Welcome to retirement.

We’ve spent 40 years of our life socking away money and now it’s time to start spending the money we’ve saved. This should be easy, right?

Unfortunately, it’s not as simple as we might have hoped. And the potential impacts of taxes could cost us. Let’s take a look.

Account Types

If you’re like me, you have several different account types, and may even have different sources within a single account. Before you skip to the next post, let’s simplify this.

In general, the accounts we’ll talk about will either be after-tax, tax-advantaged or tax-free. Only 3 types. Not so bad.

And hold on the sources for now – that’s pretty easy too.

After Tax Accounts

After tax accounts are accounts where we deposit money – drum roll please – after we’ve paid taxes. These are also known as taxable accounts.

Let’s say I get my paycheck. I take it to the bank (I know this is all electronic now, but bear with me), I take $100 in cash to buy stuff and I put the rest in my savings account. That savings account is an after tax account. I’ve already paid payroll taxes on that money.

As a general rule, we only get taxed once on any money. So in this case, we had taxes withheld from our paycheck so this money will not be taxed again.

We will however, pay taxes on interest earned. Let’s say we have $1,000 in this account and we earn 5% interest. For the year, we’ll get $50 in interest so our new balance is $1,050.

We payed taxes on the $1,000, but not the $50. The $50 in interest represents new earnings and we’ll pay taxes in the current year.

Make sense? I don’t like it but I understand.

Your CD, Brokerage Account, and High Yield Savings are typically all after tax accounts. We pay taxes on the money before we deposit it so that cost basis will not be taxed again. Any earnings will be taxable in the year they’re earned.

Tax Advantaged Accounts

There are 2 types of tax advantaged accounts. We’ll start with tax deferred and then talk about the other. Hold tight.

For tax deferred accounts, we pay no taxes on the money going in.

I had a traditional 401k for most of my working years. The beauty of a 401k is that money comes out of our paycheck each month and is automatically invested for us. But if we look closely at our paycheck, the 401k contribution comes out before taxes are calculated.

If our paycheck is $1,000 and we’re contributing $100 to our 401k, we’ll only be taxed on the amount that goes into our pocket, not the amount that went into the tax deferred 401k. So we’re taxed on $900 in earnings. Don’t get too excited though because we’ll get taxed on the rest later. That’s the deferred piece.

Traditional 401ks, 403bs SEPs and traditional IRAs are all typically tax deferred accounts.

I specify traditional, because the other type is Roth, and Roth works a little differently.

Roth

A Roth is a tax advantage account but in this case, we are taxed on the money when it goes in, but there are no taxes on earnings or distributions. Let’s look.

I get the same $1,000 paycheck. I defer $100 into my Roth 401k. I pay taxes on $1,000. Thats’ the first difference. My company withholds on the full amount.

But after that, it’s party time!!

I pay no taxes as the balance grows, which is the same as the traditional 401k, but I pay no taxes when I withdraw the money.

And here’s why that is so cool.

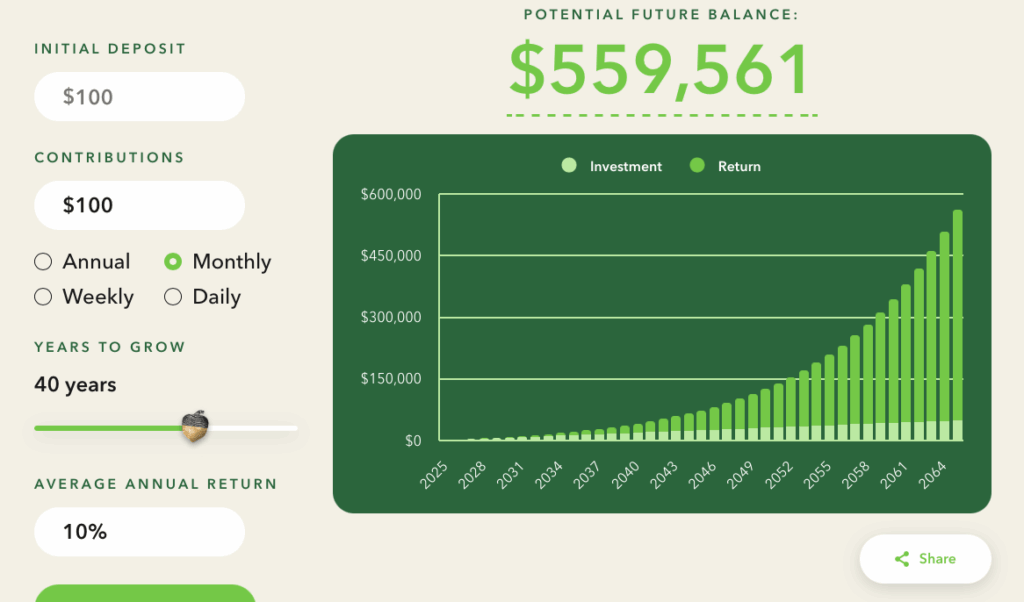

Here’s what happens if I take $100 out of every monthly paycheck for 40 years. I invest that $100 in a nice low-cost S&P 500 fund. Note that the S&P has averaged 10% return per year with dividends re-invested over the last 100 years or so.

I’ve got a pretty sweet balance of $559,561 when I retire.

Tax Impacts: Roth v. Traditional

If that’s a Roth account, I have $559.561 to spend in retirement.

