But not a good one.

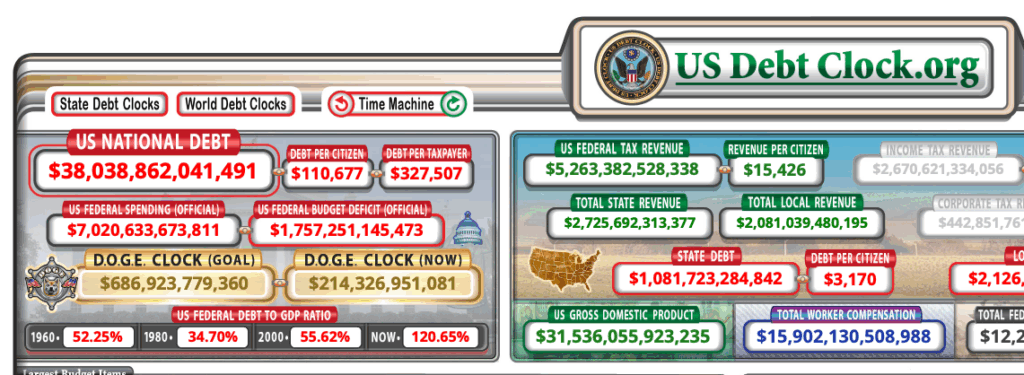

The US national debt has now surpassed $38 trillion.

I know. That’s too big a number to fathom. Today, let’s try and put that in perspective.

Look to the right of the big number. If you’re a tax payer, your share is $327,507. That’s a lot.

My grandson is 4 and my granddaughter is 1. Each of them owe $110,667. That’s a tough way to start life.

US Debt

This is money that our government has borrowed and must pay back. If you hold a treasury bond bill or note, you hold a piece of this debt.

I own UNITED STATES TREAS SER C-2035 4.25000% 05/15/2035 NTS NOTE.

Here are the details of this one note.

I bought a few bonds, but the total amount issued was over $56 billion.

What Happened?

In May of 2025, the US government needed some cash. It needed more than it had so it issued this bond for $56 billion.

I was one of the investors who bought some of these bonds.

I gave the US government $50,000.

In return, the US Government promises to pay me 4.25% annually, or $2,125. I’ll get paid $1,062.50 2 times per year. My first payment is 11/15/2025 and my final payment is on 11/15/2034.

On 5/15/2035, the US government will give me my $50,000 back and say thanks for the loan.

Over the 10 years, I’ll collect $21,250 in interest payments. How cool is that?

Who’s Paying?

Unfortunately, the US taxpayers are paying. So I’m paying myself.

This is just one note. The US treasury issues bonds, bills and notes almost every day.

In an ideal world, the US government would have a budget and would make good fiscal decisions about how to spend its tax revenue.

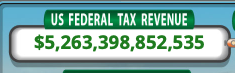

In our world, we spend the $5 trillion in tax revenue and then we sell bonds to make up the $2 trillion shortfall between what we spend and what we bring in.

And we’re paying almost $1 trillion just on the interest each year.

The point is, we’re paying this now. Today. To bond-holders. It’s not some future thing that may or may not come about.

Tax Revenue

Spending

Deficit

Interest

It’s all available on the debtclock in real time.

Memories…

Go with me…way, way, way back to January 2025. 10 months ago. Remember? It was cold.

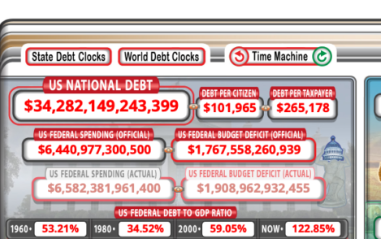

At that time, the debt was

Read my January post on social security here. That was posted on January 25, 2025.

The debt has grown almost $2 trillion in only 10 months.

That’s a cool $200 billion every month. Or about $6.6 billion every day.

That’s not what we’re spending. That’s how much we are adding to the debt. We’re spending much more than that.

Way Back

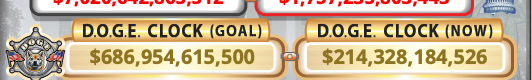

In my first post about the US debt on 2/22/2024, the debt was at

What About?

We voted Republican – let’s get a conservative in power so we can get the budget under control.

We were (some of us) encouraged by DOGE. Some experts were coming in to ruthlessly cut run-away spending.

We even report DOGE savings on the debt clock and on the DOGE website.

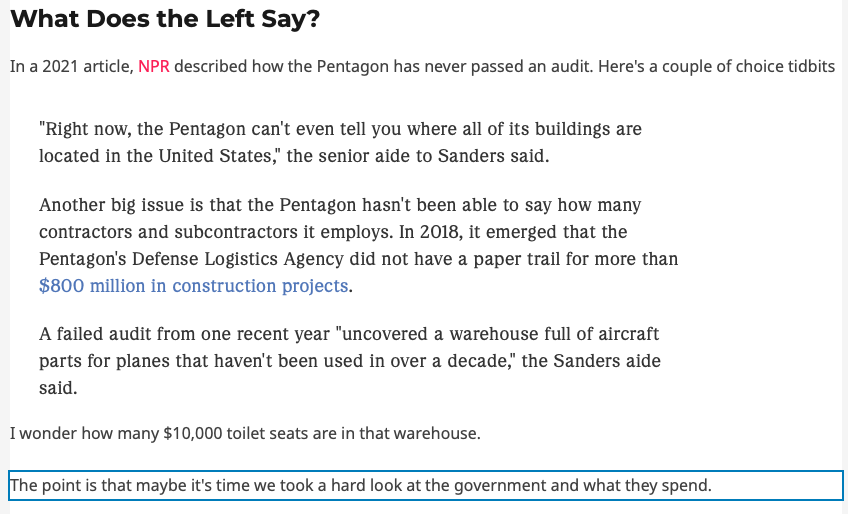

And then there was military spending. This got a lot of press before the election. The US defense department would never pass an audit – can you believe it? Must be those $10,000 toilet seats. Not kidding – read here.

I wrote:

At least there’s some good news on this front. Read this from the hill.

So we’ve got that one under control.

Don’t get you’re hopes up kids, but maybe…

Icing on the Cake

The government is shut down. This should have saved us some cash. We know it will cost us once we reopen as we need to pay for things we didn’t pay for and we lose efficiency as people trudge back to work and try and pick up where they left off, but over the last month, we should have saved a few bucks, right?

And border crossings are way down. We saw resources strained by the immigrant crisis. The cost to the American tax payer was significant. But look. Encounters are way down.

And the savings per year of $34 billion comes directly from the good folks at Homeland security.

Wrap Up

We had such promise in 2025. I thought this was the year we’d start to get our fiscal house in order.

Boy was I wrong.

The debt is rising faster than ever even though we’ve shut down a good chunk of the government, made DOGE cuts…I know, you heard it.

So that means we’re getting worse not better.

Wow.

To have some fun, search the site for debtclock. You can see all my articles about the US debt.