Today, I’m perusing the TJX annual report. Before we get into (a light assessment of) the details, let me give you my background with TJX.

I have to give my wife credit for this one. Back in 2015, she mentioned that she enjoyed finding bargains at Marshalls, TJ Maxx and Home Goods stores and wondered if the company would be a good investment.

I took a quick look and made a small investment in TJX in my wife’s IRA account. I’ve continued looking into the company over the years and I’ve made several subsequent additional investments.

It Starts With An Idea

This is how most of my investments start.

There is an idea – usually it’s about a great product or service and I wonder if the company that produces it is publicly traded. Could I become an owner – albeit of a very small piece?

This is how my investment in Netflix started. Getting DVDs by mail and maintaining a queue online seemed like a radical and life-changing idea. No more telling my daughter she had to return the movie she loved. Keep it as long as you like and watch it over and over.

Finish a movie, drop it in the mail, and get a replacement in 2 days.

Whether it is Netflix, Starbucks, or TJX, for me, it usually starts the same way. Noticing a great product or service.

A Great Product Doesn’t Always Equal a Great Business

This is the important part. Great companies are everywhere. But is the company profitable? Do they make money, or have a path to becoming profitable?

My investment career is filled with investments in Under Armor and Krispy Kreme Donuts that seemed like great investments at the time, but went on to be poor business decisions.

And while I’ve gotten better at choosing winners and losers, I still make mistakes. There is no magic formula. That’s why we need to do our research and create a thesis, and then monitor the company’s results.

Everyone was wearing Under Armor. They were becoming cooler than Nike. The clothing was great, but the business wasn’t.

I still buy Under Armor athletic gear, but I sold the stock at a loss.

Why Do I Think TJX Is Different?

The treasure hunt experience in the stores is cool. There are great bargains to be found, and they always seem to be crowded. But how is this different than Under Armor?

It’s not.

Back in 2010 and 2012, when I was buying shares of Under Armor, I was even more excited about their prospects than I was about TJX in 2015.

What Changed?

This is the biggee. While TJX has largely stuck to its knitting, Under Armor did not.

Some of the troubling events at Under Armor included some major senior executive departures, the return of the founder as CEO, and the splitting of the share classes.

Splitting share classes is not necessarily a terrible thing, but it is something to watch. In under Armor’s case, the CEO wanted a new share class for himself and other insiders that would have more voting rights so that he could maintain control of the company. This isn’t always terrible news. Alphabet did it, and while I don’t love it, it hasn’t been detrimental to the business (so far).

And then there were inventory problems at Under Armor. Target seems to suffer from this as well, but when a merchandiser is finding that they are buying or producing a lot of stuff that consumers don’t want to buy, it’s often a clear sign that they’ve lost their way.

So Under Armor had some cracks in 2018 or so. I held on til 2020 hoping for improvement then gave up.

What Makes TJX Great?

But back to TJX. A lot of the stuff that made it interesting in 2017 hold true today and I was reminded of this when I read the annual report.

Clark Howard – my favorite cheapskate – takes a trip every year. He finds out what’s on sale and then decides why he wants to go there. He’s been everywhere by this point, and he’s done it at bargain prices.

TJX seems to be working off the same playbook. Their business model is to buy stuff that’s cheap and sell it at a discount. If your warehouses and stores and your entire business is built on a flexible model, it seems like this would be valuable to shoppers and would be profitable for the company.

When I go to the Gap, I know I can find a pair of jeans and a red polo – every time. At TJX, I may find them I may not, but I will always find some stuff I hadn’t even dreamed I needed at a fantastic discount.

A Track Record of Success

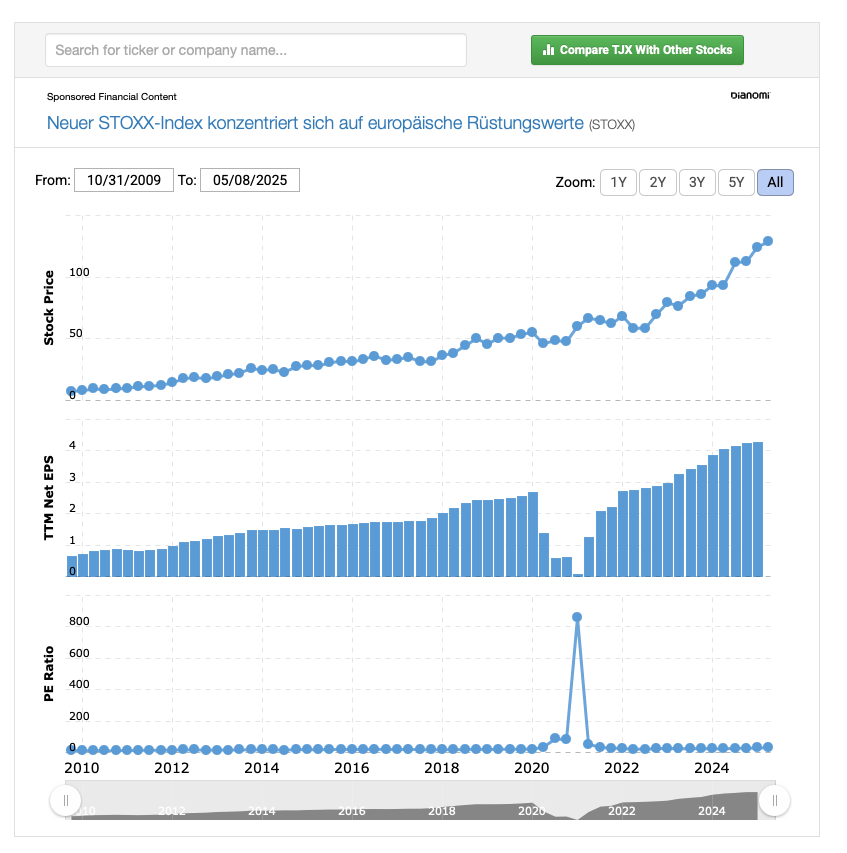

The stock price has risen steadily, and so have earnings. That’s important. The company generates a ton of cash and in addition to opening their 5,000th store, they pay a dividend and buyback shares.

TJX looks like a good idea with a solid business behind it.

CEO

This was interesting as well. I remember from my initial thesis that Carol Meyrowitz was the CEO when I first started looking at TJX. I was surprised reading today that Ernie Herrman is CEO and Carol is the executive chairman. This change took place in 2016. I love when the CEO changes and I don’t even notice. Costco is famous for this. It remains a great and consistent business through multiple CEO transitions.

Wrap-Up

15 minutes spent on the annual report with probably another 10 looking at other research reports and charts on the company.

TJX seems to be doing all the things that I hoped it would when I initially invested back in 2015.

I love being able to find a great idea (OK, my wife found it) do the research that builds my commitment in the company, and then watch over the years as it continues to grow earnings and return value to shareholders.

….and another thing…

I get lots of great ideas. More often than not, after doing my research, I decide the company is not for me.

Sometimes I’m right and I watch the company’s price drop, other times I’m wrong and I sit on the sidelines while the company’s stock price doubles.

We never know what will happen in the future. To mitigate this risk, I hold lots of companies (64 right now) and I hold positions in quite a few equity, fixed income and money market mutual funds and ETFs.