I don’t do business with National Public Data, so why should I care?

Here’s why.

Data Brokers

National Public Data is a data broker. In the post Your Parents Need Your Help, I talked about data brokers. Data brokers gather up data about us. Much of this is publicly available on social media sites, but some of it is bought from other sources.

I’ve written about the Gas Buddy app selling data to data brokers about people’s driving habits. Read more here. Insurance companies are using this to help set rates. I recently read where GM got in hot water for selling driver data to insurers. Read more here.

Data Brokers like National Public Data are gathering up information about us and selling it. What do you think their vetting process is? In other words, if a criminal wants to buy data, do you think that a data broker would recognize them and turn them away? Unlikely.

What Happened?

A massive data breach at National Public Data may have exposed personal information, including social security numbers, of over 2 billion people. Read more here. This is not cool.

There’s a lot of discussion about what really happened and whether it was 2.7 billion, or 2.9 billion, but while this plays out, it is important to stay focused on the fact that this is a huge breach that likely exposed the personal information, including social security number of lots of folks.

How Do We Know if We’re Impacted?

The linked article at CNBC mentions sites where we can go to find if our information was exposed. I do not recommend putting your social security number in here to search. As a rule, it is best to avoid sharing your social security with anyone or any site on the internet unless you are very certain you can trust that site.

I put my name and zip code in and yup, I’m impacted.

I’ve also been notified by 2 services that monitor my information. I subscribe to Norton Lifelock and Apple Card ID Theft Protection.

Identity Protection Services

I mentioned that I currently use 2 services. I’m cheap so I don’t pay for either.

I get Norton Lifelock free with my Fidelity Signature Visa card. I’ve talked about this card before. I get 2% cash back on every purchase, but the recently added free Norton Lifelock account is a big deal. I set up my account and I can add credit card numbers, bank account numbers, my SSN, and other personal info and Norton Lifelock searches for my info on the dark web and for data breaches related to my info and notifies me.

The apple card service is similar. I set up an account and enter my info, and I get notified of breaches. Both sites have a dashboard where I can see any alerts and dig into details.

Check your credit card perks. You may be entitled to a free subscription. Sign-up. It’s worth it.

Other Ways to Get Identity Protection

I have gotten mail from companies that I’ve done business with telling me they had a data breach and my information may have been compromised. In each case, the company has offered me identity protection services for no charge for a period of time. In each case, I have signed up. For some of these, I’m still getting protection even though the offer period expired.

Read these letters, even though they are long and boring. If they are from a legit company with whom you’ve done business and they offer a legit protection service from a known company like Norton, it may be worthwhile to sign-up.

But Be Careful

Be very careful of free identity protection sites, or identity protection scams. On my Norton Lifelock site, I have entered my SSN, credit card info and bank info. I’ve dealt with Norton for many years personally and in my professional career so I am familiar with them. I also did some research before signing up to get comfortable before entering any personal info. Be careful.

What Else Can I Do?

I am a big fan of the credit freeze. Read more in my post on credit scores.

When we apply for credit – a loan or credit card, or we open a financial account, the financial institution will verify our credit history with one or more of the 3 credit rating agencies, Experian, Equifax, and Transunion. If the financial institution is unable to verify our credit history, we will not be allowed to open an account.

By setting a credit freeze, we are locking our credit history so no one, legitimate or otherwise, can check our credit history. This means that no one, including us, can open a financial account with our name and SSN.

This provides a huge measure of safety for us, especially if our information was exposed. I set up a freeze on my SSN, my wife’s, and my mom’s several years ago.

The one drawback is that if I legitimately want to open a new credit card or apply for a loan, I need to go the the Experian, Equifax, and Transunion website and shut-off the freeze. Luckily the website address, the ID and password are all stored in my password manager so this is fairly simple for me. Hint: You need a password manager.

Set Up Alerts

These days, our credit card and bank account websites often offer us the ability to set up text and email alerts for different situations. I have text alerts for:

- Any foreign transactions. If my card is used outside the US, I get an alert.

- Any purchase over $300. Most of the stuff we buy is under this limit, and even though we frequently buy stuff for more than $300, it is nice to get a text alert so I can verify that the transaction is legit right away.

- Payment overdue. I set up auto-pay, but in case this fails, I’ll get a text alert so I can avoid late payment fees and interest charges.

Review Transactions

I use an account aggregator so it is easy for me to see all my account transactions in one place. You can read about aggregators in my post on budgets. But it’s also fairly easy to go through your transaction summary by logging into your bank or card account online or by looking through your monthly statement.

