It’s easy for us to get stuck on a price for something. We get it in our head, and we never want to pay more than that price, because that is what it’s worth. With inflation running rampant, my wife has a price in her head for eggs, bacon, her favorite bottle of wine, and nearly everything else she buys. If it goes above that price, we don’t buy it. We wait for a sale. That’s anchoring.

While this is a reasonable strategy when shopping for a commodity item like eggs, it may not make sense when purchasing an asset like a stock, a mutual fund or an ETF. Let’s talk about why.

Stocks

In our post on stocks, we learned that owning a stock is owning a small piece of a public company. While yesterday’s egg is pretty much the same as today’s egg, tomorrow’s egg and next month’s egg, a company is changing all the time. I was reading an article this mornig about Home Depot’s purchase of SRS Distribution. Read the article here.

Home Depot is spending $18 billion on this acquisition. For that, it gets a new business with 760 locations across 47 states that it believes will help Home Depot grow its customer base in the professional contractor space. Some agree that this makes sense, others think it’s a foolish waste of capital, but either way, Home Depot with SRS is a very different company than Home Depot of last week without SRS.

Because a stock is a share of a living, breathing company that is constantly changing, we need to keep re-evaluating what is a fair price for a share.

Mutual Funds & ETFs

Same for mutual funds and ETFs, they hold a basked of securities and each of these securities changes in value from hour to hour, not just day to day.

Car

Let’s look at another example. Most of us own a car. As we are painfully aware, that new car that we just spend $40,000 for may be worth only $37,000 as soon as we drive off the lot. See more on car depreciation here.

If you have an older car that you’re trying to sell, you may put on a new set of tires to help boost the price. Even a thorough wash and wax will likely get you a few more dollars.

The point is that the car’s value changes constantly. The same is true of businesses, and of funds and ETFs.

Why is This Dangerous?

Great question. As an investor, anchoring on a price may prevent us from buying more shares. If the price was $105 last week, why would I pay $110 or even $150 today? It makes sense to us that we would wait for more certainty in the market and buy more when the price returns to the price we have “anchored” in our mind.

But we may wait for a price that never comes and miss out on a great investment opportunity.

How Do We Know?

Let’s look at a couple of examples and we’ll talk about mitigating the risk of overpaying as well as ensuring we are paying a fair price for an investment.

Dollar Cost Averaging

In an earlier post here, I talked about dollar cost averaging. This is a strategy where an investor puts their investment purchases on autopilot. The investor makes regular purchases regardless of the price. Often this is done through an employer’s 401k plan where money comes out of each paycheck and is invested in securities within the plan.

The beauty of this is that investment occurs regardless of price. The investor buys some shares at lower prices, and some at higher prices but avoids buying all shares at a market peak.

The point here is that the investor continues to make additional investments.

Fear of Overpaying

At any point in time, it’s easy to find lots of articles about high inflation, possible recession, and other doom and gloom scenarios. As an investor, we may choose not invest more money for fear that prices will come down and we’ll have made a foolish purchase.

Is it Reasonably Priced

Rather than anchoring on price, it is important to assess whether an investment is reasonably priced. After reading the Berkshire Hathaway Annual Report (see my post here), I came away wanting to own more shares. Railroads and energy had struggled but insurance and some of the other businesses were strong. More importantly, I liked the message from management. It’s a company I want to own for the long haul.

So I went back and looked at how much Berkshire I own, and the prices I’ve paid for shares. I bought some in 2011 for $75.76 per share. I bought more in 2012 for $79.61 per share, and I bought some earlier in 2024 for $409 per share.

How could I possibly spend $409 per share after I had bought shares for just $75.76? That doesn’t sound reasonably priced!

Earnings Growth

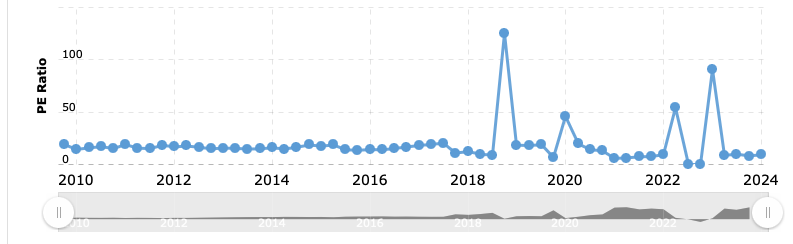

Berkshire has had pretty strong earnings growth over the past 50 years or so. One of the key metrics I like to use to value a company is price to earnings. This tells you how much you are paying for each dollar of earnings. See the charts here.

The key one to look at is the p/e ration for Berkshire over the last 15 years.

There are a couple little anomalies there, but if you look closely you’ll see that the p/e today is a bit lower than in 2011. If I buy shares today, I would be paying less for each dollar of earnings than I had in 2011. All things being equal, Berkshire seems like a better investment today at $400+ per share than it was in 2011 at $75 per share.

Wrap-Up

The danger of anchoring on price is that we, as investors, may hold off on investment until there is greater certainty in the market and prices decline. There is almost never greater certainty in the market. There is always risk, and the risk is often something we can’t predict such as a war or a terrorist act.

Prices may not decline for a long time, and when they do, do we wait for further declines? It is very difficult to win on timing the market.

In my opinion, it is better to find interesting investments (like Berkshire) and look to see if they are fairly priced. There is more to this than p/e, but that’s a good place to start. Read the post on investing thesis for more.

For my mutual fund and ETFs, I like to invest regularly. In the past, I’ve done it through an employer 401k. Now, I manually space out my investment at regular intervals. Who knows what the market will do in the short term, but this prevents me from buying at the peak.

Thanks for reading. Let me know what you think.