Checking, Savings, High Yield, Money Market, Treasuries…so many choices, which one is right? In today’s post we’ll talk about the different options for low to no risk places to put our cash. And spoiler alert…no one product is the right one. You’ll likely have a mix of several products to maximize your income while preserving liquidity.

Cash & Cash Equivalents

In this post, I’m speaking about cash and cash equivalents as an asset class. We’ll call it cash for simplicity. The other major asset classes are Equities and Fixed Income.

We all need to have some money in an investment grouping called cash. While the investment risk is low, the returns are also low. Cash is not a good place for money that needs to grow. Cash is a good place for the money we need to pay our bills, for our emergency fund, or for money we expect to spend in the near future.

Options

While the risk and the return is low for cash, there are some alternatives we should consider. Also, we likely want to have our cash investments spread across more than one investment option. Let’s take a look in detail at each one and what we might use it for.

Under The Mattress

…or the piggy bank, or the safe in the basement. I’m a big proponent of keeping a little cash in the house. Not a lot, but what do we do if we have an emergency at 4 in the morning and need money. What if the ATM network goes down? Some of our emergency fund should be close by. It earns no interest and loses to inflation, but it is there when we need it.

Checking and Savings

Many of us grew up with a local bank where we opened a checking and savings account. I remember how proud I was when I started my first real job at Zayre (now defunct department store) and I walked across the plaza to the local bank and deposited my paycheck in my savings account. For many of us, this was part of our upbringing. We need an account at the local bank branch and we need to keep our money there.

The rates paid by local banks are pretty low. My local bank offers a non-interest bearing checking account and a 1% rate for a savings account. They should be ashamed.

I use Fidelity’s cash account. I’m guessing it is similar to the cash accounts offered by other brokerages. Let’s go through the benefits and why I chose this over my local bank.

Brokerage Checking/Savings Benefits

- Online bill pay – it’s pretty common now, but was revolutionary when I opened the account 20+ years ago. I write 2 or 3 checks per year, but when I do, I enter the info online and Fidelity sends the check. No stamps and they keep records for me.

- Interest rate – I earn 2.69% and I have the option for moving some to a money market position within the account, which earns 5%. This beats 0 and 1%.

- Money Transfer – I regularly move money online between this account and Venmo and Apple Pay with a few clicks.

- Free ATM Transactions – Fidelity refunds all ATM fees automatically to my account.

The one drawback to this, along with other non-brick and mortar banks, is that I do not have a local branch I can visit for a money order, or for other in-person banking needs. This includes loans. In a post on car buying, I mentioned that we may get a lower loan rate by going to a local bank or credit union that knows us. If this is important to you, it may be worth foregoing these benefits and sticking with your local bank.

High Yield Savings

High Yield Savings accounts were viewed with skepticism years ago. Who would put their money in a bank that they can’t visit? Today, they are pretty common. And, no, you can’t visit them, but you can transfer money in and let it grow at a higher rate than your bank checking and savings. See rates here courtesy of nerdwallet.

FDIC

Let’s take a minute to talk about the Federal Deposit Insurance Corporation (FDIC). FDIC is an independent agency created by Congress to maintain stability and public confidence in the nation’s financial system. The FDIC insures deposits; examines and supervises financial institutions for safety, soundness, and consumer protection; makes large and complex financial institutions resolvable; and manages receiverships. Learn more here.

For us that means that if our bank fails, the FDIC will return our deposits. That makes FDIC insured accounts virtually risk-free.

There are specific rules around this. Each deposit account is insured up to $250,000. If we have, $251,000 in our FDIC insured account and our bank fails, we may only get $250,000 bank. I say may because there are instances where the government has required higher coverage from member banks. But for this discussion, it’s important to note that we are guaranteed coverage up to $250,000 per deposit account.

The per deposit account is specific language as well. If I have 3 accounts at Bank of America. 1 in my name, 1 in my wife’s name, and one registered as a joint account in both our names, these are 3 different accounts. Each one is insured up to $250,000.

Before you deposit money with any bank or financial institution, make sure they are an FDIC member bank.

Money Market

If an institution has a really big pile of cash, there are other things they can do with it rather than have it sit in a 1% earning bank account. Money market accounts and funds provide a way for individuals to pool their cash and experience the benefits of higher cash yields, previously only available to institutional investors. However, be aware, Money Market funds are typically not FDIC insured.

Money Market funds are mutual funds. They pool shareholder money to have the capital to invest in higher yield low-risk securities that might not be available to an individual investor. Money Market funds buy short term treasuries, CDs, Repurchase Agreements, and other low-risk securities.

You’ll notice that Money Market funds always have a Net Asset Value (NAV) of $1.00. Read here for more on NAV, what it means, and how it is calculated.

Money Market funds also have a daily mil rate – this represents the interest earned each day. Each day, the fund calculates the daily interest for each shareholder based on their balance that day and the day’s mil rate. This money acrues over the course of the month and then is paid out at the end of the month.

