Today I’ve got a couple of things on my mind that I hope you’re all interested in. It’s a mixed bag so we’ll jump around a bit. If you’re a regular reader, you know the drill.

Lunch

What better way to start than with a quick bite. Yesterday, reader Mike and I visited Vincent in Worcester to pay our respects to what could be the finest meatball sandwich available.

Drafts, mixed drinks, animal heads on the wall, what’s not to love. To say the neighborhood is sketchy doesn’t do it justice, but we went during daylight.

This time I opted for the meatball and sausage mix. Sadly they were out of cheese, but still outstanding. Fresh bread from Culpepper’s bakery sets this sandwich apart. Meatballs are home made, sausage is not and I didn’t press the bartender on the provenance (chronology of ownership). With dead animals on the wall, it’s sometimes best not to know.

Outstanding experience!!!

Plan a visit soon. Go during the day.

1980’s 401k Performance Stunk

Interesting discussion about performance and 401ks while snarfing up meatball and sausage. 401ks showed up in the early 80’s. They were new to workers and they were new to employers who offered them.

None of us knew much.

Mike recalled performance being poor. It seemed like when he left his company, he didn’t have much more than his contributions.

In the early days of 401k, employers tended to offer something called a stable value fund. The stable value funds I’ve seen aimed at protecting principal at all costs. A secondary, and far less important goal was to provide some level of income.

Performance was dismal, but they were safe for employers who were concerned that they would be blamed for employees treating their 401ks like a gambling casino.

As time went on, we all kinda learned that there were better ways to invest. Employers offered more aggressive options and stopped defaulting everyone to a stable value fund, and we got smarter about our 401ks as we started to come to grips with pensions going away and needing this new vehicle to provide for our retirement.

That’s Unfortunate

Bad for Mike, but also bad for all those workers who likely abandoned their plans when they saw that their assets weren’t growing.

While it is important to contribute, it’s also important to make smart investment choices. Most plans offer a range of investments across Cash, Fixed Income and Equity. We have the ability to manage our allocation based on our age and financial goals. We often have the choice of target date funds that will do this for us.

Target Date Funds

Stable Value Funds get an F grade in my book. They’re not appropriate for a retirement plan. We need more growth, even if it means more risk.

Target date funds are an improvement. I give them a B-.

Say I’m 25 in 2025 and I’m planning to retire at 65. My retirement date is 2065.

My target date fund starts me at a high equity percentage and slowly moves towards cash and fixed income as we approach retirement age.

A+ on the idea. This is asset allocation and I applaud a fund that does this for us.

My experience has been that these funds are overly conservative – again, since the employer is taking some responsibility in offering the fund, they often want to choose investments that won’t have their employees calling up and screaming at them when the market tanks.

I’ve also seen that they underperform the S&P 500 by a long-shot. While this isn’t a totally fair comparison since the target date fund has other asset classes by design, choosing a target date fund early in our career may cause us to forgo some hefty gains compared to being more aggressive and allocating more to an S&P 500 fund.

Here’s a comparison of the Schwab 2065 target fund with the S&P 500.

However

They are far better than a stable value fund and they do fill an important need.

Many don’t have the knowledge, time and inclination to research funds, create an appropriate allocation and select investments. For these folks, a target date fund is an outstanding option. Picking the wrong funds for our situation could be far worse.

Many folks take the annual mailing from their 401k provider, see which funds performed the best in the prior year, and move their money into these funds. Congratulations, if you’re one of these folks, you’ve mastered sell low and buy high.

Funds rarely hold the top or bottom spot 2 years in a row, Fund performance varies year to year and often a low performer one year is a top performer the next.

Constant selling and buying is bad, but selling a fund that’s down to buy a fund that is up is a recipe for disaster.

B-

So, overall I give target date funds a B-. I think with a little knowledge and legwork, we can do better. But for many people, these funds offer a much better alternative than what they’d likely do on their own.

Solar

A more comprehensive update coming, but a couple of thoughts on my recent installation.

I started with 22 panels in 2023. I’ve just gone live with 5 more panels and 2 batteries.

My solar company was outstanding during sale and implementation. Post implementation I was on my own. It would have been helpful to have someone at the company taking ownership of the myriad of issues I was facing. While some were not their fault, they should have played an active role in resolving. I’ll note them in my customer service stinks post.

But, I learned a lot in the process.

