant or 2, but how much do our taxes need to go up to pay for new government employees and systems to monitor this?

Other Considerations

So, to me, this sounds like a nightmare.

One of the great things about being a billionaire is that they often have houses in many different places. If tax payments in the US become a significant problem, folks like Mr. Buffet can easily move to a more tax-friendly location.

Will they? Some likely won’t, but some will.

Also, if we’ve gone to the trouble of implementing these processes, we may want to start lowering the threshold. Especially if we find some of the billionaires are moving their residency outside the US. How long before a version of this starts to hit you and me?

Wrap-Up

I am ignoring social media. I don’t think I’m in danger of losing my house any time soon (at least not for millionaire tax reasons) but I am watching this closely.

The US national debt is a problem. Tax revenue is not keeping up with expenses and the debt continues to grow. Short of a very successful bake sale, the only thing the government can do is raise taxes or find new things to tax. And they seem pretty excited about taxing unrealized gains.

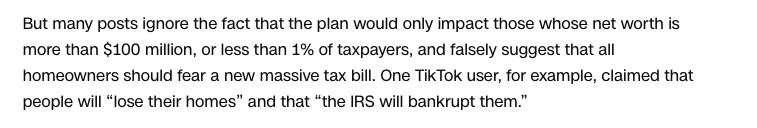

I also get concerned when journalists say:

This is a quote from that same CNN article.

I think it does a disservice to readers when journalists focus only on one piece (in this example, the proposed legislation) without considering the larger picture, specifically our growing national debt and our constantly increasing government spending.

I believe taxpayers should be concerned (maybe not fear) additional taxes. An author of an article about a new tax proposal might want to consider a broader scope to help readers understand the bigger tax picture.

Don’t panic, but keep an eye on this.

“Taxing unrealized gains” is a non-starter & single, biggest DUMBEST campaign proposal I have seen in my lifetime – full stop. NOT WORTH a detailed analysis. I have to believe someone as blatantly unqualified as Kamala Harris to lead our country must know this, so it seems to me like yet another thinly-veiled attempt by a radical liberal like Kamala “the hopeful liar in chief” Harris floats out their to try to convince her radical friend she has new ideas – yet knows it will never fly but her “redistribution of wealth” & “ tax the wealthy” friends will like the sound to her closest friends. ANY sane person sees through her charades & potentially economy shattering ideas! There is one candidate who is a real danger to our democracy & her name is KAMALA HARRIS!