Breaking the Buck

If all goes well, the fund maintains its $1 NAV and pays interest via the mil rate. I say if all goes well, because it is possible that the low-risk investments that a money market fund makes could lose value. If they did, the fund’s NAV could dip below $1. This happened one time in 2008 for one money market fund. It has not happened again. “Breaking the buck” is very bad and financial institutions work very hard to ensure that they aren’t #2 on this list.

Treasury Bonds

Treasury bonds or “Treasuries” (read more here) are issued by the US government and are viewed as the most safe and secure debt securities. Generally speaking, when you buy a treasury, you are lending money to the US government with the promise that the government will return your money in full at the maturity date and will pay you interest regularly from purchase date through maturity at the bond’s coupon rate. There are some different variations on this, but the key point is that these are backed by the full faith and credit of the US government.

Treasuries are not FDIC insured. They do have a tax benefit. While you’ll need to pay federal tax on interest and gains, there is no state tax.

Stable Value Funds

Stable Value Funds are offered in many 401k retirement plans. They are complicated products that often have an insurance component to allow them to provide a small return but guarantee the principal invested. Read more here.

Stable Value funds typically have high fees due to the insurance component, and low growth rates due to the ultra-conservative investment strategy.

Conservative Bond Funds

We’re now venturing outside of Cash and Cash Equivalents, but I wanted to touch on these briefly. Let’s look at an example.

Fidelity® Conservative Income Bond Fund (FCNVX)

Strategy

Normally investing at least 80% of assets in U.S. dollar-denominated money market and high quality investment-grade debt securities of all types, and repurchase agreements for those securities. Normally investing in securities with a maximum maturity of four years. Normally maintaining a dollar-weighted average maturity of one year or less. Potentially investing in reverse repurchase agreements. Investing more than 25% of total assets in the financial services industries. Investing in both domestic and foreign issuers.

Pros and cons

This is a mutual fund made up of low-risk securities like treasuries and high quality loans. Investors can lose some or all of their principal. Investments are not FDIC insured. The yield is currently 5.2% which is higher than most high yield savings accounts and treasuries. There is more risk, but higher return. This is not an appropriate investment for money we need to fund our budget or for our emergency fund, but for cash that we want to invest at a slightly higher rate with a longer-term time horizon, this may be a good option.

Does It Matter?

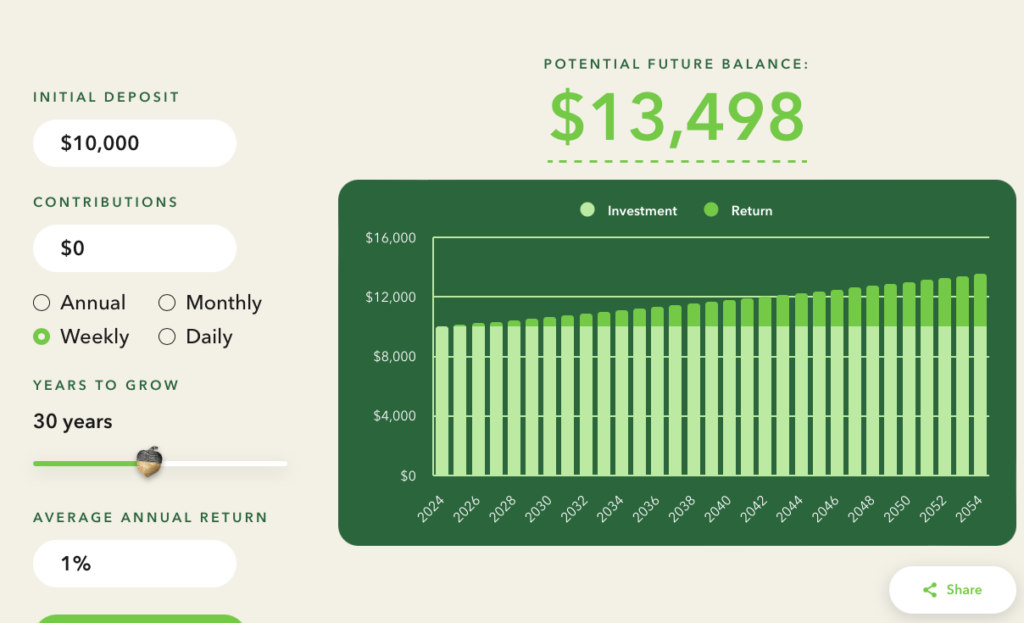

Is it worth the effort to look for higher yield? Why not just stick with our local bank’s savings account?

Worth it? Yup!

Wrap-Up

In order to grow our wealth, we need to invest in equities. Compounding is the magic that drives wealth.

Fixed income is an important part of our portfolio as well. It provides steady income and reduces some of the market-driven gyrations in our portfolio.

Cash has a place in our portfolio as well. We need an emergency fund, we need cash close by to pay our bills, but we may also have some cash on hand for either mid-term goals – spending in the next 5 years that we don’t want to risk investing in equities or fixed income.

We have options for our cash, and there are likely reasons why we would want to use some, if not all, of the options presented here.

Good luck.