After 2 consecutive years of 20%+ gains in the S&P 500, it’s time for market-watchers to start warning about the market being overvalued. Even Jaimie Dimon is expressing caution. He thinks investors need to temper their expectations.

But what does this really mean? And more importantly, how should I change my investing strategy to react to this?

Good questions. Let’s dig in.

Over-Valued

Simply put, general optimism, excitement about corporate earnings, inflation (possibly) subsiding and certainty in the oval office have caused stock prices in general to rise. Looking at the S&P 500 as a proxy for the overall market, this seems accurate.

There is no question that the S&P 500 has gone up, but let’s zoom in to some interesting details.

S&P 500 Weighting

The S&P 500 is a market-capitalization weighted index. It is a list of the 500 largest publicly traded US companies, weighted by market cap. That means a $3 Trillion company like Apple has a much higher weight in the index than $43 billion Fastenal.

Here are the Top Holdings (taken from SPY which tracks the S&P 500)

If you watch CNBC at all, you’ve heard about these companies and especially NVDA which is up well over 1,000% in the past 5 years.

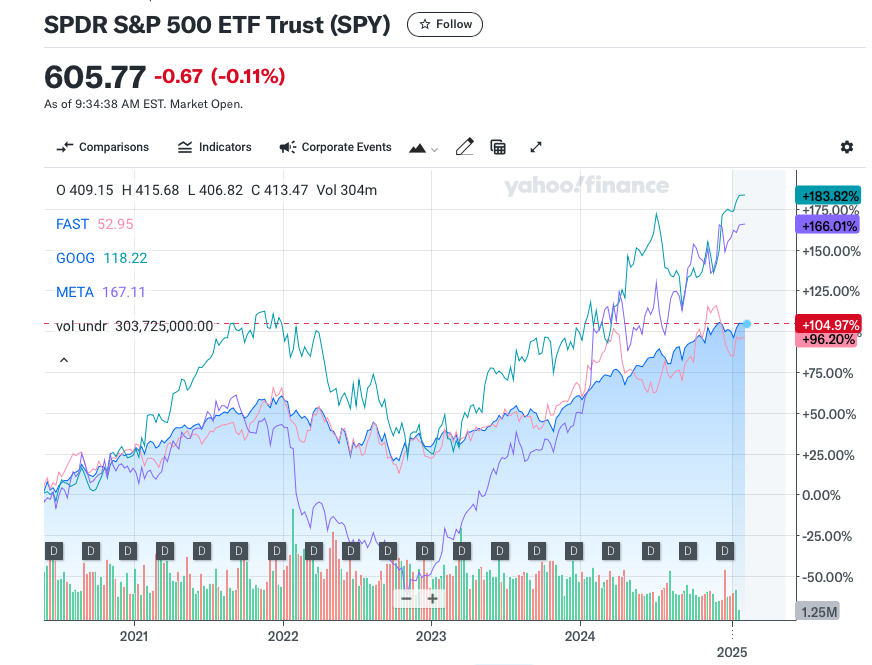

Looking at some sample companies in the chart below, we see that the weighted average (the index) performed quite well. Some out-performers, who also happen to be the highest weighted companies, also known as the Magnificent 7, have soundly beaten the index, while many other companies have not enjoyed the same gains

A lot of info, my point being that there is a difference between the index price being over-valued and the price of the underlying components.

Some of the components may be quite reasonably priced, or even under-priced (on sale!)

Determining Value

While market-watchers will confidently talk about valuation, and will be happy to tell you that Nvidia is over-valued, what does this really mean? How is value determined?

This is not a science. Value is more easily assessed on a company like Fastenal. Fastenal has been around since 1967 and has a pretty stable business.

