Time is the secret weapon in building wealth. For those who only read the 1st paragraph of an article, I wanted to get this out there first. So there you have it. Let’s talk about why.

Sylvia

In preparing for a personal finance class I was teaching a few years back, I came across an inspiring article about a woman named Sylvia Bloom. Click here to read more. I’ll give you the reader’s digest version. Sylvia was a legal secretary in Brooklyn. She was a child of the great depression and put herself through college, worked as a legal secretary for the same firm for 67 years, and amassed a fortune of $8million along the way.

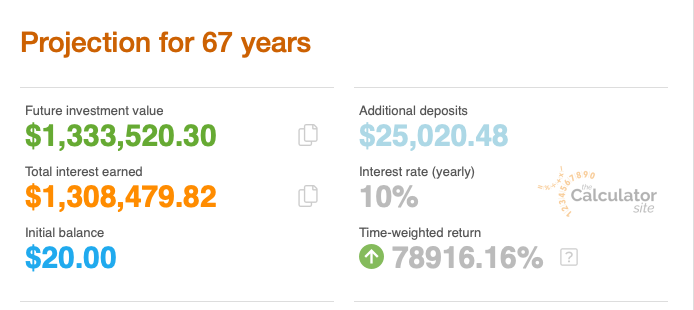

If you dig into the article, you’ll see that Sylvia had some good advice along the way. She invested in the same companies her boss was buying, but I’d argue that you could have pretty good results just investing in an S&P 500 fund. Using an online calculator, I went back in time and assumed I started with an investment of $20. I added $10 a month every month, increasing my contribution by 3% every year (as my salary increased, I added a bit more to my monthly investment). I assumed an annual growth rate of 10%, which approximates the growth of the S&P 500 with dividends reinvested. I wouldn’t have done as well as Sylvia, but I end up with $1.3million. Here’s the results, courtesy of the calculator site.

Pretty impressive. I put in around $25,000 total over the course of 67 years and ended up with well over a million.

The Secret is Time.

Check out the post on compounding to learn more.

Be Optimistic, but skeptical

So for all the skeptics – and you should be skeptical of anything you read, how do I know the S&P 500 will generate 10% returns going forward? Good question. You don’t. But a bet on the S&P 500 is a bet that the 500 largest US companies will continue to grow. And that’s not just a bet on the US economy, the S&P 500 is filled with multi-national companies like Starbucks, McDonalds, ExxonMobil, Microsoft, Apple, Proctor and Gamble, and many many others who receive a huge portion of their revenue from outside the US.

For those who don’t want to go back and read the compounding article, one of my favorite examples that demonstrates the power of compounding is the penny doubling. Say I start with a penny and the value doubles every day.

- I start with a penny

- Day 1 I have 2 cents

- Day 2 I have 4 cents

- Day 3 I have 8 cents

- Day 4, I have 16 cents

- Day 5, I have 32 cents

Big deal, right? What can I do with 32 cents? On day 31, you have $21million. Now you want to check out the post right? Click here.

The penny doubling really starts to get interesting around day 24. What this shows us is that compounding in the short term is not all that impressive, but if we are patient, like Sylvia, and let it do its work over long long periods of time, the results are pretty spectacular.

I’ll Repeat….The Secret is Time.

The problem is that none of us think we have time. Patience is no longer a virtue. Who here hasn’t had a melt-down when Netflix is buffering?

Credit cards, buy now pay later. You can have it now. Why wait?

Do you Need it, or do you Need it Today?

I read an article last week by a woman who said that she’s found a great way to save money. She only shops on Wednesday. If she decides she needs a new pair of shoes on Saturday, she needs to wait until Wednesday to buy them. More often than not, when Wednesday comes, she no longer has the need.

Be Aware of Impulses

Companies are smart – these same S&P 500 companies we talked about earlier. See why I believe in them??? Anyway, these companies are preying on our impulses. It’s like a used car dealer (no offense, I spent some time as a used car dealer). But it’s the same tactic. This price is only good until you walk out that door. Create a sense of urgency.