If that’s a traditional 401k, I have something less because I’ll need to pay taxes. Assuming I’m at a 10% tax rate in retirement, I’ll pay $55,956 in taxes when I withdraw.

Here’s an example.

A contribution of $100 per month for 40 years is (100 x 12 x 40) = $48,000. That’s what I contributed. For a Roth, I was only taxed on the $48,000. I am not taxed on the gains of roughly $510,000. No taxes!!!

For the traditional, my paycheck was a little larger because I didn’t pay taxes on the $100 contribution each month, but I’ll pay taxes on the full $559,561 at withdrawal.

Would you rather pay taxes on $48,000 or $559,561?

Even if our tax rate is lower in retirement, I’d take the Roth and only get taxed on the way in.

Sources / Contribution Types

I mentioned the account types above, but I also mentioned sources. The reason I did is that often our 401k is not a Roth or a Traditional 401k. It’s just a plain old 401k.

For most 401ks, I, as a participant, can choose whether to make traditional contributions (with no taxes taken out) or Roth contributions (taxes taken out but no taxes ever again – yay!).

And some 401ks will let us switch between the 2. I made traditional contributions for years and then when my company started offering Roth contributions, I switched.

Sounds complicated, but our company’s retirement plan record-keeper handles all of the complexity. They keep track of contributions and earnings by source so they can send us the appropriate tax forms when we take our money out.

Tax Free Accounts

This is the holy grail. No taxes going in, no taxes on earnings and no taxes going out. The triple tax advantage.

This is our Health Savings Account (HSA). We need to enroll in a High Deductible Health Plan (HDHP) in order to qualify for an HSA.

Once we have an HSA, we can contribute, up to a government max each year. As long as we use the money for qualified medical expenses, there are no taxes on withdrawal.

However, after age 65, we could take our HSA money out and buy a boat. We’d pay taxes on the withdrawal, but we never lose HSA money. It’s ours.

Read the details about an HSA here

Mid-Term Wrap Up

That’s a lot.

But it is important to understand the tax implications of each of our accounts so that we have a better understanding of which accounts to withdraw from first in retirement.

And this is an important point. For many of us our IRA or 401k will live on long after we retire. Retirement isn’t an event where we drain our 401k and start spending. In most cases, we’ll stop contributing, but the money in that account will stay invested and continue to grow as we take our distributions to support our spending.

And when we hit 75, we’ll start MRDs – minimum required distributions. Traditional accounts are tax deferred, but Uncle Sam will only wait so long for his tax receipts. Come age 75, you’ll be required to take money out each year and pay the taxes due.

Again, your 401k or IRA record-keeper will likely figure the amount out for you.

So Which First?

I’ve got a High Yield Savings, a CD, a taxable brokerage account, an HSA and a 401k. I’m 65 and retired. I need some cash to pay bills. What account do I take it from?

To make this fun, we’ll go in reverse order.

Remember, the primary driver for this decision is minimizing taxes.

Leave the HSA for Last

My HSA gives me a debit card to pay expenses. Don’t do it.

Why?

Tripe tax advantage. Let this one grow as long as possible. Choose a proper asset allocation, but don’t be afraid to put some of this money in a nice low-cost S&P 500 fund and let it run for years.

No taxes for medical expenses, and when you’re 82, you’ll have lots of these.

Even if you don’t, use it at 82 to buy a boat and pay taxes. You won’t lose the money you just have to pay taxes on the full distribution.

IRA and 401k

Whether they are Roth or Traditional, this money has tax advantages. Let it grow as long as possible.

If we’re in a situation where we have both Roth and traditional contributions, I would take the traditional first. Let the Roth continue to grow tax free as long as possible.

After Tax / Taxable Accounts

This is where I’d go first.

I’ve been retired 5 years now and I’ve been selling shares in my taxable brokerage account to pay for my spending.

Fortunately, or unfortunately, most of the positions in this account have been invested for close to 20 years. The cost basis, or the money I put in, is relatively small. I would typically take a couple hundred dollars when I had it, move it to my brokerage and buy a few shares of my favorite companies.

Over 20 years, those positions have grown, so most of what I take is capital gains on the earnings growth. I paid taxes on the cost basis going in, I paid taxes on the dividends each year, but the gains were unrealized, so no tax. When I sell, I realize the gains and pay a 15% long-term capital gains tax on the capital gains portion.

Depending on your income, the long-term capital gains rate could be zero.

One caveat here is that if we’re in a CD or other account that has a penalty for early withdrawal, we want to avoid this. If that were the case, I’d probably take tax deferred money first. I hate paying penalties

Wrap Up

Understanding the taxability of our various accounts and sources can be crucial for maximizing our retirement income. We’ve saved for most of our working lives and for most of us, pensions are a thing of the past.

Yes, there’s social security, but that won’t cover everything.

Minimizing taxes will help our savings last longer.

Nice explanation.

Does it make sense to convert money in a standard 401K into a Roth 401K?

HI Mike, yes, I think so. I have been converting a chunk each of the past few years. I believe my tax rate is going up – look at the national debt. Someone has to pay it. We’re at historically low tax rates today. I’m converting fairly small amounts that won’t bump me into the next tax bracket and us old guys need to worry about IRMA (if your income is too high, we pay a higher rate for medicare). So there are things to balance, but I’m all for creating a pile of cash that will never be taxed.