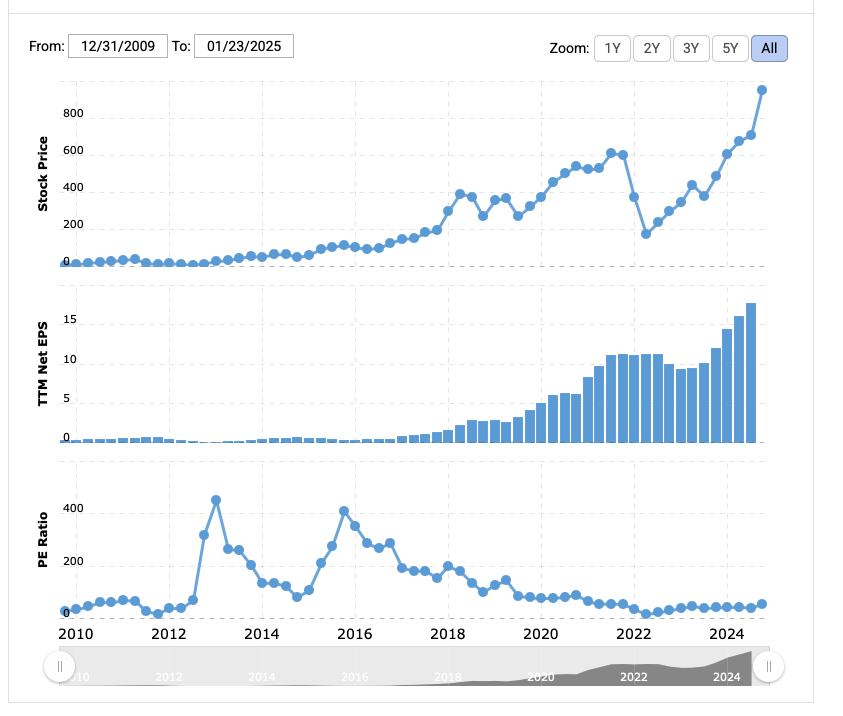

See the below price, earnings and p/e charts from macrotrends. Pretty steady price growth, earnings growth. Some p/e fluctuation as the company follows its cycles of growth/pullback like any company, but it’s fairly straightforward to assess valuation. If you want to learn how, read Benjamin Graham’s excellent book The Intelligent Investor.

Or you can read research reports on your brokerage site where Harvard MBAs have been nice enough to do the calculations for you. They don’t always agree, so read more than 1.

Valuing growth companies like Nvidia or Netflix in its early days is a bit tougher. When Fastenal’s management has an earnings call and makes a forecast for the near future business performance, we have almost 60 years of historical data on Fastenal’s performance, and management’s track record on predicting performance. With growth companies, we don’t have a lot of history and the growth projections are usually quite optimistic.

Any growth company worth its salt (or share price) needs to project 20% or more growth annually. The valuation is based on the value of the business (which is often negative in the early days) + the expected value of the growth in sales and then ultimately the economies of scale that turn revenue into profits.

Growth investors need to have a healthy dose of optimism.

Price v. Earnings

I wrote a post a while back about anchoring on price. I won’t recap everything here, but at a high level, we all have a tendency to get a price stuck in our head. Whether it’s gas at $2.50 a gallon or eggs at $2 a dozen, we somehow establish the right price and evaluate the current price based on that.

Same for stocks. When the price goes above that, it’s over-valued. Below, it’s under-valued.

The danger here is that earnings, opportunities and other business fundamentals keep changing.

This is why I try and think of companies and not stocks. Companies are dynamic. As they change, their value changes.

Earnings are a big part of evaluating a company. If a company can demonstrate that they can grow their earnings, the company is worth more.

For a growth company, demonstrating meteoric sales growth and having a strategy to translate that growth into earnings makes for a more valuable company.

And a more valuable company merits a higher stock price.

But Not Always

Events happen in the world economy that impact price.

We are in the midst of an inflationary period. With inflation, things cost more and borrowing money gets expensive. This hurts us, but it also hurts all businesses. Not all equally, but all are impacted. That’s why we saw an overall pull-back in the early days of inflation. This was an economic driven pull-back that had something to do with business fundamentals but was not directly linked to all companies equally.