And my solar production is huge. In July, I produced over 1.2 MegaWatts, consumed far less, so I’ll get a credit on my electric bill for several hundred dollars. These credits build up in March – October and I use them to pay most of my bill in November through February when the days are short.

The batteries are cool. They’ll power the house indefinitely during an outage. I see them filling up while the sun shines and powering the house at night.

And today I’m participating in my first Virtual Power Plant event. What’s that you ask? Tesla (who makes my batteries) and my electric company have teamed up to sell capacity back to the grid during high demand.

The electric company announces an expected power need (usually hot days when everyone is blasting their A/C). The Tesla app asks battery owners if they’d like to participate. I say “Yes, please”

My battery starts to hoard power. When the event begins, the electric company pulls power from my battery (down to a limit I get to set so I have some backup in case of a power failure) and afterwards sends me a check for the power it used.

I’m told that I can expect $800 per year per battery. Sweet!

Pet Insurance

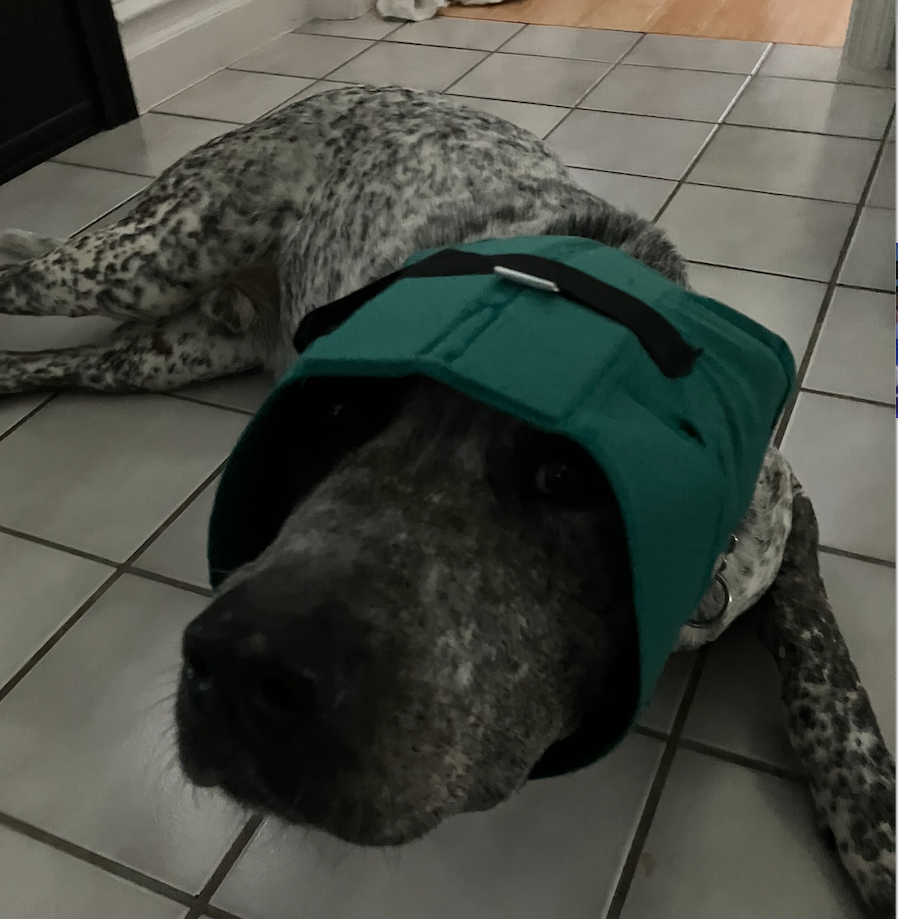

Rosco woke up this morning with a huge bubble in his ear. It looked like a roll of quarters tucked under the skin.

This has to be our 5th trip to the vet in 2 months.

Here’s what he looks like.

3 years ago my annual pet insurance was about $300. Last year it was $1,500. Big jump, but they’ve covered 90% of the cost of

- ACL surgery

- Broken toenail surgery

- Broken tooth surgery

- 2 surgeries to remove benign tumors

- Lots of visits for scrapes, infections, and other crazy stuff.

I’ve kept score. The insurance cost has been well worth it for us.

Wrap Up

That’s it.

A great sandwich and a few thoughts.

Have a great day.