Opportunity Cost

In a prior post on pet insurance, I talked about opportunity cost, but at the time, I didn’t expand on it. So for all of those who have been waiting with great anticipation…… Opportunity cost is the price you pay for NOT taking advantage of something. By choosing something, you are making a decision not to do something else. In the pet insurance example, I’m deciding to get a pet even though I know it will cost me roughly $4,800 per year in pet expenses. By deciding to get the pet, I am deciding NOT to invest the $4,800 per year for my retirement. I projected that one at a more conservative 8% rate over 20 years, but it comes to an opportunity cost of over $200,000. Extend it to 40 years and it is over $2million.

I’m not anti-pet. Look at the home page of this site and scroll down to see a picture of our dog Rosco. We love Rosco, despite his 2 ACL surgeries and thousand dollar toenail procedure.

My point is that each of us should go into these financial decisions with our eyes wide open. Go ahead and get the pet, buy the shoes you’ve dreamed of, but understand what you are doing. What are the opportunity costs? Every decision isn’t financial, but most decisions have a financial implication.

Stick to Your Knitting

So remember that time is the secret. It’s not easy to adhere to a long term investing strategy for 3 key reasons.

- 1st, there are a hundred dudes on youtube and tiktok telling us how they made millions overnight. I joke about this, but it is a factor. We live in an instant gratification world where there is constant evidence that you don’t need to be patient.

- 2nd, is buy now pay later. More pressure not to wait.

- And finally, the results of signing up for a long term investment with regular contributions can be disappointing in the beginning.

In the penny example, the 1st week is really disappointing. If you don’t have faith that you are on your way to $21million, wouldn’t it be really easy to stop when you have 8 cents? Or buy yourself something nice on day 14 when you’ve got over $100. There’s that new pair of shoes.

Shopify Tested my Conviction

In real life it can be even worse. One example from my investing past. I bought shares of Amazon long ago. Probably more luck than skill. Investing and researching companies is a hobby for me and in May of 2018, I saw in Shopify, many of the things I loved about Amazon when I first invested.

Check out the stock price chart below for the first 7 months of my Shopify journey. After a month, I’m brilliant. After 2, I’m an idiot. After several more brilliant/idiot cycles, I’m 7 months into this investment and I have less money than I put in. However, as we discussed in the post on stocks, we invest in companies not stock tickers. I did some research to see if the reasons I invested in the company still held true. They did, I held on, and today my $5,000 investment is worth over $30,000.

I have lots of stories about companies that stayed flat or dropped, which we’ll talk about in later posts. If all my investments were like Shopify and Amazon, I’d be writing this post from my Yacht. I’m not.

Investing is Learning to Ride out Volatility

The point is that having the conviction to stay the course with your investments is not always easy. Each of us has been tested. We’re just coming off a tough period in 2022 where the S&P 500 was down 18%. It was up 26% in 2023, which didn’t get you back to even if you started investing in Jan 2022, but it got you close. If you got out at the end of 2022, you locked in losses and missed a huge comeback.

We talk about an average S&P 500 return of 10% per year with dividends reinvested. This sounds nice. The reality is that the ride is bumpy. As an investor, you’re trusting that your investments in the S&P 500 will grow, but sometimes they don’t. Sometimes they don’t for a long period of time.

The Secret is Time.

It’s not easy. If it were, everyone would do it. Sylvia did though. I have to imagine she had some days where she questioned herself. I’m sure there were times where she had better uses for the money she invested. Whether she needed new shoes or a car repair, I’m sure she questioned what she was doing.

For some, the secret to building wealth has been winning the lottery, betting it all on #33 in roulette, or buying options on Gamestop. It could work. The odds are not in your favor, but it could. However, the past 100 years have shown us that the odds of buy and hold investing in the S&P 500 are heavily in your favor.