Contrast that with 9/11. Airline stocks tanked, travel tanked, and then the whole market pulled-back. Similar things happened in 2000 when the internet bubble burst, and in 2008 when the housing crisis hit. Sometimes an event will impact stock prices of all companies even though it may have little to do with the business fundamentals of some companies.

Remember Netflix

I had a bit more preamble than expected (though I should probably know better) so let’s bring it back to Netflix.

Netflix is not a member of the Magnificent 7, but it was a FAANG stock back in 2013. Netflix had periods of huge growth and periods of huge declines. It was a growth company whose stock price shot up as investors saw huge subscriber increases.

Though it was not uncommon to see a 20% or more pullback in a day when a quarterly earnings announcement alluded to lower than anticipated growth or higher expenses that might slow the transition to profitability. And then the whole quickster debacle tanked the stock for a year or so.

Netflix has made the transition to slower growth and higher profitability. I had to laugh earlier this week when one of the commentators on one of my favorite podcasts suggested that Netflix may pay a dividend in 2025. It seems like it was just yesterday that Netflix was burning through cash like nobody’s business.

While Netflix has transitioned to profitability, it still remains a high-growth company with the high expectations that come with it. It has a p/e of 48 which means that a lot of optimism is baked into the current price. For perspective, JPMorgan Chase, a well-run bank that consistently beats earnings projections, has a p/e of 13.

Netflix Earnings

Netflix reported earnings this week and the stock price shot up 13%. Subscribers grew by over 16% year over year to over 300 million. Revenue was better than expected and earnings per share more than doubled. Read more here.

A quick look at the price, earnings and p/e chart show us:

Price has skyrocketed. But earnings growth is outpacing price growth. the p/e ratio today of 48 is below the p/e of the pre-2020 years.

Is Netflix over-valued or under-valued? The price now is almost $1,000 per share. I have some shares in my brokerage account that I bought for $85.

The price is a lot higher now. But the company is profitable now, it wasn’t then. And earnings are improving almost every quarter. The market may be over-valued, but I think you could make a solid case that Netflix is under-valued.

Wrap-Up

We need to be careful how we react to statements like the market is over-valued.

First and most important, we shouldn’t react. I think there is solid evidence that the S&P 500 is over-valued. But, there was evidence it was over-valued in 2011, and it continued to go up for 7 more years (where it took a brief pause, and then it went up some more).

Second, think about your investing time horizon. If the money that you have in a nice low-cost S&P 500 fund is going to be used for expenses this year or next, it shouldn’t have been in an S&P 500 fund anyway. Maybe it’s time to take it out. But that is an asset allocation decision. Money we need in the next 5 years should be in a low volatility asset class like cash or very-short term treasuries.

If your time horizon is longer, we know the S&P 500 will fluctuate wildly but we’ve got evidence that over the past 100 years or so, it has provided roughly 10% return per year on average with dividends re-invested. And there are no periods of 20 years in which the S&P 500 has lost money, and in most, it has returned the expected 10%. Read more here.

I’m 61. 62 in May – yikes. The time horizon for some of my investments is 30 years. I am planning to 92. If I make it to 93, I could be in trouble.

I know that I’ll need to sell some securities this year to pay my expenses. Same next year and every year thereafter. But I’m not selling everything. I expect to hold my shares of Netflix to the end. Same for my Amazon and Apple shares.

I was bummed in 2023 when AMZN dropped to below $90 per share. That was a huge paper loss for me that year. Though I was still up from my original purchase price of less than $10 per share. Today AMZN is at $234 per share. I have no doubt that it will beat the market in the next 10, 20 and 30 years and I have no plans to sell it before I hit 90.

So what does the market is overvalued mean to me? Not much. I continue investing. I still evaluate companies the same way and I expect that investments in a nice low-cost S&P 500 fund will be worth significantly more 20 years from now.