In the past, scammers were obvious. Early on, I would see a $500 charge for international plane tickets, or a $1,000 purchase of a TV. It was easy to see this wasn’t my purchase and I called the credit card company and had the charges removed.

Card companies are getting good at this as well. They see a charge that is outside our normal pattern and they deny it and block the card. This is mostly helpful, but sometimes inconvenient. It was a huge bummer when I was in China taking my team to dinner and I forgot to let my credit card company know. Glad they are on top of this, but ouch.

But, scammers have gotten clever too. On my mom’s account, I had often seen charges of $29.99 and $19.99 from legitimate sounding companies. The amount is small enough that many folks may just let it slide. Look carefully and challenge charges you don’t recognize.

Wrap-Up

Data breaches are pretty common. The equifax breach in 2017 was a really big deal. The National Public Data breach is huge too. And while companies are getting better at protecting themselves, I would be willing to bet that we will see more breaches, and we will see data brokers continue to gather more and more data about us and sell it to anyone with a credit card.

The internet is a great tool for shopping and socializing, but we are not safe out there.

Some of the things that can help are

- Identity protection services from a trusted company like Norton – bonus if your credit card offers this for free

- Utilizing the credit freeze functionality offered by Experian, Equifax, and Transunion

- Setting up alerts for our financial accounts

- Carefully reviewing transactions on a regular basis

While discussing this with Rich over coffee this morning, we started thinking about where else we might be exposed if our social security number is “out there”. Kinda scary. While my credit reports are frozen, what can someone armed with my name, address, phone number and social security number get access to?

I need to think about this and do some research. Stay tuned.

Update 9/9/24

Clark Howard wrote about this here. He’s got some great tips. One of his tips addresses the social security number question Rich and I have been discussing. I have a call in to SSA (1-800-772-1213) to block electronic access to my SSN. According to Clark and the SSA site:

Stay safe and read Clark.

Update 9/16/24

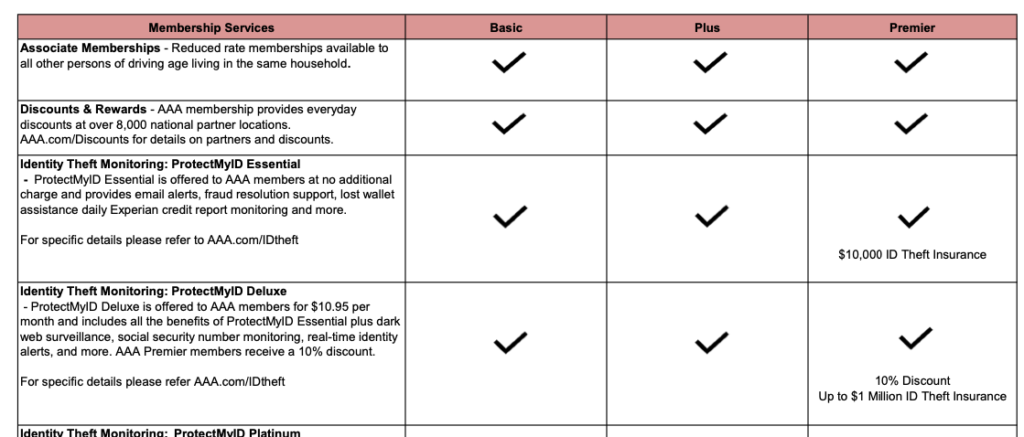

…and another thing…I realized I also get free Protect My ID Services via AAA. Since many folks have AAA, look into your membership. You can likely get identify protection services provided by Experian.

I was reminded this morning when I got an alert from them about the National Public Data Breach.

Read here from the AAA Northeast benefits page

Update 9/18/24

Social Security Block – This blocks all electronic access. This means I can no longer log in to the ssa.gov website. With Social Security Payments just around the corner for me (yes, I’m taking them at 62. Get it while it’s hot!), I don’t want to lose access. I was told by the nice person at SSA that the only way to get it back once blocked is to go to a social security office with proof of identity. Having visited the registry of motor vehicles, I’m well versed in US Government efficiency. Any action that may cause me to visit a government office is likely not worth it.

But…again, thanks to Clark Howard, who writes Should I Create an E-Verify.gov Account To Lock My Social Security Number? Actually, it is written by Christopher Smith, but it’s on Clark’s site.

This is a way to create an online e-verify account and block/unblock your SSN for e-verify purposes. E-Verify is used for employment verification. By blocking it, no one can get a job pretending to be you. I went through the detailed steps outlined in the article (nice work Christopher) and it took me about 20 minutes to block my SSN.